BUSINESS EDITION AUGUST EDITION

Dear Esteemed Member,

In this edition, we reviewed the global economy, which witnessed a rise in crude oil prices. Analyst, including the IMF had projected that this development could positively impact the growth of Nigeria’s economy. In line with our strive for continued update of members on economic developments, the macro-environment was also reviewed for the first half of 2018. We are optimistic of an improved economy going forward with the downward trend of the inflation figure and other variables.

As you are probably aware, the Federal Inland Revenue Service is reviewing taxpayer’s unutilized withholding tax credit balances and instructing commercial banks to set aside alleged amounts owed by taxpayers for full or partial amortization by the banks. We have taken time to look into this development and will appreciate your opinions too by way of feedback.

Our regular Law Report Review, Upcoming Learning & Development programmes and other activities at the Secretariat were not left out.

Have a pleasant reading.

Timothy Olawale

Editor

In this Issue:

- Macro-Environmental and Scenario Review: Half year 2018 and Outlook

- Reconciliation of Tax Position vis-à-vis Withholding Tax Utilization

- FIRS to Manage Defaulting Taxpayers’ Bank Accounts

- Law Report Review / Legal Opinion

Macro-Economic Environment and Scenario Review: Half year 2018 and Outlook

- The International Monetary Fund (IMF) concluded the Article IV consultation with Nigeria and inferred that the economy still remains vulnerable, although maintains its GDP growth forecast for 2018 at 2.1%. The Report affirms that although the country introduced new foreign exchange measures, gained from rising oil prices, benefitted from attractive yields on government securities, and maintains a tighter monetary policy, which have all contributed to better foreign exchange availability, increased reserves to a four-year high, and contained inflationary pressures.

- The Report highlighted potential risks to the economy; lower oil prices and tighter external market conditions are the main downside risks. Domestic risks include heightened security tensions, delayed fiscal policy response, and weak implementation of structural reforms. However, a further uptick in international oil prices would provide positive spill-overs into the non-oil economy.

| Oil Price Projections: 2018- 2022 | |||||||

| 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | ||

| OPEC | 52.43 | 50.00 | 55.00 | 60.00 | 65.00 | 70.00 | |

| EIA | Brent Crude | 54.12 | 54.07 | 58.85 | 75.10 | 85.10 | 90.94 |

| WTI | 50.81 | 50.57 | 55.26 | 71.85 | 81.12 | 86.66 | |

| World Bank | 52.81 | 56.00 | 59.00 | 60.00 | 60.90 | 61.90 | |

| IMF | 52.81 | 48.60 | 50.30 | 51.80 | 53.30 | 54.80 | |

| JP Morgan | Brent Crude | 54.39 | 70.00 | NA | NA | NA | NA |

| WTI | 50.91 | 65.63 | NA | NA | NA | NA | |

| Bank of America | Brent Crude | 54.39 | 64.00 | NA | NA | NA | NA |

| WTI | 50.91 | 60.00 | NA | NA | NA | NA | |

| Goldman Sachs | Brent Crude | 54.39 | 75.00 | NA | 60.00 | NA | NA |

| WTI | 50.91 | 69.50 | NA | 54.50 | NA | NA | |

Business Implication:

- The Short-term Energy Outlook by US Energy Information Administration (EIA) projected that oil prices will average $72 a barrel in 2018 and $71/b in 2019. In July 2018, global oil prices averaged $74/b. It’s $3 a barrel lower than in May. Prices are easing after traders bid them higher in response to OPEC meeting. The Turkish Lira crisis has put concerns about the health of the global economy. Analysts believed that if the economy falters, it will show up in time-spreads for oil futures.

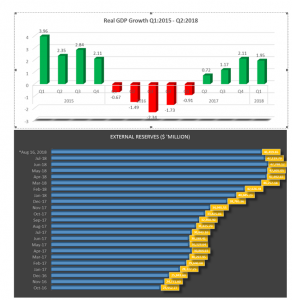

- Growth is expected to have picked up pace in the second quarter, after losing steam at the start of the year. The PMI came in at a historic high in June, rounding out the strongest quarter the index has ever recorded. In addition, firmer oil prices are supporting the energy sector and helping the government build international reserves—which hit the highest level in five years in June—to support its exchange rate regime.

- On the political front, Nigeria’s All Progressives Congress, the ruling party, unseated the opposition in regional elections in Ekiti state on 14 July. The result bodes well for President Muhammadu Buhari’s re-election bid, as the vote was regarded as a test of the electorate’s mood ahead of presidential and parliamentary votes in February. Political uncertainty had risen after a faction from within the ruling party splintered away at the start of July, declaring it no longer supports Buhari and will challenge him in next year’s election.

- At it’s 23–24 July meeting, the Monetary Policy Committee (MPC) of the Central Bank of Nigeria (CBN) decided to leave the Monetary Policy Rate (MPR) as well as all other monetary policy parameters unchanged, meeting market expectations. As a result, the policy rate remains at a record-high 14%, with the asymmetric corridor at plus 200 and minus 500 basis points around the monetary policy rate.

- The Central Bank of Nigeria’s decision to hold the monetary policy rate unchanged at a record-high figure reflects high price pressures in the economy. Pressure from rising food prices has kept inflation well above the CBN’s target of 6.0%–9.0%, and several risks to the inflation outlook persist, including significant pre-election spending and the worsening farmer-herdsmen conflict in key food-producing states.

- Fragile growth dynamics in the economy could warrant stimulus, and the Central Bank decided to ease monetary conditions in an unconventional manner by improving the flow of credit to the private sector. Specifically, the Central Bank stated it would buy “commercial paper” or debt from credit-constrained businesses if necessary to spur activity and that it would be introducing a “differentiated dynamic cash reserve requirement regime” to improve access to cheap long-term credit.

- The Monetary Policy Committee struck a cautious tone in its communiqué, mentioning that coordinated fiscal, monetary and exchange rate policy should be put in place to stem high inflation. In addition, the Bank pointed out that monetary policy normalization in the U.S. could lead to capital flow reversal, which would be stoked further if the policy rate was loosened. However, inflation is forecast to retreat in the coming quarters. Assuming the foreign exchange market continues to remain stable or improve, the Bank’s preferences are likely to opt towards a rate cut going forward. The Bank also highlighted that the public’s preference is for a rate cut.

CONCLUSIONS

- We expect higher oil prices, improved liquidity and increased public spending in the run-up to the 2019 elections should fuel faster growth this year. However, political uncertainty, as well as security concerns, continues to pose risks to economic activity. We expect GDP annual growth in 2018 to increase to 2.4% from 0.8% in 2017 and projected to 2.9% for 2019.

- As the Inflation rate dipped for the 18th consecutive month (July) to 11.14%, we anticipated the annual rate for 2018 to average 12.0%, and projected to average 10.1% in 2019. On the monetary front, we expect the MPR to end 2018 at 12.55%.

- Money supply is expected to increase further in the remaining months of the year due to increased election spending and implementation of 2018 Budget, while risks to inflation could be as a result of increased naira liquidity, food shortage as a result of herdsmen conflict.

- CBN intervention likely to decline on depleting external reserves, while strong oil proceeds would slow the pace of external reserves depletion. The PMI is likely to remain constrained in the coming months.

………………………………………………………………………………………………………………………………………………

Reconciliation of Tax Position vis-à-vis Withholding Tax Utilization

Summary

The Federal Inland Revenue Service (FIRS) has commenced an exercise for the review of taxpayers’ unutilized Withholding Tax (WHT) credit balances. We understand that the FIRS’ request is aimed at ensuring that taxpayers present all unutilized WHT credits for confirmation, reconciliation, and approval for usage.

Details

Section 81 (5) of the Companies Income Tax (CIT) Act provides that “Income tax recovered under the provisions of this section by deduction from payments made to a company shall be set off for the purpose of collection against tax charged on such company by an assessment.” Thus, taxpayers have typically utilized accumulated WHT credits to offset their tax liabilities and some currently have excess credits with the FIRS.

Consequently, the FIRS decided to review all taxpayer’s usage of WHT credits to offset their tax liabilities and validate any unutilized credit balances. We understand from the FIRS’ request that taxpayers are required to present relevant documentary proofs to support their WHT credit claims. In addition, all agreed and verified WHT positions (arrears and unutilized WHT credits) would be summarized and sign-off by the FIRS and taxpayers. The FIRS has also indicated the timeline for the exercise and noted that failure to present the necessary supports for reconciliation will close all reconciliation options and taxpayers will have to accept the FIRS’ position based on its internal records.

Also, there may be a requirement to audit formal requests for WHT credit utilization that were made three or more years ago.

Implication

Notwithstanding the apparent concerns regarding the requirement to conduct audits for WHT credit utilization requests that are more than three years, it is imperative for companies to take advantage of the opportunity to reconcile their tax position given the exigency of keeping real-time records.

Culled from Andersen Tax (Tax Alert)

……………………………………………………………………………………………………………………………………………………………………… FIRS to Manage Defaulting Taxpayers’ Bank Accounts

Summary

The Federal Inland Revenue Service (FIRS) recently started issuing letters to Commercial Banks, directing them to set aside alleged amounts owed by taxpayers for full or partial amortization by the Banks. It appears that the FIRS is relying on the powers to appoint agents (including banks) to pay any tax due to the FIRS from any money held by the agent on behalf of taxpayers in line with the provisions of the FIRS (Establishment) Act.

Details

Based on our understanding of the matter, the FIRS’ new approach to recovering outstanding taxes is predicated on the provisions of Section 49 of the Companies Income Tax (CIT) Act, 2007 (as amended) and Section 31 of the FIRS (Establishment) Act. We also understand that the FIRS wants the alleged tax debts withheld from the taxpayers’ bank accounts and remitted to the FIRS in priority to any other authorized transaction by the taxpayer. In addition, the FIRS requested that it should be notified of other proposed transactions on taxpayers’ bank accounts prior to execution.

While Section 31 of FIRS (Establishment) Act empowers the FIRS to appoint agents of tax collection, it is imperative to evaluate the actual extent of such powers. Section 31 (2) of the FIRS (Establishment) Act provides that the appointed agent may be required to pay any tax payable by the taxable person from any money which may be held by the agent of the taxable person (emphasis ours). However, there is a valid question as to when is tax can be deemed payable.

It is common knowledge that tax is either payable based on self-assessment, administrative or audit assessments. It is also clear that a tax assessment can only be deemed final and conclusive after all options to reconcile any dispute over such assessments have been explored and exhausted. Moreover, Section 49 (3) of the CIT Act as well as Section 31(5) of the FIRS (Establishment) Act provides that the provisions of the CIT Act on objections and appeals will apply to any notice given under the two sections. Given that the FIRS referred to both sections of the law in its letters, it is necessary to pay attention to the entire provisions of the sections in giving effect to any other subsection.

In addition, given the fiduciary and contractual obligations owed by banks to their customers (i.e. the taxpayers), it could be a breach of the bank’s duty to its customers to remit any alleged unpaid taxes stated by FIRS without the consent of the taxpayers or a court order requesting the banks to comply.

Implication

Notwithstanding, the powers granted to the FIRS to collect taxes from individuals and companies, the FIRS’ new approach to recover unpaid taxes may not be consistent with the relevant provisions of the legislative framework in Nigeria. The manipulation of taxpayers’ account without regard to due process could lead to distrust on the sanctity of contracts in Nigeria and scare potential investors.

Taxpayers reserve the right to object to assessment notices and resolve tax disputes without any untoward consequences on their business operations. It is equally important for taxpayers to review their records and ensure that substantial tax positions are ready and accessible in the event of this nature of disputes.

Culled from Andersen Tax (Tax Alert)

Law Report Review / Legal Opinion:

WHEN THE COURTS WOULD REJECT AN APPLICATION TO AMEND PROCESSES FILED BY THE PARTIES

Peter Yinkore & 73 Ors vs. Neconde Energy Ltd & 1 Or, unreported Suit No.: NICN/LA/611/2012

FACTS

- In 2013, the claimants /applicants filed a motion on notice for leave to amend their originating processes. However, an actual trial had not even commenced for a case the claimants filed in 2012.

A case for the Claimants:

- The claimants gave as reasons for the amendment of the fact that they omitted, due to the inadvertence of their counsel, to frontload the letters of employment of each of the claimants, their counsel while preparing for the case found a directive/guideline issued by Ministry of Petroleum Resources that would assist the Court in settling once and for all the controversy between the parties and the amendment would thus afford the claimants place before the Court all facts, information and materials that would enable the Court to properly resolve the issues in controversy between the parties, citing Ojah v. Ogboji [1976] 1 NMLR 95, and Adeleye v. Akin-Olugbade [1987] 3 NWLR (Pt. 60) 214. The claimant went on that the Court (NIC) is a specialized Court not bound by strict rules of legality or formalism, citing National Union of Chemical & Non-Metallic Workers v. Management of Metal Box Toyo Glass Ltd [1978 – 2006] DJNIC page 140, which held that the Court has the power to admit the additional or further evidence.

Case for the 1st defendant:

- The 1st defendant opposed the claimants’ application for amendment and filed a counter-affidavit and a written address. To the 1st defendant, the claimants cannot seek for an amendment as to change the character of the case they presented before the Court or set up a new cause of action under the guise of an amendment. Furthermore, that the amendment sought by the claimants was a ploy to rectify and correct all the vices and defects inherent in their case as already pointed out by the 1st defendant in its statement of defence, citing China Chijioke v. Bosde Alice B. Soetan [2006] 10 NWLR (Pt. 990) 179.

- The 1st defendant went on to compare the reliefs claimed as at 29th November 2012 and the reliefs presently claimed as per the proposed amendment, and then referred the Court to Horsfall v. West [1999] 4 NWLR (Pt. 597) 120 at 125 and China Chijioke v. Bosde Alice B. Soetan [2006] 10 NWLR (Pt. 990) 179 at 212 – 213. The 1st defendant then submitted that paragraph 30 of the statement of facts and the reliefs as proposed introduced totally new issues by importing the legal issue of the Minister’s consent for the first time also brought in new monetary claims, which were not originally in the statement of facts, thus changing the character of the claimants’ case.

- The 1st defendant urged the Court to note the several motions filed by the claimants, which motions were struck out. That where an amendment was sought purposely for a case to lose its proper meaning by reason of derailment, then it was done in bad faith, citing Yusuf v. Adegoke [2008] 40 WRN 1 at 47. The 1st defendant then urged the Court to refuse the application of the claimants.

A case for the 2nd defendant:

- The 2nd defendant also opposed the claimants’ motion for amendment by filing a counter-affidavit and a written address. The 2nd defendant noted that in the existing reliefs, the claimants are seeking for 7 reliefs, whereas in the proposed amendment, they are seeking for 9 reliefs. The 2nd defendant cited a number of case law authorities and then submitted that the amendment sought by the claimants is in bad faith and so should be refused.

- In response, the claimants filed two further and better affidavits with accompanying reply addresses to the counter-affidavits and a written address of the 2 defendants. The reply submissions of the claimants in terms of the submissions of the 2nd defendant are to the effect that the instant amendment sought was not the same with the previous ones struck out; and that the reliefs presently sought are reliefs differently against the two defendants. Also that the amendments they seek are innocuous and satisfy the requirements of the NICN Rules 2017. The claimants then referred to Benjamin Maduabuchi v. AG of Lagos State {2012] LPELR-8022(CA) and High Chief Enock Oguneyehun & ors v. The Governor of Ondo State & ors [2007] LPELR-4239(CA). In any event, that the claimants are allowed to amend if it is meant to further claims arising out of same and existing cause of action subsequent to the issue of the writ, citing Oguma v. IBWA [1988] 1 NWLR (Pt. 73) 658 SC.

ISSUES FOR DETERMINATION

- Whether the proposed amendments by the claimants in their processes would be over-reaching and injurious to the defendants.

- Whether the proposed amendments by the Claimants were in bad faith

JUDGMENT:

The Court considered the processes filed and the submissions of counsel and dismissed the case. It agreed with the defendants that they introduce additional causes of action in terms of the reliefs the claimants are praying for. Furthermore, it held that:

- A reply on points of law is meant to be just what it is, a reply on points of law. It is not meant for the party replying on points of law to reargue its case or bring in points it forgot to advance when it filed its final written address. Alternatively put, a reply on points of law is not meant to improve on the quality of a written address; a reply brief is not a repair kit to correct or put right an error or lacuna in the initial brief of argument. See: Dr Augustine N. Mozie & ors v. Chike Mbamalu [2006] 12 SCM (Pt. I) 306; Basinco Motors Limited v. Woermann Line & anor [2009] 13 NWLR (Pt. 1157) 149; Musaconi Ltd v. Aspinall [2013] LPELR-20745(SC).

- The claimants gave inter alia as reasons for the amendment they seek the fact that they omitted, due to the inadvertence of their counsel, to frontload the letters of employment of each of the claimants; and that their counsel while preparing for the case found a directive/guideline issued by Ministry of Petroleum Resources that would assist the Court in settling once and for all the controversy between the parties. The claimants’ counsel was briefed in 2012 by the claimants. It is worrying that it is only in 2017 while preparing for this case that they found a directive/guideline issued by the Ministry of Petroleum Resources that would assist this Court in resolving the instant suit. This thing about flaunting inadvertence of counsel as some kind of magic wand is worrying. Quite rightly, Iroegbu v. Okwordu [1990] 6 NWLR (Pt. 158) 643 and Erinfolabi v. Oke [1995] 5 NWLR (Pt. 395) 296 have cautioned that inadvertence or mistake of counsel has been relied upon as the basis for the present application.

- But the point that must be vigorously emphasized is that the rule which enjoins courts not to visit the inadvertence or mistake of counsel on the litigant is not intended to be a universal talisman the waiver of which will act as a panacea in all cases. Before the plea is accepted, the court must not only be satisfied that the allegation of fault of counsel is true and genuine, but also that it is availing having regard to the circumstances of the particular case. The antecedents of this case in terms of the amendments previously sought by the claimants’ counsel do not suggest that the allegation of inadvertence of the claimants’ counsel is true and genuine.

- In James Adekunle Owulade v. Nigerian Agip Oil Co. Ltd [2015] 63 NLLR (Pt. 222) 199, this Court (NIC) reviewed the authorities on the amendment of pleadings in the following words:

- The general rule is that an amendment will be granted if it is for the purpose of determining in the existing suit the real question(s) in controversy between the parties. The Supreme Court decision in Compagnie Generale De Geophysique & anor v. Jumbo Idorenyin LER[2015]296/2005 per Peter-Odili, JSC is to the effect that an amendment is seldom refused by the court. This rule was laid down as far back as the 19th Century by Bowen LJ in Cropper v. Smith (1884) 26 Ch.D 700 at 710 and 711.

- However, the general rule is subject to the qualification that the amendment will be granted if it is not fraudulent or intended to overreach the opposing party i.e. so long as it will not occasion an injustice on the opposing party. See also Shoe Machinery Co. Ltd v. Cutlan (1896) 1 Ch. 108 at 112.

- It is from these early cases that the more recent cases developed additional qualifications for the rule permitting amendment of pleadings. For instance, an amendment of pleadings should be allowed unless:

- it will entail injustice to the opposing party;

- the applicant is acting mala fide;

- by the applicant’s blunder, the application occasions an injustice on the opposing party which cannot be compensated by costs or otherwise. See Ojah & ors v. Ogboni & ors [1976] All NLR 277; [1976] 4 SC 69, Oguntimehin v. Gubere [1964] 1 All NLR 176 at 179 and Amadi v. Thomas Aplin & Co. Ltd [1972] 1 All NLR 409.

- With time, more qualifications were made to the rule. For instance, an amendment to create a suit where none exists could not be granted.

- Also an amendment to change the nature of the claims before the Court will not be granted if the amendment would not cure the defect in the pleadings. See Hong v. Federal Mortgage Finance Ltd [2001] FWLR (Pt. 62) 1898.

- Furthermore, a defendant will not be allowed to raise by way of an amendment to the statement of defence a counterclaim in respect of a cause of action that arose subsequent to the issue of the writ. See Gowon v. Ike-Okongwu [2003] 13 NSCQR 353.

- Additionally, an amendment will be refused where the effect of its being allowed is to wipe out the proceedings and substitute another. See Nwabueze v. NIPOST [2006] 8 NWLR (Pt. 983) 480.

- And an amendment if fraudulent, intended to overreach, is in bad faith, would cause avoidable delay, would take the plaintiff by surprise, introduce new matters, or work injustice against one of the parties in the suit will be rejected. See Compagnie Generale De Geophysique & anor v. Jumbo Idorenyin LER [2015]296/2005.

The Court proceeded to hold that:

- in 2012 when the suit was filed, the claimants and their counsel did not think it right to claim the reliefs they were seeking to claim, and it was only in 2017 that it dawned on them to claim the said reliefs.

- by introducing the additional causes of action, the defendants have been overreached by the claimants.

The Court dismissed the case and awarded cost at Three Hundred Thousand Naira (N300,000) payable by the claimants to the defendants (at N150,000 to each defendant) within 30 days of the ruling.

OPINION:

The golden rule of an amendment is that it must not overreach the opposing party; therefore, parties are urged to consider and review their processes before filing.

Recent Comments