Business Essential January 2019 Edition

Dear Esteemed Member,

Happy New Year and welcome to our January 2019 edition of Business Essentials. Without doubt, 2018 was a year that came with its numerous challenges for businesses and economies around the world. Unemployment, a disappointing GDP growth rate, dip in oil price amongst others, were major highlights of Nigeria’s economy. We reviewed year 2018 and present an overview of the outlook for 2019. We also looked at key events in the year and their implications for businesses and the economy.

In this edition, we also examined the efforts of the Federal Government at improving the Ease of Doing Business (EODB) ranking. We took a retrospective look at year 2018 and also give you an outline of the expected results as released by the Presidential Enabling Business Environment Council (PEBEC) for year 2019.

As the ILO celebrates its 100th year of existence this year, we bring to you a special report on its recently released future of work report which highlights actions required to be taken in order to achieve a future of work that provides decent and sustainable work opportunities for all.

On the tax front, we reviewed the highlights and significant aspects of the Public Notice by the Lagos State Government through the LIRS on the appointment of Payers of capital sums inclusive of employers as collecting agents for Capital Gains Tax (CGT).

Our regular Law Report Review, Upcoming Learning & Development programmes and other activities at the Secretariat were not left out.

Have a pleasant reading.

Timothy Olawale

Editor

In this Issue:

-

- Nigeria’s 2019 Economy: Outlook, Key Events and their implications for Businesses and the Economy.

- Ease of Doing Business- A Review of 2018 and Outlook for 2019.

- Special Report: ILO at 100- An Overview of the Report on the Future of Work

- Lagos State Internal Revenue Service Appoints Payers of Capital Sums as Collecting Agents for Capital Gains Tax

- Law Report Review / Legal Opinion

2019 MACRO-ECONOMIC EXPECTATION, WORLD BANK ECONOMIC GROWTH PROJECTION, NBS INFLATION RATE & CBN MONETARY POLICY COMMITTEE REPORT

As the New Year begins, we take a look at major events that cover the socio-political space, financial market, economy and business environment.

Key events both at the global level and in Nigeria will influence economic and business activities in 2019. The expected hike in interest rates in major advanced countries will lead to an increase in global yields and may put pressure on the Nigerian currency. There are strong indications that the US Federal Reserve, Bank of England and European Central Bank will increase interest rates in 2019. The expected increase in interest rate will also lead to an increase in the interest rate in Nigeria to stabilize the monetary policy.

The outcome of the elections and reactions will go a long way in dictating the pace of the nation’s political economy in 2019. The GDP growth rate is expected to remain at 1.9%, naira will come under speculative pressure before the elections and external reserve will continue to be depleted. There will be additional borrowing, inflation is projected to be at 13% by the end of year and the monetary policy stance would depend on inflationary figure and GDP growth rate. In Q1, 2019, the Q4, 2018 GDP report will be published by National Bureau of Statistics and this will give authentic information on Nigeria’s economic growth.

The crude oil price will equally be a major headline to watch as it will play a key role in shaping Nigeria’s fiscal plans and revenue projections. The current international price for Brent is about $61.94(CBN); this is fairly above the 2019 budget benchmark of $60. Similarly, one of the key assumptions of the proposed 2019 budget was to be producing 2.3mbpd, however, the production cap placed by OPEC on its members (1.6mbpd for Nigeria) couple with the forecast of International Energy Agency (IEA) that the global oil supply will out space demand throughout 2019 will possibly reduce the revenue and foreign exchange earnings for Nigeria. This may also cause currency weakening, rising inflation rate and increase in interest rate and yields. In addition, it may also lead to other macroeconomic instability in Nigeria due to the significant drop in foreign direct investment and foreign portfolio investments in Nigeria.

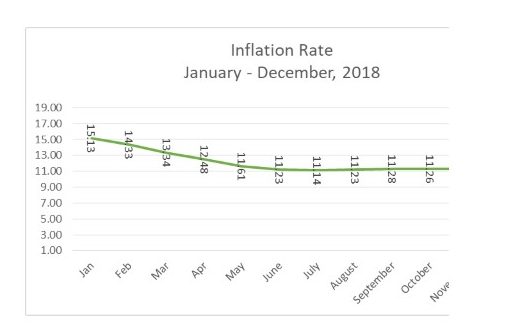

The National Bureau of Statistics (NBS): Consumer Price Index, December 2018

The NBS released the Consumer Price Index (CPI) for December 2018. The CPI measures the average change over time in prices of goods and services consumed by people for a day-to-day living. The report put December 2018 inflation rate at 11.44 percent year on year compared to 11.28percent in November 2018 and 15.36 percent in December 2017. The composite food index rose by 13.56 percent for the month of December 2018 compared to 13.30 percent in November 2018. On a month-on-month basis, the food sub-index increased by 0.81 percent in December 2018 down by 0.09 percent points from 0.90 percent recorded in November 2018.

The urban inflation rate increased by 11.73 percent (year-on-year) in December 2018 from 11.61 percent recorded in November 2018, while the rural inflation rate increased by 11.18 percent in December 2018 from 10.99 percent in November 2018. On a month-on-month basis, the urban index rose by 0.76 percent in December 2018, down by 0.07 from 0.83 percent recorded in November 2018, while the rural index also rose by 0.72 percent in December 2018, down by 0.06 percent from the rate recorded in November 2018 (0.78) percent.

In a separate development, the World Bank has projected Nigeria’s economic growth in 2019 at 2.2% and 2.45% in 2020-21, slightly upgrading its earlier estimate of 2.1% in June 2018. This is based on the assumption that oil production will recover and the slow improvement in private demand will constrain growth in the non-oil industrial sector. It also projected oil price at $67 per barrel for the current year and next year (2020). This is $2 dollar below its initial projections in June 2018. Similarly, International Monetary Fund (IMF) projected 2 percent economic for Nigeria in 2019 up from 1.9 percent project in 2018 and 2.28 percent was projected by CBN. Key headwinds to these forecasts, however, are softening oil prices, persistent security challenges arising challenges arising from insurgency on the North East, Herdsmen attack in some parts of the country and perceived political risk associated with the 2019 General Election.

According to the World Bank, “an economy cannot thrive without a healthy private sector. When local businesses flourish, they create jobs and generate income that can be spent and invested domestically. Any rational government that cares about the economic well-being and advancement of its constituency pays special attention to laws and regulations affecting local small and medium-sized enterprises (SMEs). Effective business regulation affords micro and small firms the opportunity to grow, innovate and, when applicable, move from the informal to the formal sector of an economy”.

Business environment issues are critical to the progress of the economy as the macroeconomic conditions. These are issues of infrastructure, policies consistencies, tax, regulatory environment, institutional issues and security situation. Government do not have the capacity and resources needed to create the kinds of jobs needed to absorb the current 20.9million unemployed Nigerian Youth. Strong collaboration with the private sector and massive private sector investment will facilitate job creation for the teeming youths and provide opportunities for government to generate income.

CBN Monetary Policy Committee Meeting

The Monetary Policy Committee (MPC) held the 265th meeting and its first meeting for fiscal 2019 on 21st and 22nd January 2019 amidst concerns over the slowdown in global economic activity, arising from on-going trade tensions, tightening global financing conditions and mounting external debt in Emerging Market and Developing Economies (EMDEs). On the domestic front, the resurgence of moderate inflationary pressure and possible threats to accretion to external reserves due to softening crude oil prices were noted. The Committee reviewed the developments in the global and domestic economic and financial environments in 2018, as well as the risks and outlook in the short to medium term.

On domestic output developments, the Committee noted the continued recovery in output growth in the domestic economy after the 2016 recession as real GDP grew by 1.81 percent in Q3 2018 from 1.50 percent in Q2 2018. The services and agricultural sectors continued to drive output growth, contributing 1.19 and 0.56 percent, respectively. However, the persistence of attack by herdsmen on farmers, cattle rustling and flooding in some parts of the country affected agricultural and livestock output. Based on the Manufacturing and Non-Manufacturing Purchasing Managers’ Indices (PMI), output growth for Q4 2018 is expected to expand further.

The Committee noted with satisfaction, the performance of the economy in 2018, highlighting the achievements in key macroeconomic indicators in the face of global uncertainties and domestic challenges. In particular, it noted the stability in the exchange rate, stable accretion to external reserves, moderation in inflation and the low but gradual improvement in real GDP growth in the last six consecutive quarters commencing from Q2 2017. The MPC noted that given global economic conditions and the risk confronting emerging markets and developing economies in recent times, as well as the limited productive capacity of the economy, the managed float foreign exchange management regime of the CBN has delivered the most optimal results when compared with other emerging markets in recent times. Consequently, capital flows into the domestic economy has continued unabated after an initial lull.

On external borrowing, the Committee noted the increase in the debt level, advising for caution, noting that it could fast be approaching the pre-2005 Paris Club exit level. The MPC also noted that although there was an increase in the inflation rate for the second consecutive month, month-on-month inflation continued to moderate, indicating that the year-on-year measures will also moderate in the near term.

The Committee also noted the attempt by Government to broaden the base of the Value Added Tax (VAT) and urged the authorities to expedite action in that respect, arguing that increased tax collection will reduce the pressure on government expenditure and create fiscal buffers to improve macroeconomic management.

MPC stated that the observed and recent high foreign capital inflow into the Nigerian economy despite the perception of election risk, is evidence of the confidence of the international community in the country’s macroeconomic management and provides a compelling reason for the Committee to await clarity on macroeconomic performance after the general elections in February and March 2019. In the light of the observed risk confronting the economy, including the global and domestic inflationary pressures, which have intensified the risk of currency depreciation, the MPC was of the view that a loosening option was very remote. Weighing the balance of its judgement on price stability conducive to growth, the MPC felt that tightening would result in the loss of the gains so far achieved, noting that this may drive the banks to reprise their assets; thus increasing the cost of credit as well as elevating credit risk in the economy, worsen the position of non-performing loans of the banks, dampen investments and hamper improvements in output growth, given the already fragile growth performance so far achieved.

The MPC decided by a vote of all eleven members to keep the policy parameters unchanged from their current levels as follows:

-

-

- Retain the MPR at 14 percent;

- Retain the asymmetric corridor of +200/-500 basis points around the MPR;

-

III. Retain the CRR at 22.5 percent; and

-

-

- Retain the Liquidity Ratio at 30 percent

-

2019 Key Events

Some key events, both at the global and domestic level are expected to influence economic and business activities in 2019. Below are a few of these events and their implications for businesses and investments in Nigeria.

Expected Hike in Interest Rates in Major Advanced Countries

The expected hike in interest rates in major advanced countries will lead to an increase in global yields and may put pressure on currency in Nigeria. There are strong indications that the US Federal Reserve, Bank of England and European Central Bank will increase interest rates in 2019. The expected increase in the interest rate in the international market may also lead to an increase in the interest rate in Nigeria because of monetary policy adjustments to reduce capital flight.

The 2019 General Elections

The outcome of the 2019 general elections will most likely have an impact on the overall economy as there are 2 options of a continuity in policy or change in policy, depending on which side of the divide emerges victorious between the 2 major political parties. Also, the conduct of the general elections is expected to either attract or scare foreign investors away. A peaceful election will not only ensure stability of the economy but also pave way for Foreign Direct Investments (FDIs) and Foreign Portfolio Investments (FPIs) into Nigeria.

Certain long term business and investment decisions may be taken immediately after the election if the current government retains power. However, if there is a change in power, investors may wait until after the presidential inauguration on May 29 before they take long-term investment decisions, to give them enough time to access details of the policies of the incoming government.

Oil Cut

Nigeria may lose a substantial amount of its projected crude oil revenue due to a limit on crude oil production and the drop in the global crude oil price. This may also lead to a drop in the supply of foreign exchange into Nigeria, resulting in a possible depreciation or devaluation of the Naira. Nigerian businesses should look for local alternatives, where possible, for the raw materials needed for their production process. They should also limit or eliminate foreign debt, particularly if they do not have foreign exchange receivables to mitigate the possible foreign exchange risk. Analysts also advise that businesses should put in place appropriate foreign exchange hedging strategies. The Q3 2018 Balance of Payment (BoP) report that the Central Bank of Nigeria (CBN) published shows that earnings from crude oil and gas accounted for 94.4% of total export earnings during the period. The external trade report that the National Bureau of Statistics (NBS) published for Q3 2018 shows that crude oil exports accounted for 85% of total exports. Therefore, any adverse movement in crude oil price or production has high negative implications on the Nigerian economy.

Sources:

Central Bank of Nigeria, National Bureau of Statistics, www.businessday.ng, World Bank, www.proshareng.com, FSDH Merchant Bank

EASE OF DOING BUSINESS: A REVIEW OF 2018 AND OUTLOOK FOR 2019

As Nigeria continues to intensify efforts at improving its Ease of Doing Business (EODB) ranking, The Federal Government of Nigeria has again shown its commitment towards improving the nation’s EODB ranking. The Presidential Enabling Business Environment Council (PEBEC) recently revealed its goal to move Nigeria into the top-100 on the 2020 World Bank Doing Business Index (DBI).

Review of 2018

In 2018, Nigeria improved its Ease of Doing Business (EODB) performance score from 51.52 to 52.89 as the country was ranked 146 out of 190 countries in the World Bank’s 2019 Doing Business Index (DBI) released on October 31, 2018. Four (4) reforms were recognized by the World Bank while 53 were classified as either too recent to have an impact on the business climate or yet to be validated by the private sector.

2018 was also deemed a year of extensive collaboration between the Presidential Enabling Business Environment Council (PEBEC) and key Stakeholders on Ease of Doing Business (EODB) reforms. Over the past 3 years, Nigeria increased its Distance-to-Frontier (DTF) score by over 11 points. In the same period, Nigeria moved up 24 places in the World Bank Doing Business Rankings. Overall, 32 Nigerian states improved in their ease of doing business environment led by Kaduna, Enugu, Abia, Lagos and Anambra states. Also, an independent EODB survey adjudged Nigeria’s reforms as impactful in terms of reduction in time, cost and procedures of doing business.

Outlook for 2019

In 2019, the Presidential Enabling Business Environment Council (PEBEC) has averred it will continue to work in collaboration with MDAs and other public and private sector partners to ensure that the high impact intervention is sustained. The expected results of these efforts will be the:

-

-

- Movement of Nigeria’s ranking to sub-100 in the 2020 World Bank Doing Business Report.

- Implementation of the PEBEC 2019 Action Plan

- Implementation of a strategic communications and engagement framework to drive awareness and private sector validation of reforms. The forums will be conducted starting from Q1 of 2019 to ramp up the awareness and understanding of the completed and ongoing reform initiatives for sustainability and long-term impact.

- Passage of the Companies and Allied Matters (CAMA) Bill and the Omnibus Bill.

- Expansion of regulatory reform program started with NAFDAC and NAICOM to include other regulatory agencies nominated by the private sector.

- Stakeholder Engagement Sessions will be conducted starting from Q1 2019 to ramp up the awareness and understanding of the completed and ongoing reform initiatives for sustainability and long-term impact

- Release of a sub-national business climate survey by April.

- Establishment of a National Trading Platform for the Ports (FMF/NCS)

- Concession of both Lagos and Abuja international airports as approved by the Federal Executive Council

-

Conclusion

The ambitious move of The Presidential Enabling Business Environment Council (PEBEC) to move Nigeria into the top-100 on the 2020 World Bank Doing Business Index (DBI) is laudable and we will continue to track the progress of the EODB and the activities of the PEBEC reforms and update you accordingly.

SPECIAL REPORT: THE ILO AT 100 – AN OVERVIEW OF THE REPORT ON THE FUTURE OF WORK

Introduction

This year, the ILO is celebrating its 100th anniversary and the anniversary has been identified as an opportunity to celebrate the ILO’s achievements and reaffirm its position as the authoritative global organization for the world of work. Multiple commemorative events are expected to take place around the globe to highlight the achievements of the organization and the role it plays in everyone’s lives. It will also be an opportunity to reaffirm the ILO’s core values and vision as it prepares for its second century of work.

The first major highlight of the celebration is the launch of its report of the Global Commission on the Future of Work, released on Tuesday, January 22, 2019. The report is the culmination of a process that began in 2016 with a series of national dialogues in ILO member States on the Future of Work. The Global Commission was set up with the aim of examining the output from the dialogues as part of an in-depth examination of how to achieve a future of work that provides decent and sustainable work opportunities for all.

The future of work

New forces are transforming the world of work. The transitions involved call for decisive action. Countless opportunities lie ahead to improve the quality of working lives, expand choice, close the gender gap, reverse the damages wreaked by global inequality, and much more. Yet none of this will happen by itself. Without decisive action we will be heading into a world that widens existing inequalities and uncertainties. Technological advances – artificial intelligence, automation and robotics – will create new jobs, but those who lose their jobs in this transition may be the least equipped to seize the new opportunities. Today’s skills will not match the jobs of tomorrow and newly acquired skills may quickly become obsolete. The greening of our economies will create millions of jobs as we adopt sustainable practices and clean technologies but other jobs will disappear as countries scale back their carbon- and resource-intensive industries. Changes in demographics are no less significant. Expanding youth populations in some parts of the world and ageing populations in others may place pressure on labour markets and social security systems, yet in these shifts lie new possibilities to afford care and inclusive, active societies. We need to seize the opportunities presented by these transformative changes to create a brighter future and deliver economic security, equal opportunity and social justice – and ultimately reinforce the fabric of our societies.

Seizing the moment: Reinvigorating the social contract

Forging this new path requires committed action on the part of governments as well as employers’ and workers’ organizations. They need to reinvigorate the social contract that gives working people a just share of economic progress, respect for their rights and protection against risk in return for their continuing contribution to the economy. Social dialogue can play a key role in ensuring the relevance of this contract to managing the changes underway when all the actors in the world of work participate fully, including the many millions of workers who are currently excluded.

A human-centred agenda

We propose a human-centred agenda for the future of work that strengthens the social contract by placing people and the work they do at the centre of economic and social policy and business practice. This agenda consists of three pillars of action, which in combination would drive growth, equity and sustainability for present and future generations.

This agenda focuses on three pillars of action. First, it means investing in people’s capabilities, enabling them to acquire skills, reskill and upskill and supporting them through the various transitions they will face over their life course. Second, investing in the institutions of work to ensure a future of work with freedom, dignity, economic security and equality. Third, investing in decent and sustainable work and shaping rules and incentives so as to align economic and social policy and business practice with this agenda. By harnessing transformative technologies, demographic opportunities and the green economy, these investments can be powerful drivers of equity and sustainability for the present and future generations.

The Recommendations of the ILO for a Human Centred Agenda.

The commission outlines a vision for a human-centred agenda that is based on investing in people’s capabilities, institutions of work and in decent and sustainable work.

The ten recommendations are:

-

-

- Recognize a universal entitlement to lifelong learning and establish an effective lifelong learning system that enables people to acquire skills, upskill and reskill throughout their life course.

- Step up investments in the institutions, policies and strategies that will support people through future of work transitions, building pathways for youth into labour markets, expanding choices for older workers to remain economically active and proactively preparing workers for labour market transitions.

- Implement a transformative and measurable agenda for gender equality by making care an equal responsibility of men and women, ensuring accountability for progress, strengthening the collective representation of women, eliminating gender-based discrimination and ending violence and harassment at work.

- Strengthen social protection systems to guarantee universal coverage of social protection from birth to old age to workers in all forms of work, including self-employment, based on sustainable financing and the principles of solidarity and risk sharing.

- Establish a Universal Labour Guarantee that provides a labour protection floor for all workers, which includes fundamental workers’ rights, an “adequate living wage”, limits on hours of work and ensuring safe and healthy workplaces.

- Expand time sovereignty by crafting working time arrangements that give workers greater choice over scheduling and working hours to balance work and private life, subject to the company’s needs for greater flexibility, as well as guaranteed minimum hours.

- Actively promote collective representation of workers and employers and social dialogue through public policies.

- Harness and manage technology in support of decent work and adopt a “human-in-command” approach to technology. Increasing investment in decent and sustainable.

- Create incentives to promote investments in key areas for decent and sustainable work.

- Reshape business incentive structures to encourage long-term investments in the real economy and develop supplementary indicators of progress towards well-being, environmental sustainability and equality

-

The responsibilities of the ILO

Our Commission is independent and we alone bear responsibility for our report and recommendations. Nevertheless, we are aware that the report will be transmitted for discussion at the Centenary International Labour Conference in June 2019 and is to be debated nationally at Centenary events to be convened by member States throughout the year. Therefore, we offer the following recommendations on the specific responsibilities of the Organization, emphasizing that it must remain faithful to, and be guided by, its strongly rights-based, normative mandate and in full respect of its tripartite character. We recommend that the ILO put in place the institutional arrangements to enable it to be the focal point in the international system for the development and comparative policy analysis of the national future of work strategies. We further recommend that the ILO promote coordination among all relevant multilateral institutions in framing and implementing the human-centred agenda set out in our report. We recommend that the ILO give high priority to the key challenges of transformational change at work. It needs to evaluate its standards and ensure that they are up to date, relevant and subject to adequate supervision. Above all, we see a strategic role for the ILO in deepening understanding of how processes of digitalization and automation are continuing to affect the world of work, in order to manage them for the benefit of all. This includes an evaluation of the effects of new technologies on work design and worker well-being. Specifically, we recommend that the ILO establish an innovation laboratory on digital technologies that can support decent work. The lab would pilot and facilitate the adaptation and adoption of technologies to support employers, workers and labour inspectorates in monitoring working conditions and would provide training and support on how to analyse and use the data collected. And, because technological change is an ongoing process, not simply an event, we recommend that the ILO give urgent attention to the means of its implementation.

Responsibilities and challenges of the multilateral system

At the same time as the debate on the future of work has taken centre stage, the multilateral system confronts serious questioning of its very effectiveness and legitimacy. The two are not coincidental. Multilateralism is under such pressure precisely because of doubts about its capacity to deliver credible responses to the global challenges of the day. Demonstrating that by working together in full coherence the system is able to provide such responses will do much to win back the political support that it needs to operate to its full potential.

We recommend strongly that all relevant organizations in the multilateral system explore ways to strengthen substantive joint work to implement the recommendations presented in this report. We are encouraged in this recommendation by the knowledge that the constitutions and mandates of the organizations of the UN system, the Bretton Woods institutions and the World Trade Organization (WTO) reflect complementary and compatible objectives. Their mandates are interlinked and mutually reinforcing and their in-built synergies need to be better exploited. We recommend in particular the establishment of more systemic and substantive working relations between the WTO, the Bretton Woods institutions and the ILO. There are strong, complex and crucial links between trade, financial, economic and social policies. The success of the human-centred growth and development agenda we propose depends heavily on coherence across these policy areas. Trade and financial policies are important means to the material welfare and spiritual development of the person through decent work.

By the same logic, we recommend greater international cooperation in specific work-related areas. Multilateral and international action needs to underwrite the social contract. For example, by the time of publication of our report, the UN system will have formally adopted Global Compacts on Safe, Orderly and Regular Migration and on Refugees. These will open new opportunities to build stronger system-wide cooperation on migration and on access of refugees to labour markets. Similarly, the UN Guiding Principles on Business and Human Rights, adopted in June 2011, provide a widely supported global framework for preventing and addressing adverse human rights impacts linked to business activity. This framework can be harnessed to the broader promotion of business’s positive contribution to the processes and objectives we have set out. In a similar vein, we recommend that the ILO pursue with the World Health Organization and with UNESCO, respectively, processes to give effect to the Commission’s recommendations on occupational safety and health and on lifelong learning.

Final Comment

The Commission sees its report as only the beginning of the journey. We hope that the journey will be carried forward, with broadest possible participation, nationally and internationally. Our task has been to identify what we believe to be the key challenges for the future of work and to recommend how to address them. We know that these questions are being examined in other venues and we do not expect that our views will be the only ones to be heard. But we are certain of two things. First, that because it brings together the governments, employers and workers of the world and also because of its mandate, the ILO is well suited to act as a compass and guide on this journey. Second, that whatever the merits of our own report may be, the issues we have been asked to consider the matter. They matter to people everywhere on our planet and they matter to the planet itself. Although they are difficult, we ignore them at our peril; and if we are able to come up with good answers, we will help to open up extraordinary new vistas for coming generations at work.

Taxation of Compensation for Loss of Office Vis-A-Vis LIRS’ Circular

In 2016, Nigeria was plunged into an economic recession, which lasted from the third quarter of 2016 to the third quarter of 2017, hurting many businesses. The effect of the recession has led many companies to downsize in order to manage costs. According to the National Bureau of Statistics (NBS), the unemployment rate increased from 18.8% in the third quarter of 2017 to a staggering 23.1% by the third quarter of 2018. The NBS also stated that about 3.3 million Nigerians became unemployed between December 2017 and December 2018, raising the number of unemployed Nigerians to 20.9 million. Many of such companies that have downsized have paid some of the terminal benefits including compensation for loss of employment to the disengaged staff.

In 2017, the Lagos Internal Revenue Service (LIRS) issued a public notice intimating taxpayers that although compensation for loss of employment is not taxable under the personal income Tax Act (PITA), it is liable to Capital Gain Tax (CTG) under Section 6(1) (a) of the Capital Gain Tax Act (CGTA). More recently in January 2019, LIRS issued another notice appointing payers of capital sums, including employers, as collecting agents for the purpose of deducting and remitting the CGT on capital sums. The circular directed that CGT on such sums be remitted to the Lagos State Government. Such employers are also expected to file a statement showing all recipient of ‘capital sums’ when filing their annual returns.

Ingenious as the revenue generating efforts may seem, it is important to examine the legal basis for the application of CGT to compensation for loss of employment. This piece examines the basis of the taxation of compensation for loss of employment, and the instances in which such sums, may be liable to CGT.

What Constitutes Compensation for Loss of Employment?

The PITA imposes tax on any salary, wage, fee, allowance or other gain or profit from employment including compensation, bonuses, premiums and other benefits given to an employee. Section 81(1) of the PITA provides that income tax chargeable on an employee shall be recoverable from any emolument paid to the employee by the employers. The term ‘’ emoluments’’ is defined to include all allowances, salary, wages, perquisites, bonuses, and compensations. Although compensations are liable to tax under PITA, Clause 26 of the Third schedule to PITA expressly exempts any compensation for loss of Employment’ from PIT.

Under Section 6(1)(a) of the CGTA a disposal {of assets,} is defined to include a situation where a capital sum is derived by way of compensation for loss of office or employment even though no asset is acquired by the person making the payment.

However, neither PITA nor the CGTA defines or provides guidance on what constitutes ‘’compensation for loss of employment’’ under each of the laws. Notwithstanding the above, it is clear that there are instances where such compensations may either be chargeable under the PITA or the CGTA, depending on the circumstances under which the payment is made. By virtue of section 12 of the CGTA, sums that have been taken into account when computing PIT should be excluded from consideration in the computation of CGT. This should also operate vice-versa. Thus, any payment made as compensation for loss of employment and liable to tax under PITA should not be taxable under the CGTA. Hence, it would appear that the compensation by section 6 and 36 of the CGTA is different from the compensation for loss of office exempted in paragraph 26 of the Third schedule to PITA.

When is Compensation for Loss of Office taxable under the CGTA and the PITA?

By virtue of section 6 of the CGTA, where any capital sum is derived from a sale, lease, transfer, assignment, compulsory acquisition or any other disposition of assets, particularly, by the way of compensation for loss of office or employment, such capital sum would be liable to CGTA.

A typical example where section 6 of the CGTA would apply is a case where an employee is given an official residence as compensation for loss of employment on exiting a company. In this case, the employer has disposed an asset, and the capital sum, which can be considered as the market value of the official residence, would be liable to CGTA. Consequently, we can infer that the section 6 of the CGTA should only apply where the compensation for loss of office is derived from a sale, lease, transfer, compulsory acquisition or disposal of assets as specified in the section.

Given the above, it seems cash payment to an employee, as compensation for loss of office should not fall under the purview of a section of 6 of the CGTA.

Similarly, Section 36 of the CGTA on personal injury provides another situation where CGT would apply on compensation for loss of office. Specifically, Section 36(1) contemplates a scenario where an employee is compensated for damages, injury, personal or professional wrong which does not lead to loss of office. In this case, the CGTA exempts such compensation from CGT. It can be imagined that the exemption from CGT is because such employee would still be in productive employment from which personal income tax would still be paid to the government and the law considered it fit that such an employee should not be encumbered with a tax burden after suffering a personal injury or professional loss.

On the other hand, section 36(2) of the CGTA provides for a scenario where such personal loss leads to loss of office. In this case, the compensation received by such an employee as a result of the personal loss would still not be liable to CGTA except where it exceeds N10,000.

Having considered the type of compensation for loss of office under the purview of the CGTA above, it would be safe to infer that the compensation for loss of office where cash payment is made to an employee due to staff redundancy or expiration to the employment contract should fall under the purview of the PITA and therefore exempted under Paragraph 26 of the Third schedule of the PITA.

The fact that such cash payment is made as a terminal benefit on the expiration of the employment contract or due to a staff redundancy in a recession should not change the tax treatment.

Concluding Remarks

Based on the foregoing, the nature of compensation for loss of office (employment) needs to be carefully determined first before a cheque is sent to LIRS. Although LIRS has issued notices mandating employers who have paid ‘Capital Sums’ to persons including former employees as compensation for loss of office to remit CGT on such payments, the circumstances of such payments would be very key in determining whether the amounts fall within the provisions of the PITA or the CGTA.

Consequently, it is important that employers consult their tax advisers to provide guidance on whether the CGTA would apply to any compensation for loss of office paid to ex-staff.

Exposition by AndersenTax

===============================================================================================================

LAW REPORT REVIEW / LEGAL OPINION:

SURCHARGING OF AN EMPLOYEE FOR NEGLIGENCE

Omolola Shafqat Ogungbuaro vs. Access Bank Plc, unreported Suit No. NICN/LA/289/2014

FACTS:

The claimant commenced this action in June 2014. She claimed the following reliefs against the defendant:

-

-

- a)A declaration that the claimant was not negligent and as a result, the recommendation of the management of the defendant on October 23, 2014 indicting the claimant is null and void.

- b)A declaration that the various sums of money deducted by the defendant from the accounts of the claimant are illegal, unconstitutional, null and void and same be reversed.

- c)A declaration that the sum of N1,647,307.92 (One Million, Six Hundred and Forty-Seven Thousand, Three Hundred and Seven Naira, Ninety-Two Kobo) being the total sum of money the defendant deducted from the claimant’s accounts be refunded to the claimant by the defendant with an interest at the rate of Nigerian treasury bill of 12% on the N1,647,307.92 (One Million, Six Hundred and Forty-Seven Thousand, Three Hundred and Seven Naira, Ninety-Two Kobo) from February 28, 2014 until judgment is delivered and thereafter until the judgment sum is fully liquidated.

- d)General damages in the sum of N25,000,000.00 (Twenty-Five Million Naira) only in favour of the claimant for the pain, trauma, frustration, emotional injuries and loss of quality life suffered as a result of the defendant’s action.

- e)The cost of instituting the action in the sum of N1,000,000.00 (One Million Naira) only.

-

CASE OF THE CLAIMANT:

-

-

- The claimant’s case is that on 10thOctober 2013, while she was out marketing the defendant’s products to other customers, she received a request via an electronic mail on his mobile phone from Plenco Industries Limited to transfer the sum of N2,500,00.00 (Two Million, Five Hundred Thousand Naira) only to Zenith Bank Plc.

- That upon receipt of the customer’s request by electronic mail, she tried to contact the Management of Plenco Industries Limited on phone to confirm if the transfer request is to be treated but was unsuccessful.

- That she subsequently contacted one Miss Emilia Ezeji who is the Secretary of Awolowo Branch, Ikoyi, Lagos on phone to help her send indemnity forms to Plenco Industries Limited pending the time she returns from the field after marketing.

- That by the time she got back to the Branch, the Secretary had treated the transfer request by signing on it and taking same to Operations Unit Head for onward transfer of funds to Zenith Bank Plc without her authorization or knowledge.

- To the claimant, it is the customary practice of the defendant that where a transfer request is made by a customer, the account officer of the customer can confirm the request by appending his/her signature on the transfer request before it is treated by the Operations Unit Head but where the account officer is not around, the Operations Unit Head or the Branch Service Head or the Relationship Manager in the branch is authorized to confirm transfer request before it can be treated by Operations Unit Head for onward transfer of funds to the beneficiary as indicated on the customer’s fund transfer request.

- That at about 9:30am the following day 11th October 2013, Plenco Industries Limited subsequently sent a letter to the branch that N2,500,000.00 (Two Million Five Hundred Thousand Naira) was missing.

- That the Internal Audit of the defendant thereafter setup an investigative panel to look into the transactions on the said Plenco Industries Limited’s account of October 10, 2013.

- That during interrogation and investigation by the Internal Audit of the defendant, the secretary (Miss Emilia Ezeji) admitted that the claimant asked her to send indemnity forms to Plenco Industries Limited but she assumed that she also instructed her to confirm the request for treatment.

- That while she was waiting for the Internal Audit report of the defendant, the defendant on 23rd October 2013 sent an electronic mail informing her of the defendant’s management recommendation to the effect that the sum of N1,625,000 (One Million, Six Hundred and Twenty-Five Thousand Naira) should be recovered from her at a monthly deduction of N81,250.00 (Eighty-One Thousand, Two Hundred and Fifty Naira) only for a period of 20 months.

-

CASE OF THE DEFENDANT

-

-

- To the defendant, the claimant was employed by the defendant and posted to the Awolowo Road Branch of the defendant upon being confirmed on August 3, 2009.

- That the Secretary of Awolowo Branch of the Bank had treated the transfer request upon the claimant’s instructions by the time the claimant got to the office.

- That although it is not the practice of the defendant to make the report of the Internal Audit Investigation available to staff, the claimant was advised of the outcome and findings of the investigation.

- The claimant and other staff involved in the case were invited and questioned by, and made statements to, the defendant’s Internal Audit Investigation Unit.

- That the investigation report carried out by the Internal Audit found the claimant guilty of negligence by her failing to confirm an email request purportedly emanating from a staff of a customer company (Plenco Industries Limited) before calling the Branch’s Secretary to attend to the request and scan indemnity forms to the sender of the mail.

- That the claimant and the two other staff found culpable (Kunbi Kuti and Emilia Ezeji) were duly informed of the findings and recommendations of the Internal Audit Investigation Unit, which was that the customer’s account be credited with the N2,500,000.00 and the loss recovered from the claimant for not confirming the transaction which was above the Bank’s confirmation threshold, and Kunbi Kuti for not adhering properly to the provisions of the standard operating procedure for non-cheque funds transfer.

- The defendant went on that the recommendation of the Internal Audit investigation was that the claimant should refund 65% of the loss.

- The defendant further averred that the recommendation was premised on the negligence of the claimant to confirm the email before attending to it.

- That the claimant was duly informed that pursuant to the recommendations of the Internal Audit Investigation Unit, the sum of N1,625,000.00 (or 65% of the loss) would be recovered from her by monthly deductions of N81,250.00 from her salary for a period of 20 months. The Internal Audit Investigation also recommended that 35% of the loss should be recovered from Kunbi Kuti, whilst Emilia Ezeji would be sanctioned by being returned to her employer (MS Outsourcing) for her negligence in processing the transaction and for carrying out transactions outside her core functions as a Secretary.

-

ISSUES FOR DETERMINATION

(1) Whether the claimant was negligent in the discharge of her duties as the Account Officer of Plenco Industries Limited on 10th October 2013 as alleged by the defendant.

(2) Whether the defendant afforded the claimant a fair and reasonable trial.

(3) Whether the claimant is entitled to the reliefs sought by her, in view of the facts and circumstances of the case.

(4) Whether the deduction by the defendant from the claimant’s account in payment of the 65% surcharge for loss occasioned by the claimant’s negligence was unlawful, unfair, unjust, unconstitutional and so should be paid back to the claimant.

(5) Whether, if the answer to issue (1) above is in the positive, the claimant is entitled to pre-judgment interest.

JUDGMENT

The court examined the arguments of the parties and found that:

-

-

- the Audit Investigation Unit made a finding and then recommended something different and unrelated to the findings ie that the claimant was negligent.

- Even if the claimant was negligent, does the defendant have the right to surcharge the claimant as it did? Citing Shefiu Adejare vs. MDS Logistics Plcunreported Suit No. NICN/LA/20/2013, where the Courts have generally held that an employee cannot be surcharged (i.e. make somebody repay from personal funds any losses stemming from negligent or intentional mismanagement of a fiduciary responsibility) by an employer without first being given a hearing on the issue; or where there are more than one culprit, the yardstick used for the apportionment of indebtedness and hence the surcharge”. The hearing referred to is a hearing as to the surcharge, not a hearing as to the alleged wrongdoing. See also: Alhaji A.R. Animashaun vs. UCH [1996] LPELR-492 (SC); [1996] 10 NWLR (Pt. 476) 65 and Abayomi Adesunbo Adetoro vs. Access Bankunreported Suit No. NICN/LA/293/2013

- All the Audit Investigation Unit did was come to the conclusion that the claimant was negligent and so should be surcharged. The claimant was not heard on the surcharge itself. There are two levels of investigation expected here: the one to establish guilt of the employee; the other to justify the surcharge as well as the yardstick for imposing the surcharge where there were more than one culprit. The defendant assumes the first, the investigation to establish guilt, suffices for the second.

-

The Court thereby declared as follows:

(1) That the claimant was not negligent and as a result, the recommendation of the Management of the defendant indicting the claimant is null and void.

(2) That the various sums of money deducted by the defendant from the accounts of the claimant are illegal, unconstitutional, null and void and same are hereby reversed.

(3) That the sum of N1,647,307.92 (One Million, Six Hundred and Forty-Seven Thousand, Three Hundred and Seven Naira, Ninety-Two Kobo) being the total sum of money the defendant illegally deducted from the claimant’s various accounts should be refunded to the claimant by the defendant.

(4) The said sum of N1,647,307.92 (One Million, Six Hundred and Forty-Seven Thousand, Three Hundred and Seven Naira, Ninety-Two Kobo) is to be paid by the defendant to the claimant within 30 days of this judgment, failing which it shall attract interest at 10% per annum until fully liquidated.

OPINION:

It is important for Employers to follow laid down principles and process involved in the surcharge of employees. This is to avoid the surcharge being reverted by an order of court, for not following due process.

It is equally important for investigation units of organizations to always make their recommendations in tune with their findings to avoid unnecessary and unwarranted legal Actions.

Recent Comments