Business Essential June Edition.

BUSINESS AGENDA FOR THE GOVERNMENT, NBSCONSUMER PRICE INDEX, MAY 2019 & CBN BUSINESS EXPECTATION SURVEY.

As President Muhammadu Buhari’s administration commences another four years of governance, the Nigerian populace and the business community have begun to set an agenda for the next four years for the President, with the economy as a top priority. It is therefore, pertinent for the President to be abreast of the enormous task ahead.

The composition of the President’s cabinet is vital in driving investments and economic policies of the government. The investment climate in Nigeria needs to be attractive enough to encourage private capital investment needed to expand the economy. The Policy choices focus should be for long term growth and development. Priority should be given to policies that will reset the economy in a way that works for Nigerians and an inclusive growth that can translate to an increase in purchasing power parity should be vigorously pursued.

The Executive Order 03 signed by the President during his first term, focused on patronage of locally produced goods and was well appreciated by local manufacturers as it dovetailed into a “Made in Nigeria” policy. However, efforts should be geared towards implementation across all levels of Government as this could become a game changer for the private sector.

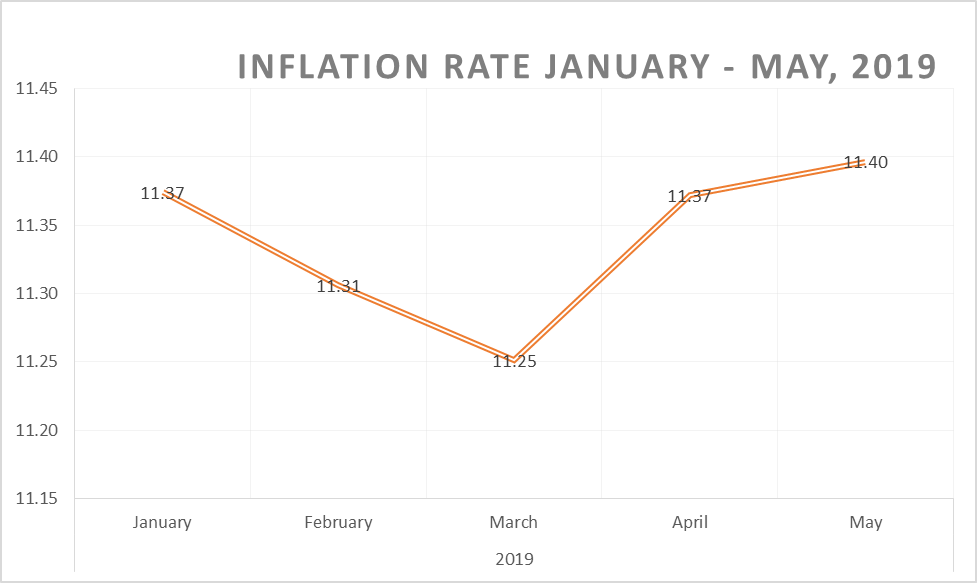

The NBS Consumer Price Index (CPI), April, 2019

The Consumer Price Index rose at a faster pace in May to the highest level this year to 11.40% on a year-on-year basis. The CPI, which measures the composite changes in the prices of consumer goods and services purchased by households over a period, increased by 0.03 percent compared with value recorded in March 2019(11.37%). The rebound in the CPI was triggered by higher food prices, which accelerated the most in the last one year

Food inflation accelerated for the second consecutive month by 13.79% in May from a year earlier compared with 13.70% recorded in April. However, core inflation, which captures all items, but exempts the prices of volatile agricultural produce, moderated from 9% to reach its lowest level in over three years.

As a result, the high inflationary pressures on household items was largely driven by heightened food inflation on the back of the commencement of rainy season which signals planting season for agricultural products, a development that has left limited farm produce in the market for consumption.

The major driver of the “increase in the inflation rate is the increase in food prices, due to the seasonality effect typically associated with the onset of the planting season. The fast-paced inflation rate could also be traced to the security challenges in some food producing regions in the country. This has reduced the supply of food items even as demand persisted, leading to an increase in prices.

On a month-on-month basis, the country’s headline inflation maintained its upward momentum by 1.11 percent in the review month from 0.94 percent recorded in April. Food inflation jumped by 1.41 percent from 1.14 percent, while core inflation quickened by 0.75 percent from 0.70 percent.

The urban inflation rate increased by 11.76 percent on a year-on-year basis in May 2019 from 11.70 percent recorded in April 2019, while the rural inflation rate rose by 11.07 percent in May 2019 from 11.08 percent in April 2019.

Also, on a month-on-month basis, the urban index rose by 1.15 percent in May 2019, this represents 0.15 percentage point from 1 percent recorded in April 2019, while the rural index also rose by 1.07 percent in May 2019, indicating 0.17 percentage point from its April 2019 level of 0.90 percent.

The CBN Business Expectation Survey

Businesses expressed optimism on Nigeria’s macro economy in May 2019 according to Central Bank of Nigeria (CBN) monthly Business Expectations Survey (BES). The May 2019 BES was conducted from May 6-10, 2019 with a sample size of 1050 businesses nationwide. A response rate of 97.0 per cent was achieved and the sample covered the services, industrial, wholesale/retail trade, and construction. The respondent firms were made up of small, medium and large corporations covering both import- and export-oriented businesses.

At 29.7 index points, respondents expressed optimism on the overall confidence index (CI) on the macro economy in the month of May 2019. The business outlook for June 2019 showed greater confidence on the macro economy with 62.7 index points. The optimism on the macro economy in the current month was driven by the opinion of respondents from services (15.7 points), industrial (9.7 points), wholesale/retail trade (2.8 points) and construction (1.4 points) sectors. Whereas the major drivers of the optimism for next month were services (36.6 points), industrial (18.7 points), wholesale/retail trade (4.9 points) and construction (2.5 points) sectors. The positive outlook by type of business in May 2019 were driven by businesses that are neither import- nor export-oriented (20.8 points), both import- and export-oriented (5.3 points), import-oriented (3.0 points), and those that are export-related (0.7 points).

On Business Confidence, all sectors expressed optimism on own operations in the review month. Respondents from the services sector expressed the greatest optimism on own operation with an index of 8.7 points, followed by the industrial sector with 3.0 points, the wholesale/retail trade with 0.8 points and the construction sector with 0.1 points, respectively. Similarly, on employment and expansion plans, Respondent firms’ opinions on the volume of business activities (68.6 points) and employment (24.8 points) indicated a favourable business outlook in next month. The employment outlook index by sector showed that the wholesale/retail trade sector indicates higher employment expansion plans with an index of (25.9 points) followed by services sector (25.7 points), industrial sector (24.9 points) and construction sector (5.9 points)

On the Business Constraint, the surveyed firms identified insufficient power supply, high interest rate, unfavourable economic climate, financial problems, unclear economic laws, unfavourable political climate, insufficient demand access to credit, competition and lack of equipment as the factors constraining business activity in May 2019

The firms also expect the Naira to appreciate in the current month, next month and the next twelve months. The respondents firms expressed satisfaction with the management of inflation by the Government; borrowing rates is expected to rise in current month, next month and the next twelve months.

Sources: Central Bank of Nigeria, NBS, www.proshareng.com, Business Day Newspaper

GLOBAL FOREIGN DIRECT INVESTMENT SLIDES FOR THIRD CONSECUTIVE YEAR AS FOREIGN INVESTMENT INTO NIGERIA DROPS BY 43%

Global foreign direct investment (FDI) flows slid by 13% in 2018, to US$1.3 trillion from $1.5 trillion the previous year – the third consecutive annual decline, according to UNCTAD’s World Investment Report 2019.The contraction was largely precipitated by United States multinational enterprises (MNEs) repatriating earnings from abroad, making use of tax reforms introduced by the country in 2017, designed for that purpose.

Foreign direct investment inflows, global and by group of economies, 2007-2018

(Billions of dollars and per cent)

Hardest hit by the earnings repatriation were developed countries, where flows fell by a quarter to $557 billion – levels last seen in 2004. “FDI continues to be trapped, confined to post-crisis lows. This does not bode well for the international community’s promise to tackle urgent global challenges, such as abject poverty and the climate crisis,” UNCTAD Secretary-General Mukhisa Kituyi said. “Geopolitics and trade tensions risk continuing to weigh on FDI in 2019 and beyond,” he cautioned.

The tax-driven fall in FDI, which occurred in the first two quarters, was cushioned by increased transaction activity in the second half of 2018. The value of cross-border merger and acquisitions (M&As) rose by 18%, fueled by United States MNEs using liquidity in their foreign affiliates.

Developing country flows managed to hold steady (rising by 2%), which helped push flows to the developing world to more than half (54%) of global flows, from 46% in 2017 and just over a third before the financial crisis. Half of the top 20 host economies in the world are developing and transition economies.

Despite the FDI decline, the United States remained the largest recipient of FDI, followed by China, Hong Kong (China) and Singapore. In terms of outward investors, Japan became the largest followed by China and France. The United States was out of the top 20 list, due to its MNEs massive repatriation of investment earnings.

Foreign direct investment inflows, top 20 host economies 2017 and 2018

(Billions of dollars)

Foreign direct investment outflows, top 20 home economies 2017 and 2018

(Billions of dollars)

FDI drops by 43% in Nigeria

Despite Foreign Direct Investment increasing in sub-Saharan Africa by 13% in the previous year, Foreign direct investment in Nigeria, Africa’s top oil producer, plunged by 43 per cent to $2bn, according to a Reuters report.

Foreign investment in sub-Saharan Africa rose 13% last year to $32 billion, bucking a global downward trend and reversing two years of decline, according to the United Nations World Investment Report. Development of new mining and oil projects, a new U.S. development-finance institution and the ratification of an agreement to create a continent-wide free-trade area could further boost foreign direct investment (FDI) in 2019, it said.

Africa stands in sharp contrast to developed economies, which saw FDI inflows plunge 27% to their lowest level since 2004, the United Nations Conference on Trade and Development wrote in its “World Investment Report”.

Some African countries fared better than others, however. The Southern African region performed the best, taking in FDI of nearly $4.2 billion, up from -$925 million in 2017. Which saw Foreign investment in South Africa more than double to $5.3 billion. President Cyril Ramaphosa, who took office last year pledging to revive the economy, is seeking to attract $100 billion in FDI to Africa’s most developed economy by 2023.

Though much of the South African jump came from intracompany loans, new investments included a $750 million Beijing Automotive Group plant and a $186 million wind farm being built by the Irish company Mainstream Renewable Energy.

By contrast, inward FDI to Nigeria, a major oil producer, plunged 43% to $2 billion. Investors were put off by a dispute between the government and South African telecom giant MTN over repatriated profits. Banks HSBC and UBS both closed representative offices there in 2018. That left Ghana, which is in the midst of an oil and gas boom and saw inflows of $3 billion, as West Africa’s leading destination for foreign investment. Italy’s Eni Group was behind Ghana’s largest greenfield investment project. Ethiopia remained East Africa’s top recipient of FDI at $3.3 billion, despite an 18% drop compared with the year before. Kenya, Uganda and Tanzania all saw increases in FDI inflows. Foreign investment in Uganda jumped 67% to a record $1.3 billion, boosted by the oil and gas development of a consortium that includes France’s Total, CNOOC of China and London-listed Tullow Oil.

Modest recovery likely in 2019

In 2019, FDI is expected to recover in developed economies as the effect of the U.S. tax reforms winds down.Greenfield project announcements – indicating forward spending plans – also point to a rise, as they were up 41% in 2018 from a low in 2017. Nevertheless, the weak underlying FDI trend indicates that a rise in FDI may be relatively modest and may be further reined in by other factors, such as geopolitical risk, escalating trade tensions and a global shift towards more protectionist policies.

The underlying FDI growth trend has been anemic since 2008. If one-off factors such as tax reforms, megadeals and volatile financial flows are stripped out, FDI over the past decade averaged only 1% growth per year, compared with 8% between 2000 and 2007, and more than 20% before 2000. “The stagnating trend of the decade is ascribed to a range of factors that include declining rates of return on FDI, the increasingly asset-light forms of investment and a generally less favourable investment policy climate,” said UNCTAD’s investment and enterprise director, James Zhan. “However, the current trend is more of policy driven than economic cycle driven,” he emphasized.

State-owned MNEs are close to 1,500, with their presence in the top 100 global MNEs increased by one to 16.The value of their M&A activity shrank to 4% of total M&As in 2018, following a gradual decline from more than 10% on average in 2008–2013. Much of the continued expansion of international production is driven by intangibles.

FDI inflows and the underlying trend, 1990-2018

(Indexed, 2010 = 100)

Longer-term trend

The longer-term trend also shows the growth of non-equity modes of international production outpacing FDI, as evidenced by the relative growth rates of royalties, licensing fees and services trade. The top 100 MNE ranking for 2018 shows the importance of industrial MNEs sliding, with some dropping out of the list.

MNEs in the global top 100 account for more than one third of business-funded R&D worldwide. International Greenfield investment in R&D activities is sizeable and growing.

New data on the global network of direct and indirect bilateral FDI relations show the important role of regional investment hubs in intraregional trade. A significant part of investment between developing countries (South–South FDI) is, however, ultimately owned by developed-country MNEs.

Source: United Nations Conference on Trade and Development (UNCTAD),Reuters

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

TAXATION OF NIGERIA’S DIGITAL ECONOMY: CHALLENGES AND PROSPECTS

The digital economy is fast becoming the most innovative and widest reaching economy in the world. In 2018, the Nigerian Investment Promotion Commission explained that the Nigerian digital economy is expected to generate $88 billion and create three million new jobs by the end of 2021.

However, Nigeria may find that it is unable to tax the huge income that the digital economy would generate unless it amends its laws to adapt to changing technological advancement.

Typically, the general rule under Nigeria tax laws for taxing income of foreign enterprises in a given jurisdiction is by establishing that the entity has a taxable presence or has a permanent establishment (PE) in Nigeria. Given that digital transactions require little or no physical presence of the transacting parties, the income from the transaction may not be captured in the jurisdiction where the income is derived.

Whilst the Nigerian tax authorities are working towards ensuring digitalisation of the tax collection process, it is unfortunate that this digitalisation has not been extended to cover effective monitoring and collection of taxes from digital transactions. However, the Chairman of the Federal Inland Revenue Service (FIRS), Mr. Babatunde Fowler, recently disclosed that the FIRS would soon begin collection of Value Added Tax (VAT) on online transactions. According to the Chairman, the FIRS plans to start directing banks in Nigeria to be the collecting agents for VAT on online transactions for purchase of goods and services. As innovative as this move may sound, it may give rise to a number of undesirable consequences given that no clear legal framework exists for this move.

This Article discusses some of the challenges and prospects of taxing the digital economy in Nigeria and examines some developments in other jurisdictions with respect to taxation of the digital economy.

Challenges of Taxing the Digital Economy in Nigeria

The applicable rules for corporate taxation in Nigeria do not effectively capture the realities of a modern economy in our world of fast-paced digital transactions. Given that non-resident companies are taxed in Nigeria based on profits derived from Nigeria, the question as to whether a foreign company is liable to income tax in Nigeria is usually controversial. Section 13 of Companies Income Tax Act (CITA) implies that a non-resident company must have physically performed activities in Nigeria, directly or indirectly, before such a company can be liable to income tax in Nigeria. Thus, where a software company provides online data to users in Nigeria without being physically present in Nigeria in any form, it may be difficult to conclude that such a company is liable to CIT in Nigeria, although the company could have derived income from Nigeria. A major challenge is therefore determining at what point such non-resident would be deemed to have carried on business in Nigeria and thus liable to income tax in Nigeria. This is because the absence of the required fixed base or physical operations in Nigeria under Section 13 of CITA has made it difficult for the FIRS to establish liability of such foreign companies to Nigerian tax.

To ensure that digital companies do not escape tax in Nigeria, the FIRS has often required Nigerian companies to withhold tax on all payments made to non-resident persons regardless of the non-establishment of the tax presence specified under Section 13 of CITA. This requirement has encountered resistance from taxpayers given that such non-resident persons may not be liable to tax under Nigerian laws. However, the FIRS seems to have succeeded in ensuring that VAT is deducted and accounted for on cross border payments for transactions between foreign companies and Nigerian companies such as in the case between Vodacom Business Nigeria Limited v FIRS and held that the Nigerian company was required to account for the VAT on such transactions regardless of the fact that the supplier/foreign company did not perform the services and had no physical presence in Nigeria.

Thus, the absence of relevant provisions in the Nigerian tax laws covering taxation of digital activities is a major challenge that has resulted in loss of revenue to the government.

Insights from Other Jurisdictions

It is important to note that the challenges arising from taxation of digital transactions are not peculiar to Nigeria. Due to the resultant revenue loss arising from these challenges, various jurisdictions and international associations have sought means to ensure that taxes are paid in the jurisdiction where income is derived. We have examined below some of the measures taken by other jurisdictions on the taxation of the digital economy.

India

India introduced new digital permanent establishment rules effective April 2019 to address the challenges that arise from taxation of the digital economy. These rules, which are contained in the 2018 Indian Finance Act, seek to subject businesses that have a “significant economic presence” in India tax notwithstanding that such businesses may not have any physical presence in India. The Act defined “significant economic presence” to mean, amongst others, transactions where the aggregate payments exceeds such amounts as may be prescribed. In addition, India currently imposes a surcharge tax of 6% on payments to foreign companies for online advertising services when such companies do not hold a permanent establishment in India.

Ultimately, these rules aim at capturing companies that do significant business in India through digital channels but who would not have been captured by preexisting PE rules.

European Union

In March 2018, the European Commission (the Commission) proposed new rules to ensure that digital business activities are taxed in a fair and growth-friendly manner in the EU. The Commission has made two legislative proposals.

One proposal recommends that member states apply an interim tax on companies that generate an annual total revenue of over £750 million and an annual total revenue of over £50 million from digital activities in the EU. This interim tax is to cover the main digital activities that are currently escape tax in the EU ad is to be levied at 3% on the gross revenue of businesses derived from online advertising, sale of collected user data and other digital services etc. The other proposal seeks to introduce the concept of a “taxable digital presence” or a Virtual Permanent Establishment (VPE). A VPE is designed to introduce a taxable nexus for digital businesses operating within the EU with little or no physical presence.

Prospects for Taxation of the Digital Economy in Nigeria

Given the rising statistics on the digital economy and its immense potential, it has become expedient for the Nigerian tax authorities to explore a more creative approach to ensure effective taxation of the digital economy.

Nigeria will need to borrow a leaf from other nations that have taken bold steps to tackle tax leakages in the digital economy through innovative tax legislation. Just like India, the government should expand the scope of “fixed base” under Section 13 of the CITA to ensure that the digital economy is effectively captured for income tax purposes. The introduction of a digital fixed base in Nigeria will certainly increase the tax base, thereby ensuring an increase in government revenue.

A major drawback, however, relates to enforcement of taxation of digital transactions, given that most digital transactions are concluded with non-resident companies, which makes efficient tracking of such transactions difficult. However, with proper legislation on taxation of digital transactions, the tax authorities can work with the banks to identify payments relating to digital transactions with non-resident companies that should be subject to tax. Furthermore, tax authorities should leverage the automatic exchange of information exchange of information between jurisdictions and employ innovative technology to secure a proper database of the various online suppliers of goods and services. This will go a long way in providing the tax authorities with sufficient data to go after tax defaulters directly.

Conclusion

It is apparent that the digital economy is a major economy given its immense reveue potentials for the government. With a population of over 180 million people, Nigeria stands to gain a lot with the taxation of the digital economy and it has become expedient for the Nigerian tax authorities to explore a more creative approach to ensure taxation of the digital economy.

Consequently, it is important for the Nigerian government to enact a legislation to address the issues inherent in taxation of the digital economy rather than seeking to extend the interpretation of existing laws that are not sufficient to bring cross border transactions into the tax net.

Exposition by AndersenTax

LAW REPORT REVIEW / LEGAL OPINION

EMPLOYMENT BY CONDUCT OF THE PARTIES

Mr. Casmir Onuchukwu vs. Petroleum Products Pricing Regulatory Agency, unreported Suit Number: NICN/ABJ/373/2017

FACTS

The claimant commenced the action on 18th December 2017, and sought the following:

1. A declaration that the non-confirmation and non-regularization of his employment after the contract period had elapsed was unlawful and ultra vires the 1999 Constitution, the Public Service Rules and the NNPC’S Corporate Policy and procedure Guide, (CPPG).

2. A declaration that by keeping the claimant in its employment and continued payment of monthly salary to him after the contract period had expired, the defendant, by operation of the law, was assumed to have confirmed and regularized the said contract of employment of the claimant, and therefore, estopped from terminating claimant’s employment, let alone treating him as a temporary/contract staff.

3. A declaration that the termination of the employment of the claimant was unlawful and ultra vires the defendant. The defendant having allowed the claimant to continue to work and earn salary for a period of 5 years and six months after the contractual period had elapsed, thereby giving the impression that the claimant has satisfactorily completed the contractual period and have been employed as a permanent staff.

4. A declaration that it was unlawful and ran afoul of the Public Service Rules for the defendant to have kept the claimant on grade level SS6 Step 1, and without promotion throughout claimant’s five years and six months meritorious service to the defendant. A mandatory order of the court directing the defendant to absorb and reinstate the claimant as a permanent staff and placed him on the appropriate grade level and step, calculated in line with the spirit and letter of the Public Service Rules, from March 2012

CASE OF THE CLAIMANT • The claimant testified that he was employed as a temporary staff by the defendant for a period of 6 months and his temporary appointment was renewed for another period of 6 months. • However, at the expiration of the renewed period of engagement, no letter was issued to the claimant terminating or renewing the contract of employment. • The claimant continued to work for the defendant and the defendant continued to pay the claimant his monthly salaries until September 2017, when the defendant terminated the appointment of the claimant. The claimant also stated that the defendant encouraged him to continue to work for the claimant by paying him monthly salary.• The claimant, further, stated that the defendant introduced him to the Embassy of the Netherland as its Senior Staff and sponsored him to attend seminars and conferences. • The claimant urged the court to order his reabsorption into the service of the claimant and payment of his salaries and entitlement.

CASE OF THE DEFENDANT • It was the defendant’s case that it gave express approval of renewal of the contract of employment of the claimant and other contract staff on monthly basis until the Petroleum Industry Bill was passed. • The defendant did not assured the claimant that it was making serious efforts at securing requisite presidential/governmental approval to recruit permanent staff and never assured the claimant that he will be given preference and right of first refusal when the defendant is aware that the Federal Government has placed embargo on employment. The defendant never converted the claimant to a permanent staff member, because due process was not followed in the engagement of the claimant as a temporary staff in the first place and the use of temporary appointment as a prelude to permanent employment is forbidden by the Corporate Policy and Procedure Guide (2003) and there is no provision for temporary appointment in the 2006 version.

ISSUES FOR DETERMINATION

1. Whether the Claimant has proved his case to render the termination of his temporary employment unlawful.

2. Whether the Honourable Court can order specific performance by way of directing the Defendant to absorb or reinstate the Claimant as a permanent staff member of the Defendant when the Claimant was never employed as a permanent staff

JUDGMENT:

The Court held as follows

• It is without any doubt that by effluxion of time the initial temporary employment of the claimant as well as the renewed temporary contract have all been determined. The reason being that they were to last for specified period of six months. This is because a contract can be determined by performance or lapse of the period of performance, as has been with the temporary appointment of the claimant. Going by the Supreme Court decision in the case of THOMAS vs. LOCAL GOVERNMENT SERVICE BOARD (1965) LPELR-25204(SC), (1965) 1 ALL NLR 174, temporary appointment can be justified as the law allows making of such appointment. The reason being that the power to make an appointment includes both the power to appoint for an indefinite period and the power to appoint for a fixed period. The apex court gave example to the effect that a school teacher might, for example, be appointed for one term, or an engineer for the duration of a particular piece of work or on probationary. These are appointments that are recognized by a well-known practice. This case is an authority for the view that the claimant ceased to be an employee of the defendant on 31st March 2012.

• Having determined that there is nothing left of the contracts, the next question to answer is the status of the services rendered by the claimant to the defendant from April 2012 to 25/9/17, when the defendant determined the claimant’s contract. The answer to this question is very necessary and it is what will determine whether the claimant is entitled to the reliefs being sought or not. It is pertinent to note that in law, contract of employment like all other contracts can be created in writing, by conduct of parties or orally. A contract of employment means any agreement whether oral or in writing, expressed or implied whereby one person agrees to employ another as a worker and that other person agrees to serve the employer as a worker. See SCC LTD vs. AFROPAK NIG. LTD (2008) ALL FWLR (PT.4256) 1827

• It is clear from the facts as disclosed by the pleadings of the parties and evidence before the court that, the continuation by the claimant to work for the claimant after the expiration of his temporary appointment and the continuation of payment of salaries for work done by the defendant, is a clear proof that the claimant and defendant have entered into a fresh contract of employment. However, what is baffling is that the contract created was not in writing to have specified terms of the engagement. It was also not orally agreed by the parties. Rather the contractual relationship was created by conduct of the parties. This is evident in the claimant rendering service to the defendant and the defendant paying for the services rendered.

• In contract of employment, the relationship between employer and his employee is a contractual one and is governed by the terms and conditions of the contract between them. This means an employee is only entitled to make claims from his employer based on stipulations contained in the terms and conditions of the contract. See NWAUBANI vs. GOLDEN GUNEA BREWERIES PLC (1995) 6 NWLR (Pt.400) 184.

• The position taken by the claimant and the defendant regarding the nature of employment of the claimant may have been because the claimant’s employment was not reduced into writing. However, the payment of monthly salary by the defendant to the claimant spanning the period April 2012 to 25/9/17, clearly goes to show that the claimant’s appointment is a permanent one. This position is strengthened by the fact that the engagement was not seasonal or intermittent, rather it was continuous and carried out at the premises or workplace of the employer. The evidence before the court clearly shows that the claimant served the defendant for over three years, this has made his contract of employment permanent and entitled him to all the rights and privileges of a permanent worker under the Labour Act. Applying Section 7(1) of the Labour Act to the facts of this case, one can without any fear of contradiction state that the claimant in this case has proved the existence of contract of service between the claimant and the defendants which was not reduced into writing, but entered into by conduct of parties.

• It is apparent from the evidence before the court that the defendant has breached the provisions of section 7(1) of the Labour Act, for not providing the claimant with written terms and condition of service required to be made available to the claimant not later than three months after the beginning of his work with the defendants. In view of the state of pleadings and evidence in proof showing that the claimant has worked continuously for over three years for the defendants, he is in the eye of the law not a temporary worker, but a permanent employee as against the position of the defendants.

• The law is trite that where the contract of service was entered into by way of conduct, and where there are no express words available, the terms and conditions will be inferred from the evidence and circumstances surrounding the case as well as conduct of the parties and statutory provisions See DANIELS vs. SHELL BP PETROLEUM DEVELOPMENT (1962) 1 ALL NLR 19. Also in IBAMA vs. SHELL PETROLEUM CO. NIG. LTD (1998) 3 NWLR PT.542 493

• In view of absence of evidence to establish that the claimant was appointed under the Federal Civil Service Commission, the court held that the claimant’s employment was not governed by the provisions of Public Service Rules. This finding equally applied to the NNPC’s Corporate Policy & Procedure Guide (CPPG).

• In view of the finding that the case was not governed by Public Service Rules, or the Corporate Policy & Procedure Guide (CPPG) and that the employment of the claimant is not one that has statutory flavour since the provisions of the Petroleum Pricing & Regulatory Agency, Act 2003 did not expressly make provisions for appointment and discipline of the employees of the defendant, the court held that the claimant’s contract of service is governed by the Common Law and Labour Law.

• At common law, a master can at any time terminate the employment of his employee as long as necessary notice of termination is given or payment in lieu of notice. There was no evidence before the court to show that notice of termination was given or payment in lieu of notice made. In the circumstance, the court in line with the provision of section 11 of Labour Act, considered the length of service put in by the claimant with the defendant, and held that the defendant is to pay one month salary in lieu of notice to the clamant as what the claimant is entitled to in law.

In view of the foregoing, the Court ordered that:

1. There is nothing in the public service or Corporate Policy & Procedure Guide that mandate the defendant to confirm or regularize a fixed term of contract of service not governed by public service rules or the policy.

2. The defendant’s keeping of the claimant in its employ and paying claimant salary after the expiry of fixed term cannot amount to confirmation or regularization of the fixed terms of contract of service that has expired as there was nothing left to confirm or regularized.

3. The keeping of the claimant in the employ of defendant amounted to the creation of a fresh new contract of service between the claimant and the defendant by conduct of the parties and governed by the common law and the labour law.

4. The new contract created by conduct having not been provided for in the rules and regulation of the defendant or terms specified in writing cannot be said to have statutory flavour. Rather it is a master and servant relationship that was created.

5. Generally, promotion in service is not automatic it is earned. The claimant has not adduced evidence for earning promotion to warrant the court granting him promotion.

6. The claimant is not entitled to the payment of N200,000,000.00 damages as there is no proof to that effect. The claim is vague as there was no particularization.

7. The defendant is hereby ordered to pay the claimant one month salary in lieu of notice for wrongful termination of appointment without giving claimant notice.

8. Cost in the sum of N500,000.00 was awarded to the claimant against the defendant.

OPINION

Employers of Labour should ensure that contracts of temporary staff are either renewed or terminated in writing.

Employers are encouraged to regularly undertake a Staff Audit of its temporary staff with a view to ascertaining the duration of the various contracts – for appropriate/necessary actions.

UPCOMING TRAINING ON THE KNOWLEDGE AND APPLICATION OF THE NIGERIAN LABOUR, EMPLOYMENT AND CURRENT SOCIAL LAWS, ABUJA.

Recent Comments