Business Essentials – February 2019 Edition

Dear Esteemed Member,

Welcome to our February 2019 edition of Business Essentials. In this edition, we reviewed the National Bureau of Statistics’ (NBS) report on the GDP for 2018 and present to you highlights of the report. We also took a look at the Central Bank’s monthly business survey report, inflation rate and other macro-economic indices.

The year 2018 was one with its challenges for different economies around the world and the volatility of oil price was a peculiar feature all through the year. In contrast, the year 2019 appears to have started on a positive note as the price of crude continues to improve. We examined some global events in 2019, which is believed to have impacted positively on the price of Crude oil.

On the tax front, we gave an overview of the 2018 fiscal year, which witnessed increased tax activism by different revenue generating agencies of the Government and the Ministry of Finance. We also presented expected developments in the Nigerian tax and fiscal space in 2019.

Our regular Law Report Review, Upcoming Learning & Development programmes and other activities at the Secretariat were not left out.

Also in this edition are pictures from different courtesy visits by the Secretariat to member-companies.

Have a pleasant reading.

Wale-Smatt Oyerinde

Editor

In this Issue:

- Central Bank Monthly Business Survey Report, National Bureau of Statistics (NBS) Q4, 2018 GDP Review & January Inflation Rate

- Nigerian Tax & Fiscal Outlook 2019

- Global Events in 2019 and its Impacts on the Price of Crude Oil.

- Pictures from Courtesy Visits

- Law Report Review / Legal Opinion

CENTRAL BANK MONTHLY BUSINESS SURVEY REPORT, NATIONAL BUREAU OF STATISTICS (NBS) Q4, 2018 GDP REVIEW & JANUARY INFLATION RATE

The Central Bank released the monthly Business Expectation Survey (BES) for January 2019, with a response rate of 94.8 per cent and sample covered the following sectors: Services, Industry, Wholesale/retail trade, and Construction Sectors. The respondent firms were made up of small, medium and large corporations covering both import- and export-oriented businesses

At 25.9 index points, respondents expressed optimism on the overall Confidence Index (CI) on the macro economy in January 2019. This was less optimistic when compared to its level of 30.5 index points recorded in December, 2018. The drop in business confidence about the economy is not unconnected to the fragile economy and political tensions associated with the General elections. The businesses outlook for February 2019 showed greater confidence on the macro economy with 62.1 index points. The optimism on the macro economy in the current month was driven by the opinion of respondents from services (13.0 points), industrial (10.9 points), wholesale/retail trade (1.5 points) and construction sectors (0.5 points). Whereas the major drivers of the optimism for next month were services (35.0 points), industrial (20.0 points), wholesale/retail trade (5.4 points) and construction sectors (1.7 points).

On business constraint, the surveyed firms identified insufficient power supply (61.6 points), high interest rate (60.0 points) unfavourable economic climate (55.3 points), unclear economic laws (53.5 points), financial problems (52.9 points), unfavourable political climate (50.8 points), insufficient demand (45.7 points) and competition (44.2 points) as the major factors constraining business activity in the current month.

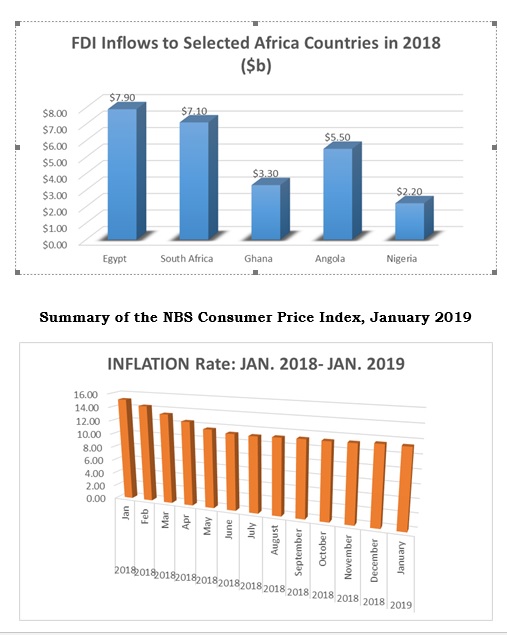

In a separate development, the Foreign Direct Investment(FDI) into the country declined by 36% from $3.5 billion in 2017 to $2.2 billion in 2018 according to a report from United Nations Conference on Trade and Development (UNCTAD) making it the lowest foreign inflows that the country has recorded in the last 13 years. The paucity of FDI into Africa’s largest economy despite its huge endowment of natural resources and youthful population reflect the dearth of critical infrastructure facilities. Nigeria’s unfriendly business environment is making the country worse-off in attracting foreign direct investments as investors have no choice but to look at other African Markets. FDI into Egypt stood at $7.9 billion; South Africa $7.1billion; Ghana $3.3 billion while Angola $5.5billion in 2018.

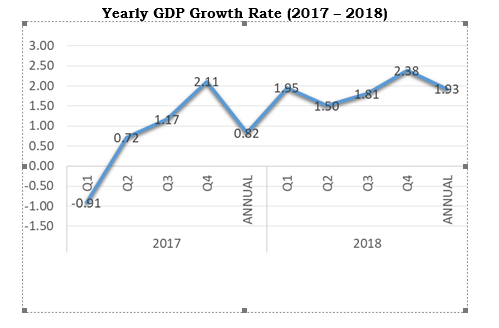

Nigeria’s inflation rate for January, 2019 retracted by 0.07% compared with the previous month. The latest data release by NBS shows consumer price index, (CPI), which measures inflation increasing by 11.37 percent (year-on-year) in January 2019.

On month-on-month basis, the Headline index increased by 0.74 percent in January 2019, same rate as was recorded in December 2018 (0.74) percent. The percentage change in the average composite CPI for the twelve months period ending January 2019 over the average of the CPI for the previous twelve months period was 11.80 percent, showing 0.3 percent point from 12.10 percent recorded in December 2018. The urban inflation rate increased by 11.66 percent (year-on-year) in January 2019 from 11.73 percent recorded in December 2018, while the rural inflation rate increased by 11.11 percent in January 2019 from 11.18 percent in December 2018.

On a month-on-month basis, the urban index rose by 0.77 percent in January 2019, up by 0.01 from 0.76 percent recorded in December 2018, while the rural index also rose by 0.71 percent in January 2019, down by 0.01 percent from the rate recorded in December 2018 (0.72) percent. The corresponding twelve-month year-on-year average percentage change for the urban index is 12.20 percent in January 2019. This is less than 12.51 percent reported in December 2018, while the corresponding rural inflation rate in January 2019 is 11.46 percent compared to 11.75 percent recorded in December 2018.

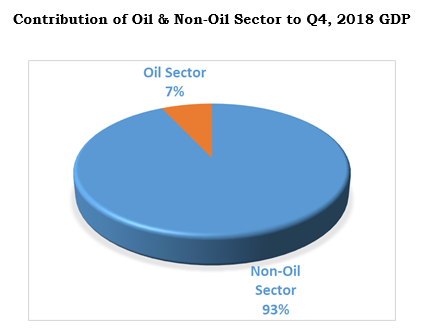

Highlights of Q4, 2018 GDP

The GDP advanced to 2.38% in real terms (year on year). This represents an increase of 0.27% points when compared to the fourth quarter of 2017 which recorded a growth rate of 2.11%. It also indicates a rise of 0.55% points when compared with the growth rate recorded in Q3 2018. On a quarter on quarter basis, real GDP growth was 5.31%.

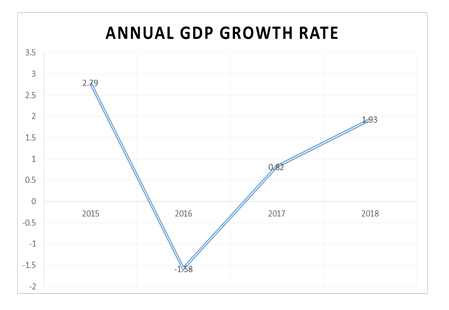

The fourth quarter growth performance implies that real GDP grew at an annual growth rate of 1.93% in 2018, compared to 0.82% recorded in 2017, an increase of 1.09% points.

The expansion of the economy by 1.93% in 2018 falls below the population growth rate of 2.6% in 2018. This indicates a negative per capita income which means Nigerians are growing poorer. Also, the economy is not expanding to create job opportunities for unemployed youths.

According to the International Monetary Fund, (IMF) per capita income data, Nigeria’s income declined by 26 percent to $2050.2 in 2018 from $2763.2 in 2015.

Contribution of Oil Sector

The Oil sector contributed 7.06% to real GDP in Q4 2018, down from figures recorded in the corresponding period of 2017 and the preceding quarter, where it contributed 7.35% and 9.38% respectively. For 2018, the contribution of the oil sector to aggregate real GDP was 8.60%, slightly lower when compared with 8.67% in 2017.

The Non-Oil sector contributed 92.94% to real GDP in the fourth quarter of 2018, slightly higher than the 92.65% seen in Q4 2017. For 2018, annual contribution was recorded at 91.40% against 91.33% in year 2017. Key performing activities on an annual basis include Transport, Information & Communication, Electricity, Water, as well as Arts & Entertainment.

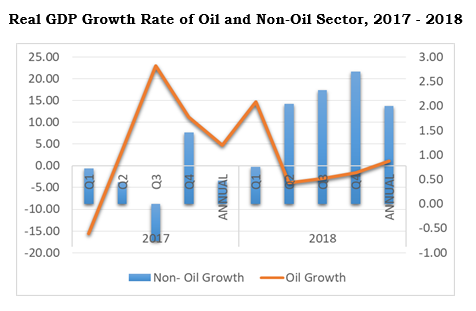

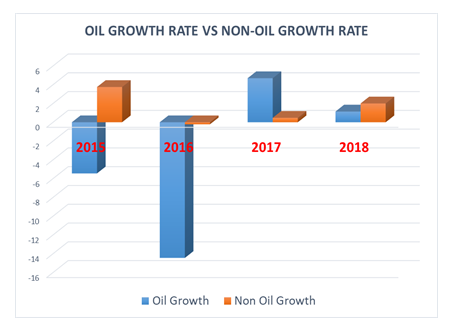

Growth Rate of Oil & Non-Oil

The non-oil sector grew by 2.70% in real terms during the fourth quarter of 2018. This is 1.25% points higher than the growth rate recorded in Q4 2017, and 0.38% points higher than the growth rate recorded in Q3 2018.

On an annual basis, the non-oil sector recorded a growth rate of 2.00% in 2018, performing considerably better than 0.47% seen in 2017. The key performing activities during the quarter were Information and communication, Transportation & Storage, Arts & Entertainment, Agriculture and Manufacturing.

The oil sector recorded a real GDP growth rate contracted by 1.62% (year-on-year) in Q4 2018, indicating a decline of –12.81% points relative to the growth rate recorded in the corresponding quarter of 2017. However, when compared to Q3 2018, growth increased by 1.29% points. On an annual basis, real GDP growth for the oil sector stood at 1.14% as against 4.69% recorded in 2017.

The non-oil sector was the main driver of the economy’s growth in 2018. The sector expanded 2 percent in 2018 from 0.5 in 2017, this is a true sign of a broader economic recovery. Services drove half of growth, industry a fifth and agriculture a quarter.

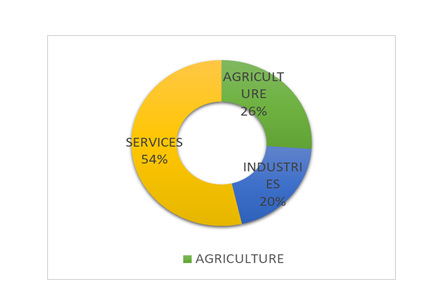

The contribution of Agriculture, Services & Industries in Q4, 2018

Agriculture contributed 26.15% to overall GDP in real terms during the Q4 2018, slightly higher than the contribution Q4 of 2017 (26.13%), but lower than the third quarter of 2018 (29.25%). Service Sector contributed 53.62% to GDP in Q4, 2018 marginally higher than Q4, 2017 and Q3, 2018 with 53.35% & 48.79% respectively.

The contribution of Industries to Q4 2018, GDP reduced from 21.97% in Q3 2018 to 20.24% in Q4 2018. Also, the contribution of Q4 2017(20.52) is higher than Q4, 2018(20.24)

Q4 2018 growth performance of each sector implies that Service, Agriculture and Industries grew at an annual growth rate of 1.83%, 2.12% and 1.94% respectively in 2018, compared to -0.91%, 3.45% & 2.15 recorded in 2017.

This shows that the annual growth rate of Agriculture and Industries decline while there was an improvement in Service Sector.

Sectoral Contribution to Real GDP Q4, 2018

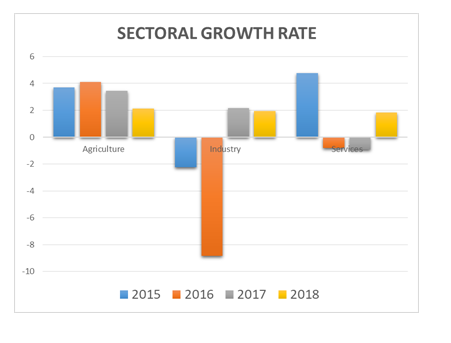

Comparative Analysis of Annual Sectoral Growth Pattern and GDP Growth Rate (2015 – 2018)

- The performance of the Agricultural Sector improved in 2016 from 3.72% in 2015 to 4.11% in 2016. However, there was a sharp reduction of 1.33% from the Agricultural sector in 2018(2.12%) compare with 2017(3.45%). The performance of this Sector in 2018 was against the current government’s effort to boost agricultural output and diversify the economy.

- There was negative growth in the industrial sector in 2015 ( -2.24%) and 2016 (-8.85%). Growth in this sector, however, gained momentum in 2017(2.15%) before a slight dip in 2018(1.94).

- After an impressive growth in 2015 (4.78%), there was negative growth in the Service Sector in 2016(-0.82%) and 2017(-0.91%). 2018 however, recorded a positive growth of 1.83%

Comparative Analysis of Annual Sectoral Growth Pattern and GDP Growth Rate (2015 – 2018)

The annual growth rate of GDP peak in 2015 at 2.7% before the recession of 2016 which led to the growth rate contracting to -1.58% in 2016. There was however a positive growth of 0.82% & 1.93% in 2017 and 2018 respectively.

Non-oil sector has been the main driver of the economy. The sector recorded 3.75%, -0.22%, 0.47% and 2% growth rate from 2015-2018 respectively.

In a related developments, oil growth rate decline in 2015 & 2016 to -5.45% & -14.45% respectively. The growth rate however increases in 2017 (4.69%) before plummeted to 1.14% in 2018.

GLOBAL EVENTS IN 2019 AND THEIR IMPACTS ON THE PRICE OF CRUDE

Introduction

Year 2019 is witnessing an increase in Global oil prices which is largely connected to some array of global events. Some of these events include the supply cut by the Organization of Petroleum Exporting Countries (OPEC), political turmoil in Venezuela, as well as economic sanctions on Iran.

Brent Crude, which is the global benchmark for gauging crude prices now averages about $66 per barrel. This is the highest level ever recorded of the benchmark since November last year when crude prices dipped.

Volatility in oil price was a major feature of year 2018, with price of oil going as low as $50 per barrel. This led to OPEC’s plan on voluntary supply cut quotas among its members and allies in a bid to cushion the effect of one of the biggest oil price falls in years on the economy of its members. The decision was to take 1.2 million barrels per day off the market for the first six months of 2019. The surge of U.S. oil production, which had increased by 2.5 million bpd since early 2016 to 11.7 million bpd, had given OPEC and other oil pumpers more pressure in global market competition.

Despite the slowdown in economic growth that emerged in late 2018, oil prices have been driven up this year by supply cuts led by the Organisation of the Petroleum Exporting Countries (OPEC). OPEC, as well as some non-affiliated producers such as Russia, agreed late 2018 to cut output by 1.2 million barrels per day (bpd) to prevent a large supply overhang from growing.

2019 Events

Iran ban and Political Instability in Venezuela

Iran and Venezuela are two of the world’s biggest crude oil producers. But the two countries are facing severe political and economic challenges. These challenges have so far worked to OPEC’s advantage because global crude prices keep rising. The US Government had last year imposed economic sanctions on Iran as part of measures to frustrate the Persian Gulf nation’s nuclear ambitions. The USA is also refusing to buy Venezuelan crude exports which according to Experts, might be a deliberate plan aimed at forcing the country’s embattled President, Nicolas Maduro out of office.

Following the US sanctions, Venezuela’s oil inventories have swelled to a five-year high as the nation struggles to find buyers for its oil. Venezuelan oil exports are sharply falling while oil storage tanks in the country are filling up, as Nicolas Maduro’s regime is struggling to find new buyers for Venezuela’s oil.

The US sanctions not only cut off Venezuela’s exports to the United States—its key outlet market until a few weeks ago—but also ban US exports of naphtha to Venezuela, which the country uses to dilute its thick heavy oil to make it flow. Analysts expect that a shortage of diluents could accelerate from this month the already steadily declining Venezuelan oil production and exports. In the low case scenario, where the status-quo continues and Venezuela is unable to offset the effects of US sanctions and secure new financing, the country could see its crude oil production decline by an additional 20 percent in 2019, dropping to about 800,000 bpd, before sliding to 680,000 bpd in 2020.

In a similar event, the sanction on Iran had in late 2018, seen Iranian oil exports plummeting to around 1.3 million barrels a day, from 2.4 million last spring, as customers had sought other suppliers in anticipation of the sanctions. Experts had also predicted that the sanctions would shave off another 900,000 barrels in 2019. According to experts, the sanctions would cut roughly 2 percent of global oil supplies.

Conclusion

Nigeria has started considering a cut in crude oil production in line with the OPEC-wide output cut agreed in December 2018. President Muhammadu Buhari has expressed Nigeria’s willingness to cooperate with OPEC on supply cuts. OPEC had in 2018, assigned Nigeria a production cut quota of 2.5 percent of the 1.7 million bpd the West African country was producing when the cut agreement was struck. This amounts to about 40,000 bpd as stated by the Minister of state, Petroleum Resources.

NIGERIAN TAX & FISCAL OUTLOOK 2019

Introduction

The 2018 fiscal year witnessed an increased tax activism by the revenue authorities and the Ministry of Finance. These events clearly demonstrated the government’s intention to widen the tax net and raise additional revenue.

The high tax revenue drive in the year 2018 was evidenced by the extension of the Voluntary Assets and Income Declaration Scheme (VAIDS), the introduction of the Voluntary Offshore Assets Regularization Scheme (VOARS), the release of the revised Income Tax (Transfer Pricing) Regulations 2018 (the Regulations), amongst other major activities in the year.

As part of the Federal Inland Revenue Service’s (FIRS) collection efforts in the year, banks were appointed as agents for collection of tax from taxpayers that were considered to be in default of tax payments and their bank accounts were frozen for this purpose. These developments were mainly due to the dip in global oil prices and the revenue shortages, which encouraged the government to push towards diversification of the economy and improvement of Nigeria’s tax to Gross Domestic Product (GDP) ratio.

This document seeks to review the key highlights for 2018 and comment on the expected developments in the Nigerian tax and fiscal space in 2019.

Key Tax and Revenue Highlights in 2018

- Tax Administration

In the year 2018, the FIRS recorded a total tax revenue collection of about ₦5.32 trillion. The oil component of the ₦5.32 trillion is ₦2.467 trillion (46.38%), while the non-oil component is ₦2.852 trillion (53.62%). The FIRS has a revenue target of ₦8 trillion for 2019.

The World Bank Group, which tracks the ease of doing business in different countries, published its 2019 Doing Business Report (the Report) in October 2018. The Report ranks Nigeria at 146 out of 190 countries on the ease of doing business index, a drop from 145 ranking for the year 2018. However, on the ease of paying taxes, Nigeria recorded an improvement from 171 in 2018 to 157 in 2019. This growth may be attributed to regulatory reforms such as the introduction of ICT initiatives geared at improving the tax system and making the payment of taxes easier and simplified.

As mentioned earlier, the VAIDS, which was originally introduced in July 2017, was extended till 30 June 2018. According to the Chairman of the FIRS, the Scheme generated about ₦54 billion in paid taxes. Upon conclusion of the VAIDS, the FIRS undertook an exercise to track non-compliant taxpayers with annual banking turnover of ₦1 billion and above. This exercise accounted for about ₦21 billion additional taxes.

The Federal Government also launched the VOARS in October 2018 offering a 12-month window allowing taxpayers with undisclosed offshore assets and incomes within the past 30 years to voluntarily declare the assets and pay the corresponding taxes on such assets/incomes. However, since the introduction of the Scheme in October 2018, there has been little or no evidence of enforcement on the part of the government nor eagerness on the part of taxpayers to participate in the Scheme. It would appear that the Scheme seems to be have been targeted at clamping down on corrupt practices rather than tax compliance. Moreover, those targeted under the VOARS should have already been covered under the concluded VAIDS.

- Tax Legislation and Policy

The House of Representatives in January 2018 passed the Petroleum Industry Governance Bill (PIGB); almost 8 months after the Senate passed the Bill on 25 May 2017. The Bill was subsequently forwarded to the President for assent within the course of the year. However, the President withheld his assent for constitutional and legal reasons.

The Federal Government of Nigeria also released the Income Tax (Country by Country Reporting) Regulations, 2018 (the CbC Regulations) giving effect to the Country-by-Country Multilateral Competent Authority Agreement signed on 27 January 2016 and ratified on 3 August, 2016. The CbC Regulations which was published in an official gazette dated 8 January 2018 requires Multinational Enterprises (MNEs) headquartered in Nigeria that meet the specified threshold of global revenue to provide tax authorities with information about the MNEs’ global activities, profits, and taxes. This is to better assess international tax avoidance risks; improve transparency in the tax practices of the MNEs; and prevent tax evasion or avoidance through base erosion and profit shifting.

Similarly, the FIRS released the revised Income Tax (Transfer Pricing) Regulations 2018 (the TP Regulations) which ushered in a Transfer Pricing (TP) specific penalty regime. The TP Regulations repeals the Income Tax (Transfer Pricing) Regulations No. 1 2012 (the 2012 Regulations) and has an effective date of 12 March 2018.

However, the TP Regulations will be applied to the basis period commencing after 12 March 2018. The revised TP Regulations introduces a stiffer TP Regime in Nigeria.

Although the exemption of certain categories of companies from contemporaneous TP documentation requirement will reduce the compliance burden on such companies, the introduction of stiff administrative penalties for TP offences is a material change that will affect taxpayers.

The Federal Government approved an increase in the excise rates on tobacco and alcoholic beverages effective 4 June 2018, via circular: 17642/II/172 of 5 March 2018. The revision introduces additional specific rates to the pre-existing ad-valorem rate for Tobacco (Cigarettes) and replaces the old ad-valorem rates for alcoholic beverages with specific excise rates. It is expected that there will be a surge in the Federal Government’s revenue from these products.

On 26 March 2018, the President assented to Nigeria’s Double Tax Agreement (DTA) with Singapore and a Memorandum of Understanding (MoU) with Switzerland and the International Development Association following the approval by the Federal Executive Council. There was no formal ratification of the agreements by the National Assembly. The DTA clarifies the taxing rights of both countries on income arising from cross-border transactions between Nigeria and Singapore and also reduces the incidence of double taxation on such income while the MoU is in line with Switzerland’s policy on returning illegally acquired assets and provides for the disbursement of returned funds in tranches.

In another development, the FIRS issued a Public Notice (PN) on 24 July 2018 which was addressed to taxpayers with annual turnover of ₦1 billion and above. Based on the PN, the FIRS is to prosecute taxpayers (falling within the income bracket of ₦1 billion and above) who failed to remit their taxes. The PN also stated that the FIRS intends to explore all legal means to recover all tax liabilities without further recourse to taxpayers, in the event of non-compliance.

- Tax Adjudication

The TAT, which was dissolved in 2016, was reconstituted by the Federal Government across the six geopolitical zones as well as Lagos State and the Federal Capital Territory, Abuja. The reconstitution was announced by the then Honourable Minister of Finance, Kemi Adeosun, in Abuja on 12 July 2018. The reconstitution of the TAT will expectedly foster speedy resolution of existing and fresh tax disputes. With the increased budgetary target of the FIRS and the increased disputes between the tax authorities and taxpayers, the reconstitution of the TAT is rather timely.

Budget Speech

The Budget Speech indicates a downward review of the total revenue and expenditure projection for the year 2019 compared to the 2018 figures. The key assumptions underlying the 2019 budget proposal vis-à-vis the 2018 budget assumptions are reproduced below:

| 2018 | 2019 | |

| Oil Price Benchmark | $51 | $60 |

| Oil Production Estimates | 2.3 million bpd | 2.3 million bpd |

| Exchange Rate | ₦305/$ | ₦305/$ |

| Real GDP Growth | 3.5% | 3.01% |

| Inflation Rate | 12.42% | 9.98% |

The total revenue projection for the year 2019 vis-à-vis the revenue projections for the year 2018 is reproduced below:

| 2018 (₦) | 2019 (₦) | Variance | |

| Total Revenue | 7.165 Trillion | 6.966 Trillion | -3% |

| Oil Revenue | 2.999 Trillion | 3.668 Trillion | 23% |

| Non-Oil Revenue | 1.385 Trillion | 1.386 Trillion | 0% |

| Independent Revenue | 847.95 Billion | 624.58 Billion | -26% |

Other projected revenue sources include ₦710 billion from JV Equity restructuring, ₦38 billion from other recoveries and ₦104.11 billion from other sundry income. The percentage breakdown of the projected revenue sources is as shown below:

Breakdown of 2019 Revenue Projections by FGN

| Oil Revenue | 53% |

| CIT | 12% |

| VAT | 3% |

| Customs | 4% |

| Independent Revenue | 9% |

| Signature Bonus | 1% |

| JV Resturcturing | 10% |

| Grants & Donor Funding | 3% |

| Domestic Recoveries & Fines | 3% |

| Others | 2% |

Specifically, the estimate for non-oil revenue consists of revenue from Companies Income Tax (CIT), Value Added Tax (VAT) and Customs Duties. The breakdown of the expected revenue from each of these sources for the year 2019 vis-à-vis the 2018 budgetary revenue projections is shown below:

| 2018 (₦) | 2019 (₦) | Variance | |

| CIT | 794.69 Billion | 799.52 Billion | 1% |

| VAT | 207.51 Billion | 229.34 Billion | 11% |

| Customs Duties | 324.86 Billion | 1.386 Trillion | -7% |

The above table indicates a 1% increase in the CIT revenue projection, an 11% increase in the VAT revenue projection and a 7% reduction in the Customs Duties revenue projection for the year 2019. Clearly, these figures indicate that the government intends to improve its expected revenue from CIT and VAT. However, the reduction in the projected revenue from Customs Duties may well be in line with the government’s overall drive to improve economic performance by clamping down on importation of food items and refined petroleum products which would result in an inadvertent reduction of Customs Duties collectible by the government on such products.

The proposed total expenditure for the year 2019 is estimated at ₦8.83 trillion which is 3.22 % less than the 2018 appropriated expenditure. The breakdown of the expenditure (₦8.03 Trillion) is as shown below:

| Recurrent (non-debt) Expenditure | ₦4.03 Trillion |

| Capital Expenditure | ₦2.03 Trillion |

| Debt Service | ₦2.14 Trillion |

| Sinking Fund | ₦0.12 Trillion |

| Statutory Transfers | ₦0.49 Trillion |

The deficit of ₦1.86 trillion is expected to be funded as shown below:

| Privatisation Proceeds | ₦210 Billion |

| Domestic Borrowings | ₦824.82 Billion |

| Foreign Borrowing | ₦824.82 Billion |

Although the revenue estimates for the year indicates a reduction in the expected revenue from Customs Duties, revenue from VAT and CIT is expected to increase by 11% and 1 % respectively when compared to the 2018 figures. Thus, it is expected that the government would continue in its drive to generate increased revenue from taxes in the year 2019.

Tax Insights for 2019

- Tax and Transfer Pricing

The year 2018 witnessed significant developments in the Nigerian TP space. These include the introduction of the CbC Regulations and release of the TP Regulations amongst others. We expect year 2019 to be impacted by these developments.

One of the major revisions in the TP Regulations was the introduction of a TP specific penalty regime in Nigeria. The introduction of administrative penalties and the other changes were aimed at encouraging increased compliance with the TP Regulations among taxpayers and providing certainty in the treatment of certain related party transactions. The FIRS issued a notice indicating that it will begin to enforce compliance by imposing the administrative penalties on defaulting taxpayers from January 2019.

On the other hand, the CbC Regulations requires MNEs headquartered in Nigeria with a consolidated group revenue of ₦160 billion and above to prepare and submit a CbC Report not later than 12 months after the last day of the accounting year of the MNE Group. Also, constituent entities in Nigeria are required to notify the FIRS of the entity within the Group responsible for preparing and filing the CbC Report. Similar to the TP Regulations, the CbC Regulations contains penalties for non- compliance with its provisions.

The combined effect of these developments will lead to an increased level of compliance and disclosures made to the FIRS. Thus, given the level of information that will become available to the FIRS, taxpayers, especially the MNEs, are likely to experience increased information/ document requests from the FIRS as well as TP audits and disputes in a bid to shore up government revenue. As a result, it is important that taxpayers take proactive steps to minimize their TP risk exposures by meeting all their TP compliance requirements timely, implementing appropriate TP policies and having in place robust and comprehensive TP audit defence files.

- Focus on Value Added Tax

The 2019 revenue projections indicate an 11% increase in the estimated revenue from VAT compared to the year 2018. The projected increase in VAT collections is in line with the National Tax Policy and the Economic and Growth Recovery Plan (2017 – 2020) which projects an increase in the VAT rate for luxury items from 5 to 15 per cent within the period. In addition to the projected increase in VAT rate, a number of audit reports issued by the FIRS in recent times are focused more on VAT and Withholding tax issues as opposed to other tax types. Perhaps this move by the FIRS is in line with the government’s overall objective of improving VAT collections in the year 2019.

Furthermore, the Value Added Tax Act (Amendment) Bill which is currently before the National Assembly expands the scope of the application of VAT to include intangible property. It also includes an obligation on resident beneficiaries of VATable services to deduct and remit VAT to the FIRS in cases of transactions with non-resident entities.

Following from the above, it is clear that the intention of the government is to increase revenue generation from VAT by expanding the VAT base and possibly increasing the VAT rates. Moreover, there is a likelihood that the government may be moving into a differential VAT rate system where certain luxury items, as well as carbonated drinks, will be subjected to higher VAT rates. However, given that the year 2019 is an election year it remains uncertain whether the legislature would speedily review and pass the proposed legislative changes into law.

- Tax Adjudication

In 2018, the TAT was reconstituted after over two years of inactivity. It commenced its sittings in November 2018 by attending to existing appeals filed from the year 2015 while entertaining new appeals. Given the FIRS’s commitment to raise ₦8 trillion in revenue collections in the year 2019, it is expected that there would be a significant number of disputes between the taxpayers and tax authorities which would result in increased appeals before the TAT in the course of the year. It is hoped that the adjudication process will be improved to ensure speedy resolution of tax disputes.

Conclusion

Although the proposed budget for the year 2019 indicates a reduction in the projected revenue and expenditure for the year, the revenue from CIT and VAT is expected to increase from the 2018 budgetary figures. Thus, it would appear that the Federal Government would continue to drive increased tax compliance. It is also anticipated that the Federal Government’s strategy of increasing revenue by focusing on non-oil revenue sources will continue in 2019.

It is also possible that the government will introduce new items to the list of items banned from importation within the course of the year. Although this move may result in a reduction in revenue from Customs Duties as projected by the 2019 budget, it would be in line with the government’s overall objective to clamp down on importations and encourage local manufacturing.

Culled from Andersen Tax

PICTURES FROM COURTESY VISITS

NECA Director-General (Right) receives a souvenir from Managing Director of Frieslandcampina WAMCO Plc., Mr. Ben Langat during a courtesy visit to the company on 7th February 2019

Managing Director, Ikeja Electricity Distribution Company, Mr. Anthony Youdeowei (4th from left), Director General, NECA, Mr. Timothy Olawale (Middle) and a cross-Section of NECA Delegates and Representatives of Ikeja Electricity Distribution Company During a Courtesy Visit to the Company on 7th February, 2019

(L-R) Mr. Wale-Smatt Oyerinde, Deputy-Director Membership Services, NECA, Mrs. Celine Oni, Director Learning and Development, Engineer Patrick Anegbe, Managing Director, Intercontinental Distillers Ltd., Mr. Timothy Olawale, Director-General, NECA and Mr. Peter Edore, Head HR, Intercontinental Distillers Ltd.

Chairman Lagos Chapter, Institute of Chartered Secretaries and Administrators of Nigeria (ICSAN), Mr. Francis Olawale (2nd from left) receives souvenir from the NECA DG, Mr.Timothy Olawale during a courtesy Visit to NECA House on 8th February, 2019

LAW REPORT REVIEW / LEGAL OPINION:

When an Action is Statute-Barred

Alhaji Summonu Adetunji Omole vs. Nigeria National Petroleum Corporation & 1 Or Unreported Suit No. NICN/LA/820/2016

FACTS

The claimant filed the suit by way of a complaint dated and filed on 28th December 2016. By the statement of claim, the claimant claimed against the defendants jointly and severally for:

- a)That the purported letter of termination of the claimant’s appointment as Security Officer Grade II and as a pensionable staff of the Nigerian National Petroleum Corporation and the contemporaneous contract appointment offered to the plaintiff by the 1st defendant both letters dated the 4th day of December, 1988 are ultra vires, unconstitutional, null and void.

- b)That the claimant’s appointment as a permanent and pensionable staff of the 1st and 2nd defendants from or about 15th July 1979 still subsists and is valid with all the attached rights, salaries obligation and privilege unimpaired until he attains the statutory age of 60 years and for specific order restoring the claimant thereto.

- c)That the purported termination of the contract appointment of the claimant if ever there was one, by the 2nd defendant’s letter dated 14th of March, 1990 is ultra vires, unconstitutional, illegal, null and void and of no effect and for a specific order restoring the claimant thereto.

- d)That the purported termination of the pensionable appointment of the claimant by the 1st defendant is wrongful and amount to wrongful dismissal being in breach of the rules of natural justice and also contrary to civil service rules and 1999 Constitution, the claimant being a public officer.

ALTERNATIVELY

- e)An order for the payment of (N100,118,546.40) One Hundred Million, One Hundred and Eighteen Thousand, Five Hundred and Forty-Six Naira and Forty Kobo to the claimant by the defendants jointly and severally as special and general damages suffered by the claimant and in consequence of the wrongful dismissal or wrongful termination, whichever is applicable.

The defendants entered formal appearance, filed their defence processes and then filed a preliminary objection praying that the suit be dismissed. The grounds upon which the preliminary objection was based are: the suit was statute-barred; and the claimant did not comply with the statutory provisions requiring the issuance of a pre-action notice, thus rendering the suit incompetent.

Case for the Defendants

On whether the suit was statute-barred, the defendants referred to section 12(1) of the NNPC Act Cap 320 LFN 1990 which provides 12 months as the limitation period within which suits against NNPC can be brought. That from the originating processes, the claimant indicated that he was wrongfully disengaged from the employment of the defendants on 4th December 1986 and on same date issued with a contemporaneous contract appointment. That by implication, the cause of action arose in December 1986; and since the instant suit was filed on 28th December 2016, a clear 30 years after the cause of action arose, the suit must be statute-barred. The defendants referred to number of case law authorities: Egbe v. Adefarasin [1987] 1 NWLR (Pt. 47) 1, Madukola v. Nkemdilim [1962] 2 SCNLR 341, Tukur v. Governor of Gongola State [1987] 4 NWLR (Pt. 117) 517, Jeric (Nig) Ltd v. UBN Plc [2000] 12 SC (Pt. II) 133 and Sandra v. Kukawa Local Government [1991] 2 NWLR (Pt. 179) 379.

On the issue of pre-action notice, the defendants referred to section 12(2) of the NNPC Act which enjoins a pre-action notice on one month to the NNPC before a suit can be commenced against it. There was no evidence in the claimant’s processes before this Court showing compliance with the pre-action notice requirement of section 12(2) of the NNPC Act; neither was a copy filed in Court in line with Order 3 Rule 23(1) of the NICN Rules 2017. The defendants relied on a number of cases: Dominic E. Ntiero v. NPA [2008] LPELR-SC.39/2001, Barclays Bank Ltd v. CBN [1976] 6 SC 175 and Eze v. Ikechukwu [2002] 18 NWLR (Pt. 799) 348. The defendants concluded by urging that the suit be struck out or dismissed.

Case for the Claimant

The claimant reacted by filling a counter-affidavit and a written address. The claimant submitted a sole issue for determination: whether this suit can be statute-barred having complied with the section 12(1) of the NNPC and when the cause of action arose in 1990 and the claimant instituted action at the Lagos High Court which was one of the courts constituted to entertain such a matter. To the claimant, the case of action arose on 14th March 1990 when the defendants terminated the claimant’s appointment in 1990. The claimant’s counsel gave a pre-action notice to the defendants before suing at the Lagos High Court as per Suit No. LD/1476/90 – which pre-action notice was sufficient for the instant suit. Secondly, that since the Constitution was made to operate prospectively; the claimant had to commence the instant suit in this Court as held in Aremo II v. Adekanye [2004] 13 NWLR (Pt. 891) 572 ratio 2. For these reasons, the claimant concluded by urging that the preliminary objection of the defendants be discountenanced and the claimant allowed to proceed with the trial of this suit.

JUDGMENT

The Court held that the claimants’ case succeeds in terms of the following declarations and orders:

- a)In determining whether a matter is statute-barred, courts are called upon to ascertain what the cause of action is, when it arose and when the suit was filed. If the period between the date the suit was filed and when the cause of action arose is more than the limitation period, the matter is said to be statute-barred. From the processes filed, the court found and held that the suit was statute-barred.

- b)The claimant argued that he first filed an action at the Lagos High Court (Suit No. LD/1476/90) before filing the suit. Although he brought in this argument in terms of his submission that the pre-action notice he served for purposes of the Lagos High Court Suit should suffice for purposes of the instant suit, in his oral adumbration of his written address, the claimant’s counsel suggested that (and this is the context in which his written submission about the Constitution having prospective effect was made) he had to file the instant suit because the Third Alteration to the Constitution divested the Lagos High Court of jurisdiction in Suit No. LD/1476/90, and the Lagos High Court had no power to transfer the case to this Court. This argument must fail since Echelunkwo John & 90 ors v. Igbo-Etiti LGA[2013] 7 NWLR (Pt. 1352) 1 at 14 – 17 held that State High Courts have the power to transfer labour/employment cases pending before them to the National Industrial Court. The argument of the claimant in opposition to the preliminary objection was lame and unconvincing and so must fail.

- c)In the whole, the court found and held that the suit was statute-barred; and on this ground alone the case was liable to be dismissed. See NPA Plc v. Lotus Plastics Ltd[2005] 19 NWLR (Pt. 959) 158, which held that where a Court makes the finding that a matter is statute-barred, the proper order to make is one of dismissal.

- d)The preliminary objections of the defendants succeed. The suit was accordingly dismissed.

OPINION

Parties are expected to comply with certain requirements (Facts and Law) before instituting an action in Law. The preliminary objection was decided based on a mixture of Law and Facts.

Recent Comments