Business Essentials – April 2019 Edition

Welcome to the April 2019 edition of Business Essentials. In this edition, we reviewed the Consumer Price Index (CPI) as reported by the National Bureau of Statistics (NBS), which showed a retraction for the third consecutive month. We also examined the Misery Index forecast for 2019, Central Bank’s Business Expectation Survey and an overview of Nigeria’s overall macro-economic environment.

President Muhammad Buhari signed the new national Minimum Wage Bill into law on April 18, 2019. An increase in the minimum wage is expected to have its short and long terms fiscal and economic implications for Nigeria. We examined some of the expected changes and also, the implication of the new minimum wage on individuals, business and the economy, especially in the areas of government spending, employment and tax.

As we continue to monitor the relentless tax drive of the Federal Inland Revenue Service (FIRS) and the State Internal Revenue Services for year 2019, we reviewed some of the issues around final and conclusive tax assessments while also examining common pitfalls that lead to unfavorable tax assessments issued to taxpayers.

Also in this edition are pictures from 2019 annual Retreat of Technical Committees which held between 12th and 13th April, 2019 at Park Inn by Radisson, Abeokuta.

Our regular Law Report Review, Upcoming Learning & Development programmes and other activities at the Secretariat were not left out.

Have a pleasant reading.

Wale-Smatt Oyerinde

Editor

In this Issue:

- National Bureau of Statistics (NBS) March CPI, CBN Business Expectation Survey, Misery Index Report & IMF Growth Forecast

- Nigeria’s New National Minimum Wage: Responses and Implications for the Economy

- Tax Dispute Resolution: Critical Issues on Final and Conclusive Assessment

- Pictures from the Retreat of Technical Committees

- Law Report Review / Legal Opinion

NATIONAL BUREAU OF STATISTICS (NBS) MARCH CPI, CBN BUSINESS EXPECTATION SURVEY, MISERY INDEX REPORT & IMF GROWTH FORECAST

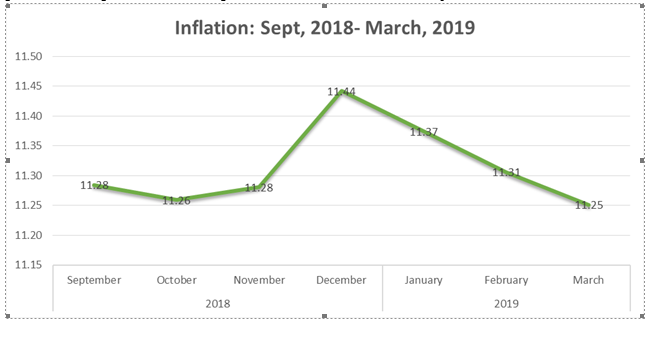

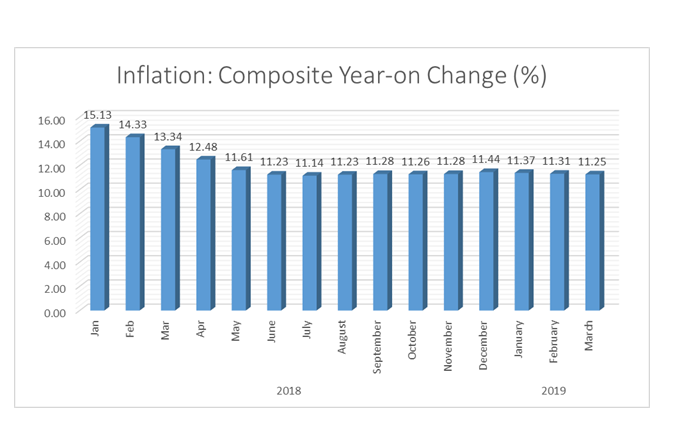

The NBS Consumer Price Index (CPI), March, 2019

The Consumer Price Index has retracted for the third consecutive month in March 2019 to reach its lowest level in seven months. The CPI, which measures the composite changes in the prices of consumer goods and services purchased by households over a period, slowed by 11.25 percent on year-on-year (yoy) basis in March 2019, representing a 0.06 percentage points drop from 11.31 percent recorded in February 2019. This was largely driven by the continuous decline in food inflation, which dropped for the fourth straight month to 13.45 percent in March from 13.47 percent in February, even as core inflation, which excludes the prices of volatile agricultural produce, also declined by 9.5 percent from 9.8 percent.

The urban inflation rate reduced to 11.54 percent (year-on-year) in March 2019 from 11.59 percent recorded in February 2019, while the rural inflation rate declined to 10.99 percent in March 2019 from 11.05 percent in February 2019. On a month-on month basis, the urban index rose by 0.81 percent in March 2019, up by 0.05 from 0.76 percent recorded in February 2019, while the rural index also rose by 0.77 percent in March 2019, up by 0.06 from the rate recorded in February 2019 (0.71) percent.

The corresponding twelve-month year-on-year average percentage change for the urban index is 11.78 percent in March 2019. This is less than 11.95 percent reported in February 2019, while the corresponding rural inflation rate in March 2019 is 11.08 percent compared to 11.23 percent recorded in February 2019.

The CBN Business Expectation Survey

The Central Bank of Nigeria released March 2019 Business Expectations Survey (BES) which was carried out during the period March 11-15, 2019 with a sample size of 1050 businesses nationwide. A response rate of 96.2 per cent was achieved, and the sample covered the services, industrial, wholesale/retail trade, and construction sectors. The respondent firms were made up of small, medium and large corporations covering both import-and export-oriented businesses

On the overall business outlook, respondents expressed optimism on the overall confidence index (CI) on the macro economy in the month of March 2019 at 28.2 index points. The businesses outlook for April 2019 showed greater confidence on the macro economy with 64.8 index points

The optimism on the macro economy in the current month was driven by the opinion of respondents from services (16.8 points), industrial (8.6 points), wholesale/retail trade (2.3 points) and construction sectors (0.5 points). Whereas the major drivers of the optimism for next month were services (37.0 points), industrial (19.4 points), wholesale/retail trade (6.2 points) and construction sectors (2.2 points). The positive outlook by type of business in March 2019 were driven by businesses that are neither import-nor export-oriented (20.3 points), both import-and export-oriented (4.1 points), import-oriented (3.5 points), and those that are export-related

On business constraints the surveyed firms identified insufficient power supply (63.9 points), high interest rate (55.3 points), unfavourable economic climate (54.6 points), financial problems (51.8 points), unfavourable political climate (50.0 points), unclear economic laws (49.4 points), insufficient demand (42.8 points) and access to credit (41.8 points) as the major factors constraining business activity in the current month.

Respondents firms identified insufficient power supply, high interest rate, unfavourable economic climate, financial problems, unfavourable political climate, unclear economic laws, insufficient demand and access to credit as major factors constraining business activity in March 2019. The firms also expect the Naira to appreciate in the current month, next month and the next twelve months. Level of inflation is expected to moderate in both next six months and the next twelve months; borrowing rates is expected to rise in current month, next month and the next twelve months.

In a sharp contrast to the result released by CBN on BES, the misery index forecast for 2019 posted on FocusEconomics website showed that Nigeria is ranked sixth position out of 130 countries in the world. The misery index is an economic indicator calculated by simply adding the unemployment rate to the inflation rate. The Index is useful in determining how an average citizen in a given country is doing, as higher rates of unemployment and inflation are associated with increased socioeconomic issues for a country.

Nigeria miserable position in the miserable index has not showed any improvement since 2016. For the two African giants, Nigeria and South Africa, unemployment rate contributes most to their Misery Index score. In Nigeria, unemployment has surged to 23.1% in Q3 2018 from 9.0% since 2015. Although inflation has been trending downwards since early 2016, it has remained persistently above the Central Bank’s target range of 6.0%–9.0%. In South Africa, while unemployment is projected to stay near 27% for the next five years, inflation touched a 10-month low in January on slowing fuel costs.

In a related development, the International Monetary Fund (IMF) confirmed that “Nigeria’s economy is recovering” with real GDP growing 1.9% in 2018, up from 0.8% in 2017 accompanied by converging exchange rates and falling inflation. The report however calls attention to structural and policy challenges such as large infrastructure gaps, low revenue mobilization, continued FX restrictions and banking sector vulnerabilities. The IMF notes that “under current policies, the outlook therefore remains muted” and concludes that growth may not exceed 2.5% except additional reforms are implemented. In the Fund’s view, risks are “moderately tilted downwards” with possible upsides from higher oil prices.

Similarly, the IMF Chief Economist and Director of Research Department had advised the Federal Government during a recent media briefing on the IMF’s World Economic Outlook to initiate policies that would enhance the contribution of the private sector to Nigeria’s economic growth. The Fund stated that the trade tension between the United States and China as well as the tension in the European Union over the Brexit would affect the performance of Nigeria’s economy negatively, even as it called for proactive policies to mitigate external shocks. The Fund had earlier cut the Nigerian GDP forecast to 2.1% from 2.3%.

Nigeria’s overall macroeconomic conditions are improving with continued stability in exchange rates, declining inflation and rising FX reserves even though capital markets remain weak. Policy is however insufficiently supportive of growth and public sector finances may be distressed! A restructuring of government revenue and debt is urgently required especially in light of imminent increases in government wage bills.

References: CBN, NBS, Business Day, Proshare.com

NIGERIA’S NEW NATIONAL MINIMUM WAGE: RESPONSES AND IMPLICATIONS FOR THE ECONOMY

On March 19, 2019, the new national minimum wage bill, an issue that featured widely in the 2019 presidential campaigns, finally received legislative approval. The Senate approved ₦30,000 as the new National minimum wage, after nearly 8 years of no-increase from the ₦18,000 paid as minimum wage since 2011. The wage increase was due for review in 2016 according to the law that stipulates that minimum wage should be reviewed at least once every 5 years. As of 2017, Nigeria’s labour and trade unions had initiated agitations and advocacy for a raise for minimum wage workers, particularly owing to the over-due review and inflation’s effect on the value of the wages received.

The sustained outcry undertook threatening dimensions, such as strikes and protests on several occasions, to accentuate their demands. In light of the newly approved minimum wage, this piece highlights the plausible responses of the government, businesses, and the macro-economy at large.

Fiscal Responses

Government’s Non-capital Spending to expand.

As the new wage policy awaits the president’s assent, implementation processes become potentially inevitable and the government is expected to fund the costs arising from implementing the policy. Such costs arise in the form of an increase in personnel expenses with spikes in the percentage of the government revenue utilized for wage bills. According to the CBN, the federal government’s personnel cost rose by 18.5% to N1.85 trillion as the minimum wage was increased from N7,500 to N18,000 in 2011, thus accounting for 52% of FG retained revenue. By 2016, personnel spending had gulped about 59% of FG’s N3.2 trillion revenue and are now projected to enlarge to N2.29 trillion in 2019. While the federal government is faced with this stern burden of incorporating the new wage bill into its already strained finances, states face a more severe test given the recurring struggles to pay salaries.

Economic Responses

Sustained Inflationary Pressure

In theory, businesses are forced to raise prices when there is an increase in minimum wage, and this ultimately places cost-push inflationary pressures on the economy. Real business practices conform to this theory. A strategic attempt to absorb increasing labour costs tend to cause producers to transfer the cost of wage increase to product prices, which are eventually borne by consumers in form of higher prices. For example, in 2003 when the government reviewed a wage increase, prices of goods and services rose, and inflation rate spiked from about 10.5% to as high as 24%. A similar wage-increase in 2011 saw the inflation rate remain at double-digit for two years thereafter, according to data from the CBN.

Likely Increase in workers purchasing power

With the least paid worker earning N30,000, it is expected that the cumulative increase in purchasing power of workers will facilitate increased economic activities. As consumers buy more, businesses will have to produce more.

Going Forward:

Although revenue from taxation has grown over the years, efforts of the government and revenue generating agencies to improve tax revenue have yielded limited progress. While collection processes have improved, other areas for improvement exist such as limited tax coverage that mitigates the collection efforts. To ensure that efforts yield the much-needed progress and beyond the existing collection process, widening Nigeria’s tax net is absolutely necessary.

Lagos state sets a remarkable example for other states to follow through its model tax administrative machinery. The machinery granted full autonomy to the Lagos State Inland Revenue Service in 2006 and created new tax operational units within the agency. In 2008, the agency introduced the self-assessment filling system and a system for collaboration with other MDAs. To capture a wider range of the informal sector, in 2016, tax assessments were translated to various local languages, and more than 39 tax stations had been established across the state with compliance initiatives as priority. As a result of the wider coverage, Lagos state has witnessed unprecedented IGR growth – from a monthly average of N5.1 billion in 2006 to N56.7 billion in 2018. Going forward, states whose tax agencies lack such machinery should first be granted autonomy by the state governments. Further, capturing a wider range of informal sector in each state and at the federal level through similar initiatives is vital to adding more taxpayers into the tax net.

Individuals and businesses are not left out in ensuring that the new minimum wage policy works for the improvement of the economy. To do this, critical emphasis on employee/worker productivity is essential, particularly when the alternative retrench mechanism is not an option. For individuals: collecting a higher wage is needful to encourage their improved commitment and performance. For businesses: given that productivity is an important determinant of economic growth, spurring productivity could inform higher national output. More regular assessments and demanding increased realistic targets from each employee are imperative measures that could be used to ensure improved productivity among workers and employees.

Source: Centre for the Study of the Economies of Africa

TAX DISPUTE RESOLUTION: CRITICAL ISSUES ON FINAL AND CONCLUSIVE ASSESSMENT

In 2018, the Federal Inland Revenue Service (FIRS) reported that it collected N5.32trillion in tax revenue. This was as a result of the increased drive for tax collection and must have given the FIRS, the confidence to set a very ambitious tax revenue target of N8trillion for 2019. This drive for improved tax collection is also seen at the sub national level where most State Internal Revenue Services (SIRS) are aggressively engaging taxpayers in a bid to raise revenue. Given the plan to approve the national minimum wage of ₦30,000 and the resultant increase in Government expenditure, it is expected that the tax authorities will become even more aggressive in their effort to shore up tax revenues.

In the past year, the FIRS embarked on several initiatives aimed at expanding the tax net and raising revenue. As part of the FIRS’ efforts, it gathered huge data on potential taxpayers and their business activities. The data was then processed to profile potential taxpayers who hitherto had not paid their taxes. This resulted in the issuance of back duty tax assessments to ensure recovery of unpaid taxes. For many taxpayers who received such back duty tax assessments for the first time, it was evident that they were not aware of the stipulated timelines for responding to such back duty assessments and the implications of missing the deadlines for objection.

Where the taxpayer disputes the assessments, the tax laws allow taxpayers to object the additional assessment within a specified timeline1, stating the specific grounds of objection. Failure to object within the specified period may make the additional liabilities final and conclusive.

This article seeks to review the issues around final and conclusive tax assessments and addresses common pitfalls that lead to unfavorable tax assessments issued to taxpayers.

When and how do assessments become final and conclusive?

Generally, a tax assessment is final and conclusive when a taxpayer agrees with the tax liability raised in the assessment notice following an objection or an appeal. Another reason may be due to failure to respond to an assessment within the specified deadline as provided within the tax laws. With respect to Companies Income Tax (CIT), Section 76 of CIT Act (CITA) provides that:

“Where no valid objection or appeal has been lodged within the time limited by Section 69, 72 or 75 of this Act as the case may be, against an assessment as regards the amount of the total profits assessed thereby, or where the amount of the total profits has been agreed to under Section 69 (5) of this Act, or where the amount of such total profits has been determined on objection, revision under the proviso to Section 69 (5) of this Act, or on appeal, the assessment as made, agreed to, revised or determined on appeal, as the case may be, shall be final and conclusive for all purposes of the Act as regards the amount of such total profits; and if the full amount of the tax in respect of any such final and conclusive assessment is not paid within the appropriate period or periods prescribed in this Act, the provisions thereof relating to the recovery of tax, and to any penalty under section 85 of this Act, shall apply to the collection and recovery thereof…”

Based on the foregoing, a final and conclusive assessment may be the high note of a tax dispute where the taxpayer agrees to the assessment and settles the tax liability. A problem only arises where the assessment is inconsistent with the taxpayer’s position and the tax authority has considered the assessment as final. In this scenario, the FIRS may issue a Notice of Refusal to Amend (NORA) and the next avenue to seek redress will be through litigation. Most taxpayers are usually not willing to explore this option due to cost implication and protracted nature of most cases. Some of the issues to consider in avoiding unfavorable final and conclusive assessments are as follows:

- Timeline specified by law

The timeline to submit a valid objection to a tax assessment is critical in challenging an unfavorable final and conclusive assessment from the tax authorities. Failure to respond to an assessment within the time provided by the relevant tax laws automatically makes the assessment final and conclusive.

Whereas the provisions of CITA and Personal Income Tax Act (PITA) require that a valid objection to tax assessments should be filed within thirty (30) days of receipt of such assessment, Section 38 of the Petroleum Profits Tax Act (PPTA) stipulates that an objection must be filed within twenty-one (21) days of receipt of the assessment. Notwithstanding the provisions of the tax laws, there are instances where the tax authorities issue assessment notices to companies and demand a response within seven (7) days of receipt after which the assessment would become final and conclusive.

Given the above, it is important to examine section 13(2) of the Fifth Schedule to the FIRS Establishment Act (FIRSEA), which provides for a 30-day timeline to respond to an assessment notice. Specifically, Section 13(2) of the Fifth Schedule of the FIRSEA provides that “an appeal under this Schedule shall be filled within a period of 30 days from the date on which a copy of the order or decision is being appealed against is made or deemed to have been made by the Service…”

Section 68(2) of the FIRSEA also addresses the seeming inconsistency between the provisions of Section 38 of the PPTA, which requires a 21 day deadline for companies operating in the Upstream Sector of the Oil and Gas Industry to respond to an assessment notice, and Section 13(2) of the FIRSEA. Based on Section 68(2) of the FIRSEA, where the provisions of any other law (including the PPTA), are inconsistent with the provisions of the FIRSEA, the provisions of the FIRSEA will prevail and the provisions of that other law will to the extent of the inconsistency, be void.

Consequently, any other timeline required to respond to an assessment that is different from a 30-day period from the date of receipt of the assessment notice is invalid. Hence, a company operating in the Upstream Sector of the Oil and Gas industry may choose to object to an assessment on the 30th day after receiving an assessment notice without running a risk of the assessment being final and conclusive.

- Incomplete/Inadequate records

An objection is considered valid where the taxpayer states the ground of objection and the amount of tax due (if any) to the tax authority. This would typically involve the submission of documents such as receipts, evidence of tax filings and other documents that will support the taxpayer’s position. There are instances where the taxpayer is aware of the timeline for submission of a valid objection to the tax authority but unable to do so due to insufficient or absence of the appropriate records to support the tax position. Where the taxpayer proceeds with a notice of objection with inadequate document, the tax authority will most likely reject the objection and issue a NORA, thus foreclosing the taxpayer’s right to further object the assessment except he seeks redress in court.

Although the Companies and Allied Matters Act (CAMA) requires companies to retain their accounting records for six years, based on the tax laws, taxpayer’s records can be subjected to tax investigation for periods exceeding six (6) years where any form of fraud, wilful default or neglect is suspected. In this instance, it may be difficult for the taxpayer to provide a 10-year-old document that is required to defend a favourable tax position, within a 30-day deadline. The taxpayer may request an extension of the timeline in this circumstance or better still, the provisions of the tax laws should be revisited for a more realistic period an audit cover.

The above notwithstanding, taxpayers should ensure proper tax and accounting records are kept in order to be able to respond to assessment notices speedily. Electronic record keeping options should be explored to prevent possible loss to fire and damage.

- Lack of proper correspondence management framework

It is important for taxpayers to have an effective system of managing correspondence with the tax authorities. The framework should include ability to track date of receipt of all pieces of correspondence and the relevant personnel to receive such correspondence when delivered to the company. There have been instances where assessment notices were received by security personnel and kept amongst other documents until the deadline lapsed, thus exposing the taxpayer to undue liabilities.

An effective system to track correspondence will help to guide taxpayers on the time available to review the assessment, collate all necessary documents and respond to the tax authority. The failure of taxpayers to keep track of the date of receiving an assessment can result in unnecessary additional tax liabilities.

Review of Judicial precedence and practical implications

The judicial pronouncement on when an assessment becomes final and conclusive has been interesting and seem to provide some laxity to the taxpayers with respect to the timeline required to object to an assessment notice. For example, in the case between Theodak Nigeria Limited (Plaintiff) vs. FIRS, the Federal High Court (FHC) was to determine whether an assessment based on the value of the taxpayer’s property can be said to be final and conclusive. The FIRS referred to Section 69(1) and (2) of CITA and opined that the Plaintiff did not object to the assessment notices within 30 days of receipt and as such, the assessments had become final and conclusive.

However, the FHC held that the use of the word “may” in Section 69(1) of CITA does not place the Plaintiff under any obligation to file an objection to FIRS. The Court further emphasized that the use of the word “may” in the section implies that the objection to the FIRS is discretionary and not mandatory. That notwithstanding, the word “may” has also been held to be equivalent of shall in a number of tax cases. Thus, the word “may” can also be read to impose a legal obligation to file an objection with the FIRS in the event of a dispute. While the judgment gives taxpayers some grounds to argue that the timeline is subject to his discretion, it is a best practice to respond to an assessment notice within the 30-day deadline.

In another Tax Appeal Tribunal (TAT) case; Lagos State Internal Revenue Service; Lagos State Internal Revenue Service (LIRS) vs. Star Deep Water Petroleum Limited (SDWPL), one of the issues for determination was whether failure to submit notice of objection to the LIRS within the 30 days specified under PITA can result in an assessment being final and conclusive. The TAT held that given that the assessment was not valid ab initio, failure of SDPWL to object to the assessment within the 30 days deadline does not make the assessment final and conclusive. This judgment suggests that an assessment can only be final and conclusive where the basis of the assessment is valid in the first place. Thus, it behoves the tax authority to take cognizance of this case while issuing assessment notices. Taxpayers may not also want to wait for litigation process to determine the validity of an assessment, before addressing the issues raised therein.

Conclusion

Given the ambitious tax revenue target of the Federal and State governments, it is important that taxpayers coordinate their business affairs in a manner that does not expose them to unnecessary tax assessments, which may culminate into unfavorable final and conclusive tax assessments.

Where final and conclusive tax assessments have already been issued, taxpayers are advised to work closely with their tax consultants to ascertain the legality and validity of such assessments, in order to take the next appropriate steps as specified in the tax laws.

Exposition by AndersenTax

Mr. Timothy Olawale, Director-General, NECA welcoming participants to the Retreat

Mr. Mauricio Alarcon, Managing Director, Nestle Nig. Plc. and Keynote Speaker giving the Keynote Address at the Retreat

Dr. Joshua Bamfo, Partner, Andersen Tax LP making a presentation on the Nigerian Economy at the Retreat

L-R: Mr. Bode Ayeku, Chairman, NECA’s Committee of Legal Advisers and Company Secretaries, Elder P.A Oyewole, Vice Chairman, NECA’s Committee of Finance Experts, Mr. Timothy Olawale, Director-General, NECA, Mr. Mauricio Alarcon, MD/CEO Nestle Nigeria Plc, 2nd Vice President of NECA and Keynote Speaker, Mr. Chuma Nwankwo, Chairman, NECA’s Committee of Human Resources and Learning Experts during the Retreat.

Group Photograph of Participants and Facilitators at the Retreat

LAW REPORT REVIEW / LEGAL OPINION:

TERMINATION OF CONTRACTS OF EMPLOYMENT

Obanye v. Union Bank of Nigeria Plc (2018) LPELR-44702(SC)

FACTS:

An Employee, whose appointment was terminated without being issued Notice for the required period as contained in his contract of employment, sued the Employer for damages. He cited wrongful termination of his employment and wanted some other entitlement in Court.

ISSUES:

Whether an employee suing for wrongful termination of employment is entitled to damages more than his salary in lieu of notice

JUDGMENT:

The Court held the Court held as follows:

- a)The narrow issue in this appeal is the measure of damages recoverable for wrongful termination of employment. The law is settled that an employer who has the right to hire also has the right to fire. The employer has an unfetted right to terminate the employee’s employment. He may terminate for good or bad reason or for no reason at all. The motive for exercising the right does not render the exercise ineffective. See: Shitta-bey v. Federal Public Service Commission (1980) SC 40 @ 56; Olaniyan v. University of Lagos (1985) 2 NWLR (Pt. 9) 599; Dudusola v. Nigeria Gas Co. Ltd. (2013) 10 NWLR (Pt. 1363) 423.

What is essential is that the firing must be done in accordance with the terms and conditions of the employment. See: Organ & Ors v. N.L.N.G. Ltd & Anor (2013) 16 NWLR (Pt. 1381) 506, Osisanya v. Afribank (Nig.) Plc (2007) 6 NWLR (Pt. 1031) 565.

- b)In an employment with statutory flavour, where the procedure for employment and discipline, including dismissal, are clearly spelt out in the relevant statute, the employer must comply strictly with its provisions in terminating the employment or in dismissing the employee. Any other manner of terminating the employment which is inconsistent with the statute is null and void and of no effect. See: Bamigboye v. Unilorin (1999) 10 NWLR (Pt. 622) 290; Comptroller General of Customs & Ors. v. Gusau (2017) 4 SC (Pt. II) 128.

- c)In other cases where the employment is governed by the agreement of the parties, removal by way of termination of appointment or dismissal must be in accordance with the terms agreed upon. Failure to comply with the terms renders the termination wrongful but not null and void.

- d)The only remedy available to an employee in an ordinary master and servant relationship for wrongful termination of employment is a claim for damages. The rationale being that a servant, though wiling, cannot be foisted upon an unwilling master. See: U.B.N. Ltd v. Ogboh (1995) 2 NWLR (Pt. 380) 647 @ 664; Ibama v. S.P.D.C (Nig.) Ltd. (2005) 17 NWLR (Pt. 954) 364.

- e)Where the parties have agreed that the contract of employment may be terminated by either party upon the giving of notice or the payment of the equivalent salary for the period of notice, the measure of damages for wrongful termination or dismissal is the amount the servant would have earned over the period of notice. See: Chukwumah v. Shell Petroleum (1993) 4 NWLR (Pt. 289) 512

- f)In the instant case, by virtue of the Collective Agreement, the appellant was entitled to one month’s salary in lieu of notice. The effective date of termination of his appointment was 28thNovember, 2003 when he was served with the termination letter. The evidence showed that he had worked for the month of November, 2003 and had therefore earned the salary he was paid for that month. The Court below was right when it held that he was entitled to one month’s salary in lieu of notice and any other entitlement legitimately due to him at the time of termination of his employment and nothing more.

OPINION

It is imperative for Employers of Labour to adhere to the terms and conditions contained in the contract of employment. Terms and Conditions of employment are not only contained in the Letter of Employment. The Handbook, Collective Agreements, the ILO Conventions, the Labour Laws, etc are instructive materials.

Recent Comments