Business Essential No 3. Vol 15

Dear Esteemed Member,

In a very remarkable but positive turn of events, the Central Bank of Nigeria (CBN) announced the deregulation of foreign exchange market: the FX market will be market-driven with only occasional interventions by the Apex Bank. In this edition, we analyzed the new foreign exchange policy, the operational mechanism and macroeconomic implications of the policy.

We also share recent advocacy developments at the Secretariat: Highlights of Position presented at a meeting with Executive Chairman of Securities & Exchange Commission (SEC) and our Position on the Draft Amended National Code of Corporate Governance sponsored by the Financial Reporting Council of Nigeria (FRC). Our regular Labour and Employment Law Review, Upcoming Training Programmes and recent activities of the Association were not left out.

Have a pleasant reading.

Timothy Olawale

Editor

In this Issue:

- New Foreign Exchange Policy of CBN: A Cursory Review

- Highlights of NECA’s Position at the Meeting With Executive Chairman, Securities & Exchange Commission (SEC)

- Highlights of NECA’s Position On the Draft Amended National Code Of Corporate Governance Of The Financial Reporting Council Of Nigeria (FRC)

- Labour & Employment Law: Collective Agreement (Ganiu Lawal & 3 Others Vs. Federated Steel Mills Limited) (2014) 42 N.L.L.R. Pt 130, P. 306 Nic

- Upcoming Training Programmes

NEW FOREIGN EXCHANGE POLICY OF CBN: A Cursory Review

The recent move by the CBN does not only have monetary policy implications, but the larger picture that Nigeria is now embracing market-oriented policies in resource pricing and allocation. Coming to terms with this reality has taken a long learning curve with credibility of key public institutions undermined while also constituting a huge cost to public finances, external reserves and economic growth. Yet, we think credibility could be won back if reforms continue at current pace.

Major highlights of the new Foreign Exchange Policy:

- The FX market will operate as a single market structure through the autonomous/interbank market. The system is expected to be broadly market driven.

- The CBN will only participate in the FX market through interventions which can be via the interbank market or through Secondary Market Intervention Sales (SMIS) i.e. sales to authorized dealers (Wholesale) or end-users (retails) at the CBN’s discretion.

- The 41 items classified as not valid for FX will remain inadmissible in FX interbank market.

- No Bureau de change operator is allowed to operate within the interbank market.

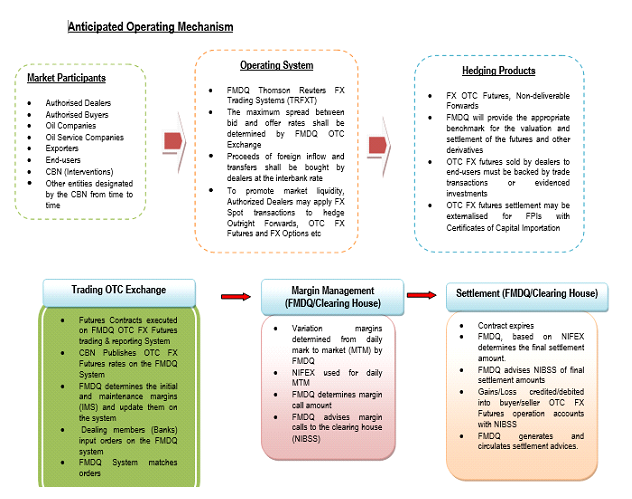

- Risk management/hedging products (Forwards, Futures, Swaps and Options) offered by the CBN and authorized dealers will be introduced to deepen the currency market, boost liquidity and promote financial security in the market.

- Authorized FX Primary Dealers (FXPDs) will be introduced to deal with the CBN on large trade sizes on a two-way quote basis.

- Other Authorized Dealers (non-FXPDs) shall be allowed to operate in the Interbank FX market.

- FXPDs will act as counterparties and participants to ensure market efficiency and improve liquidity.

- To qualify as an FXPD, an authorised dealer must meet at least two of the following three criteria as of 31st May 2016:

- Minimum shareholders fund unimpaired by losses of at least N200billion

- Minimum of N400billion in total foreign currency assets and

- Minimum liquidity ratio of 40%

In relation to the criteria, the listed banks, according to our analysis could qualify to participate as FXPD: Access, ETI, FBNH, GTB, UBA, Zenith, Diamond and UBN. Though, other banks could be approved by the CBN after meeting the criteria.

| Banks | Foreign Currency Assets (bn ’N) FY 2015 | Shareholders’ Funds (bn ’N) Q1: 2016 | Liquidity ratio (Q1:2016) | Qualified |

| FBNH | 1,549 | 575.2 | 58.2% | Yes |

| Zenith | 1,324 | 621 | 47.7% | Yes |

| UBA | 1,160 | 347 | 50% | Yes |

| GTB | 972 | 434 | 36.1% | Yes |

| Access | 559 | 382 | 37.6% | Yes |

| Diamond | 668.7 | 220.4 | 52.4% | Yes |

| FCMB | 358 | 163 | 38.2% | No |

| Fidelity | 329 | 184 | 37.5% | No |

| Sterling | 216.9 | 94 | 46.0% | No |

| Skye – – | 320.9 | 145.2 | N/A | No |

| Stanbic- – – | N/A | 117.5 | 48.5% | No |

| UBN | 179.2 | 243 | 45% | Yes |

| UNITY | N/A | 83.5 | N/A | |

| WEMA | 21.2 | 45.5 | 65.1% | No |

| ETI++ | 3,119 | 506.5 | Yes |

Source: Company Filings

++ Group Financial Result

– – Shareholders’ Fund computed as at Q3:2015, Foreign Currency Asset as at FY 2014;

– – -All data computed from Q3:2015

- Decision to introduce FXPD will have further impact on the competitive dynamics of the banking industry with Tier-1 banks – which overwhelmingly dominate the list of qualified institutions – gaining more competitive advantage.

- By providing FXPDs exclusive access to deal with the CBN for large-volume transactions (with no capped spread on resale of the FX sold to other authorised dealers and retail clients), corporate clients with huge demand for FX could shift deposits to designated FXPDs, further widening the Cost of Funding gap between Tier-1 and Tier-2 banks.

- This will all inevitably filter into bottom-line performance which will further segregate the profitability of FXPDs and other banks. Yet, we believe the decision of the CBN is justified, given the need for FXPDs to have sufficient liquidity, capital base and assets to independently source for FX.

Macroeconomic Implications

- Manufacturing Sector Growth: With the liberalisation of the foreign exchange market, we now expect many manufacturing companies to find it relatively easier to source dollars to import essential raw materials. For many manufacturing companies, the difficulty to open letters of credit significantly hampered production, leading to steady decline in manufacturing output over the last 3 to 4 quarters (with the exception of Q4’15).

- Inflation Rate: Whilst the new forex policy will see the NGN/USD rate depreciate substantially relative to the hitherto official rate of N199/USD, we do not envisage a concomitant increase in price levels. Many businesses were already sourcing dollars at a significantly higher rate than the official N199/USD, which implies that the pass through effect of a higher exchange rate already reflected on price levels.

- Monetary Policy Response: A liberalisation of the foreign exchange market signals a restrictive monetary policy. We expect the CBN to use available monetary policy tools to limit liquidity in the financial system as a way to keep check on the exchange rate. Conventionally, an aggressive rise in the benchmark monetary policy rate would be expected. However, with the weak transmission link between the monetary policy rate and other interest levels (treasuries and bond yields) in the Nigerian economy, we do not envisage a drastic rise in the MPR.

- Likely Appreciation of the Naira in the parallel market: At the close of trading on the first day of the FX auctions (20th June, 2016), Naira closed at N285/USD. If this auction continues very aggressively in the next 4 – 5 weeks such that most of the backlog is cleared, we expect a Naira appreciation at the black market, and the gap between the new interbank rate and the black market rate narrowed.

- Increased local participation envisaged for equities: For equities, we foresee an initial sell-off by foreign portfolio investors (FPI) so as to repatriate funds. However, if the FX market functions optimally in the next few weeks most FPIs who have been on the sidelines, awaiting some form of clarity on the FX situation, may return to the market. In anticipation of this, we expect a local market play by both retail and institutional investors, especially retail. Also, with renewed buy interests from retail investors and given their speculative nature, the equities market should experience some level of volatility in the coming weeks.

Advertisement

HIGHLIGHT OF NECA’S POSITION AT THE MEETING WITH EXECUTIVE CHAIRMAN, SECURITIES & EXCHANGE COMMISSION (SEC), ON 22ND JUNE 2016

Filing of Q4 Interim Unaudited Results

Our member Companies have been complying with their legal/regulatory obligation to file interim and annual results/returns with SEC. The only area of dispute/concern is with respect to filing of Q4 interim unaudited results. A number of our member Companies have been served with demand notices directing payment of several hundreds of millions of Naira as penalties for alleged failure to file Quarter 4 interim unaudited results for a number of years with threats of enforcement. The objective of our engagement on this subject matter is to appeal to SEC to reconsider its position with respect to filing of Quarter 4 Interim unaudited results by Companies and for it to withdraw the penalties served on our member Companies, for the following reasons:

- The Applicable Law & Regulations on Filing of Annual & Interim Accounts:

Section 60(1) of Investments & Securities Act, 2007 & Rule 38(1) of SEC Rules states that: “All public companies whose securities are required to be registered shall file with the Commission on a periodic or annual basis and on a specified format its audited financial statement and other returns as may be prescribed by the Commission from time to time”. SEC Rule 39(2) then provides that the Audited Results shall be filed with the Commission not later than ninety (90) days after the financial year end in line with the provisions of CAMA.

SEC Rule 41(1) provides that “Public quoted companies shall not later than thirty (30) days from the end of each quarter file with the Commission and SIMULTANEOUSLY (emphasis supplied) with the relevant Securities Exchanges and the investing public a quarterly report prepared in accordance with the International Financial Reporting Standard (IFRS).” It is apparent from what will be said hereafter that this simultaneous filing of Q4 interim results with SEC and NSE is not feasible.

- NSE Rules on Filing of Quarterly Financial Statements:

Rule 19.6 states that “An Issuer shall announce the financial statements for each of the FIRST THREE QUARTERS of its financial year immediately after the figures are available, but in any event not more than 30 days after the relevant financial period”. This rule clearly shows that NSE does not require public listed companies to file Q4 interim unaudited results.

Rule 30.2 states that “Going to press or otherwise allowing a leak in financial results without informing The Exchange shall attract a suspension from trading and a fine equivalent to 50% of the annual listing fees”. This rule clearly shows that filing of Q4 unaudited results with any other body and or disclosure of same to the investing public without informing the NSE will attract sanction/penalty from NSE.

- NASB (FRC) Standard:

STATEMENT OF ACCOUNTING STANDARD ON INTERIM FINANCIAL REPORTING SAS 30 issued by the Nigerian Accounting Standards Board (the predecessor of Financial Reporting Council) states in its second paragraph as follows: “INTERIM financial Reports are accounting information covering the operations of an organization for a period less than a full financial year, developed at various points during the year. Such reports usually cover a period of three, six or nine months”

The compelling proposition/submission from the foregoing is that SEC should align with the unambiguous, practical, realistic, and best practice position as lucidly expressed in the NSE & FRC Rules/Standards that filing of Q4 Results is not required. This will bring clarity and certainty to the matter. This is more so when the Amendments to the NSE Listing Rules (excluding filing of Q4 unaudited results) were approved by SEC on 19th May, 2014.

Practical Reality: Filing of Q4 Interim Vis-À-Vis Year End Audited Results

- From the Rules of SEC rehashed above, interim unaudited results are to be filed within 30 days of a quarter ends; while year-end audited accounts are to be filed within 90 days of year end. In the case of filing of Q4 interim unaudited results, and audited year-end results for a company with 31 December year-end, there is just a gap of 60 days (between 31 January for unaudited Q4 results and 31 March for audited results). As we all know, interim results are unaudited and are subject to audit adjustments for accuracy and reliability. Unaudited Q4 Interim Results which when accumulated with the earlier submitted Q1, Q2 and Q3 Interim results should reflect a company’s performance for a year, would create a practical problem. This is especially so when the audited results usually end up being different from the interim unaudited results as a result of audit adjustments. Having two sets of results, one unaudited and the other audited in circulation at the same time will have confusing and misleading effects on investors and the investing public, with serious adverse effect on the integrity of the company and the capital market.

- The view that Q4 interim unaudited results should be filed by 31 January by companies with 31 December year-end in order not to deprive the investing public of information from 1 November (when the last Q3 unaudited results were last filed) to 31 March (when the audited results are expected to be filed) is not supported by recent developments for the following reasons:

- The 90 days specified for filing audited results is the latest date for the accounts to be filed and NOT the earliest date.

- Although companies are required to file their audited results within 90 days, nowadays, a lot of companies file their results less than 45 days after year-end and this can be confirmed from the NSE Issuers Portal. Therefore, companies with 31 December year-end which are required to file their audited results by 31 March 2016 actually filed their audited results by the second week in February 2016 (just few days after SEC requires them to file Q4 unaudited results i.e. 31 January). For example, Nigerian Breweries Plc filed its 2015 audited results with the NSE on 10 February 2016. Therefore, if audited results which the investing public would rely upon are available just few days after companies are required to file the unaudited Q4 results (which are subject to audit adjustments), there is no reason to insist that the Q4 unaudited results should be filed as the investors are actually given very reliable information within reasonable time.

- To confirm the current trend of early filing of audited results, several PLCs held their AGMs to approve 2015 audited accounts, such as GTB and WAPIC on 5 April 2016; Zenith Bank on 6 April; UBA on 8 April 2016; African Prudential Plc on 12 April 2016, etc. The above facts further confirm that the audited results of these companies were filed early February 2016 for them to hold AGMs in April. This is in view of the fact that based on statutory timelines, AGMs of listed PLCs can only be held after 40 days of filing the results with regulatory authorities.

Click here for the full details

HIGHLIGHTS OF NECA’s POSITION ON THE DRAFT AMENDED NATIONAL CODE OF CORPORATE GOVERNANCE OF THE FINANCIAL REPORTING COUNCIL OF NIGERIA (FRC)

THE SUBJECT MATTER

The Financial Reporting Council of Nigeria (FRC) recently released amended draft National Code of Corporate Governance (draft Code or NCCG) for Nigeria sequel to the first Public Hearing held on 30th June 2015. The NCCG is for three (3) sectors: Private Sector, Public Sector and Not-for-Profit.

We support Government’s efforts to deepen corporate governance provisions and practices in Nigeria. At the same time however, there is a need to align certain provisions in the NCCG with existing laws in the country as well as the need to recognise the different operational needs and set up of companies.

We have set out below, some key areas of concern that need to be reviewed in the draft amended Code for the Private Sector. (Click here for the full details)

CONCLUSION

Although, the Minister of Industry, Trade and investment (MIT&I) is vested with power to make regulations under the Act, a directive is not sufficient to make the Code mandatory or confer power on the FRC to impose sanctions. It is clear that any sanction to be imposed for breach of the Code is at the sole discretion of the FRC, as the Code contains no penalties for breach. We urge Government to enact or put in place Business Friendly Regulations/ Policies etc. in the interest of the Economy.

Typically, Codes of Corporate Governance are either legislated or made voluntary for companies to sign up for. The Code, in its current form, is an attempt by the FRC to legislate a code of corporate governance, and also rehashed the provisions of some laws (including CAMA and the Investment and Securities Act) and in the process attempt to amend the said laws. The Code should either be issued as a regulation consistent with existing laws or made voluntary for companies.

Finally, the Government should not be seen to be increasing the burdens of companies when they should be making them lighter. A few provisions in the draft code have the implications of increasing the burdens with the appointment of more external consultants including auditors and assessors. This code should not be seen as an avenue to create more work for consultants at the expense of companies and shareholders.

Advertisement

LABOUR & EMPLOYMENT LAW: Collective Agreement (Ganiu Lawal & 3 others vs. Federated Steel Mills Limited) (2014) 42 N.L.L.R. Pt 130, P. 306 NIC

Facts:

- The claimants’ complaint was against the right of the defendant to terminate their employment in furtherance to a collective agreement which was reached between the Association of Metal Products, Iron and Steel Employers of Nigeria (AMPISEN) and Steel and Engineering Workers’ Union of Nigeria (SEWUN).

- The position of the defendant was that because the claimants were accredited members of SEWUN and they paid their dues regularly to the Union; they are bound by the terms and conditions in the collective agreement.

Issues

- Whether or not the Collective Agreement between Association of Metal Products, Iron and Steel Employers of Nigeria (AMPISEN) and Steel and Engineering Workers’ Union of Nigeria (SEWUN) was enforceable on the claimants; thereby making the termination of the claimants’ employment by the defendant proper.

The Judgement

On jurisdiction of the National Industrial Court over interpretation and application of Collective Agreement:-

By the provisions of section 254C of the Constitution of the Federal Republic of Nigeria 1999 as amended by third Alteration Act 2010, the National Industrial Court has exclusive jurisdiction in civil causes and matters relating to the determination of any question as to the interpretation and application of any Collective Agreement.

On definition of Collective Agreement:-

Section 54 of the National Industrial Court Act 2006 defines Collective Agreement as: any agreement in writing regarding working conditions and terms of employment concluded between:

- An organisation of employers or an organisation and representing employers (or an association of such organisations) on the one part, and

- An organisation of employees or an organisation and representing employees (or an association of such organisations) on the other part.

From the above provisions, therefore, the Court has unfettered jurisdiction to interpret the Collective Agreement between AMPISEN and SEWUN.

In the instant case, the claimants being members of SEWUN were covered by the Collective Agreement entered into by SEWUN with AMPISEN. Thus, the Collective Agreement is applicable to the claimants. See: ASCSN vs. Ho. Minister of Works & Ors (2011) 22 NLLR pt. 63, p 493

Final Judgment:-

The Judge held the Collective Agreement between AMPISEN and SEWUN was binding on the claimants; consequently their compulsory retirement was proper. The claimants’ suit was, accordingly, dismissed.

OPINION:

Parties are bound by their agreement and what has been done by agreement can only be undone by another agreement.

Performance Management and Appraisal System for Improved Productivity

Date: 28 – 30 June, 2016

Duration: 3 Days

Venue: NECA Learning Center

Course fee: Members: N110,500; Non- Members: N115,500

For further details please contact Adewale (08069720364) adewale@neca.org.ng or Visit www.neca.org.ng

Recent Comments