March Edition: Business Essential

Welcome to the March 2019 Edition of Business Essentials.

In this edition, we reviewed some of the implications of the re-election of the current administration while also highlighting areas that need urgent attention. We also examined the highlights of the National Bureau of Statistics (NBS) report on foreign trade for Q4 2018, Central Bank’s Business Expectation Survey and CBN’s Monetary Policy Committee Report.

Amidst unstable oil prices, attempts by the government to improve on its revenue generating ability and the urgent need for diversification, we took a cursory look at the growth prospects in the mining sector despite the low credit provision available for the sector and the need to ensure more accessible funds for stakeholders in a bid to improve the sector’s business environment.

Following the recent signing into law of the Federal Competition and Consumer Protection Bill by President Muhammadu Buhari and its resultant effect on the relevant provisions of the Investment and Securities Act (ISA) on mergers, we examined the new Act and discussed key provisions and regulatory implications in the Act that are relevant to merger transactions in Nigeria.

Also in this edition are pictures from different courtesy visits by the Secretariat to member- companies. Our regular Law Report Review, Upcoming Learning & Development programmes and other activities at the Secretariat were not left out.

Have a pleasant reading.

Wale-Smatt Oyerinde

Editor

In this Issue:

– Economic Agenda for the New Dispensation, National Bureau of Statistics (NBS) Q4, CBN MPC Report, Foreign Trade Statistics and February CPI.

– Growth Prospects in the Mining Sector Despite Low Credit Provision

– The Federal Competition and Consumer Protection Act 2019: Regulatory Implications for Merger Transactions in Nigeria

– Pictures from Courtesy Visits

– Law Report Review / Legal Opinion

– 2019 Retreat of Technical Committees

ECONOMIC AGENDA FOR THE NEW DISPENSATION, NATIONAL BUREAU OF STATISTICS (NBS) Q4, CBN MPC REPORT, FOREIGN TRADE STATISTICS AND FEBRUARY CPI.

The re-election of President Muhammadu Buhari at the 2019 Presidential Elections signals continuity in the existing economic policies with respect to the foreign exchange regime, which had renewed investors’ confidence in the Nigerian markets. Furthermore, President Buhari’s victory presents him a new opportunity to choose between setting the country on the path to prosperity or sustaining poor policy choices with economic consequence of bleaker growth prospects. Nigeria’s fiscal vulnerabilities as well as her economic structural faults continue to worsen poverty levels, unemployment and economic growth, which require the government to take a decisive, tough and impactful decisions.

The Minister for Budget and National Planning, Mr. Udoma Udo Udoma and the Executive Chairman of the FIRS, Mr. Babatunde Fowler recently hinted that the VAT rate is likely to go up to enable government fund the new minimum wage of N30,000 per month approved by the National Assembly. It is pertinent to note that an increase in VAT is inconsistent with the current economic reality. The VAT rate will unavoidably reduce consumer spending, leads to higher inflation, interest rate hike and more unemployment. Instead of increasing the VAT, the government should rather focus on implementing strategies and policies that will aggressively grow jobs and diversify the Nigeria’s economic base away from excessive reliance on crude oil.

Business Expectation Survey of the Central Bank of Nigeria (CBN)

The Central Bank released the monthly Business Expectation Survey for February 2019 with a response rate of 97.4 per cent and sample covered the following sectors: services, industry, wholesale/retail trade, and construction sectors. The respondent firms were made up of small, medium and large corporations covering both import- and export-oriented businesses.

At 22.1 index points, respondents expressed optimism on the overall confidence index (CI) on the macro economy in February 2019. The businesses outlook for March 2019 showed greater confidence on the macro economy with 58.5 index points. The optimism on the macro economy in the current month was driven by the opinion of respondents from services (12.9 points), industrial (7.3 points), wholesale/retail trade (1.0 points) and construction sectors (0.8 points). Whereas the major drivers of the optimism for next month were services (33.4 points), industrial (17.7 points), wholesale/retail trade (5.3 points) and construction sectors (2.1 points).

The positive outlook by type of business in February 2019 were driven by businesses that are neither import- nor export-oriented (14.3 points), import-oriented (4.0 points), both import- and export-oriented (3.2 points), and those that are export-related (0.6 points)

On Employment and Expansion plans, the positive outlook in the volume of business activities (64.4 index points) and employment (24.8 index points) indicated a favourable business outlook in March. The employment outlook index by sector showed that the services (26.1 points), indicates the highest prospects for creating jobs, followed by industrial sector (24.6 points), wholesale/retail trade sector (22.5 points) and construction sector (12.5 points). Also, exchange rate expectation shows that majority of the respondent firms expect the naira to appreciate in the current, next and the next twelve months as their confidence indices stood at 23.3, 32.6 and 54.7 index points, respectively. Also, respondent firms are satisfied with the management of inflation by the Government with a net satisfaction index of 3.3 percent in February 2019.

The firms that were surveyed identified insufficient power supply, unfavourable economic climate, high-interest rate, unclear economic laws, financial problems, unfavourably political climate and insufficient demand as the major factors constraining business activity in the current month.

CBN Monetary Policy Committee Report.

The Monetary Policy Committee (MPC) of the CBN met on the 25th and 26th March 2019; against the backdrop of developments in the global and domestic economic environments in the first quarter of 2019. The Committee for the first time since July 2016 cut the Monetary Policy Rate by 50bps to 13.50%, while keeping all other policy levers at previous levels.

The Committee welcomed the continued positive sentiments in the Manufacturing and Non-Manufacturing Purchasing Managers’ Indices (PMIs) for the 24th and 23rd consecutive months in March 2019. This improved outlook was attributable to the continued stability in the foreign exchange market, various interventions by the Bank in the real sector and the effective implementation of the Economic Recovery and Growth Plan (ERGP) by the Federal Government. Furthermore, on the current measure of national output, the MPC noted the need to rebase the GDP, an exercise which was last carried out in 2010.

On developments in Money and Prices, the Committee noted the continued moderation in inflation as headline inflation (year-on-year) declined further to 11.31 per cent in February 2019 from 11.37 and 11.44 per cent in January 2019 and December 2018, respectively. The decrease in headline inflation was driven mainly by food inflation, which declined to 13.47 per cent in February 2019 from 13.51 percent in January 2019, while core inflation declined marginally to 9.80 per cent from 9.91 per cent in the previous month.

The Committee observed the tepid output growth in 2018, but noted with satisfaction that it strengthened in the last quarter of 2018 as well as the positive forecast for 2019. It further noted with great satisfaction, the continued moderation in all measures of inflation, sustained stability in the exchange rate and the robust level of external reserves. It commended the recent upsurge in capital inflows into the economy, noting this to be a demonstration of sustained confidence by the foreign investor community in the Nigerian economy. The Committee was, however, not unmindful of developments in the global economy, noting the recent slowdown in growth in some advanced economies and the dovish stance of some major central banks as an early warning sign of broader macroeconomic vulnerabilities. It, therefore, underscored the need to monitor the trend in capital flows and the continued downturn in the equities market, noting that the recent surge in portfolio inflows were concentrated in the money market.

The Committee averred that the relative volatility in oil prices and its impact on accretion to reserves which could easily undermine the stability observed in the foreign exchange market. It, however, noted that current developments in the oil futures market indicate that oil prices will remain considerably above the Federal Government’s 2019 budget benchmark. The Committee urged the Federal Government to sustain its implementation of the ERGP, while ensuring that growth is all inclusive. It reiterated the need to concentrate effort on addressing the problem of weak power infrastructure, as well as support domestic manufacturing. The Committee also called on all relevant institutions of the government to address the menace of smuggling and dumping of goods into Nigeria; and encouraged the Bank to continue to explore available scenarios to deal with the activities of economic and policy saboteurs, including those involved in dumping and smuggling, in a bid to accelerate domestic production of goods in Nigeria.

The MPC noted the positive moderate outlook for growth and the risks in the horizon. The Committee also noted that having achieved a relatively stable exchange rate with price stability, it is imperative that monetary policy should explore the next steps necessary for enhancing growth, reducing unemployment and diversifying the base of the economy. It further observed that per capita income growth is very negligible, while aggregate demand remains weak. Aggregate output also remains below the potential output level, implying sufficient headroom for non-inflationary growth. This new direction has, therefore, become imperative against the backdrop of the aftermath of the general national elections and strong inflow of foreign direct and portfolio investments into the economy.

The Committee urged for the speedy passage of the other aspects of the Petroleum Industry Bill (PIB) to fast track the development of the value chain in the sector and create employment. It also welcomes the passage of the National Minimum Wage Bill by the National Assembly and call for its speedy implementation in order to boost domestic aggregate demand.

The Committee further observed that the performance of the monetary aggregates were below their benchmarks, indicating headroom for monetary growth. The MPC noted the encumbrances and constraints imposed on fiscal policy and the associated vulnerabilities as it has consistently failed to mobilise sufficient revenues to support development as enunciated in the ERGP, leaving room for continued debt financing, not previously envisaged. Against this backdrop, it is imperative for monetary policy to provide the much needed leverage to support output growth and employment generation in the country.

On a more cautious note, the Committee expressed concern and sympathises with the fiscal authorities, over the growing fiscal deficit, external debt and debt service, and urged the need to closely monitor the public procurement process in order to improve efficiency in public resource management.

In its consideration of the best monetary policy option, the Committee noted the need for all agencies of Government to work hard, not only in consolidating the growth so far achieved, but also in ensuring that appropriate policies are put in place and implemented to create jobs on a mass scale and diversify the economy in a proper direction. In doing this, the policy options facing the MPC at this meeting is a decision between retention of the current stance of monetary policy or a slight loosening of the policy rate, backed by the substantial stability of the major macroeconomic indicators. The Committee felt that given the relative stability in the key macroeconomic variables, there is the need to signal a new direction that is pro-growth.

In summary, the MPC voted to:

- Adjust the MPR by 50 basis points from 14.00 to 13.50 per cent;

- Retain the asymmetric corridor of +200/-500 basis points around the MPR

- Retain the CRR at 22.5 per cent; and

- Retain the Liquidity Ratio at 30 per cent.

Highlights of NBS Foreign Trade Q4, 2018

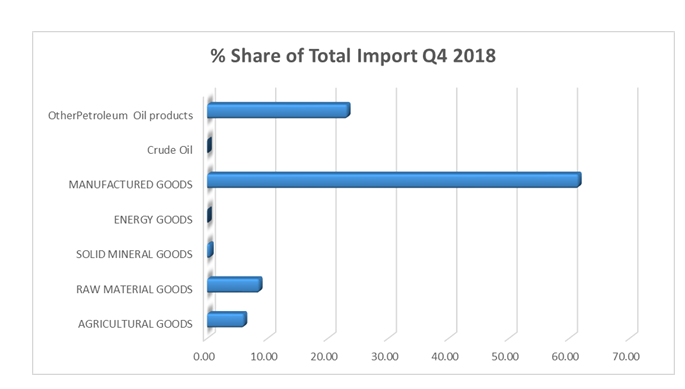

Import.

- The value of total imports fell to 14.99% in Q4 2018 compared to Q3 2018, but rose 69.6% over the corresponding quarter of 2017.

- Imported Agricultural products was valued at N5.0 billion, or 2.23% less than in Q3 2018, and N8.7billion or 3.8% lower than Q4, 2017.

- The value of Raw material imports grew 9.5% more than the value recorded in Q3, 2018 and 10.8% more than the value recorded in Q4 2017.

- The value of imported manufactured goods decreased by 23.5% against the value recorded in Q3, 2018 but rose by 82.2% against its value in Q4, 2017.

- The value of other oil products imported was N832.2 billion, or 28.6% lower than in Q3, 2018 but 118.98% higher than the corresponding quarter of 2017.

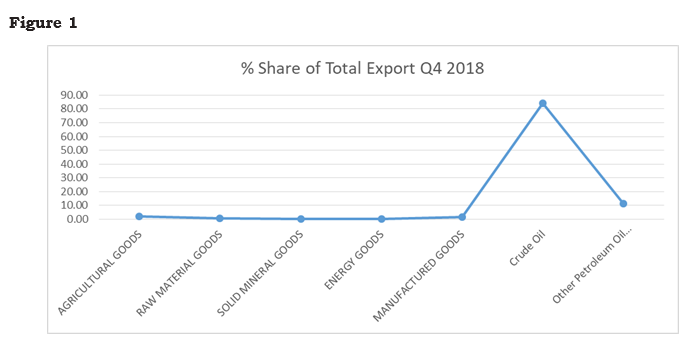

Export

- The value of total exports in Q4, 2018 increased by 3.52% against the level recorded in Q3, 2018 and 28.46% higher than its value in Q4, 2017.

- The value of Raw material goods exports in Q4,2018 was 26.7% higher than the value in Q3 and 7.7% higher than the value recorded in Q4 2017.

- The value of manufactured goods exports rose by 14.97% in Q4 2018 when compared with the value recorded in Q3 2018 but decreased 36.6% against the corresponding quarter in 2017.

- The value of Crude oil exports in Q4 2018 was 1.98% higher than in Q3 2018 and 29.95% higher than in Q4 2017.

- The value of other oil products exports increased by 3.5% in Q4 2018 when compared with Q3 2018, and 15.99% compared to Q4 2017. The value of agricultural exports rose by 115.1% in q4 2018 compared to q3 2018 and 118.5% compared to q4 2017.

From the above figures, the value of the crude oil as the percentage share of total export is 84.18% while the Manufacturing had 61.53% from the percentage share of total import. This figure shows that over 60% of the manufactured goods consume in the Nigeria are imported. This does not portray any good sign for a Nation that is desirous in alleviating poverty and curbing the scourge of unemployment.

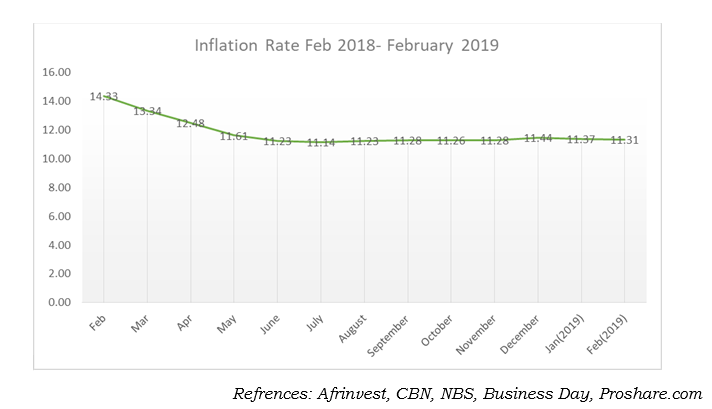

NBS Consumer Price Index (CPI), February, 2019

The NBS released the Consumer Price Index (CPI) for February, 2019. The CPI which measures inflation increased by 11.31 percent (year-on-year) in February 2019. This is 0.06 percent points lower than the rate recorded in January 2019 (11.37) percent. The percentage change in the average composite CPI for the twelve months period ending February 2019 over the average of the CPI for the previous twelve months period was 11.56 percent, showing 0.24 percent point from 11.80 percent recorded in January 2019.

The urban inflation rate increased by 11.59 percent (year-on-year) in February 2019 from 11.66 percent recorded in January 2019, while the rural inflation rate increased by 11.05 percent in February 2019 from 11.11 percent in January 2019. On a month-on-month basis, the urban index rose by 0.76 percent in February 2019, down by 0.01 from 0.77 percent recorded in January 2019, while the rural index also rose by 0.71 percent in February 2019, same rate as was recorded in January 2019 (0.71) percent.

The corresponding twelve-month year-on-year average percentage change for the urban index is 11.95 percent in February 2019. This is less than 12.20 percent reported in January 2019, while the corresponding rural inflation rate in February 2019 is 11.23 percent compared to 11.46 percent recorded in January 2019.Consumer Price

Figure 3

GROWTH PROSPECTS IN THE MINING SECTOR DESPITE LOW CREDIT PROVISION

In its recently released data, the National Bureau of Statistics (NBS) has revealed that the production of solid minerals in Nigeria hit 55.85 million tonnes in 2018 according to the State Disaggregated Mining and Quarrying Data. NBS data shows that compared to the 45.79 tons of solid minerals produced in 2017, solid minerals production increased to 55.85 tons in 2018, representing a 22% growth between the two periods.

Key Highlights of the Report

- Production in Nigeria’s Mining and Quarrying sector grew by 22% in 2018

- Mining and Quarrying receives the lowest bank credit to the private sector

- Ogun Stateproduced the highest tonnes of solid minerals

- Bayelsa Stateproduced least tonnes of solid minerals in 2018

- Limestoneproduction was the highest in the year

- Garnet and Rubyare the least produced solid minerals in 2018

Production in the sector grew by 22%, recording the highest growth in Limestone at 95%

The Nigerian mining and quarrying sector recorded 22% growth in the production of solid minerals in 2018. The break down shows that Limestone recorded the highest with 27.19 million tonnes produced.

Increase in limestone production – The volume of production in limestone further shows that compared to the preceding year of 2017, limestone production grew by 95% in 2018. In the year 2017, 13.9 million tonnes of limestone was produced, while it rose to 27.19 million tons in 2018. In total, the production of limestone represents about 49% of the total tonnes of minerals produced.

Granite and Laterite followed closely with 9.63 million tonnes and 5.07 million tonnes produced, representing 17% and 9% of the total tonnes of minerals produced in 2018. However, Garnet and Ruby are the least produced solid minerals in 2018.

At the state level, Ogun produced the highest tonnes of solid minerals

Ogun State produced the highest tonnes of solid minerals among the 36 States and the FCT. The State produced 16.49 tonnes of solid minerals representing 30% of the total tonnes of solid minerals produced in the year under review.

Kogi and Cross River States followed closely with 15.13 million and 3.49 million tonnes of solid minerals produced representing about 27% and 6% of the total tonnes of solid minerals produced.

However, Bayelsa and Borno States produced the lowest – The two states the produced the least are Bayelsa and Borno States with zero and 8,403.30 tonnes of minerals produced respectively.

Growth prospects in the Mining Sector despite low Bank Credit Provision

The Nigerian mining and quarrying sector has shown growth prospects despite the low bank credit given to the private sector in 2018.

Recent data shows that mining and quarrying received the lowest allocation of credit to the private sector with N20.69 billion, representing a meagre 0.14% of the total bank credit to the private sector. Shortchanging an important sector like mining and quarrying is obviously not good for the economy.

Progress Made So Far

Late last year, the Nigerian Government awarded a mining contract to ten exploration consulting firms, a move that was described as part of the country’s efforts to develop the mining sector.

Early in this month, the Federal Government launched a report designed to enhance the contribution of the solid minerals sector to Nigeria’s revenue of Gross domestic product, GDP. During the lunching, the Executive secretary of the Nigeria Extractive Industries Transparency Initiative (NEITI), Mr. Waziri Adio stressed that the mining sector has not been tapped to the fullest despite its potential to create jobs, address social issues and grow the entire economy

Some Downsides Despite Rich Mineral Deposits

Nigeria is considered a global haven for 54 unexploited mineral resources strewn across 22 states of Nigeria. Despite the rich resources, poor policy perception and the absence of specialized technocrats have plagued the sector.

In its latest 2019 NEITI’s report titled “Improving Transparency and Governance for Value Optimisation in Nigeria’s Mining Sector,” NEITI identified low perception index, weak regulatory architecture, and the absence of mining majors as the bane of the sector.

Why the FG should invest more in the Mining Sector

Just Recently, the Nigerian Association of Chambers of Commerce, Industry, Mines, and Agriculture (NACCIMA) and the sector’s stakeholders, stated that the volume of Nigeria’s iron ore alone can generate over $60 billion on a yearly basis if well managed.

This implies that the growth opportunities that await Nigeria in the mining sector cannot be overemphasised.

Conclusion

Against the foregoing, therefore, the Federal Government of Nigeria needs to build and implement a robust regulatory framework for the mining sector. Also, the Federal Government must revamp the institution and technical structure; ensuring more accessible funds for stakeholders to improve the sector’s business environment.

References: NBS, Nairametrics

THE FEDERAL COMPETITION AND CONSUMER PROTECTION ACT 2019: REGULATORY IMPLICATIONS FOR MERGER TRANSACTIONS IN NIGERIA

The Global Transaction Forecast (Report) issued by Baker Mckenzie and Oxford Economics predicts that merger and acquisition (M & A) transactions in Nigeria will continue to rise. Based on the Report, in 2017, M&A transactions in Nigeria amounted to $469m and rose to $2.7bn in 2018. In 2019, it is projected that deals around $2.9bn will be completed, dropping to $2.5bn in 2020. In 2021, M & A deals in Nigeria are projected to rise to about $3bn.

Previously, the Securities and Exchange Commission (SEC) was saddled with the regulation of all merger transactions in Nigeria. However, this responsibility now lies with the Federal Competition and Consumer Protection Commission (the Commission) given the recent signing into law of the Federal Competition and Consumer Protection Bill by President Muhammadu Buhari on 5th February 2019. With the repeal of relevant provisions of the Investment and Securities Act (ISA) on mergers, the new Federal Competition and Consumer Protection Act (Act) has introduced a change in the regulatory framework for merger transactions in Nigeria and companies seeking to merge would be required to undergo a new procedure different from the one under the ISA.

There will be a transition period of about 3 months before the Commission will become operational. During this period, SEC will still entertain ongoing applications till its completion. However, companies and other business entities seeking to file new merger applications will need to wait until the Commission resumes duties. This piece examines the new Act and discusses key provisions / implications in the Act that are relevant to merger transactions in Nigeria.

General Overview of the Federal Competition and Consumer Protection Act 2019

The Act aims at promoting a competitive market and protecting consumer rights in Nigeria. Prior to the enactment of the Act, there was no single piece of legislation regulating competition in Nigeria. Thus provisions of laws regulating competition were found in various legislation such as the ISA; the Nigerian Communications Act 2003; the Electric Power Sector Reform Act 2005 amongst other laws. However, the new Act applies to all businesses in Nigeria and supersedes all laws on competition and consumer protection, except the Constitution of the Federal Republic of Nigeria 1999.

The Act prohibits unfair business practices or abuse of dominant market position by any company, as well as any agreement to restrain competition such as agreements for price fixing, price rigging, collusive tendering etc. To regulate and facilitate competition, the President may from time to time, by order published in the Federal Gazette, declare that prices for goods and services specified in the order shall be controlled in accordance with the provisions of the Act.

In addition, the Act mandates the Commission to administer the provisions of the Act as well as set up the Competition and Consumer Protection Tribunal to adjudicate over conducts prohibited by the Act and exercise jurisdiction in accordance with the Act.

The Act also regulates Merger transactions for public and private companies. Specifically, the Act repealed Sections 121-128 of the ISA and introduced new provision relating to mergers. However, Section 121 (1) (d) of the ISA has been retained and this section allows SEC to continue to determine whether all shareholders are fairly, equitably and similarly treated and given sufficient information with respect to mergers. In addition, given that the provisions of ISA on takeover and acquisitions remain unaffected by the new Act, SEC will also continue to enforce compliance with the takeover provisions in the ISA and monitor acquisition of shares of public companies.

Highlights of Key Provisions in the Act on Merger Transactions

Given the enactment of the Act, a new regulatory regime now exists for merger transactions in Nigeria. Below are a number of key provisions/changes introduced by the Act.

Definition of Mergers

Under the Act, the definition of mergers has been extended to include “joint venture”. This is an interesting addition which could have far reaching implications for current or proposed joint venture (JV) arrangements, given that the Act did not define what type of joint venture would typically fall within the purview of the commission or how a merger could be achieved through a JV arrangement. For example, it is not clear whether a one-off JV arrangement between business partners or the JV arrangement enshrined in the oil and gas industry where two or more parties combine to fund oil exploration would be deemed a merger transaction. Thus, it is important that the commission provides guidelines on the type of JV arrangements that would be deemed a merger within the meaning of the Act.

Application of the Act to Transactions outside Nigeria

Another interesting provision is the application of the Act to transactions relating to the acquisition of shares or other assets outside Nigeria resulting in the change of control of a business, part of a business or any asset of business in Nigeria.

This, a change in the ownership of an offshore parent of a Nigerian entity that results in the change of control of the Nigeria business would typically fall within the purview of the Act. For example, if company A (a UK multinational) acquires majority shareholding in Company B, another UK company that has a wholly owned subsidiary in Nigeria and this offshore transaction results in the change of ownership/control of the Nigerian subsidiary, the transaction could be deemed a merger under the Act.

It is therefore important for companies, particularly multinational entities to pay attention to this new development as it could have major impact on their business activities/decisions.

Thresholds and Approvals for Mergers

Unlike the ISA that specifically provides for thresholds in determining small and large mergers (pending when SEC issues its guidelines on thresholds), the Act does not provide any threshold. Instead, the commission through a number of steps including inviting written submissions on the proposal from the public, is empowered to determine this threshold. The involvement of the public in the determination of the threshold is laudable.

However, given that no threshold is included in the Act and the Commission is yet to come up with its threshold, it would be difficult for parties to determine if their transaction falls into the category of review and whether the approval of the Commission would be required for the merger.

Thus, it is expected that the Commission would be constituted soon and would come up with the relevant thresholds to provide certainty for businesses with respect to proposed merger deals.

Requirement for Court Sanction

Pursuant to the ISA, the SEC is required to refer a notice of a large merger to the court. However, the requirement for court sanction of a merger is conspicuously missing in the Act. Thus, it appears that a merger may no longer require the sanction of the court and can be implemented once the approval of the Commission is obtained.

Typically, the scheme of merger becomes binding on the shareholders upon sanction of the scheme by the court with orders including cancellation of the issued share capital of the absorbed company, transfer of the assets/liabilities of the absorbed company to the enlarged entity and the dissolution of the absorbed company without being wound up, etc. Without a court order contemplated under the new framework, how will the absorbed company be dissolved or how will its assets/liabilities transferred to the enlarged entity? Would the Commission’s approval simply suffice for these purposes? Would the parties, as a matter of practice, still approach the court for sanction of the scheme? These are some of the concerns that businesses may have with this new legislation.

Introduction of Monetary Penalty for Regulatory Infractions

Similar to the ISA, parties to a large merger require the prior approval of the Commission. Thus, parties who fail to obtain approval of the Commission before implementing a merger shall be liable upon conviction to a fine not exceeding 10% of their turnover in the business year preceding the date of the offence. The impact of such fine could be enormous given that it is levied on the turnover of the erring parties. It is therefore important for businesses to obtain the approval of the Commission before proceeding with their merger transaction.

Additional Regulatory Burden for Companies

The number of regulatory approvals for merger transactions in Nigeria, especially for regulated companies, appears to have increased with the additional requirement for approval of mergers by the Commission. For example, a listed insurance company would typically require approval or “No Objection” from the National Insurance Commission (NAICOM) before proceeding with the merger. The Competition Commission would also consider the anti-competitive effects of the merger before granting its approval. In addition, listed companies would still require regulatory clearance from the Nigerian Stock Exchange in respect of the merger.

The fact that the Act did not repeal Section 121 (1) (d) of the ISA means that a company would still be required to obtain a “No Objection” from SEC to determine whether all shareholders are fairly, equitably and similarly treated and given sufficient information regarding the merger.

Conclusion

On the whole, the new law has changed the landscape for merger transactions in Nigeria given the expansion of the meaning of merger to include JV arrangements and the application of the Act to transactions outside Nigeria which results in the change of ownership of a Nigerian company, amongst other key provisions. Given the far-reaching effect that this might have on proposed merger transactions, it is important for companies to consult their professional advisers before the commencement of any proposed merger.

Exposition by AndersenTax

PICTURES FROM COURTESY VISITS

Pictured: Director General of NECA, Mr. Timothy Olawale (2nd from Left) and Managing Director of Eko Hotels Limited, Mr. Ghassan Fadoul (3rd from Left) during a courtesy visit to Eko Hotels Limited

Director-General of NECA, Mr. Timothy Olawale presenting a souvenir to Managing Director, Eko Hotels Limited, Mr. Ghassan Faddoul

Deputy-Director, Membership Services, Mr. Wale-Smatt Oyerinde and Deputy-Director, Legal Regulatory & Tax, NECA, Mr. Thompson Akpabio presenting a souvenir to the MD/CEO Neimeth Pharmaceuticals Plc.,

Mr. Matthew Azoji, during a courtesy visit to the company

The Director-General, NECA, Mr. Timothy Olawale (Right) pictured with the Director-General, National Directorate of Employment (NDE), Dr. Nasiru Mohammed Ladan during a courtesy visit to the Agency.

Mr. Christos Giannopoulos, Managing Director/CEO PZ Cussons Nigeria Plc. (Right) receives a souvenir from the Director-General, NECA, Mr. Timothy Olawale during a courtesy visit to the company.

Director-General, NECA, Mr. Timothy Olawale (Middle) and Managing Director, Mandilas Group Ltd., Ms. Ola Debayo-Doherty during a courtesy visit to Mandilas Group Ltd.

(L-R) Deputy Director, Membership Services, NECA, Mr. Wale-Smatt Oyerinde, Human Resources Manager, Air France KLM, Mr. Essi Kaya, Director, Learning and Development, NECA, Mrs. Celine Oni, Director-General, NECA, Mr. Timothy Olawale, Regional HR Director Nigeria & Ghana, Air France KLM, Marian Brandriet,, Deputy-Director, Legal, Regulatory & Tax, Mr. Thompson Akpabio during a courtesy visit to Air France KLM.

Courtesy visit to Schlumberger Nigeria Limited

NECA Pays a Courtesy Visit to INTELS

Courtesy vist to NLNG

Port Harcourt Geographical Group Meeting

LAW REPORT REVIEW / LEGAL OPINION:

Judgment of the National Industrial Court: When an Action is Statute-Barred

Alhaji Summonu Adetunji Omole vs. Nigeria National Petroleum Corporation & 1 Or Unreported Suit No. NICN/LA/820/2016

FACTS

The claimant filed the suit by way of a complaint dated and filed on 28th December 2016. By the statement of claim, the claimant claimed against the defendants jointly and severally for:

- a)That the purported letter of termination of the claimant’s appointment as Security Officer Grade II and as a pensionable staff of the Nigerian National Petroleum Corporation and the contemporaneous contract appointment offered to the plaintiff by the 1st defendant both letters dated the 4th day of December, 1988 are ultra vires, unconstitutional, null and void.

- b)That the claimant’s appointment as a permanent and pensionable staff of the 1st and 2nd defendants from or about 15th July 1979 still subsists and is valid with all the attached rights, salaries obligation and privilege unimpaired until he attains the statutory age of 60 years and for specific order restoring the claimant thereto.

- c)That the purported termination of the contract appointment of the claimant if ever there was one, by the 2nd defendant’s letter dated 14th of March, 1990 is ultra vires, unconstitutional, illegal, null and void and of no effect and for a specific order restoring the claimant thereto.

- d)That the purported termination of the pensionable appointment of the claimant by the 1st defendant is wrongful and amount to wrongful dismissal being in breach of the rules of natural justice and also contrary to civil service rules and 1999 Constitution, the claimant being a public officer.

ALTERNATIVELY

- e)An order for the payment of (N100,118,546.40) One Hundred Million, One Hundred and Eighteen Thousand, Five Hundred and Forty-Six Naira and Forty Kobo to the claimant by the defendants jointly and severally as special and general damages suffered by the claimant and in consequence of the wrongful dismissal or wrongful termination, whichever is applicable.

The defendants entered formal appearance, filed their defence processes and then filed a preliminary objection praying that the suit be dismissed. The grounds upon which the preliminary objection was based are: the suit was statute-barred; and the claimant did not comply with the statutory provisions requiring the issuance of a pre-action notice, thus rendering the suit incompetent.

Case for the Defendants

On whether the suit was statute-barred, the defendants referred to section 12(1) of the NNPC Act Cap 320 LFN 1990 which provides 12 months as the limitation period within which suits against NNPC can be brought. That from the originating processes, the claimant indicated that he was wrongfully disengaged from the employment of the defendants on 4th December 1986 and on same date issued with a contemporaneous contract appointment. That by implication, the cause of action arose in December 1986; and since the instant suit was filed on 28th December 2016, a clear 30 years after the cause of action arose, the suit must be statute-barred. The defendants referred to number of case law authorities: Egbe v. Adefarasin [1987] 1 NWLR (Pt. 47) 1, Madukola v. Nkemdilim [1962] 2 SCNLR 341, Tukur v. Governor of Gongola State [1987] 4 NWLR (Pt. 117) 517, Jeric (Nig) Ltd v. UBN Plc [2000] 12 SC (Pt. II) 133 and Sandra v. Kukawa Local Government [1991] 2 NWLR (Pt. 179) 379.

On the issue of pre-action notice, the defendants referred to section 12(2) of the NNPC Act which enjoins a pre-action notice on one month to the NNPC before a suit can be commenced against it. There was no evidence in the claimant’s processes before this Court showing compliance with the pre-action notice requirement of section 12(2) of the NNPC Act; neither was a copy filed in Court in line with Order 3 Rule 23(1) of the NICN Rules 2017. The defendants relied on a number of cases: Dominic E. Ntiero v. NPA [2008] LPELR-SC.39/2001, Barclays Bank Ltd v. CBN [1976] 6 SC 175 and Eze v. Ikechukwu [2002] 18 NWLR (Pt. 799) 348. The defendants concluded by urging that the suit be struck out or dismissed.

Case for the Claimant

The claimant reacted by filling a counter-affidavit and a written address. The claimant submitted a sole issue for determination: whether this suit can be statute-barred having complied with the section 12(1) of the NNPC and when the cause of action arose in 1990 and the claimant instituted action at the Lagos High Court which was one of the courts constituted to entertain such a matter. To the claimant, the case of action arose on 14th March 1990 when the defendants terminated the claimant’s appointment in 1990. The claimant’s counsel gave a pre-action notice to the defendants before suing at the Lagos High Court as per Suit No. LD/1476/90 – which pre-action notice was sufficient for the instant suit. Secondly, that since the Constitution was made to operate prospectively; the claimant had to commence the instant suit in this Court as held in Aremo II v. Adekanye [2004] 13 NWLR (Pt. 891) 572 ratio 2. For these reasons, the claimant concluded by urging that the preliminary objection of the defendants be discountenanced and the claimant allowed to proceed with the trial of this suit.

JUDGMENT

The Court held that the claimants’ case succeeds in terms of the following declarations and orders:

- In determining whether a matter is statute-barred, courts are called upon to ascertain what the cause of action is, when it arose and when the suit was filed. If the period between the date the suit was filed and when the cause of action arose is more than the limitation period, the matter is said to be statute-barred. From the processes filed, the court found and held that the suit was statute-barred.

- The claimant argued that he first filed an action at the Lagos High Court (Suit No. LD/1476/90) before filing the suit. Although he brought in this argument in terms of his submission that the pre-action notice he served for purposes of the Lagos High Court Suit should suffice for purposes of the instant suit, in his oral adumbration of his written address, the claimant’s counsel suggested that (and this is the context in which his written submission about the Constitution having prospective effect was made) he had to file the instant suit because the Third Alteration to the Constitution divested the Lagos High Court of jurisdiction in Suit No. LD/1476/90, and the Lagos High Court had no power to transfer the case to this Court. This argument must fail since Echelunkwo John & 90 ors v. Igbo-Etiti LGA[2013] 7 NWLR (Pt. 1352) 1 at 14 – 17 held that State High Courts have the power to transfer labour/employment cases pending before them to the National Industrial Court. The argument of the claimant in opposition to the preliminary objection was lame and unconvincing and so must fail.

- In the whole, the court found and held that the suit was statute-barred; and on this ground alone the case was liable to be dismissed. See NPA Plc v. Lotus Plastics Ltd[2005] 19 NWLR (Pt. 959) 158, which held that where a Court makes the finding that a matter is statute-barred, the proper order to make is one of dismissal.

- The preliminary objections of the defendants succeed. The suit was accordingly dismissed.

OPINION

Parties are expected to comply with certain requirements (Facts and Law) before instituting an action in Law. The preliminary objection was decided based on a mixture of Law and Facts.

2019 RETREAT OF TECHNICAL COMMITTEES

The retreat would hold from 12th – 13th April 2019 at Park Inn by Radisson, Abeokuta. The theme for the 2019 Retreat of the Technical Committees is “Enterprise Sustainability- Prospects and opportunities for Competitiveness” and the keynote address will be given by the MD/CEO Nestle Nigeria Plc. and 2nd Vice President, NECA, Mr. Mauricio Alarcon.

Other topics on economy, human resources, regulatory and tax, health and finance would also be discussed.

For enrolment and other details, please contact: 08033624608, 08055170579, 08069720364, nkiru@neca.org.ng, thompson@neca.org.ng, adewale@neca.org.ng.

Recent Comments