Business Essentials Vol. 4, No 7

Dear Esteemed Member,

As you are well aware, the Organised Private Sector (OPS) in the past had repeatedly called on Government to come up with a sound Economic Roadmap as guide for its policies and programmes. The recent economic recession had made the need more obvious thus it was not surprising when the Federal Government, in one of its recent engagement with the Private Sector on economic matters shared the details of its yet to be unveiled Nigeria’s Economic Recovery and Growth Plan (ERGP) with us. The Plan lays out a total of 60 strategies that will collectively bring about the overall objective of inclusive growth through structural economic transformation. We devoted this edition to share with you, highlights of the Plan and our views on some of the initiatives.

We also shared the Secretariat’s Press Release on its concern about the planned enforcement of the Stamp Duties Acts by FIRS. Our regular Labour and Employment Law Review and Upcoming Training Programmes were not left out.

Have a pleasant reading.

Timothy Olawale

Editor

In this Issue:

- Overview Of Nigeria’s Economic Recovery And Growth Plan (ERGP)

- Human Resource Humour: The Shredder

- LABOUR & EMPLOYMENT LAW: Action in a Representative Capacity (Livinus A. Olisakwe & 4 others (for themselves and on behalf of sacked staff of Air Nigeria Development Limited) vs. Air Nigeria Development Limited & 2 Others) (2014) 51 N.L.L.R. Pt 170, P. 438 NIC

- Upcoming Training Programmes

Overview of Nigeria’s Economic Recovery and Growth Plan (ERGP)

For decades, crude oil has accounted for over 90% of Nigeria’s foreign exchange earnings, and 65% of Government income, the recent crash in oil prices has therefore resulted in significant economic stress. Nigeria has typically funded its rising import bill (just over US$50b a year), with what it earns from crude oil exports (over US$70b a year), however with the recent price corrections, Nigeria must rethink its entire economic strategies. To leap out of the doldrums, the Federal Government had developed the Economic Recovery and Growth Plan (ERGP) to showcase its economic development plans and initiatives in attracting foreign direct investment and boosting the economy.

During the unveiling of the economic blueprint at the Presidential Villa in Abuja, at the second Presidential Business Forum presided over by Acting President, Prof. Yemi Osinbajo, the Director General of NECA, Mr. Olusegun Oshinowo represented the Organised Private Sector at the event.

The Minister of Budget and National Planning, Senator Udoma Udo Udoma, in his presentation informed that the Economic Recovery and Growth Plan (ERGP) is a Medium Term Plan for 2017 – 2020, which builds on the Strategic Implementation Plan (SIP) and is developed for the purpose of restoring economic growth while leveraging the ingenuity and resilience of the Nigerian people – the nation’s most priceless assets. The blueprint articulated with the understanding that the role of government in the 21st century must evolve from that of being an omnibus provider of citizens’ needs into a force for eliminating bottlenecks that impeded innovations and market based solutions.

Nigeria aspires to have a rapidly growing economy with diversified sources of growth, increased opportunities for its people, and a socially inclusive economy that reduces poverty and creates jobs for the millions of young people entering the labour market annually. To achieve these objectives the Federal Government of Nigeria is determined to provide the leadership required to establish a well-governed society with stable macroeconomic conditions, and a dynamic, competitive environment that enables the private sector to thrive.

The ERGP aims to restore sustained economic growth while promoting social inclusion and laying the foundations for long-term structural change. It will focus on providing macroeconomic stability, stimulating priority sectors and tackling critical constraints to long-term growth.

- Current Issues/Situations

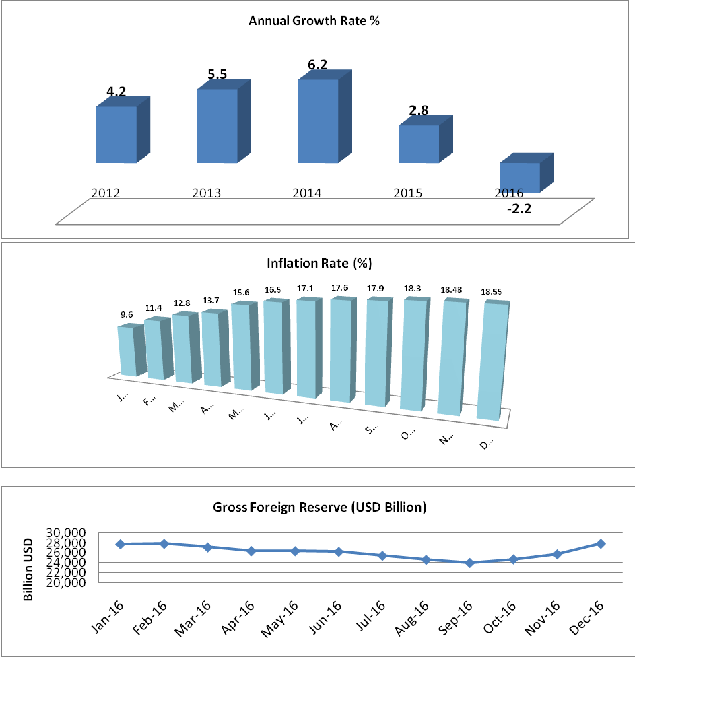

As a result of external challenges and structural weaknesses in the economy, in 2016, the country entered into recession (negative GDP growth in 3 consecutive quarters): GDP growth has slowed; Inflation rate is ticking upwards (reaching 18.5% in December 2016, from 9.6% in January 2016)- decreasing the purchasing power of low-income households as well as decreasing businesses’ and investors’ confidence; Gross Foreign Exchange Reserves declined from $29billion in January 2016 to $23billion in October 2016 due to severe pressure before the introduction of the flexible foreign exchange regime, which allows the exchange rate to be determined by supply and demand. However, within the last 3 months, the Foreign Reserve witnessed tremendous improvement, now at $28.6 billion. Also, the difference between the Interbank and Parallel Market rate has further widened, the naira fell to a record N510/$1USD against the greenback on the black market this week. That’s 38 percent weaker than the official rate of 315.

All these variables also affected the Foreign Direct Investment, which in 2011 attracted about 8.8billion investment but could only attract about $1.6billion investment as at the end of 2nd Qtr of 2016. Federal Government’s Revenue witnessed a drop, from N3.2trillion in 2014 to N2.7trillion in 2016, while Expenditure is on the increase, from N4.0trillion in 2014 to N4.9trillion in 2016, with fiscal deficit of about 2.5% of the GDP.

All these variables also affected the Foreign Direct Investment, which in 2011 attracted about 8.8billion investment but could only attract about $1.6billion investment as at the end of 2nd Qtr of 2016. Federal Government’s Revenue witnessed a drop, from N3.2trillion in 2014 to N2.7trillion in 2016, while Expenditure is on the increase, from N4.0trillion in 2014 to N4.9trillion in 2016, with fiscal deficit of about 2.5% of the GDP.

State Government revenues have also declined while their debt levels have increased. Due to declining revenues, some State Governments could not meet their recurrent expenditures e.g salaries for civil servants, health workers, teachers, etc. In June 2016, a bailout of N90billion was arranged for State Governments.

Therefore, there is need for a coherent and credible package of sustainable economic measures for economic turnaround.

Plan of Action based on the Economic Recovery & Growth Strategies

We have 2 options in the short-term:

- Do Nothing: The macro environment to remain unstable, public finances deteriorate, Federal & State budgets are not implemented; unemployment rises as manufacturers, etc lay off workers, potential for civil unrest; economy recession continues, GDP growth remains negative in short term.

- Take a bold home grown action: Identify revenue sources to plug fiscal deficit and boost reserves (e.g privatizations, tax revenues, etc); implement bold structural reforms (e.g. for power, road, railways, public service reform, and competitiveness)

The Economic Recovery and Growth Plan proposed that the GDP growth could reach 7% in 2020, with a projection of about 2.8% in 2017, 4.8% in 2018, 4.2% in 2019 and 7.0% in 2020, i.e 4.9% compound annual growth rate over the 4 –year period.

Macroeconomic Environment:

The ERGP planned programmes of action and initiatives to achieve revamping the economic back to growth includes:

Achieve Fiscal Stability:

To achieve the set target, the country needs to increase its oil production level, which had been severely hit by repeated attacks in recent past (in February 2016, the Forcados Export terminal exporting about 0.25 mbpd was attacked, similarly in May 2016, NCTL platform was attacked accounting for about 0.22 mbpd export and in July 2016 Qua Iboe Terminal producing 0.15mbpd was also attacked). These entire instances led to reduction in the oil production to about 1.6mbpd as at November 2016 from the budgeted 2.2mbpd oil production.

Contribution of the non-oil resources, especially taxes was argued to be in dismal, tax to GDP ratio is around 5 times smaller than peer countries (Kenya:18%, South Africa:19%, Turkey:19%, Mexico: 16%, Brazil:16% China:17%, India:16% and Nigeria:3%). It indicated that the country could reasonably double its non-oil tax revenues and reduces expenditures while taking a closer look at the rising debt profile.

Key Initiatives

- Increase oil production level back to 2.2mbpd in 2017 (by tackling security issues in Niger Delta region and initiate a peace process with the militants) and to 2.5mbpd by 2020 by attracting new investments, fix regulatory uncertainty and initiate a debt recovery process. This will translate to increased revenue from Oil, from the present 700billion to about N1.3trillion- N1.45 trillion within the next 4 years.

- Accelerate non-oil revenue generation by focusing on increasing the tax base, improving effectiveness of revenue collection, and increasing Independent Revenue

- Optimize CAPEX spend through portfolio and project optimization and by leveraging private capital; rationalise OPEX by fighting against fraud in personnel expenditures and by “doing more with less” for overheads

- Optimize debt strategy by rebalancing public debt portfolio with more external borrowing and by issuing bonds for contractors arrears

- Privatize selected Oil and Non-oil assets through reducing the Federal Government’s stake in JV Oil assets and significantly reducing FGN stakes in other Oil and Non-oil assets.

Opinion:

- We believe that the peace initiative embarked upon by the Acting President, Prof Yemi Osinbajo within the Niger Delta region, if followed through, will yield a positive outcome on Oil production/revenue, however, there is the need to speedily initiate the passage of the Petroleum Reform Bill (PRB), which we believe will boost investor’s sentiment in the Oil & Gas Sector.

- We also advocate that quick and decisive action should be taken on the privatization of the four (4) refineries as a means of ensuring the efficient running of the refineries and savings on the wastes associated with the turnaround maintenance.

- On reduction of the Recurrent Expenditure, we canvass for quick implementation of the Oronsanye Report on the merging of some Government Ministries, Departments and Agencies (MDAs) with overlapping responsibilities and the right thing to do is to rationalise the roles and responsibilities of these MDAs, through integration, merger and in some instances, outright scrapping.

Monetary Stability:

Key Initiatives

- Align monetary, trade and fiscal policy by maintaining a stable exchange rate regime, adopting a flexible market-determined exchange rate and using trade policies (e.g import tariffs) to reduce demand pressures for current 41 prohibited items.

- Increase financial system stability by strengthening the supervisory framework of the financial institutions and encouraging banks to shore up/increase capital.

Opinion

- The plan to replace administrative measures on the list of 41-items banned by CBN for accessing FX is a welcome development; this has formed part of our advocacy in recent past with Government. We believe that this development, though not in the immediate, will help to reduce the demand for US dollar.

External Balance

Key Initiative

- Improve current account balance by improving non-oil exports, promoting import substitution, and incentivizing inflow of FDI

Opinion

- We believe that the Export Expansion Grant has undergone several changes over the years and is threatening the confidence of the international business community on Nigeria’s non-export policies. We welcome the initiative to restructure the EEG to a tax credit system, however, we suggest that Government should also consider diversifying the utilization of the Negotiable Duty Credit Certificate (NDCC) to include payment of other government taxes and levies to reduce the pressure on Nigeria Customs Service which is currently the only collecting agency.

- There is no doubting the possibility of a rapid development of Nigeria’s non-oil export sector to displace crude oil as a major foreign exchange earner. Growing the non-oil export sector represents the only and sustainable alternative for Nigeria, therefore, Government must understand that policy consistency will be key to the attainment of this objective, so that investors can take a longer-term view on injecting more/new/fresh investments into the Nigerian economy

The ERGP also identified four (4) strategic sectors in the economy to drive investment, which include Agriculture, Manufacturing, Solid Minerals, Services, Construction, Oil & Gas (downstream), and cross sectors strategies.

4 Key Priorities to Address the Situation

The ERGP aims to restore sustained economic growth while promoting social inclusion and laying the foundations for long-term structural change. Federal Government expected at implementing four (4) big Execution Priorities or categories of initiatives to kick-start the economic recovery. These initiatives include focusing on providing macroeconomic stability, stimulating priority sectors and tackling critical constraints to long-term growth.

Priority 1: Stabilize the macroeconomic environment:

- To achieve the growth aspirations, the first requirement is a stable macroeconomic environment with low inflation, stable (market reflective) exchange rates and sustainable fiscal and external balances. This requires that monetary, trade and fiscal policies are well aligned to ensure coherence and effective coordination.

- Non-oil revenue will be accelerated through improved tax and Customs administration, including introduction of tax on socially harmful (e.g. tobacco, alcohol, etc.) and luxury (e.g. private jets, motor vehicles, etc.) commodities. This would ensure a more diversified fiscal revenue base away from the current dependence on crude oil and gas.

- Fiscal consolidation will also be pursued through cost cutting measures that include rationalization of overheads and recurrent expenditures and sub-national fiscal coordination. Selected national assets will be privatized to reduce fiscal burden of the privatized institutions on the government. To avoid any reversal to the fiscal regime of fuel subsidy, Government will put in place an automatic fuel price adjustment mechanism to safeguard against changing economic realities.

Priority 2: Achieve agriculture and food security

Agriculture has contributed to GDP growth in Nigeria in a consistent manner. The sector grew by 4.88 percent in Q3 2016 and by as much as 13 per cent in previous years, suggesting immense unrealized potential. Investments in Agriculture can guarantee food security, have the potential to be a major contributor to job creation, and will save on the foreign exchange required for food imports. Successful harvests will also help to reduce inflation and promote economic diversification. ERGP focuses on the needs of the people by prioritizing food security as a critical national objective, and plans are already in place for national self-sufficiency in rice by 2018 and wheat by 2019/2020.

Priority 3: Expand energy infrastructure and capabilities

- The Energy sector is fundamental to development across all other sectors of the economy. The ERGP will address issues of energy from the perspective of electric power and the petroleum sector. With regard to the power value chain, efforts will be concentrated on overcoming challenges related to governance, funding, legal, regulatory, and pricing across the three main power segments of generation, transmission and distribution, and ensuring stricter contract and regulatory compliance. The ERGP aims to achieve 10 GW of operational capacity by 2020 and to improve the energy mix through greater use of renewable energy. The Plan also aims to increase power generation by optimizing non-operational capacity, encouraging small-scale projects, and building more capacity over the long term. Government will also invest in transmission infrastructure.

With regard to the oil and gas sector, the intention is to increase the production of crude oil and gas while adding value in the downstream petroleum sector. Success in both power and petroleum will entail major outcomes:

- Urgently increase oil production: Restore production to 2.2 mbpd in the short term and 2.5 mbpd by 2020 to increase export earnings and government revenues by an additional N800 billion annually, and reduce the fiscal deficit and debt service ratios.

- Expand power sector infrastructure: Achieve 10 GW of operational power capacity by 2020 to boost economic activity across all sectors and improve the quality of life of the citizenry.

- Boost local refining for self-sufficiency. Reduce petroleum product imports by 60 per cent by 2018, become a net exporter by 2020, save foreign exchange and prevent reversion to the fuel subsidy regime.

Priority 4: Drive industrialization through local enterprise

- Strengthening of small-scale businesses and the promotion of industrialization are priorities for economic recovery. Nigeria’s manufacturing sector has been particularly vulnerable to the stagnant economic conditions. It contracted by 4.38 per cent in Q3 2016 (down from 13 per cent in previous years) largely due to the difficulty of accessing foreign exchange to import intermediate goods and raw materials, and falling consumer demand. This contraction is as a result of infrastructural bottlenecks and an uncompetitive business environment. The sector is expected to contribute to growth in the short term through policies to improve the usage of existing capacity, through increased availability of foreign exchange and greater domestic value addition.

- One major strategy is to accelerate implementation of the National Industrial Revolution Plan (NIRP) through Special Economic Zones (SEZs). The focus will be on priority sectors to generate jobs, promote exports, boost growth and upgrade skills to create 1.5 million jobs by 2020.

- A revitalized manufacturing sector will create jobs, stimulate foreign exchange earnings and grow the important micro, small and medium enterprises (MSMEs) which have greater importance given their contribution to economic activity. Further, the involvement of small businesses in the service sector is a major lever for economic recovery. The service industry accounts for 53 per cent of GDP and contains key sectors that can contribute to short-term economic growth and longer-term structural change.

- While the telecommunications and Information and Communications Technology services (ICT) sector grew in absolute terms by 9.26 per cent in Q3 of 2016, it offers huge scope for further growth, especially from opportunities in the digital economy. Creative industries, especially music and film, also have great growth potential, as do both financial services and tourism.

Conclusion

These four priorities are to be underpinned by a focus on governance and delivery, which have been identified as crucial to the successful implementation of the Plan. Transparent, effective and fair governance is being deepened through the continued fight against corruption, strengthening the security system, public service reform, and reinforcing sub-national coordination.

Across all of these areas, the ERGP lays out a total of 60 strategies that will collectively bring about the overall objective of inclusive growth through structural economic transformation. Each strategy has a clear set of activities associated with it and a budget allocation for which the responsibility lies with a Ministry, Department or Agency of the Federal Government.

The delivery mechanism will be a major determining factor in the successful implementation of the Plan. To this end, the implementation strategy focuses on prioritising the identified strategies, establishing clear system of accountability for well-defined assignment of responsibilities, setting targets and developing detailed action plans, allocating resources to prioritised interventions, creating an enabling policy and regulatory environment, developing an effective monitoring and evaluation system to track progress, and using effective communication strategy.

Human Resource Humour: The Shredder

Human Resource Humour: The Shredder

A young engineer was leaving the office at 5:45pm, when he found the Managing Director standing in front of a shredder with a piece of paper in his hand.

“Listen”, said the MD, “this is a very sensitive and important document, and my secretary is not here. Can you make this machine work?

“Certainly”, said the young engineer. He turned on the machine, inserted the paper, and pressed the start button.

“Excellent, excellent!” said the MD as his paper disappeared inside the machine, “i just need one copy”.

Lesson: Never, ever assume that your boss knows everything.

PRESS RELEASE: NECA URGES CAUTION AS FIRS SEEKS ENFORCEMENT OF STAMP DUTIES ACT

The attention of Nigeria Employers’ Consultative Association (NECA) has been drawn to the news making the rounds that the Federal Inland Revenue Service planned to turn its focus on the enforcement of stamp duties. It would be recalled that the Federal Court of Appeal had in the matter between Kasmal International Services Limited and Access Bank and 23 others, directed all Deposit Money Banks (DMB) to discontinue the illegal charging of N50 per transaction in lieu of Stamp Duties. Despite calls by NECA and other well meaning Nigerians, the Central Bank of Nigeria (CBN) is yet to direct Banks to obey the judgment of Court.

Speaking in Lagos, the Director General of NECA, Mr. Olusegun Oshinowo, remarked that: “the outright disobedience of court order by the CBN is not good for the country, especially as it sends a wrong signal to foreign investors and sets back the efforts of Government at promoting the rule of law”. He added ”the CBN is portraying itself to be bigger than the law of the land”

Speaking further, he averred that: “the OPS welcomes the take-over of collection of stamp duties by the Federal Inland Revenue Service (FIRS), which is in line with extant law, i.e. the First Schedule to the Federal Inland Revenue Service (Establishment) Act except that the amount collectable is 2 kobo and not N50”.

LABOUR & EMPLOYMENT LAW: Action in a Representative Capacity (Livinus A. Olisakwe & 4 others (for themselves and on behalf of sacked staff of Air Nigeria Development Limited) vs. Air Nigeria Development Limited & 2 Others) (2014) 51 N.L.L.R. Pt 170, P. 438 NIC

Facts:

By a General Form of Complaint dated and filed on 20th September 2012, the claimants sought the following reliefs, amongst others:

- A declaration that the purported termination of the claimants’ employment by the defendants via media in the face of newspaper was wrongful, unlawful, illegal, null and void and of no effect whatsoever.

- A declaration that the Notice of dismissal on the newspaper was not a valid notice.

- An order that the defendants pay the claimants the arrears of salary from May 2012 to August 2012.

- An order that the defendants pay the claimants at least one month salary in lieu of notice which was never served on them.

- An order that the defendants produce the Tax Clearance Certificates of the claimants in respect of Taxes deducted from their monthly emoluments that due and outstanding as agreed upon in the Employee Handbook, etc

- In reaction, the 2nd and 3rd defendants filed a conditional appearance dated 9th October 2012, Notice of Preliminary Objection, Affidavit in Support and Written Address dated and filed on 16th October 2012.

The preliminary objection is seeking the following:

- An Order striking out the entire suit on the grounds that the reliefs in the Statement of Facts of the claimants are personal in nature and cannot be brought in a representative capacity, and on the grounds that the Statement of Facts did not show that the claimants had the requisite consent and authority of all the parties before instituting the case in a representative capacity

- Alternatively, an order striking out the names of the 2nd and 3rd defendants on the grounds that they are the Chairman and Chief Executive Officer of the 1st defendant-company, and that the acts complained of by the claimants related only to acts of the company, a duly registered company with separate legal personality which is distinct from the legal personality of the 2nd & 3rd defendants.

Issues

- Whether the claimants have complied with the provisions of the National Industrial Court Rules, 2007regarding procedure for commencing representative action

- Whether the 2nd & 3rd defendants are necessary parties

The Judgement

On Requirement for an action in a representative capacity in the National Industrial Court:-

By virtue of the provisions of Order 4, Rule 2 of the National Industrial Court Rules 2007, the only requirement of the rule for bringing an action in a representative capacity is that parties should state on the originating process the capacity in which they are suing without more. If it is in representative capacity, it should be so stated. In the instant case, the claimants clearly indicated that they are suing “for themselves and on behalf of sacked staff of Air Nigeria Development Limited”. This endorsement satisfies the requirement of the Rule of Court

On whether letter of authority satisfies the requirement of representative action:-

Where each of the claimants in an action submits letter of authority and/or consent to the named claimants to sue on behalf of each of the them and to represent them in the suit, that satisfy the requirement of representative action. In the instant case, apart from the endorsement in the originating process, a perusal of the exhibits shows that each of the claimants had frontloaded a letter of authority and/or consent to the named claimants to sue on behalf of each of them and to represent them in the suit. This satisfies the requirement of representative action in this court.

On when court will allow action in representative capacity:-

Where there are common interest and common grievance that the claimants have, which if these issues succeeded, will be beneficial to all the claimants, the court may permit action in representative capacity. In the instant case, the claimants’ compliant before the court are against the termination of their employment which they claimed was communicated to them through newspaper publication. They claim for their one month’s salary in lieu of notice, arrears of salary from May 2012 to August 2012, remittance of their 15% pension contribution, etc. these are the common interest and common grievance that the claimants have, which if these issues succeeded, will be beneficial to all the claimants. See: Asinobi & Anor vs. Nigerian Breweries Plc (2010) 21 NLLR pt 60, p.517

On whether an agent of a disclosed principal who act within his scope of authority can be sued:-

An agent of a disclosed principal cannot be sued when the said agent acts within the scope of his authority. In other words, a party acting on behalf of known and disclosed principal incurs no liability. From the Statement of Facts, the 2nd & 3rd defendants are the Chairman and Chief Executive Officer of the 1st defendant company. It follows, therefore, that the 2nd & 3rd defendants are agents of a disclosed principal in this suit. A cursory look at the processes before the court will show that all the 2nd & 3rd defendants did were within the scope of their duty as employees of the 1st defendant.

On whether agents of known and disclosed principal are necessary parties in a suit:-

Agents of known and disclosed principal who act within the scope of their authority need not be joined as necessary parties in a suit as their presence may not be necessary for the effectual determination of the suit. This also accords with the well known principle of law as regards corporate personality and corporate litigation. In the instant case, the 2nd & 3rd defendants are not necessary parties to this suit as their presence is not necessary for the effectual determination of this suit.

Final Judgment:-

The Judge held as follows:

The names of the 2nd & 3rd defendants be struck out of the suit for being improperly joined

The preliminary objection as it relates to striking out of the suit failed and was dismissed

The processes filed shall be amended accordingly to reflect the names of the remaining parties to the suit

The matter shall proceed to hearing

OPINION:

The court has always allowed parties to sue in a representative capacity without the necessity of seeking the leave of court. The endorsement without more satisfies the requirement of suing in a representative capacity.

Management Skills Development for New Managers

Date: 16 – 17 March 2017

Duration: 2 Days

Venue: NECA Learning Centre

Course Fee: Members: N82,500; Non- Members: N87,500

Annual NECA Retreat Of Technical Committees

Date: 24 – 25 March 2017

Duration: 2 days

Venue: TBA

Course Fee: Members: N95,000; Non- Members: N100,000

For further details please contact Adewale (08069720364) adewale@neca.org.ng

Visit www.neca.org.ng

Recent Comments