Business Essentials Vol, 4 No 15

Dear Esteemed Member,

In this edition, we x-rayed key reforms to Company Registration Procedures and regulatory compliance requirements against the backdrop of the Presidential Enabling Business Environment Council initiatives.

We also highlighted key points in the second quarter press briefing by NECA’s President, Mr. Larry Ettah. Our regular Labour and Employment Law Review and Upcoming Training Programmes were not left out.

Have a pleasant reading.

Timothy Olawale

Editor

NECA 60th Anniversary and AGM

In this Issue:

- Regulatory Compliance & the Investor’s Dream: How Close is Nigeria to the “Ease Agenda”?

- Key Reforms To Company Registration Procedures

- Courtesy Visit of Management of Nigeria Social Insurance Trust Fund (NSITF) to NECA House

- Highlights of Press Briefing by Mr. Larry E. Ettah, President, Nigeria Employers Consultative Association (NECA), On Thursday June 15, 2017

- FG Introduces New Interest Rate Regime For Outstanding Tax Payments

- Labour & Employment Law: Supreme Court Says Court Of Appeal Had Exclusive Appellate Jurisdiction Over All Decisions Of The NICN

- Upcoming Training Programmes

Boost Your Productivity by Going on a News Diet When you need to get something done in a hurry, it can seem daunting to find the time. Where will you possibly find those extra hours? One way to give yourself additional time is to go on a news diet. Don’t just tune out the news — cut yourself off completely. Turn off any news feeds on your computer. Block news websites and stop notifications on your laptop and phone. And delete your Facebook, Twitter, and LinkedIn apps. Even try to avoid walking by newsstands on your way to work. It’s amazing how many hours consuming news media can take up: If you spend two hours a day thinking about or looking at the news, this hiatus will give you back 14 hours per week to maximize your available time and sharpen your focus. Of course, the news diet should be temporary. We all need to stay informed about what’s going on, so only opt out of the news cycle for short periods of time while you’re trying to get something done. Adapted from “3 Ways to Get More Done Right Now,” by Kabir Sehgal |

How Close is Nigeria to the “Ease Agenda”?

There are multiple regulatory agencies in Nigeria operating on the framework of various laws and practices, with administrative authorities constituted at different levels to enforce compliance. With such plethora of regulatory authorities, overlap and duplicity of functions, operational models, resulting in sometimes multiplicity of charges and bureaucratic bottlenecks become the daily experience of stakeholders.

It is therefore not surprising that, based on World Bank’s 2017 Ease of Doing Business Report, Nigeria ranked 169th out of 190 countries (a higher ranking means greater gap from best practice). A summary of the rankings for Nigeria and other African countries is provided below:

| Indicators | Nigeria | South Africa | Kenya | Ghana |

| Starting a Business | 138 | 131 | 116 | 110 |

| Dealing with Construction Permit | 174 | 99 | 152 | 117 |

| Registering property | 182 | 105 | 121 | 77 |

| Getting credit | 44 | 62 | 32 | 44 |

| Protecting minority investors | 32 | 22 | 87 | 87 |

| Paying taxes | 182 | 51 | 125 | 122 |

| Trading across border | 181 | 139 | 105 | 154 |

| Enforcing contract | 139 | 113 | 87 | 114 |

| Resolving insolvency | 140 | 50 | 92 | 115 |

| Overall Ranking | 169 | 74 | 92 | 108 |

The major underlying parameter assessed in arriving at the above rankings includes; the procedure, time and cost involved in complying with the above indicators. Therefore, the number of regulatory agencies business entities are subjected to plays a huge role in determining total compliance time, cost and procedures, which ultimately influences the World Bank’s rankings.

There is no gainsaying that an efficient regulatory system and a vibrant economy are two peas in a pod. An effective regulatory system provides an undistorted corporate environment in which large businesses thrive, small enterprises grow and investors participate. Accordingly, streamlining such duplicity and overlap would be crucial to delivering on the “ease of doing business” agenda.

A pertinent question would then be whether Nigeria has a regulatory framework that is nimble, agile, or adaptive enough to unlock its potential for economic growth and development as well as enhance ease of doing business?

In order to improve Nigeria’s regulatory framework, ex-President Goodluck Jonathan inaugurated a seven-member committee on the 18th of August 2011, charged with the responsibility of making recommendations towards the restructuring and rationalization of government parastatals, commissions and agencies. The Committee, through its White Paper, made numerous recommendations, chief of which was to slash the number of statutory government agencies by one hundred and two (102). Although some of the committee’s recommendations have been adopted, there is still room to further streamline the operations of multiple agencies.

Highlighted below are some potential considerations to realising such an agenda:

- Synchronising regulatory processes

One major solution to curb time spent on multiple regulatory approvals (on similar issues) is to synchronize the registration processes. This could be via a revitalisation of the concept of One-stop-shop where relevant regulators are under one roof and can attend to investor’s queries and processing of approvals. This can also create an avenue for government to obtain constructive feedback from key stakeholders in various industries of the economy.

The Presidential Enabling Business Environment Council (PEBEC) was set up by the Presidency to look into ease of doing business in Nigeria. PEBEC has begun initiating various reforms, e.g. a synchronized process between Federal Inland Revenue Service and Corporate Affairs Commission has been established such that taxpayers can obtain their Tax Identification Number upon incorporation. With the pace of PEBEC, there is evidence of a structured and systemic synchronisation of inter-related regulatory agencies and their processes which should eliminate duplication and thereby reduce the cost of compliance wherever applicable.

- Automating registration, compliance processes and business data base

The average investor’s dream of an effective and efficient regulatory environment is one which makes use of technological innovations to ensure convenience, certainty and cost effectiveness in the compliance process.

It is therefore important that these registration systems are automated to reduce the time taken to get the process completed and the cost incurred during the process. Also, automating the regulatory system in Nigeria would improve compliance processes (annual & monthly filings) for individuals and companies. Thus, reducing compliance burden for companies and individuals.

There are instances where same documents are required by the same regulators. With the automation, it makes it easier for regulators to verify companies’ records, ease approval process and maintain appropriate information bank for other uses.

The above notwithstanding, the role of other stakeholders in managing these regulatory compliance hurdles and ensuring the regulatory compliance journey is without tears cannot be overemphasized.

Member-companies are urged to maintain standard work ethic, demonstrate good industry specific knowledge, and provide adequate regulatory and legislative support to investors so as to make compliance to regulatory requirements easy.

Currently, Nigeria desperately needs more investors and responsible taxable persons paying their taxes to spur growth of the economy. As such, government at all levels should consider adopting mechanisms that will promote business growth and increased investment while ensuring the economic environment is continuously modified to bring about an easy, convenient, seamless and cost effective regulatory system.

The Nigerian business environment narrative must signal ease in all ramifications and not frustration, simplicity and not complications.

Based on feedback from relevant Ministries, Departments and Agencies (MDAs), other reforms already implemented include:

- Starting a business

- Visa issuance

- Visa on arrival now effective

- Forty eight (48) hour visa issuance by Nigerian embassies

- Business registration

- Automated name search with Corporate Affairs Commission (CAC)

- Decentralization of the business registration process whereby applications do not have to be referred to Abuja

- Introduction of a new form CAC1.1 which consolidates previous forms – CAC 2, 2.1, 4 & 7

- Access to credit

Registering movable assets: The National Collateral Registry (NCR), an initiative of the Central Bank of Nigeria has been set up to improve access to finance particularly for Micro Small and Medium Enterprises. The NCR is a central database for registering movable assets which can be used as collateral for accessing finance

- Paying taxes

- E-filing and payment of taxes: The Federal Inland Revenue Service (FIRS) has set up the Integrated Tax Administrative System for electronic filing and payment of taxes

- Online tax registration: The FIRS has set-up an online platform for tax registration and obtaining tax clearance certifications

- Getting electricity

- Connecting a new consumer

- Registration forms available online for download

- All new registrants are now given meters to measure usage before consumption begins

- Customer support: Distribution companies have provided twenty four (24) hour operational customer care numbers

- Registering property

- Automation of permits: Lagos State Government has automated the issuance of electronic Certificate Of Occupancy and Planning Permits

OPINION

- Feedback indicates that some of the reforms enumerated above have not become fully operational. Whilst this teething problem appears normal, business community and other stakeholders are required to explore the improved procedures that are aimed at making it easier to do business in Nigeria and continue to place demand on the system for overall improvement.

- The immediate target may have been set at improving Nigeria’s ranking; the ultimate goal is to have a system that works for everyone making investment decisions in Nigeria.

Key Reforms to Company Registration Procedures

According to information made available by the Presidential Enabling Business Environment Council (PEBEC), the Corporate Affairs Commission has stopped receiving manual applications in Abuja, Enugu, Kano, Kaduna and Port-Harcourt.

This means that all applications would need to be submitted via the online registration portal. It is expected that this will be cheaper, faster and convenient for businesses.

Applicants processing new registration in these locations are to complete the application forms and pay the registration fee as well as Stamp Duty (where applicable) on the Company Registration Portal (CRP) and thereafter upload all necessary and duly executed documents through the Corporate Affairs Commission (CAC)’s upload interface.

Various reforms completed by the CAC over the last few months include:

- Automatic generation of Tax Identification Number (TIN): Upon completion of company registration, TIN will be sent automatically to the email used for registration.

- Public search window: This makes it possible to see which company names are available for registration.

- Electronic stamp duty: It is now possible to get e-stamp registration documents when registering a company.

- Document upload functionality: This allows applicants to upload and submit all documents including those requiring signatures online without the need for applicants to submit hard copies to the CAC.

- Consolidated form (CAC forms 1-7 to CAC 1.1): The CAC form online has been streamlined to remove any unnecessary information request in order to make the registration process faster.

- Certification of registration documents: Direct applicants are no longer required to sign the declaration of compliance before a Commissioner for Oaths or Notary Public.

The efforts to simplify company registration are commendable. We hope these initiatives will be extended to ongoing compliance requirements by existing companies sooner rather than later.

Courtesy Visit of Management of Nigeria Social Insurance Trust Fund (NSITF) to NECA House

Mr. Adebayo Somefun, new Managing Director/Chief Executive of NSITF in a chat with NECA’s Director-General, Mr. Olusegun Oshinowo

Group Photograph: NECA & NSITF Management Team

PRESS BRIEFING BY MR LARRY E. ETTAH, PRESIDENT, NIGERIA EMPLOYERS CONSULTATIVE ASSOCIATION (NECA), ON THURSDAY JUNE 15, 2017

It is my pleasure to welcome you all to this press conference. I propose to speak on behalf of NECA which has just concluded a quarterly meeting of its Governing Council this morning, on the Nigerian Economy and Policy and offer our views and recommendations on how Nigerian economic recovery and growth can be accomplished on a sustainable basis.

- Global Economic Overview

The IMF April World Economic Outlook Update upgrades global growth projections from 3.4% to 3.5% indicating a slight improvement in global outlook. The World Bank similarly raised its own projection from 2.6% to 2.7%. The UN Department of Economic and Social Affairs (DESA) retained its earlier projection of 2.7% global output growth in 2017.

With respect to Nigeria, the IMF retained its 0.8% projected GDP growth for Nigeria, while World Bank raised its projection from 1.0% to 1.2%.

In relation to oil prices, OPEC Basket and Brent Crude Oil prices slightly declined in the month of May averaging $49.20 and $50.33 respectively. This represents a 4.17% and 3.79% decline from April. The Organization of the Petroleum Exporting Countries (OPEC) met on May 25 and announced an extension to voluntary production cuts through March 2018 that were originally set to end in June 2017. EIA forecasts OPEC crude oil production will average 32.3 million barrels per day (b/d) in 2017 and 32.8 million b/d in 2018. EIA forecasts Brent spot prices to average $53/b in 2017 and $56/b in 2018. West Texas Intermediate (WTI) crude oil prices are forecast to average $2/b less than Brent prices in both 2017 and 2018.

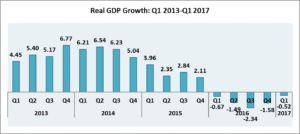

- GDP Data Q1 2017

NBS data released in May 2017 show that Nigeria’s economic recession continued in Q1 2017 ending March. The rate of economic contraction however reduced to -0.52% in Q1 2017 confirming a trend since Q4 2016 which suggests a continuing moderation in the size of the recession.

In Q1 2017 non-oil sector growth was marginally positive at 0.72% while the substantial recession in the oil sector persisted at -11.64%. Economy-wide, growing sectors included agriculture (3.39%), solid minerals (31.47%), transport (10.55%), information and communications, including telecommunications (2.73%), utilities (2.35%). Some other sectors recorded marginal growth including manufacturing (1.36%), construction (0.15%), finance and insurance (0.67%), professional/scientific/technical services (1.48%), administration and support services (1.22%), education (0.86%), health and social services (1.07%) and other services (1.66%)

Several sectors remain in recession-public administration (-2.07%), real estate (-3.10%), accommodation and food services (-3.96%) and trade (-3.08%). Within manufacturing food, beverage and tobacco; cement; textile, apparel and footwear; oil refining; wood and wood products; and pulp and paper are now growing again.

- Nigerian Macroeconomic Indicators

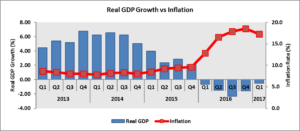

The good news is that inflation figures moderated for a fourth consecutive month in May 2017, reducing to 16.25%. The level of inflation remains high however especially in the context of a recession and rising unemployment, which confirms the continuation of the phenomenon of stagflation (the simultaneous existence of unemployment, reflecting “stagnant” economic conditions such as recession, and inflation)

This absurdity is more apparent, given that in the preceding 2010-2014, inflation moderated while economic growth was strong. This trend suggests mis-alignment of policy tools in the monetary policy toolkit adopted by monetary authorities. Current monetary conditions suggest a tenuous impact of monetary policy tools in reducing inflation in Nigeria, given that inflation has mostly been driven by currency devaluation and food production and distribution.

The most important negative consequence of this policy misalignment has been the high interest rate regime prevailing in the economy in spite of the recessionary environment.

It is accepted practice in economic management in most jurisdictions that the correct posture in a recession is a reflationary fiscal policy and monetary easing, including reducing interest rates. Instead the CBN has maintained tight monetary policy and raised interest rates. We are of the view that this approach is sub-optimal and has failed. It is based on an erroneous assumption that tight monetary policy would constrain inflation and temper pressures on the Naira. Instead the actual experience confirms that Nigerian inflation is driven by cost elements usually currency devaluation and food and energy prices, while Naira values are shaped by oil prices and the FX reserves rather than monetary conditions, especially as CBN has maintained administrative control of the currency value.

Manufacturers and other employers of labour have thus had to cope with a triple whammy of recession, high inflation and high interest rates caused by the wrong policy choices made by the monetary authorities. We call on the CBN to now move towards lowering interest rates and specifically to reduce the Monetary Policy Rate (MPR) which has been kept at 14% since July 2016.

Another dimension of the negative implications of current interest rate policy is the phenomenon of “crowding out” of private sector access to credit by credit to government.

Data from the CBN demonstrates that credit expansion to government is outgrowing by large margins credit to the private sector. For example, between February and April 2017, while credit to government grew by 3.10%, 27.81% and 7.54% respectively while private sector credit grew marginally in February by 0.10%; declined by 1.89% in March; and also declined by 1.48% in April on a month-on-both basis. On a year-on-year basis, credit to government expanded by 15.43%, 19.76%, 37.46% and 42.15% in January to April 2017, while private sector credit grew only 19.76%, 19.17%, 17.96% and 13.23% in the same period.

This phenomenon led the IMF to note in its recent Article IV Consultation Report on Nigeria that “lending to the private sector was largely crowded out by government borrowing, and remains essentially flat…” based on 2016 data. This development is a consequence of the high interest rate regime and the incidence of government borrowing through treasury operations at between 17-18%. We urge the CBN to review this anomaly to empower the private sector to fulfill its role as the engine of economic growth as envisaged under the ERGP.

Unemployment rose to 14.2% in Q4 2016 with NBS reporting that 3.4million people lost their jobs in 2016. We believe growing unemployment is directly attributable to erstwhile policy gaps as well as flawed FX policies that constrained the productive sector. We acknowledge that current FX policies have improved the situation reflecting in modest improvements in GDP as we have just seen. We urge CBN to sustain these improvements in FX management and availability, and move towards a market-based system. It is also important that government sustain implementation of the policies and reforms envisaged in the ERGP.

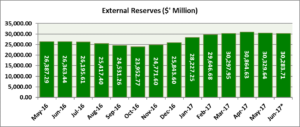

We observe that after growing from October 2016 to April 2017, from $23.9bn to $30.8bn, our foreign reserves have stagnated and now declined to $$30.2bn by June 8, 2017 according to CBN figures.

It is important to acknowledge positive trends some of which we have already discussed:-

It is important to acknowledge positive trends some of which we have already discussed:-

- Successful $1.5bn Eurobond offer

- Increasing FX rate convergence and availability

- Resurgence of growth on the Nigerian capital market

- Moderation in inflation and reducing rate of GDP contraction.

The key issue is how to leverage these improvements into a sustainable position through aggressive policy reforms.

- Ease of Doing Business

We congratulate the Acting President, the Minister of Industry, Trade and Investment and the Presidential Enabling Business Council (PEBEC) for the progress made in the enabling environment reforms under the ERGP symbolized in the executive orders issued by the Ag. President. The three EOs which deal with budget, local content and ease of doing business demonstrate government’s commitment to improving the business environment and implementing the ERGP.

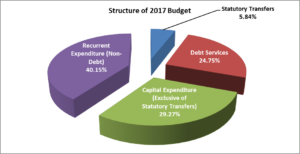

- Review of 2017 Federal Government Budget

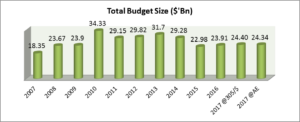

We note that even though the 2017 budget represents a N1.4Trillion increase in Naira terms, it is flat in Dollar terms.

We believe the major budget assumptions now look fairly reasonable. We commend the increased percentage allocation to capital expenditure a positive, continuing trend under current government.

We are however concerned that structural dependence on borrowing remains a concern-while debt/GDP ratio is low, debt servicing ratios in our view are tending towards unsustainable. In the approved budget, debt servicing represents 25% of the entire budget and approximately 40% of budgeted revenue. We suspect that actual debt service/revenue may be as high as 50-60% of revenue as reportedly recorded in the 2016 actual budget performance.

In the circumstances, we believe the imperative for government is greater leverage of private capital. We also note that the level of external borrowing, total sovereign debt and budget deficits are large and growing!

On a separate note, we would like to call attention to several important vacancies in the structure of government. As NECA, we are particularly concerned with non-constitution (or non-approval by the Senate) of the boards of key regulatory boards which have to do with economic and employment issues such as the Securities and Exchange Commission (SEC), National Pensions Commission (PenCom), Financial Reporting Council of Nigeria (FRCN) and Nigerian Social Insurance Trust Fund (NSITF).

We urge the Acting President and/or the Senate to expedite action on constitution and approving these boards and other appointments.

- The Political Environment

We wish to close this press conference by expressing our concerns on the uncertainty and tensions currently being experienced in the political environment. In recent times, we are however worried about political pronouncements by various ethnic and regional groups that could threaten national peace and stability, and therefore economic prosperity in Nigeria. We call on all stakeholders to de-escalate the current tensions and avoid any actions which could threaten our mutual co-existence. We also urge all political parties and individuals to avoid further elevating political risk as we move towards 2019.

…………………………………………………………………………………………………………………………

FG Introduces New Interest Rate Regime For Outstanding Tax Payments

In its renewed bid to minimise tax evasion, deter non-compliance and promote voluntary compliance, the Federal Government of Nigeria has announced a new interest rate regime for unpaid taxes. The Minister of Finance, through a recent communiqué, directed the Federal Inland Revenue Service (FIRS) to implement a 5% spread on the Central Bank of Nigeria (CBN) Monetary Policy Rate (MPR) for 2017, on the interest rate charged for tax payments not made within the statutory timeframe.

Consequently, the current practice of applying a flat rate of 15% by FIRS as interest charge on unpaid taxes is expected to cease. With the current CBN official rate of 14%, total interest charge on unpaid taxes will go up to about 19% (i.e. 14% MPR plus a spread of 5%).

It could be recalled that the FIRS had in 2014 and 2015 issued two separate public notices retaining the interest rate chargeable in default of payment of taxes at 15%. However, this practice was questioned by various stakeholders as to the powers of FIRS to fix interest rates. This defect seems to have been cured with the directive of the Minister, as S. 32(1)(b) of the Federal Inland Revenue Establishment Act (FIRSEA) empowers the Minister to determine the spread to be added to the MPR (official interest rate) issued by the Central Bank of Nigeria (CBN).

Effective date for implementation of the new interest rate is 1 July 2017.

OPINION:

We will continue to monitor developments in this space and update you as further facts become available. In the meantime, we advise taxpayers to promptly evaluate potential tax exposure with the aim of closing any identified compliance gap(s) before the implementation date.

……………………………………………………………………………………………………………………………………………….

Labour & Employment Law: Supreme Court Says Court Of Appeal Had Exclusive Appellate Jurisdiction Over All Decisions Of The NICN

Facts:

- The Court of Appeal in Lagos had in 2014 referred to the Supreme Court an appeal in the case of Mainstreet Bank Ltd vs Victor Anaemen Iwu (SC/ 885/14).

- The case was consolidated with a related appeal in the case of Coca-Cola Nig. Ltd vs Titilayo Akinsanya, in which the Court had in 2013 held that there was no right of appeal against the decision of the NICN, except as limited in Section 243(2)-(4) of the 1999 Constitution.

- The appellate court had referred the appeal to the Supreme Court, seeking a resolution of the substantial question of law on the finality of its decisions.

- The issue of finality of the decisions of the Industrial Court had generated a lot of controversy in the legal profession among Litigants, Employees, Employers of Labour and the Academia with several appeals awaiting the outcome of the decision of the Apex Court on the issue.

Issues:

Whether the Court of Appeal, as an appellate court created by the Constitution of the Federal Republic of Nigeria, has the jurisdiction, to the exclusion of any other court of law in Nigeria, to hear and determine appeals arising from decisions of the NICN

Decision:

In its judgment on June 30, 2017, a panel of Justices of the Supreme Court, presided by Justice Mary Peter-Odili, held that there was no constitutional provision divesting the Court of Appeal of jurisdiction to hear appeals emanating from the NICN.

The apex court also held that the right of appeal was not limited to fundamental rights cases.

Before now, some users of the NIC believed that only appeals on the grounds of breach of fundamental rights could be appealed. But the Supreme Court held that the Court of Appeal had exclusive appellate jurisdiction over all decisions of the NICN.

The apex court held among others, that the jurisdiction of the Court of Appeal to hear and determine all civil appeals on decisions of the NIC was not limited to only fundamental human rights.

The Supreme Court further ruled that, “The lower court, that is, the Court of Appeal, has the jurisdiction, to the exclusion of any other court in Nigeria, to hear and determine all appeals arising from the decisions of the trial court.

“No constitutional provision expressly divested the said Court of Appeal of its appellate jurisdiction over all decisions on civil matters emanating from the trial court.

“And, as a corollary, the jurisdiction of the court to hear and determine all civil appeal on decisions of the National Industrial Court is not limited to only fundamental human rights.”

Opinion:

The Supreme Court in SC/ 885/14: held that the Court of Appeal has the jurisdiction to hear all Appeals from the National Industrial Court, that there is no constitutional provision divesting the Court of Appeal of jurisdiction to hear all appeals from the National Industrial Court and that the Right of Appeal is not limited to Fundamental Rights Cases. This is settled law and a welcomed development in our Labour and Employment Jurisprudence /Law.

……………………………………………………………………………………………………………………………………………….

UPCOMING TRAINING PROGRAMMES (June/July)

Business Communication, Report Writing & Presentation

Date: 19 – 21 July 2017

Duration: 3 days

Venue: NECA Learning Centre

Course Fee: Members: N115,500; Non- Members: N120,000

Facilitation Course For Managers: Facilitating Memorable Learning

Date: 23 – 25 July 2017

Duration: 3 Days

Venue: NECA Learning Centre

Course Fee: Members: N115,500; Non- Members: N120,000

For further details please contact Adewale (08069720364) adewale@neca.org.ng

Visit www.neca.org.ng

Recent Comments