Business Essentials Vol 4. No. 1

Dear Esteemed Member,

We welcome member-companies to the year 2017. As the Nigerian economy continued to be perturbed with vagaries of economic challenges, it is imperative for organised businesses to develop internal strategies to stay afloat in such situations. We had, thus, started the year on the note of a cursory look at the macroeconomic environment as it unfolds within the last half of the year 2016 and outlook for Q1 2017 with a review of the critical implications for Business.

We also shared developments at the National Assembly on the planned review of the Companies Income Tax Law and the recently released General Circular by your Association on Agreement reached with NSITF on the “Continued Implementation of the Employee Compensation Scheme”.

The regular Labour and Employment Law Review and 2017 Training Programmes were not left out.

Have a pleasant reading.

Timothy Olawale

Editor

In this Issue:

- Nigerian Macroeconomic Review And Outlook For 2017

- Senate Moves to Amend Companies Income Tax Act (CITA)

- LABOUR & EMPLOYMENT LAW: Constructive Dismissal (Miss Ebere Ukoji vs. Standard Alliance Life Assurance Company Limited (2014) 47 N.L.L.R. Pt 154, P.531. NIC

- Upcoming Training Programmes

NIGERIAN MACROECONOMIC REVIEW AND OUTLOOK FOR 2017

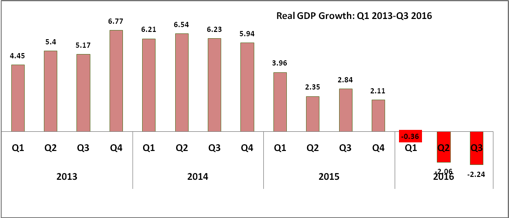

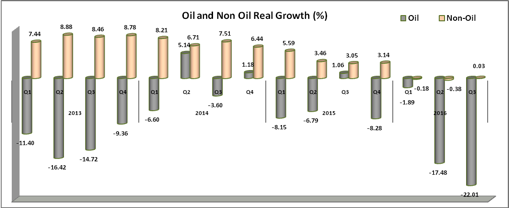

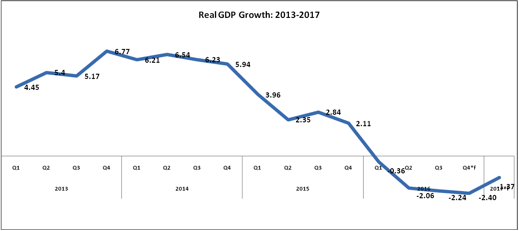

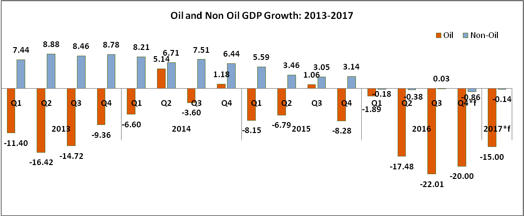

The released data by the National Bureau of Statistics (NBS) shows that Nigeria’s economic output contracted in the third quarter of 2016 by 2.24% y-o-y, a further decline from -2.06% y-o-y in the preceding quarter (Q2′ 2016) and worse than the 2.84% y-o-y growth recorded in the corresponding quarter of 2015 (Q3’2015). Growth in the oil sector was subdued while the non-oil sector rebounded. The Oil Sector real GDP contracted by -22.1% y-o-y in Q3’2016 (Q2’2016: -17.48% y-o-y and Q3’2015: 1.06% yo-y), oil production fell to 1.63 mbpd, moderating downwards from production levels in Q2’2016. Oil production was also lower relative to the corresponding quarter in 2015 by 0.54million barrels per day when output was recorded at 2.17mbpd. The non-oil sector rebounded in Q3’2016, growing by 0.03% in real terms in the third quarter of 2016, reversing the last two quarters of negative growth recorded in Q1 and Q2’2016 at -0.18% and -0.38% respectively. The non-Oil sector contributed 91.81% to the nation’s GDP in Q3’2016, higher from shares recorded in the Q2’2016 (91.74%) and the corresponding quarter of 2015.

The recovery in the non-oil sector was driven by stronger performances in sectors such as agriculture (4.54%), financial & insurance sector (2.64%), arts, entertainment and recreation (1.99%) etc. One of the major factors why Nigeria’s economic contraction deepened in the third quarter was due to the oil industry.

In a separate development, the Monetary Policy Committee (MPC) of the Central Bank of Nigeria (CBN) recently met to review developments in the economy as well as consider the path of monetary policy for the first quarter of 2017. At the end of the two-day meeting, the committee voted to leave all its policy instruments unchanged, notably, it retained the MPR at 14%, CRR at 22.5% and the liquidity ratio at 30%.

Foreign Exchange Market

The legal tender appreciated slightly by 0.16% at the interbank FX market to a new rate of N305.00/1$ compared to N305.50/1$ the previous week. In contrast, at the parallel market segment, the currency depreciated by 1.06% to trade at N470/$1 for the week ended November 25 from a rate of N465/$1 quoted the prior week on the back of fresh dollar scarcity at the retail end of the market. Series of raid by security agencies on BDC operators have led to recent hoarding of the greenback. The ongoing clampdown on BDC operators by security agents may negatively impact dollar supply thus the currency may likely depreciate further at the unofficial segment.

Macroeconomic Data: 2010 – Q3 2016

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016Q2 | 2016 Q3 | |

| Exchange Rate (N/$) | 150.30 | 153.86 | 157.50 | 157.31 | 158.55 | 195.52 | 208.59 | 303.18

* Sep- 305. |

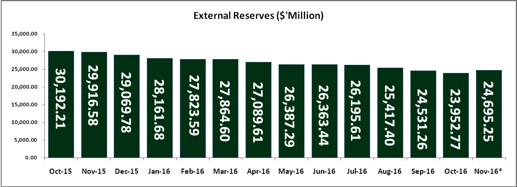

| Foreign Reserves ($’Million) | 32,339.3 | 32,639.8 | 43,830.4 | 42,847.3 | 34,241.5 | 28,284.8 | 26,505.4 | 24,531.26

* Nov- 24,695.25 |

| Number of Months of Import Equivalent | 7.7 | 5.9 | 9.2 | 9.3 | 6.7 | 6.5 | ||

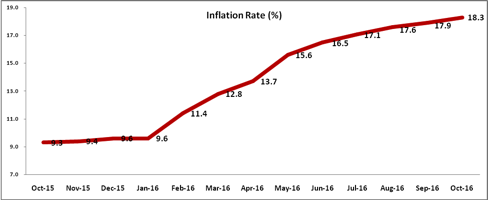

| Inflation Rate (%) | 11.8 | 10.3 | 12.0 | 8.0 | 8.0 | 9.6 | 16.5 | 17.9 |

| Market Capitalisation (N’ Billion) | 9,918.2 | 10,275.3 | 14,800.9 | 19,077.4 | 16,875.1 | 17,000 | 17,283.9 | 16,524.1 |

| Manufacturing Capacity Utilisation (%) | 56.2 | 56.3 | 56.8 | 57.8 | 59.6 | 57.2 | 51.7 | |

| Prime Lending Rate (Average) (%) | 19.59 | 16.03 | 16.79 | 16.69 | 16.55 | 16.83 | 16.65 | 17.14 |

Commodities Market

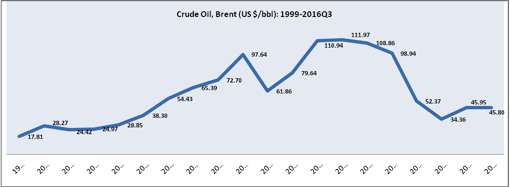

Crude oil prices rose slightly last week as the organisation of Petroleum Exporting Countries (OPEC) move closer to agreeing an output cut when it meets. Bonny light, Nigeria’s reference crude rose by $1 or 3.0%, to settle at $46.75 per barrel. In contrast, prices of precious metals prices nose-dived, gold price dropped below $1,200 per ounce for the first time in eight months to settle at $1,186.84 last week, buckling under continued pressure from a stronger dollar. Similarly silver also closed lower at $16.47 per ounce with a loss of 12 cents. This week, we see oil prices trend upwards on the back of expectations of an OPEC deal to limit production.

OUTLOOK FOR Q4 2016 and 2017

Crude Oil Average Spot Price Outlook

| 2016 | 2017 | 2018 | 2019 | 2020 | |

| OPEC | 40 | 45 | 50 | 55 | 60 |

| EIA | 37.56 | 50.00 | 57.55 | 72.66 | 81.58 |

| World Bank | 43.3 | 55.2 | 59.9 | 62.7 | 65.6 |

| IMF | 43 | 50.6 | 53.1 | 54.4 | 56.3 |

Real GDP Outlook: Oil and Non Oil

Implications for Business

- As both medium-term political economy scenarios and short-term macroeconomic outlook offer limited indicators of a significant turnaround with upside possibilities hinged on a credible Economic Recovery and Growth Plan being quickly adopted and implemented. Businesses must adopt a conservative and defensive posture, focusing on cost reduction or optimization, and robust enterprise risk management systems- the critical question is, can your businesses survive a sustained (two to three years…) period of recession or low growth?

- Businesses will also have to review and if possible, restructure their business models in line with the following imperatives:-

- Reduction of FX dependency and export opportunity seeking

- Improving business processes and enhancing operational efficiencies

- In spite of recession and low growth, pockets of hidden or previously unexploited “blue oceans” may yet abound in the economy. Businesses will have to find them!

- Businesses must also prepared for the social consequences of recession-industrial crisis, restive communities, higher levels of fraud and crime; and greater stress and ill-health among employees.

- The short-term macroeconomic outlook suggests a period of high risks and limited upsides with the clear implication of very conservative risk management and prudent growth strategies.

- We expect growth in Q1 2017 to remain negative and recovery is unlikely even through 2017, except a very bold and credible Economic Recovery and Growth Plan centred on private capital and investment is quickly adopted and implemented.

- The immediate prognosis is for a sustained period of negative or low growth and downside scenarios remain feasible.

Senate Moves to Amend Companies Income Tax Act (CITA)

The Senate has passed for Second Reading, a Bill for an Act to amend the Companies Income Tax and for other matters connected thereto. The Bill, which was sponsored by Senator Andy Uba (Anambra, PDP), scaled the First Reading hurdle on November 26, 2015 and it specifically seeks to amend Sections 34, 36, 39 and 40 of the principal Act.

Highlights of the Bill

- Expand Scope of Incentives: The Bill seeks to expand the scope of incentives granted to companies that provide infrastructure (electricity, water and tarred roads) where such infrastructures have not been provided by the government. It will also increase the tax holiday for companies engaged in mining of solid minerals and gas utilization.

- Rural Investment Allowance: The Bill seeks to amend Section 34 of CITA by lowering the threshold for eligibility for Rural Investment Allowance [RIA]. Currently, where a company incurs capital expenditure on electricity, water and tarred roads for its business because no such government infrastructure is available within 20 kilometres of its business, the company is entitled to claim RIA at specified rates depending on the type of infrastructure provided.

- If the Bill is passed into law, the minimum distance to government provided infrastructure will be reduced from 20 to 10 kilometres. Also the rate of allowance will be increased for provision of tarred roads from 15% to 20%. In addition, a new section 34A will be introduced to grant a ten year tax holiday for companies carrying on business in places where there are no government provided infrastructure.

- Tax holidays and Investment Tax Relief: The Bill seeks to amend section 36 by increasing the tax holiday granted to companies engaged in mining of solid minerals from three to five years. Also section 36 will be amended to increase the tax holiday for companies engaged in gas utilization (downstream sector) from three to five years which can be renewed for an additional two years.

- Also section 40(10) is to be amended by reducing the threshold for claiming Investment Tax Relief [ITR] from 20 to 10 kilometres. In addition, the ITR that may be claimed on tarred road will increase from 15% to 20%. However, telephone services which used to be a qualifying infrastructure will no longer qualify for ITR.

OPINION

- We believe that the Bill would be one of the potent tools that could trigger the much-desired investments in local manufacturing and industrialization by both foreign and local companies, adding that it would also provide an opportunity for the development of rural areas and provision of infrastructure by members of the Organised Private Sector. The intent of the Bill is that the expected economic activities to be generated by virtue of the provisions of the amendments sought are to be concentrated in the rural and semi-urban areas, where infrastructures are lacking.

- We are of the opinion that any initiative aimed at improving the availability and quality of infrastructure across the country should be commended. However, it is not clear how well these proposed changes are based on empirical data given the very little uptake by companies since the incentive was introduced decades ago. The expected benefit from the incentive should also be measured against the associated cost and revenue loss.

- It is also important to ensure sufficient coordination between all government initiatives including the ongoing comprehensive review of the current incentive regime.

The Bill has been referred to the relevant Senate Committee for further legislative inputs

LABOUR & EMPLOYMENT LAW: Constructive Dismissal (Miss Ebere Ukoji vs. Standard Alliance Life Assurance Company Limited (2014) 47 N.L.L.R. Pt 154, P.531. NIC

Facts:

- The claimant (Miss Ebere Ukoji) was employed by the defendant (Standard Alliance Life Assurance Company Limited) from 6th June 2011.

- On 1st November 2011, she was informed about an email, wherein it was alleged that she was spreading rumours of a sexual escapade between a staff and her driver.

- On 3rd November 2011, she was served with a memo and a copy of the email. The memo stated that she was responsible for the spreading of the rumour and was requested to respond to the allegation of character assassination. She responded and denied the allegations.

- The defendant then set up a 4-person Committee to investigate the matter. The committee invited only the claimant and the driver.

- She alleged that she was coerced into resigning her appointment or would be sacked by the Committee.

- On the other hand, the defendant alleged that the claimant was issued with a query with an email attached.

- The defendant alleged that the work of the panel was still in progress when the claimant tendered her resignation.

- The defendant denied the allegation that it threatened the claimant to resign, and that the claimant in her resignation letter expressed profuse gratitude for the opportunity offered her to serve the defendant.

- That upon the claimant tendering her resignation letter, she was paid all that was due to her.

Issues

- Whether the claimant was compelled to resign her employment with the defendant. In other words, was the claimant constructively dismissed by the defendant even when it was the claimant who tendered a letter of resignation?

The Judgement

On what Constructive Dismissal entails:-

Globally, and in labour/employment law, constructive dismissal, also referred to as constructive discharge, occurs when an employee resigns because his/her employer’s behaviour has become intolerable or heinous or made life difficult that the employee has no choice but to resign. Given that the resignation was not truly voluntary, it is in effect a termination. In an alternative sense, constructive dismissal or constructive discharge is a situation where an employer creates such working conditions (or so changes the terms of employment) that the affected employee has little or no choice but to resign. Thus, where an employer makes life extremely difficult for an employee, to attempt to have the employee resign, rather than outright firing the employee, the employer is trying to create a constructive discharge.

On when resignation can amount to termination of appointment:–

Where resignation of appointment by an employee has been found not truly voluntary, it is in effect a termination of appointment. In the instant case, the involuntary resignation of the claimant is in effect, a termination.

On Legal consequences of constructive dismissal:–

Generally, a constructive dismissal leads to the employee’s obligations ending and the employee acquiring the right to seek legal compensation against the employer. The employee may resign over a single serious incident or over a pattern of incidents. Generally, the employee must have resigned soon after the incident.

Judgment

Justice B. B. Kanyip of the National Industrial Court held that the claimant’s employment was wrongfully terminated and that she was coerced to resign her employment with the defendant.

OPINION:

The steps taken by Management points to the fact that the Claimant was coerced to resign her employment, such as:

- The composition of the panel and the fact that even those that should be questioned were instead members of the panel.

- The matter bothered more on defamation of character, than official issues and the High Court would have been a better place to seek redress. The investigation was not for infractions against the defendant.

Recent Comments