BUSINESS ESSENTIALS Vol. 3 No 20

Dear Esteemed Member,

Following the official release of the Gross Domestic Product Q2, 2016 growth estimate by National Bureau of Statistics (NBS) and the July, 2016 Consumer Price Index which indicated a worsening situation for the Inflation rate, there is no more controversy on the status of the Nigerian economy being in full swing recession.. In this edition, therefore, we reviewed the two reports and offered our opinion on a possible way out for the economy from the doldrums.

In the next few editions of this bulletin, we will be reviewing the “2016 World Bank Doing Business Report”, starting with a general overview of Nigeria’s ranking in the report vis-a-vis the Global Competitiveness Report of the World Economic Forum 2015 – 2016. The report simply buttressed the numerous obstacles the economy needs to overcome to attract the much desired foreign direct investment to shore up her revenue.

The regular Labour and Employment Law Review and Upcoming Training Programmes were not left out.

Have a pleasant reading.

Timothy Olawale

Editor

In this Issue:

- Rising Inflation and GDP Contraction: Way Out of the Doldrums

- Ease of Doing Business In Nigeria: Too Cold for Comfort

- LABOUR & EMPLOYMENT LAW: Pension (Ibinabo Oyibo vs. CIL Risk and Asset Management Limited) (2014) 45 N.L.L.R. Pt 146, P. 724 NIC

- Upcoming Training Programmes

RISING INFLATION AND GDP CONTRACTION: WAY OUT OF THE DOLDRUMS

INFLATION RATE

The Inflation Rate, as released by the National Bureau of Statistics (NBS) for July 2016 showed that inflation slipped to 17.1% compared to 16.5% in June 2016, the highest in almost eleven (11) years. This reflected a nine month consecutive rise, although with an indication of slowdown as the month-on-month pace of increase slowed for the second consecutive month to 0.6% points in July vis-a-vis 0.9% in June. This was due to slower pace of increase in most divisions contributing to the headline CPI.

Source: NBS/NECA Research 2016

Main Driver of Increase

This inflation figure was strongly impacted by sustained increases in prices of goods and services amidst speculative and uncertainty of petroleum products, protracted foreign exchange challenges, increase in energy bills and lukewarm economic policy direction of the present government.

Most notable in the consumer basket was the increase in the food and core indices to 15.8% and 16.9%, respectively. Food inflation increased to 15.8% in July from 15.3% in June. Both domestic and imported food products influenced the increase in the food sub-index. The highest contributors to the increase in the food basket were fish, bread, cereals, potatoes, yam and other tubers. Imported food inflation increased to 20.5% in July from 20.1% in June. The core index increased YoY to 16.9% from 16.2% in June, primarily driven by fuel and electricity costs.

The increase here was heavily triggered by lingering structural challenges around power and energy, resulting in higher bills in electricity, solid fuels, liquid fuels (PMS, kerosene & diesel) and lubricants for transport and machines. Also, FX challenges led to higher cost of imported items such as electronic gadgets, books & stationaries, furniture & fittings, machines and vehicle spare parts.

| Highest Price Change | Lowest Price Change | |

| Food Index | Fish, Bread, Cereals, Potatoes, Yam and other Tubers | Milk, Cheese, Eggs, Fruits, Oils and fats |

| Core Index | Solid fuel, Fuels, and Lubricants for transport and electricity | Health, Transport, recreation and culture |

GDP GROWTH

Unfortunately, the inflation figures came at the same time the National Bureau of Statistics (NBS) released Q2, 2016 GDP growth estimate. Real GDP growth came in at historic negative of 2.06% (the biggest since -7.59% recorded in Q1-2004). Having already contracted in the first quarter (– 0.4%), the negative growth in Q2 officially throwing us into full swing recession for the first time since 2004.

A quick look at the breakdown of the GDP figure shows that the oil sector recorded a negative growth of 17.48% (from -1.89% in Q1-2016 and -6.8% in Q2-2015) while output in the non-oil sector declined by 0.38% (from -0.18%in Q1-2016 and a growth of 3.46% in Q2-2015). Overall, the significant contraction in the oil sector GDP (the biggest since -14.47% in Q3 2013) largely accounted for the -2.06% national output growth. The non-oil sector marks its first recession since 2004 while the oil sector marks the third straight negative growth since Q4-2015.

Over the three months period, output from the oil sector was negatively affected by the record fall in domestic production as a result of several militants’ attacks on crude oil & gas facilities.

The non-oil sector on the other hand suffered from:

- protracted constraints in accessing foreign exchange and

- Slowdown in business investment decisions: occasioned by the delayed passage of the 2016 budget.

These were in addition to systemic issues such as lingering fuel supply shortages, significant drop in electricity power outage, manufacturing under-utilization occasioned by limited access to forex and weak consumer demand, as well as the rampaging activities of the Fulani herdsmen (adding to insecurity concerns) in some parts of the country.

A quick look at the breakdown of the biggest components of the GDP shows that agriculture grew by 4.5% y/y while trade (-0.03% y/y) and services (-1.86% y/y) contracted.

Major Drivers of the Plunge

- Attacks on oil installations sank oil GDP :

Over the period, the security situation in the Niger Delta deteriorated further as various groups stepped up attacks on oil installations, prompting IOCs to declare force majeure along Nigeria’s major oil and gas export terminals. Consequently, mean crude oil production fell to a 14 year low of 1.69mbpd in Q2, 16 (-16% YoY, -19% QoQ) even as NNPC reported a 7% YoY decline in average daily gas production to 7,251mmsfcd in the period.

- Real estate and ICT slowdown dragged Services GDP lower

In Services, deceleration in its largest sub component (ICT)—where growth slowed to a thirteen quarter low of 1.4% YoY, was key driver of sector contraction. During the period, NBS data shows a 0.6% YoY decline in mobile subscriber base to 150 million (vs. average growth of 8.5% YoY post-rebasing). Akin to trends in prior quarters, real estate contraction (-5.3% YoY) provided further drag on Services as slowing activities in the luxury real estate market, a fall-out of the on-going anti-corruption crusade and excess supply of office space in urban centres, left sector GDP in the red zone for a second consecutive quarter.

WAY OUT OF ECONOMIC RECESSION

- Build on our Productive Base

The present system whereby we produce raw materials, sell them to foreign countries at low market prices and buy their finished products at exorbitant prices, thereby, mounting pressures on the Naira should be stopped. We must strive to reverse this.

- The Economy Needs Fiscal Stimulus Packages

The alarming economic crisis in the country demands an immediate shock therapy with an intensive and acute care. Fiscal and monetary policies can help in the short-to-medium term. Pro-cyclical fiscal and monetary measures should be replaced with counter-cyclical measures, as the former would worsen the economic situation. The current economic situation calls for responsible fiscal stimulus package to stimulate both aggregate supply and demand, especially of the poor and majority of Nigerians; the 99 percent will spend more to uplift the domestic economy than the less than 1 percent few elites that spend more on foreign goods and services.

Our high unemployment and insecurity are intertwined and require immediate scaling up of public sector investments in social safety nets, conditional cash transfers, public works and other public goods employing direct labour and can be stimulative across sectors, especially agriculture and manufacturing which are more labour-intensive, and raise aggregate demand. Such public sector investments are not impossible as fiscal leakages from corruption, over-bloated high recurrent expenditure, and untapped revenue sources at both the federal and State levels are plugged. External borrowing especially via the multilateral development banks and euro-bonds, as well as foreign direct investment will be crucial.

In addition, critical public sector reforms are needed in key areas: long-term fiscal sustainability at all levels of government, corruption, and democratic governance. It also requires freeing government from narrow corporate interests with a network of patronage and opaque system fuelling rent-seeking opportunities and corrupting our democratic system.

Complementary Monetary Stimulus Packages

Besides public investments and fiscal rationalization, another immediate step to support the objective of employment generation and job creation deals with monetary policy. The central bank needs to pursue full-employment and welfare-oriented monetary policy objectives, which include lowering the high monetary policy rates of 14 percent, aimed essentially at foreign portfolio investors, with their capital feast and famine cycles. It is difficult for businesses, especially SMEs and manufacturers, to afford and grow businesses and employ more people with lending rates of more than 20 percent.

While the mantra of monetarism has helped with price stability (not any more as inflation rates rose to 17.1 percent year on year) as defined by the CBN, the hawks within the Monetary Policy Committee (MPC) still do not believe that high unemployment rate is the number-one economic evil today. With the high rate of unemployment and jobless growth, it is safe to state that the economy is already below its potential output; and added to it are the potential recessionary gaps from realized and emerging shocks. It has been argued by notable economists that excessive emphasis on low inflation targets can be counterproductive in the aftermath of severe shocks such as currently witnessing in the economy.

Beyond the immediate fiscal and monetary policy measures to support job creation, each government or regime needs a signature economic success with scalable impacts on inclusive, shared, sustained prosperity. Avoiding the recession with counter-cyclical fiscal and monetary policies and measures was clearly foretold.

OUTLOOK

- Monetary Policy Committee Meeting: We expect that during the next meeting of the Monetary Policy Committee (MPC) of the Central Bank from 19 – 20 September, 2016, it should be decisive and bold to tweak the MPR in order to boost productivity.

- Given the unclear security situation in the Niger Delta, we think IOCs are unlikely to sanction full scale repair works on damaged facilities without a lasting cessation of violence in the region. The foregoing pushes possibility of a recovery in oil production to above 2million bpd levels beyond 2016 and leaves the recessionary picture for the oil sector intact.

EASE OF DOING BUSINESS IN NIGERIA: TOO COLD FOR COMFORT

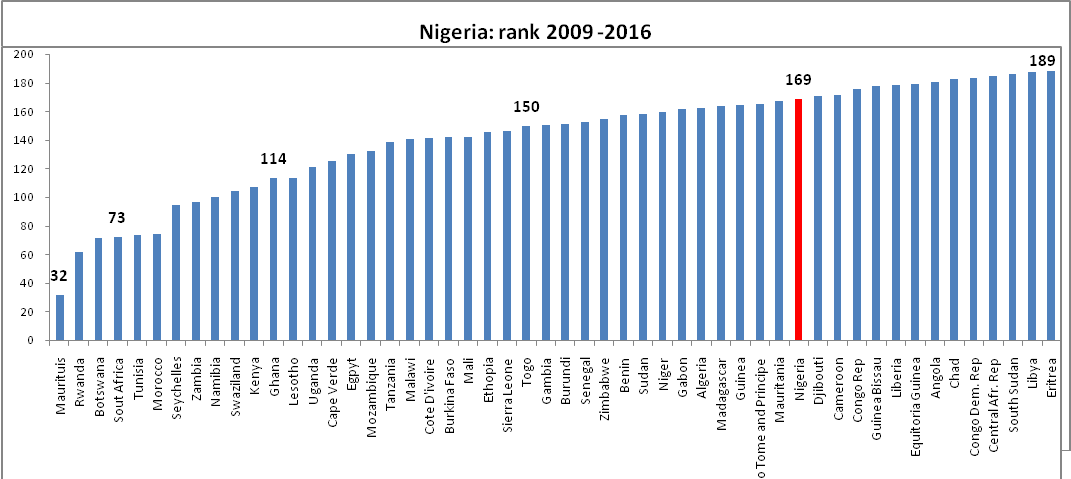

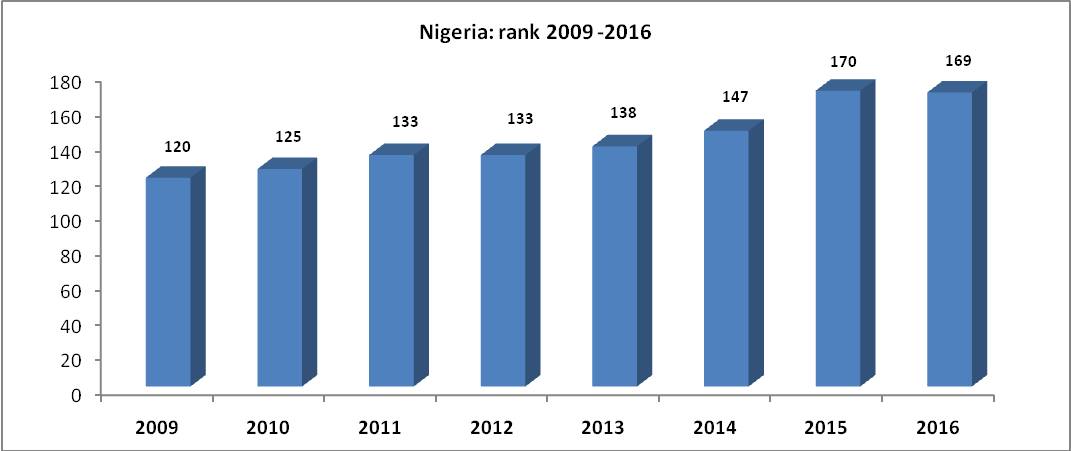

The economic objectives of any government are to, among other things, curb inflation, stabilise the exchange rate, improve balance of trade, and drive economic growth through the private sector. The World Bank Doing Business Report 2016 said it was more difficult to do business in Nigeria in 2016 than it was last year, as the country remained one of the poorest business destinations in the world. Of 189 countries surveyed, Nigeria improved marginally by just one step from its ranking in 2015, moving from 170th position with 43.56 per cent points in 2015 to 169 with 44.69 per cent points.

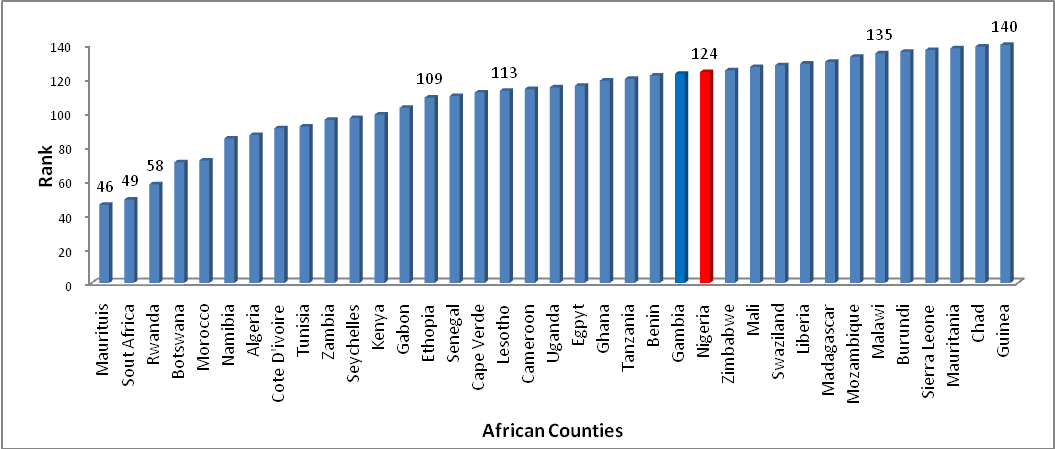

Nigeria ranked 39th out of 53 countries surveyed in Africa.

Source: World Bank Doing Business Report, 2016, NECA Research

How Nigeria feared over the years

Source: World Bank Doing Business, NECA Research

We also analysed the Global Competitiveness Report of the World Economic Forum 2015 – 2016, which provides an overview of the competitiveness performance of 140 economies. Nigeria ranked 124 among the 140 countries surveyed. In Africa, among the 37 Africa economies, Nigeria ranked 25th. This validates the earlier assertion of World Bank in its Doing Business Report of ease of doing business in the country.

Nigeria ranked 25th among 37 countries in Africa

The World Bank Doing Business Report based its analysis on reforms under these 10 topics, which include:

- Starting a business,

- Dealing with construction permits,

- Getting electricity

- Registering property

- Getting credit

- Protecting minority investors

- Paying taxes

- Trading across borders

- Enforcing contracts, and

- Resolving insolvency.

According to the World Bank Doing Business Report, improving the ease of doing in Nigeria has witnessed very few reforms when compared to other countries surveyed over Source: Global Competitiveness Report, 2015- 2016, NECA Research the years. The list of reforms in the country since 2008 include:

| 2008 | |

| Starting a Business | Nigeria made starting a business easier by introducing an online system for company name search and increasing efficiency at the company registry. |

| Dealing with Construction Permits | Nigeria made dealing with construction permits easier by setting an official time limit for issuing permits. |

| 2009 | |

| Trading Across Borders | Nigeria speeded up exporting and importing by upgrading facilities at Apapa port in Lagos |

| 2010 | |

| Getting Credit | Nigeria improved its credit information system through a central bank guideline defining the licensing, operational and regulatory requirements for a privately owned credit bureau |

| 2013 | |

| Getting Credit | Nigeria improved access to credit information by distributing credit information from retail companies. |

| Paying Taxes | Nigeria introduced a new compulsory labour contribution paid by the employer. |

| 2016 | |

| Registering Property | Nigeria made transferring property in Lagos less costly by reducing fees for property transactions. |

| Protecting Minority Investors | Nigeria strengthened minority investor protections by requiring that related-party transactions be subject to external review and to approval by disinterested shareholders |

It should be noted that Doing Business 2016 Report was based on data as of June 1, 2015 (except for the paying taxes indicators, which cover the period January–December 2014).

OPINION

With various indications suggesting declining inflow of Foreign Direct Investment into the country in the past few years, it is crucial that the present administration review its strategies and efforts in revamping the trend and stimulate growth in the face of global economic turndown, before the economy could attain its position as investors’ choice of first call.

We of the opinion that much still needed to be done to rescue the economy from the doldrums in view of the damning effect of the recessed economy, which included: declined capacity utilisation, closure of businesses, high unemployment , unfair competition from smuggled products , import restrictions, trade credit evaporation (S&P, Moody and Fitch cuts Nigeria’s ratings / outlook to negative, rating remains at B+), shrinking supplier credit and bills for collection, cold feet by export credit agencies to grant more credit. These, should be addressed urgently to promote recovery.

LABOUR & EMPLOYMENT LAW

Pension (Ibinabo Oyibo vs. CIL Risk and Asset Management Limited, 2014) 45 N.L.L.R. Pt 146, P. 724 NIC

Facts:

- The claimant (Ibinabo Oyibo) was employed by the defendant (CIL Risk and Asset Management Limited) as a Senior Analyst from July 2008 to October 2010, when she resigned from the services of the defendant. The letter of resignation incorporated a demand for the arrears owed her by the defendant in the sum of N4,607,689.89

- The claimant pleaded that the defendant accepted her resignation by a letter dated 25th November 2010 wherein it admitted being indebted to her in the sum of N4,257,671.31 and indicated its intention to off-set the sum due to her on a salary basis until liquidation of the total sum.

- The claimant rejected the defendant’s proposed mode of payment and requested for her money through her Solicitors.

- Furthermore, the claimant conducted an inquiry into her Pension Fund Administrator(PFA) Account and obtained her statement of account. The inquiry revealed that the defendant failed to pay her PFA contribution to the Pension Fund Managers where she registered, even after the defendant had deducted the amount from her monthly salary from the inception of her employment. The PFA contribution due to her, as admitted by the defendant was N1,270,208.42

- The defendant’s case was that it accepted the claimant’s resignation letter dated 25th November 2010 but did not admit indebtedness to the claimant to the tune of N4,257,671.31, rather the defendant only stated the sum due to the claimant resulting from her resignation as the defendant did not have control over pension fund.

- Furthermore, that at no time did the defendant enter into an agreement with the claimant to pay her pension contribution to her directly because it does not have control over pension contribution fund.

- That the claimant was part of the management that took decision to stop payment of salaries. And that the defendant mutually agreed with all its staff, including the claimant, to stop paying salaries because there was no money to pay salaries and the defendant was hoping that with good effort the fortune of the defendant will be turned around.

Issues

- Whether or not the Defendant was in compliance with the Pension Reform Act.

The Judgement

On Employees’ obligation to open a retirement saving account under Pension Reform Act:-

Under the pension contribution scheme, the Pension Reform Act mandates the employee to open a retirement savings account with a pension fund administrator of his/her choice into which his/her pension contributions will be paid. The claimant, in the instant case, complied with the said law.

On whether pension contribution is payable directly to the employee:-

Pension contribution under the Pension Reform Act is payable directly to the employee’s account domiciled at his or her pension fund administrator. Pension contribution is not payable directly to the claimant. In the instant case, the defendant failed to remit the pension contributions into the claimant’s pension fund administrator.

On whether employee is bound to bring any complaint against her employer before the Commission or join her Pension Fund Administrator in a suit:-

An employee is not bound to bring any complaint against her employer before the Pension Commission neither is he/she obliged to join his/her Pension Fund Administrator (PFA) where the PFA is not a necessary party. Its inclusion will not be fatal to his/her case, as there is no cause of action against it and the judgment or order of court can be effective without such joinder.

The claimant in this suit does not have any complaint against her pension fund administrator neither is she bound to bring any complaint against employer before the Commission. There is no cause of action in this suit against the PFA. Her PFA need not be a party in this suit before the order of this court can be effective as it is the responsibility of the defendant under the Pension Reform Act to pay the claimant’s pension contribution into her Retirement Saving Account (RSA).

Final Judgment:-

The Court ruled that the argument of the defendant was baseless, and a misconception of the law and it was, therefore, discountenanced. The case of the claimant succeeded and the court ordered, that:

- The defendant shall pay to the claimant the sum of N2,287,462.89 being her outstanding salaries up to November 2010 and 13th month salary for 2009

- The defendant shall pay to the claimant the sum of N700,000 being the claimant’s Medical Allowance up to 2010

- The defendant shall pay the sum of N1,270,208.42 into the claimant’s retirement saving account being her contributory pension

- The above sums are to be paid within 30 days from the date of the judgment

The sum of N25,000 was also awarded in favour of the claimant – to be paid by the defendant, being litigation cost or cost of the action.

OPINION:

Under the Pension Reform Act, an employer is bound by law to pay employees’ pension into his/her pension fund administrator.

50th Advanced Course On Human Resources Management, Labour & Employment Relations.

Date: 19th – 23rd September, 2016

Venue: GREEN LEGACY RESORT, ABEOKUTA, OGUN STATE

Fee: N225,000(NECA Members), NON-MEMBERS: N235,000

Planning for Golden Years in Retirement: Connecting to a Qualitative Future after Work Life.

Date: 12th – 14th October, 2016

Venue: NECA Learning Centre

Fee: N110,500 (NECA Members) N115,500 (Non-NECA members)

Time: 9:00am – 4:00pm

For further details please contact Adewale (08069720364) adewale@neca.org.ng. Visit www.neca.org.ng

| For Advert Placement: kindly contact Timothy Olawale on tim@neca.org.ng, 08033435439 |

Recent Comments