Business Essentials: October, 2017 Edition

Dear Esteemed Member,

We appreciate the several feedbacks indicative of yearnings for the restoration of your darling publication, Business Essentials which was briefly rested for strategic reasons. The publication is now a monthly piece. This has no effect on the periodic release of the “NECA RedFlag” as the need arises.

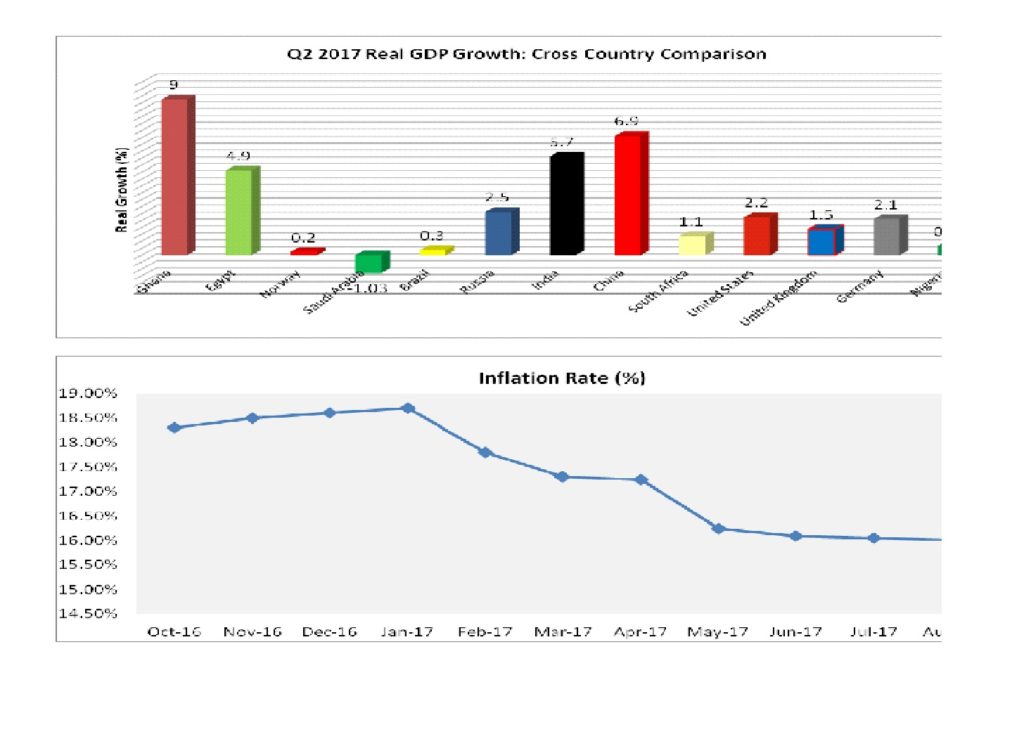

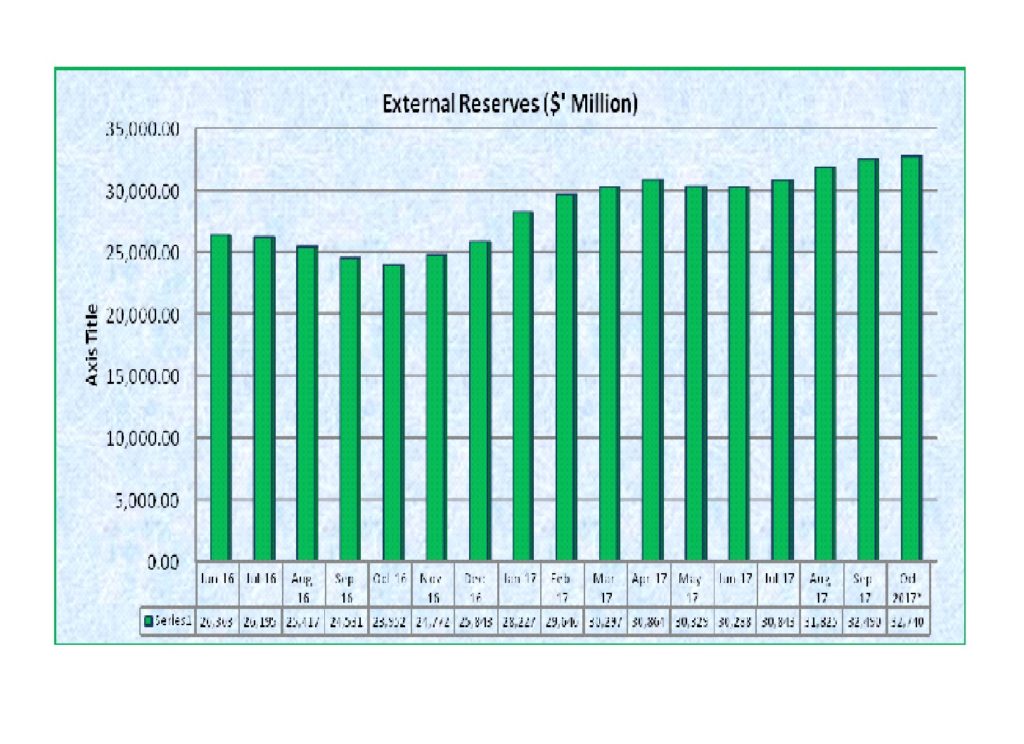

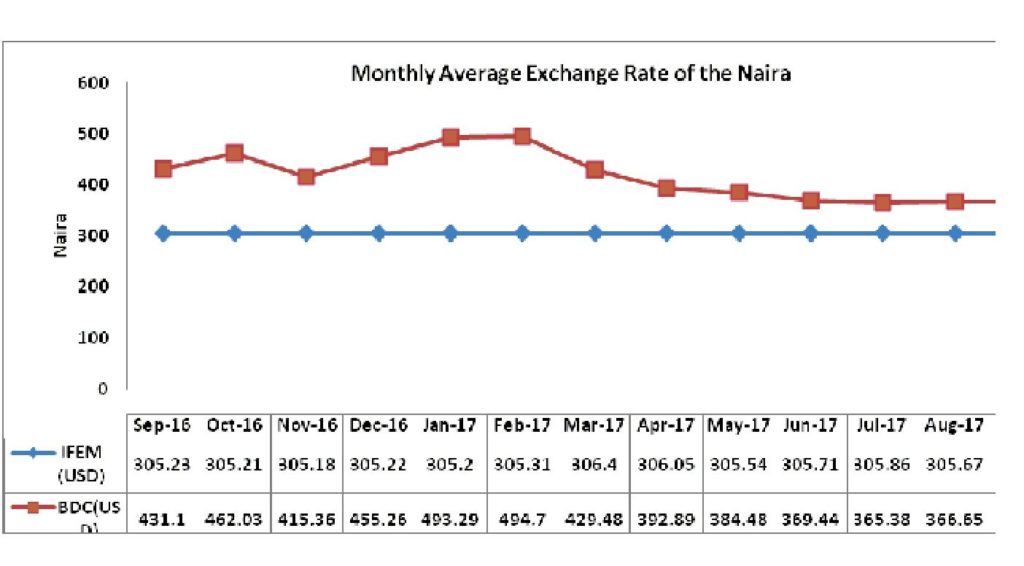

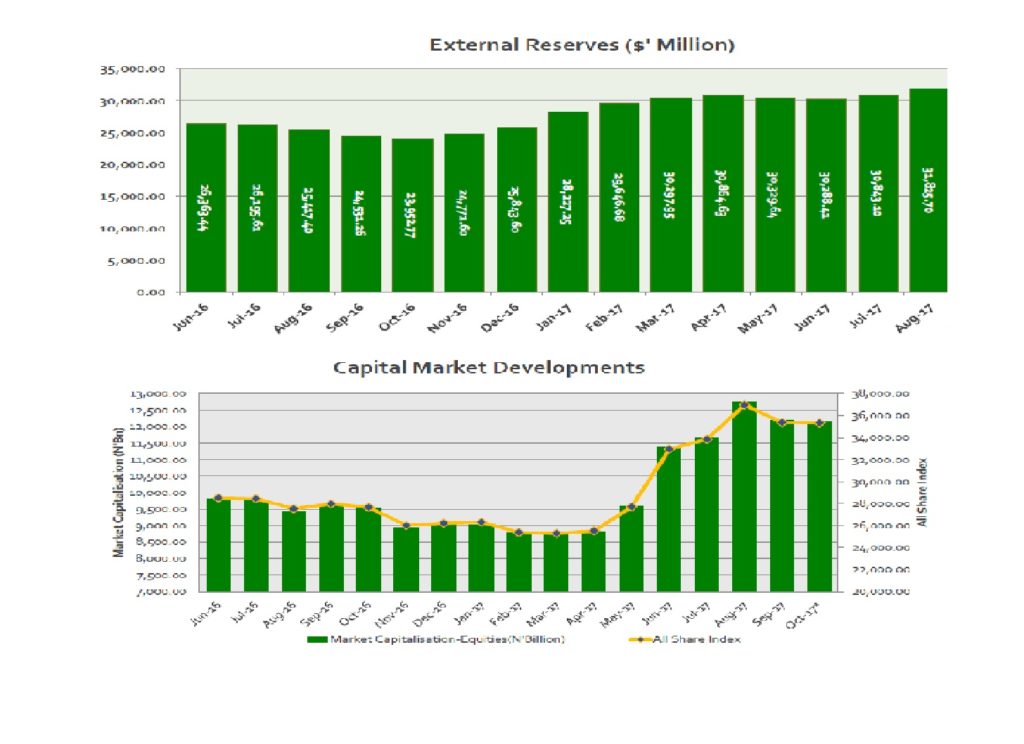

In this edition, we reviewed the macroeconomic variables, with the downward trend of the inflation figure, the growth in the economy measured by the GDP, growing External Reserves, amongst others, and implications for business. We also looked at current Government policies and its implication on Business; the recent illegal Property Valuation by Federal Inland Revenue Services (FIRS) which we believed is tantamount to double taxation and injurious to business, and its implication on Business.

We closed the edition with our columns on Law Report Review / Legal Opinion, Upcoming Meetings of various Expert Committees, News from International Employers Organisation (IOE)/International Labour Organisation (ILO), General Circulars and Legislative Observatory, etc.

Have a pleasant reading.

Timothy Olawale

Editor

In this Issue:

- Review of General Macroeconomic Variables and Implication to Businesses

- Current Government Policies And Implication on Business: Illegal Taxation On Property By The Federal Inland Revenue Service

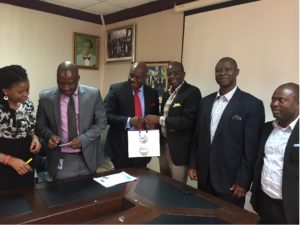

- Pictorial: NECA Delegation to LIRS Management, Suntory Foods & Beverage Limited Management visits NECA House

- Law Report Review / Legal Opinion:

- Upcoming Meetings of various Expert Committees

- News from International Employers Organisation (IOE)/International Labour Organisation (ILO),

- General Circulars: Request For Audited Reports By The House Of Representative’s Committee On Capital Market And Institutions

- Legislative Observatory: National Water Resources Bill 2017

Review of General Macroeconomic and implication on Businesses

Implications:

- Oil prices averaging $55pb are positive for Nigeria since the budget benchmark is $44.50. However oil prices alone are insufficient to cure Nigeria’s severe economic problems-recession/low growth, high inflation, narrow export base, weak policy and increasingly fiscal unsustainability.

- Beneath Nigeria’s headline exit from recession through Q2 GDP growth of 0.55%, underlying economic performance is very weak and broad sector reviews are troubling!

- Similarly while the trend regarding YoY headline inflation is positive declining for the 8th straight month to 15.98%, the level is still quite high and some important components especially domestic food inflation are still trending higher.

- One unambiguously positive set of indicators relate to the FX scenario with continued exchange rate stability, rising reserves and reported improvements in transaction volumes on the Importers and Exporters Window.

- It is telling that only bank and pension fund assets are rising within FSI as PMIs, insurance and finance company assets are shrinking, as treasury assets continue to crowd out other financial savings and remaining savers flight to (relative) safety. Government fiscal situation suggests nothing may change in the short term.

FGN Capital Development Fund Account for July 2017

| S/N | Description | 2017 Approved Budget | Jan | Feb | March | April | May | June | July | cum. | |||

| Annual | Monthly | Prorata | Variance | ||||||||||

| ₦b | ₦b | ₦b | ₦b | ₦b | ₦b | ₦b | ₦b | ₦b | ₦b | ₦b | ₦b | ||

| a | b | c=b*7 | |||||||||||

| 1 | Balance B/Fwd | – | – | – | 271.662 | 266.718 | 296.643 | 353.972 | 332.785 | 281.220 | 174.695 | 271.662 | |

| 2 | INFLOWS: | ||||||||||||

| 3 | Domestic Borrowing | 1,254,274 | 104,523 | 731,661 | 170.000 | 220.000 | 120.000 | 120.000 | 200.000 | 200.000 | 1,030.000 | (224.274) | |

| 4 | Foreign Borrowing – USD One Billion Eurobond | – | – | – | – | – | 300.000 | 300.000 | 300.000 | ||||

| 5 | Miscellaneous Credits | – | – | – | 0.148 | 0.163 | 1.751 | 0.740 | 1.447 | 0.018 | 1.555 | 5.822 | 5.822 |

| 6 | Transfer from CRF | – | – | ||||||||||

| 7 | Total Inflows | 1,254,274 | 104,523 | 731,661 | 170.148 | 220.163 | 421.751 | 120.740 | 201.447 | 0.018 | 201.555 | 1,335.822 | 604.162 |

| 8 | Net Amount Available | 1,254,274 | 104,523 | 731,661 | 441.810 | 486.881 | 718.394 | 474.712 | 534.232 | 281.238 | 376.250 | 1,607.484 | 875.824 |

| 9 | OUTFLOWS: | – | |||||||||||

| 10 | Capital Expenditure – 2016 | – | – | – | 32.959 | 40.234 | 190.891 | 71.927 | 72.172 | – | 408.187 | (408.187) | |

| 11 | Capital Expenditure – 2017 | 217,450 | 181,208 | 1,268,456 | – | – | 113.531 | – | 13.156 | 6.543 | 4.991 | 138.221 | 138.221 |

| 12 | Transfer from CRF to meet Recurrent & Domestic Debt Obligations | – | – | – | 142.133 | 150.000 | 292.133 | (292.133) | |||||

| 13 | Transfer to Excess Domestic Crude Account | – | – | – | – | ||||||||

| 14 | Transfer to TSA Sub-Rec | – | – | – | 60.000 | 70.000 | 145.000 | 100.000 | 100.000 | 475.000 | (475.000) | ||

| 15 | Miscellaneous Credits Transfer to CRF | – | – | ||||||||||

| 16 | Manual AIEs uo Cap Supply yet to be mandated | – | 0.624 | 0.624 | (0.624) | ||||||||

| 17 | Transfer to OAGF Retention Account | – | – | – | 22.684 | 22.684 | (22.684) | ||||||

| 18 | Total outflows: | 217,450 | 181,208 | 1,268,456 | 175.092 | 190.234 | 364.422 | 141.927 | 253.012 | 106.543 | 105.615 | 1,336.849 | (68.392) |

| 19 | Net (Deficit)/ Surplus | 1,036,824 | (76,685) | (536,795) | 266.718 | 296.647 | 353.972 | 332.785 | 281.220 | 174.695 | 270.635 | 270.635 | (807.432) |

Current Government Policies and Implication on Business

ILLEGAL TAXATION ON PROPERTY BY THE FEDERAL INLAND REVENUE SERVICE

In April 2017, the Federal Inland Revenue Service (FIRS) had served companies with a phony letter on Property Valuation & Assessment Visit, which was addressed to the “Property Owner”.

NECA had then sought authentication of the letter and its contents from the Executive Chairman of the FIRS. In response, the FIRS had confirmed knowledge of the issuance and further explained that the exercise was “targeted at companies which are liable to tax under the Companies Income Tax Act but have not registered as tax payers and have not filed any tax returns.” Read more

L-R: Executive Chairman, LIRS, Mr Ayodele Subair presenting a gift to Mr. Olusegun Oshinowo, DG, NECA during NECA’s courtesy call on the LIRS Chairman.

L-R: Executive Chairman, LIRS, Mr Ayodele Subair presenting a gift to Mr. Olusegun Oshinowo, DG, NECA during NECA’s courtesy call on the LIRS Chairman.

Mr. Chinedum Okereke, Managing Director, Suntory Beverage & Food Nigeria Ltd. receiveing gift from Mr. O.A. Oshinowo, DG,NECA during a courtesy visit to NECA House

LABOUR & EMPLOYMENT LAW: On Proof of claim for Terminal Benefit (Thomas Boadi vs. Christopher Geighengan) (2014) 47 N.L.L.R. Pt 153, P.372. NIC

Facts:

- The claimant (Thomas Boadi) alleged that there was an oral employment agreement between the parties in which the defendant (Christopher Geighengan) employed him as a driver from 2005 to 2010 initially on a monthly salary of N25,000 and that it was later increased to N30,000 per month.

- As a result of this relationship, the defendant gave him accommodation in his boys’ quarters.

- His main claim was that from October 2009 to July 2010, the defendant failed to pay him his salaries in the sum of N300,000 (being arrears of salaries for 10 months) and the sum of N500,000 as his terminal benefits.

- The claimant argued that even though the defendant was not around for these period, since his employment with him was not determined by the defendant and that when the defendant eventually came back, he (the claimant) still drove him as the defendant’s driver, and such was entitled to his arrears of salary.

- The claimant alleged that the Landlady of the Guest House where they (the claimant & the defendant) stayed forcefully ejected him from the premises on the instruction of the defendant, thereby subjecting him to untold hardship, trauma and pains. He, therefore, claimed N5 million as general damages for his ordeal.

- On his part, the defendant claimed that the oral agreement between the parties was to engage the claimant on an ad hoc basis because he was not permanently resident in Nigeria, so he did not need a permanent driver.

- The defendant stated that he was not a tenant in the Guest House, where the claimant had alleged was his official residence but was in occupation of that premises by his employer; Afrijet Airlines

- He contended that the claimant worked for him as an ad hoc driver from 2007 and was paid N1,500 for every day that the claimant drove him whenever he was in the country consulting for his Employer, Afrijet Airlines and so did not employ any permanent staff during his stay in the country, as he was not resident in the country but he only comes each time there was need.

Issues

- Whether or not there is a Contract of employment between the parties and if the answer is in the affirmative; whether the claimant has arrears of salary to claim and the period of the said arrears of salary

- Whether or not the claimant is entitled to any terminal benefits, damages and interest on the claimed sum

The Judgement

On meaning of “employee” and employer”:-

By section 54(1) of the National Industrial Court Act 2006, “employee” means a person employed by another under oral or written contract of employment whether on a continuous, part-time, temporary or casual basis and includes a domestic servant who is not a member of the family of the employer. Under the same section, an “employer” means any individual or body corporate or unincorporated who has entered into a contract of employment to employ any other person as an employee or apprentice.

In the instant case, going by the above meaning of employee and employer, the claimant is a permanent worker/driver of the defendant as claimed by him or an ad hoc worker/driver (otherwise known as temporary worker or worked on casual basis) as claimed by the defendant

On Proof of claim for Terminal Benefit:-

Where an employee makes claims for terminal benefit, he must give evidence on his condition of service with the employer entitling him to it either orally or through document. In the instant case, the claimant in respect of his claim of N500,000 terminal benefit, failed woefully to show how he arrived at that figure or sum of money as his terminal benefit. He did not give any evidence on his condition of service with the defendant entitling him to terminal benefit either orally or through document.

On meaning of damages and basis of such award:–

Damages are the pecuniary compensation or award given by a process of law to a person who has suffered loss or injury whether to his person or property through the unlawful act or omission of another. The sum to be awarded is usually for the loss that naturally flows from the breach of a contract or duty by the defendant. From the averments in the instant case, it was the Landlady of the Guest House and her agents that ejected the claimant and his family from the premises and not the defendant. Since the basis for asking for these damages was as a result of an act done by a third party (the Landlady) and not for the action or inaction of the defendant, the claimant was not entitled to the damages claimed.

On when the National Industrial Court can award interest on judgment:–

By the provision of Order 21 Rule 4 of the National Industrial Court Rules, 2007, it is only after judgment that the National Industrial Court can award interest on the judgment if the judgment debtor failed to liquidate the judgment sum as directed by the Court. It then follows that before judgment, the court cannot award interest on the claimed sum.

Final Judgment

On the whole, the court held that:

- The claimant was an employee of the defendant, and had worked with the defendant from October 2009 to July 2010 – for which he was not paid. The claimant is entitled to N300,000 arrears of salary from the defendant.

- The claimant is not entitled to N500,000 terminal benefit and N5 million damages from the defendant because the claims were not proved at all. The two claims were dismissed.

- The defendant is to pay the claimant the judgment sum of N300,000 within 14 days from the date of the judgment, failure of which would attract interest at the rate of 20% per annum until the judgment sum was finally liquidated.

OPINION:

It is important to note that cases are decided on their merits and the facts (terms and conditions of employment, Agreements (oral or written) etc) before the court, especially at the National Industrial Court (NIC). The NIC is not a Court that STRICTLY follows formalities and technicalities but more of facts in arriving at its judgment. The duty of the court and equity demands that substantial justice should be done.

Notice of upcoming Meetings of the Committees:

- Committee of Legal and Company Secretaries (COLACS)

Date: Thursday, 9th November, 2017

Venue: NECA House

Time: 10:00am

- Electricity Distribution Companies Meeting (DISCOS)

Date: Monday, 13th November, 2017

Venue: NECA House

Time: 10:00am

- Committee of Human Resource & Learning Experts (CHRLE)

Date: Wednesday, 15th November, 2017

Venue: NECA House

Time: 9:30am

News from IOE/ILO

Sluggish SME development hurts jobs and the economy, ILO says

With more than 201 million workers unemployed in 2017 – an increase of 3.4 million compared to 2016 – enterprises, particularly small and medium-sized enterprises (SMEs), play a crucial role in creating decent jobs around the globe. Between 2003 and 2016, the number of full-time employees within SMEs nearly doubled, with the share of total employment attributable to SMEs rising from 31 per cent to 35%, according to the ILO’s World Employment and Social Outlook 2017: Sustainable Enterprises and Jobs. However, in the past year, their contribution to total employment has stagnated. Between 2015 and 2016 the contribution of SMEs to total employment remained virtually unchanged, increasing from 34.6 to 34%.

According to the report, private sector enterprises accounted for the bulk of global employment in 2016. These enterprises employed 2.8 billion individuals, which represents 87% of total employment. While permanent full-time employment in SMEs grew more than in larger firms between 2003 and 2008 – on average 4.7 percentage points higher in small and 3.3 percentage points higher in medium-sized enterprises – employment growth premium of SMEs was absent during the period between 2009 and 2014. “To reverse the recent trend of employment stagnation in SMEs, we need policies to better promote SMEs and a better business environment for all firms, including access to finance for the younger ones,” said Deborah Greenfield, ILO Deputy Director-General for Policy.

In developing economies, SMEs account for 52% of total employment, compared with 34% in emerging economies and 41% in developed economies. Job dynamics among young firms in terms of full-time permanent employment have also weakened since the global financial crisis, the report says.

The full-time permanent employment growth rate among young firms was on average 6.9% points higher than for established firms during the pre-crisis period, but the difference declined to 5.5 percentage points in the post-crisis period. This change reflects developments in the overall business environment, whereby new and younger firms have been shedding jobs at a much faster pace than before.

Way Forward:

· Investing in workers key feature of sustainable enterprises

The report also finds that providing formal training for permanent employees is associated with higher wages, higher productivity and lower unit labour costs, while increasing the use of temporary employment is associated with lower wages and lower productivity, without any implications for unit labour costs.

Evidence indicates that, on average, enterprises that provide formal training to their full-time permanent employees pay 14% higher wages, are 19.6% more productive and have 5.3% lower unit labour costs, compared with those that do not offer training. Alternatively, on average, having a higher share of temporary employment by 10 percentage point is associated with lower average wages by 2.6% and lower productivity by 1.9 %, which thus does not give competitive advantage in terms of their unit labour costs.

· Innovation and trade boost jobs and productivity

The report finds innovation is an important source of competitiveness and job creation for enterprises. Innovative firms, overall, tend to be more productive, create more jobs, employ more educated workers and offer more training. They also hire more female workers.

In some cases, however, innovation has led to more intensive use of temporary workers (particularly, in firms with product and process innovation) and to higher concentration of women in temporary employment. For example, firms implementing product and process innovation tend to employ more temporary workers than non-innovators by over 75%.

Trade and engagement in global supply chains are also important stimuli for job creation and productivity growth. As trade has stagnated in recent years, so too has trade-related employment. In 2016, 37.3% of workers were employed in private formal exporting firms. This share is lower than the pre-crisis share of 38.6%. The report notes that trading firms have higher productivity and pay higher wages than those firms not engaged in trade.

However, the productivity premiums for exporting and importing outweigh the wage premium by 13 and 5 percentage points. This indicates that there is scope to share gains from trade in a more inclusive manner.

· SMEs important source of female employment

The ILO research shows that full-time female permanent employees in the formal sector are more likely to be found in SMEs than in large firms. On average, and across all regions, around 30% of full-time permanent employees in SMEs are women, compared with 27% in large enterprises. Moreover, the share of women’s employment, particularly in SMEs, is strongly correlated with the per capita income of a country. Greater numbers of women in enterprises may therefore have a positive impact on growth and development, because micro-enterprises and SMEs often offer women an entry point into the formal labour market.

Finally, the ILO’s flagship report insists on the key role of social dialogue between governments, employers and workers for enterprise sustainability. “While governments play an important role in shaping institutions that boost sustainable enterprises and inclusive growth, workers and their organizations advocate appropriate policies and regulations as well as representation. Through these concerted actions, sustainable enterprises can foster equal employment opportunities, workers’ protection and rights, and invest in workers as well as other important factors of production,” concluded Greenfield.

……………………………………………………………………………………………….

Circulars/Press Releases:

RE: REQUEST FOR AUDITED REPORTS BY THE HOUSE OF REPRESENTATIVE’S COMMITTEE ON CAPITAL MARKET AND INSTITUTIONS

The attention of your Association has been drawn to yet another letter from the House of Representatives, this time, from the Sub Committee on Capital Market and Institutions on Regulation and Compliance, requesting:

- 5 Years Audited Annual Report

- Compliance Status to Corporate Governance

Our Legislative Observatory: National Water Resources Bill 2017

- A Bill for an Act to Establish a Regulatory Framework for the Water Resources Sector in Nigeria, Provide for the Equitable and Sustainable Development, Management, Use and Conservation of Nigeria’s surface Water and Groundwater Resources and for Related Matters (HB. 1021) Executive

First Reading: 04/05/2017

Second Reading: 06/07/2017

Committee Referred to: Water Resources

Public Hearing Held on: 17-18/10/2017

OUR POSITION ON THE NATIONAL WATER RESOURCES BILL 2017

- Objectives of the Bill:

We believe that the objective of the Bill is Item 64 of the Exclusive Legislative list of the Constitution of the Federal Republic of Nigeria, 1999 as amended. It states “Water from such sources as may be declared by the National Assembly to be sources affecting more than one state”.

We note the initiative behind the Bill, as it is intended to:

- regulate the activities of those involved in the sale of water in the water sector so that these commercial operators can secure reasonable returns on their capital;

- protect the long-term interests of consumers with regard to the price, quality and reliability of services in the water sector;

- approve and regulate tariff, fees and other charges charged in the sector, etc.

- Our Concerns:

We wish to state that it is the responsibility of Government to provide water for the citizens i.e. Individuals and corporate. However, we observe that in Section 106 of the Bill, there are Charges for Water Use, which should be expunged. Where Citizens resort to self help by providing water for their use, they should not be penalized or slammed with charges, as it could be perceived that the essence of the Bill and/ Commission is pecuniary rather than ensure sanity and quality control on the subject matter.

It is the failure of Government to discharge this fundamental social responsibility that led to construction of boreholes in homes and by private entities/ individuals. Thus, it is morally wrong for Government to seek to tax people for a basic and fundamental social service that it should provide in the first place.

- The Bill provides for the Nigeria Water Resources Regulatory Commission, its Board and Functions in sections 16 and 17. It listed the functions of the Commission, which conferred on them the process, powers to regulate and manage water resources as well as that of water supply. This situation makes the Commission both managers and developers. There is need to reconsider the arrangement so that a Regulatory Agency does not turn around to become a water user. Furthermore, Stakeholders in the Organised Private Sector were not considered, as they would be affected by the activities and operation of the Commission.

- Part IX of the Bill deals with Licensing and it appears to demonstrate pecuniary intentions in the Bill. This is at varies with the Objectives of the Bill in section 1.

Furthermore, companies provide the water they use due to the inability of the government to provide this basic requirement of life, despite the payment of taxes to the government. It is a big burden for companies to provide the water they need because they are required to buy generators and other accessories to get the water. It is unfair for the same government to now impose charges/tax on the water provided by the companies for their use as it amounts to penalty. We refer the Lawmakers to the judgment of Justice I.N. Buba in the 2015 case between Warm Spring Waters Nigeria Limited & Others and Federal Inland Revenue on why a government that is not able to provide portable water for its citizens cannot impose tax on such water.

Conclusion

Businesses are confronted with several challenges and should not be choked out of existence or over-burdened by more bills/ charges, especially in these challenging times.

Recent Comments