Business Essentials May 2018 Edition

Dear Esteemed Member,

In this edition, our focus is on the global upswing in economies, as depicted by the recently released World Economic Outlook. Nigeria and Sub-Saharan Africa also experienced relative growth with a caution from the IMF: the “current favorable growth rates will not last, but policymakers should seize this opportunity to bolster growth, make it more durable, and equip their governments better to counter the next downturn”. We, therefore, expect and welcome views in the comment section of this edition of the business essential on our blog; what Nigerian Government should be doing to give life to the sound counsel from the IMF.

We also reviewed global developments and the impact on businesses, portfolio and income; shared with you the economic benefits of the recently passed Companies and Allied Matters Act Bill (Repeal and Re-enactment), 2018, which was adjudged as one of the business-friendly bill passed in the 8th Assembly, not forgetting our regular Law Report Review, Upcoming Learning & Development programmes and other activities at the Secretariat.

Have a pleasant reading.

Timothy Olawale

Editor

In this Issue:

- The Nigerian Economy Review: Q1 2018 and Implication for Business

- An Overview of Companies and Allied Matters Act (CAMA) Bill (Repeal and Re-Enactment 2018)

- PICTORIAL: The Executives and Governing Council Members of National Institute of Marketing of Nigeria (NIMN)

- PRESS RELEASE: Encomiums As Corporate Nigeria Honours Dr. Christopher Abebe.

- Law Report Review / Legal Opinion: Judgment of the National Industrial Court: When an Action is Statute-Barred.

- Upcoming Meetings of various Technical Committees

The Nigerian Economy Review: Q1 2018 and Implication for Business

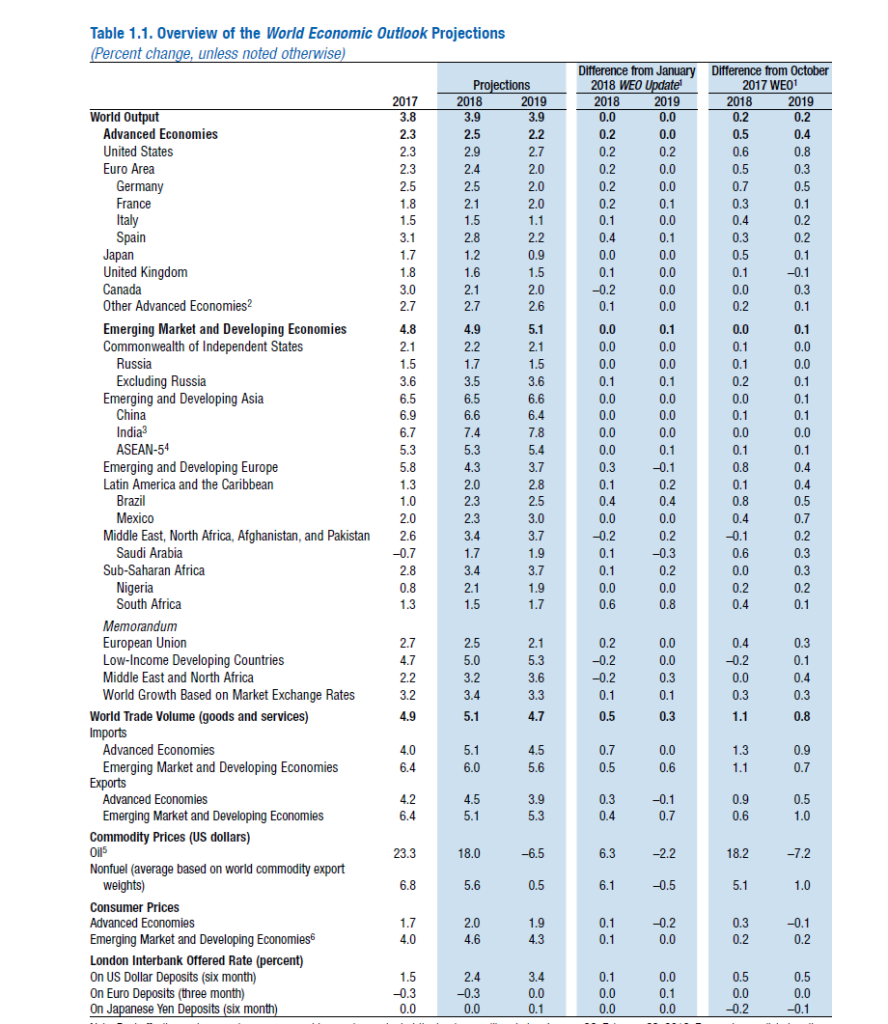

According to the IMF World Economic Outlook (April 2018), the global world growth remains positive:

- Advanced economies as a group will continue to expand above their potential growth rates this year and next before decelerating, while growth in emerging market and developing economies will rise before leveling off. For most countries, current favorable growth rates will not last.

- Policymakers should seize this opportunity to bolster growth, make it more durable, and equip their governments better to counter the next downturn.

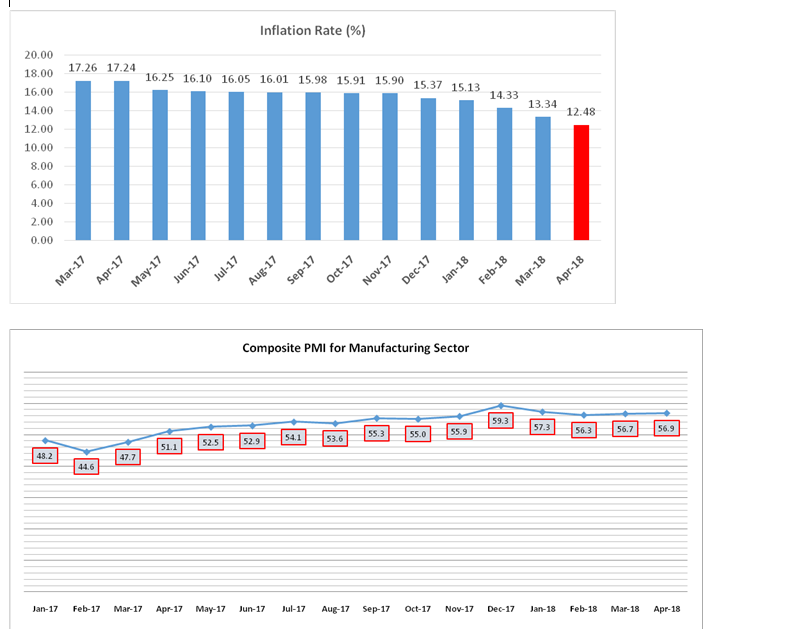

- Growth in sub-Saharan Africa is projected to rise to 3.4 percent in 2018 (from 2.8 percent in 2017), and improve slightly thereafter through the medium-term to about 4.0 percent. While the headline numbers suggest a broadly unchanged picture relative to the October World Economic Outlook (WEO), revisions to growth projections for key large economies point to underlying differences in prospects across the region.

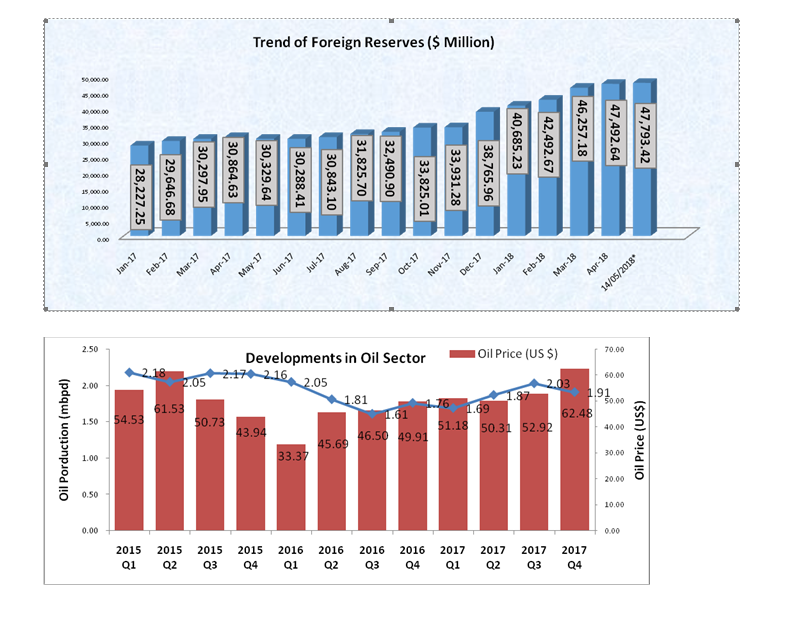

- In Nigeria, the economy is projected to grow 2.1 percent in 2018 and 1.9 percent in 2019 (up from 0.8 percent in 2017), reflecting improved oil prices & revenue, production and recently introduced foreign exchange measures that contribute to better foreign exchange availability. The forecast is 0.2 percentage stronger in each year relative to the October WEO forecast.

- Inflation in sub-Saharan Africa is projected to moderate slightly in 2018 and 2019 but is expected to remain in double digits in key large economies, reflecting supply factors, and assumed monetary policy accommodation to support fiscal policy in Nigeria.

| Select South Saharan Economies | ||||||

| Countries | Interest Rate | Inflation Rate (%) | Unemployment Rate (%) | GDP Growth Rates (%) 2017 | Income per Capita ($) | Minimum wage ($/month) |

| Ghana | 18 | 10.3 | 5.77 | 8.5 | 1,707.70 | 57 |

| Kenya | 9.5 | 4.18 | 11 | 4.4 (Q3, 2017 | 1,143.10 | 69 |

| South Africa | 6.5 | 4.00 | 26.7 | 1.5 (Q4 2017) | 7,504.3 | 206 |

| Angola | 18 | 21.47 | 6.2 | 0.94 | 3,606.60 | 68.43 |

| Nigeria | 14 | 12.48 | 18.8 | 0.83 | 2,457.8 | 50 |

Business Implication:

- Oil price crosses a 3-year high of $75pb, Nigeria’s production remains solid at 1.8mbpd. The geopolitical tension in Iran is creating oil jitters as LNG price also inched up to $2.76/mmbtn.

- Nigeria’s other major export is at an 18month high of $2,890/mt. External accounts are looking good with $3.85bn per month of oil revenue and reinforced by $5.14bn inflow into the Investors’ & Exporters’ FX Window. Naira traded flat in the parallel market atN362/$.

- External Reserves accretion has built up to $47.93bn, providing 13.16months cover for imports and payments, which could shield the economy from any sharp outflows of hot money.

- CBN (Manufacturing) Purchasing Managers’ Index (PMI) increased from 56.7 in March to 56.9 in April 2018, and expectation was that it would improve better in May, to be driven by the passage of the National Budget coupled with robust trading activity, consumer demand and improved FX liquidity.

- Dwindling purchasing power, high-interest rates, budget delays and squabbles are now taking their toll.

- Inflation rate eased for the 15th straight month in April, moving closer to the CBN’s target and expanding room for monetary-policy makers to consider trimming their key interest rate. Consumer-price growth slowed to 12.48%(this is 0.86% point less than the rate recorded in March 2018 (13.34%). That’s the lowest rate since March 2016.

CONCLUSIONS

- We believe that the Monetary Policy Committee (MPC) would still err on the side of caution as future inflation pressures may come from higher food costs in the wake of worsening insecurity that has disrupted production and supply. Price pressures could increase through higher State spending on this year’s budget, which was just recently passed, awaiting the President’s assent, and before elections in February 2019.

- About 30 percent of proposed expenditure is the investment in roads, rail, ports, and power to help boost economic growth, which the International Monetary Fund forecast at 2.1 percent this year. The expansion was less than 1 percent last year.

- With the launch of the National Food Security Council, aimed at developing sustainable solutions to herdsmen crisis amongst others, we envisaged that the Council would develop pragmatic approaches that will help in restoring peace in the Middle Belt in the coming months. We also envisage that food inflation will edge higher in May 2018, following the commencement of the Islamic fasting season (Ramadan) and planting season would lead to an accentuation in inflationary pressures.

An Overview of Companies and Allied Act (CAMA) Bill (Repeal and Re-Enactment)

The Companies and Allied Matters Decree No. 1 of 1990 was promulgated to repeal the Companies Act of 1968. Since its promulgation into law, the now Companies and Allied Matters Act, Cap. C20, Laws of the Federation of Nigeria, 2004 (the Act) is over twenty (20) years with minimal amendments during the period.

It became apparent that the entire Nigerian corporate landscape was heavily hamstrung by several provisions in the Act, which have been described as impeeding modern business practices in the light of national and global reforms; particularly as legislation, which set up most of the peer regulators have since been amended on different occasions. It has, therefore, been determined that the provisions of the Act are not in tandem with global trends and that same requires extensive amendments to make the Act more contemporary and relevant.

The Act is one of the most critical pieces of legislation which impacts the Nigerian business climate, especially the Micro, Small and Medium Scale Enterprises (MSMEs). It also directly affects the influx of Foreign Direct Investment (FDI) into Nigeria because of its relevance to ease of doing business and ease of investing in Nigeria.

The Bill reflects several key provisions, which are discussed below:

Single Member Companies

By this Bill, provisions which make it possible for a single person to form a private company is being introduced for the first time in Nigeria. This provision is consistent with what is obtainable in several other progressive economies such as the United Kingdom, India, and Singapore.

Limited Liability Partnerships

From a careful review of the provisions of the Bill, a new form of the legal entity known as Limited Liability Partnerships was formed. The essential feature of a Limited Liability Partnership is that it combines the organizational flexibility and tax status of a partnership with limited liability for its members.

Financial Assistance

Companies will now be permitted to provide financial assistance to their shareholders under the new Bill. The current position is that a company and its subsidiaries are prohibited from giving gifts, loans, indemnities, credit or other assistance, for the purpose of aiding a person to purchase the company’s shares, where such financial assistance would result in a reduction in the net assets of the company or result in the company having no assets. The proposed Bill reflects a market-friendly advancement from the current position. It also improves companies’ chances of attracting much-needed investment, since there are now provisions in the Bill which enable shareholders/potential shareholders to have access to funds, which in turn enables them to invest in such companies.

Reduction in Share Capital

In order to ease the process of doing business, amendments have been proposed in the Bill to the process by which a company can reduce its share capital, by enabling private companies to reduce share capital of such companies if a special resolution to that effect is passed, without the added burden of applying to court for a confirmation of the reduction.

Resolving Insolvency

The Bill introduces a company rescue and insolvency legal regime, which is not focused on a company’s demise, but on rescuing companies from insolvency through the inclusion of an insolvency framework. An effective insolvency regime in Nigeria have a dual aim: to save viable businesses, and to ensure that non-viable businesses can quickly exit the market, allowing deployment of assets to more productive firms. It will see to the following benefits: lower costs of credit; increased access and availability of credit; improved creditor recovery; strengthened job preservation through reorganization and business rescue; promotion of entrepreneurship; and other benefits for small businesses.

This, in turn, improves and increases overall economic stability in the country. The insolvency provisions will border on:

- Administration – which serves as a rescue mechanism for insolvent entities and allow such entities to carry on running their businesses. One of the main advantages of this model is that the administrator is appointed to act in the interest of the company and not, as in the case of the receivership, in the interest of the person that appointed him;

- Netting Provisions – which are geared towards addressing provisions contained in the insolvency provisions in the Bill; and

- Corporate Voluntary Arrangements – which is a procedure which allows a company to settle debts by paying only a proportion of the amount that it owes to creditors and also allows a company to come to some other arrangement with its creditors over the payment of its debts.

Company Secretary

The Bill is seeking to further ease the regulatory burden of companies by making provisions which limit the requirements to appoint a Company Secretary to public companies, thereby making it optional for small companies and companies with one shareholder.

Annual General Meeting

Pursuant to the provisions of the Bill, small companies would no longer be mandatorily required to convene and hold Annual General Meetings.

Minority Shareholder Rights

The Bill is geared towards enhancing minority shareholder rights. It proposes to regulate related-party transactions and shareholders access to judicial redress. It also protects the shareholders’ rights in corporate governance as a proxy for Nigeria’s overall corporate governance standards and ease of access to financing from capital markets. Shareholders to bring actions both in respect of a company and any of its subsidiary companies and other companies related to the parent company.

Beneficial Ownership

The Bill has provisions which mandate the disclosure of beneficial interests in a company’s shares and prescribes punitive measures for failing to disclose such interests. In this regard, where a person holds interests on behalf of another in a nominal capacity in a company, both parties (the owner and the nominal holder) are required to disclose the beneficial interests to the company in question.

Exemption from Audit

The Bill has provisions which exempt small companies from appointing auditors. Specifically, the Bill exempts a company from appointing auditors: (i) if it has not carried on business since its incorporation; or in a particular financial year; and (ii) where the company’s turnover is not more than N10m and its balance sheet total is not more than N5m.

Economic Impact Of The Provisions Of The Bill

The introduction of new provisions in the Act would greatly improve ease of doing business and generally enhance the business climate in Nigeria. Some of the economic benefits to be realized by Nigeria if the proposed amendments are passed into law include the following:

Ensure more business-friendly regulation for Micro, Small and Medium Enterprises: It has been determined from a collaborative survey by the Nigerian Bureau of Statistics (NBS) and the Small & Medium Enterprises Development Agency of Nigeria (SMEDAN) that the Act is currently designed to regulate mostly larger type companies and that the provisions of the Act imposes unnecessary costs on smaller type companies. According to the said survey, there are over 37 million MSMEs in Nigeria, which contributes almost 50% of the Gross Domestic Product in nominal terms and account for 84.02% of all Nigerian jobs. By making the provisions of the Act friendlier to MSMEs, the amendments to the Act have the potential to increase activities of MSMEs, thereby growing the Nigerian economy in the process.

Fewer reporting obligations for small companies: Another impact of the Act is to reduce the financial reporting obligations of small companies. Such companies, as stated above will be exempt from the yearly audit process. This invariably means that cost is reduced and more money can be plowed back into the business for expansion. For the Nigerian economy, this translates to more jobs and a more stable economy.

Reduction in Time and Cost for Setting up a Company: The proposed amendments to the Act makes it more attractive for small businesses operating within the informal sector, which contributes about 64% to the Gross Domestic Product (GDP). These companies will be able to formalize their businesses by registering at the Corporate Affairs Commission. This has the potential of widening the tax base of the country and invariably increase revenue earned from taxation of corporate entities.

Promotion of Financial Stability: The introduction of model netting provisions in the Bill as a means of mitigating credit risks associated with over the counter derivatives promotes financial stability and investor confidence in the Nigerian Financial Sector. The proposed provisions also minimize risks associated with the performance of certain large financial institutions, thereby making the financial positions of Nigerian financial institutions more secure.

Increasing Investor Confidence in the Nigerian Financial Sector as well as all sectors of the economy: Investor confidence in the Nigerian financial sector and indeed, all sectors of the economy is expected to significantly improve, due to a competitive and business-friendly environment where companies are regulated in line with global best practice.

CONCLUSION

Nigeria’s legal framework for undertaking business in the country must reflect the challenges of modern markets in which business and investment decisions are increasingly determined by global conditions. This increasingly global market place should incorporate regulatory conditions which are modeled around international best practice.

The proposed amendments to the Act would have the overall effect of making Nigerian Company Law more fit for today’s business realities, improve the business environment and performance across the Nigerian economy as a whole, as well as reduce direct compliance costs for businesses in Nigeria.

Culled from—Proshare

Law Report Review / Legal Opinion: Judgment of the National Industrial Court: When an Action is Statute-Barred

Alhaji Summonu Adetunji Omole vs. Nigeria National Petroleum Corporation & 1 Or Unreported Suit No. NICN/LA/820/2016

FACTS

The claimant filed the suit by way of a complaint dated and filed on 28th December 2016. By the statement of claim, the claimant claimed against the defendants jointly and severally for:

- That the purported letter of termination of the claimant’s appointment as Security Officer Grade II and as a pensionable staff of the Nigerian National Petroleum Corporation and the contemporaneous contract appointment offered to the plaintiff by the 1st defendant both letters dated the 4th day of December 1988 are ultra vires, unconstitutional, null and void.

- That the claimant’s appointment as a permanent and pensionable staff of the 1st and 2nd defendants from or about 15th July 1979 still subsists and is valid with all the attached rights, salaries obligation and privilege unimpaired until he attains the statutory age of 60 years and for a specific order restoring the claimant thereto.

- That the purported termination of the contract appointment of the claimant if ever there was one, by the 2nd defendant’s letter dated 14th of March, 1990 is ultra vires, unconstitutional, illegal, null and void and of no effect and for a specific order restoring the claimant thereto.

- That the purported termination of the pensionable appointment of the claimant by the 1st defendant is wrongful and amount to wrongful dismissal being in breach of the rules of natural justice and also contrary to civil service rules and 1999 Constitution, the claimant being a public officer.

ALTERNATIVELY

- An order for the payment of (N100,118,546.40) One Hundred Million, One Hundred and Eighteen Thousand, Five Hundred and Forty-Six Naira and Forty Kobo to the claimant by the defendants jointly and severally as special and general damages suffered by the claimant and in consequence of the wrongful dismissal or wrongful termination, whichever is applicable.

The defendants entered a formal appearance, filed their defence processes and then filed a preliminary objection praying that the suit is dismissed. The grounds upon which the preliminary objection was based are: the suit was statute-barred; and the claimant did not comply with the statutory provisions requiring the issuance of a pre-action notice, thus rendering the suit incompetent.

Case for the Defendants

On whether the suit was statute-barred, the defendants referred to section 12(1) of the NNPC Act Cap 320 LFN 1990 which provides 12 months as the limitation period within which suits against NNPC can be brought. That from the originating processes, the claimant indicated that he was wrongfully disengaged from the employment of the defendants on 4th December 1986 and on same date issued with a contemporaneous contract appointment. That by implication, the cause of action arose in December 1986; and since the instant suit was filed on 28th December 2016, a clear 30 years after the cause of action arose, the suit must be statute-barred. The defendants referred to number of case law authorities: Egbe v. Adefarasin [1987] 1 NWLR (Pt. 47) 1, Madukola v. Nkemdilim [1962] 2 SCNLR 341, Tukur v. Governor of Gongola State [1987] 4 NWLR (Pt. 117) 517, Jeric (Nig) Ltd v. UBN Plc [2000] 12 SC (Pt. II) 133 and Sandra v. Kukawa Local Government [1991] 2 NWLR (Pt. 179) 379.

On the issue of pre-action notice, the defendants referred to section 12(2) of the NNPC Act, which enjoins a pre-action notice of one month to the NNPC before a suit can be commenced against it. There was no evidence in the claimant’s processes before this Court showing compliance with the pre-action notice requirement of section 12(2) of the NNPC Act; neither was a copy filed in Court in line with Order 3 Rule 23(1) of the NICN Rules 2017. The defendants relied on a number of cases: Dominic E. Ntiero v. NPA [2008] LPELR-SC.39/2001, Barclays Bank Ltd v. CBN [1976] 6 SC 175 and Eze v. Ikechukwu [2002] 18 NWLR (Pt. 799) 348. The defendants concluded by urging that the suit be struck out or dismissed.

Case for the Claimant

The claimant reacted by filling a counter-affidavit and a written address. The claimant submitted a sole issue for determination: whether this suit can be statute-barred having complied with the section 12(1) of the NNPC and when the cause of action arose in 1990 and the claimant instituted action at the Lagos High Court, which was one of the courts constituted to entertain such a matter. To the claimant, the case of action arose on 14th March 1990 when the defendants terminated the claimant’s appointment in 1990. The claimant’s counsel gave a pre-action notice to the defendants before suing at the Lagos High Court as per Suit No. LD/1476/90 – which pre-action notice was sufficient for the instant suit. Secondly, that since the Constitution was made to operate prospectively; the claimant had to commence the instant suit in this Court as held in Aremo II v. Adekanye [2004] 13 NWLR (Pt. 891) 572 ratio 2. For these reasons, the claimant concluded by urging that the preliminary objection of the defendants be discountenanced and the claimant allowed to proceed with the trial of this suit.

JUDGMENT

The Court held that the claimants’ case succeeds in terms of the following declarations and orders:

- In determining whether a matter is statute-barred, courts are called upon to ascertain what the cause of action is, when it arose and when the suit was filed. If the period between the date the suit was filed and when the cause of action arose is more than the limitation period, the matter is said to be statute-barred. From the processes filed, the court found and held that the suit was statute-barred.

- The claimant argued that he first filed an action at the Lagos High Court (Suit No. LD/1476/90) before filing the suit. Although he brought in this argument in terms of his submission that the pre-action notice he served for purposes of the Lagos High Court Suit should suffice for purposes of the instant suit, in his oral adumbration of his written address, the claimant’s counsel suggested that (and this is the context in which his written submission about the Constitution having prospective effect was made) he had to file the instant suit because the Third Alteration to the Constitution divested the Lagos High Court of jurisdiction in Suit No. LD/1476/90, and the Lagos High Court had no power to transfer the case to this Court. This argument must fail since Echelunkwo John & 90 ors v. Igbo-Etiti LGA [2013] 7 NWLR (Pt. 1352) 1 at 14 – 17 held that State High Courts have the power to transfer labour/employment cases pending before them to the National Industrial Court. The argument of the claimant in opposition to the preliminary objection was lame and unconvincing and so must fail.

- In the whole, the court found and held that the suit was statute-barred; and on this ground alone the case was liable to be dismissed. See NPA Plc v. Lotus Plastics Ltd [2005] 19 NWLR (Pt. 959) 158, which held that where a Court makes the finding that a matter is statute-barred, the proper order to make is one of dismissal.

- The preliminary objections of the defendants succeed. The suit was accordingly dismissed.

OPINION

Parties are expected to comply with certain requirements (Facts and Law) before instituting an action in Law. The preliminary objection was decided based on a mixture of Law and Facts.

PICTORIAL: The Executives and Governing Council Members of National Institute of Marketing of Nigeria were at NECA House, on a Courtesy visit, on 3rd May 2018.

Second row: (Left)Mr. Tony Agenmonmen, President, NIMN (middle) Mr. Olusegun Oshinowo, DG, NECA

https://news.neca.org.ng/index.php/2018/05/27/press-release-encomiums-as-corporate-nigeria-honours-abebe/

https://news.neca.org.ng/index.php/2018/05/27/upcoming-event/

Recent Comments