Business Essentials July 2018 Edition

Dear Esteemed Member,

The outlook for 2018 remains challenging, as private sector lending remains low and foreign exchange inflows are mostly short-term. Since the national budget has a tremendous impact on all facets of the economy, including the Private Sector, our focus in this edition of your publication was a review of the Approved 2018 Federal Budget and its implication on Businesses.

We shared the pictorial view of events at NECA’s 61st Annual General Meeting / Interactive Session with Executive Chairman, FIRS. Also of importance in this edition, is a tax review article on rulings of the Federal High Court on taxability of export proceeds and matters arising on penalty and interest for tax default.

Our regular Law Report Review, Upcoming Learning & Development programmes and other activities at the Secretariat were not left out.

Have a pleasant reading.

Timothy Olawale

Editor

In this Issue:

- Review of the 2018 Federal Budget and Implication for Business

- PICTORIAL: NECA 2018 Annual General Meeting/ Interactive Session with Executive Chairman FIRS, Mr. Babatunde Fowler, Held on 17th July 2018.

- Federal High Court Rules on Taxability of Export Proceeds

- Penalty And Interest For Tax Default: Matters Arising

- Law Report Review / Legal Opinion: Judgment of the National Industrial Court: When an Action is Statute-Barred

- Upcoming Meetings of various Technical Committees

Review of the 2018 Federal Budget and Implication for Business

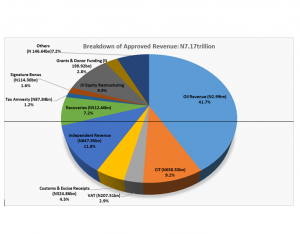

| Fiscal Items | 2018 Approved Budget | 2017 Approved Budget |

| Oil Production | 2.3mbpd | 2.20mbpd |

| Oil Price | $51/b | $44.5 |

| Exchange Rate | N 305/$ | N 305/$ |

| Inflation Rate | 12.42% | 15.74% |

| Nominal GDP | N 113.09trillion | N 107.96trillion |

| GDP Growth Rate | 3.5% | 1.5% |

| Revenue | N7.165 trillion | N 5.084 trillion |

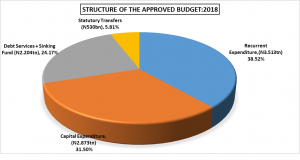

| Expenditure | N9.120 trillion | N 7.441 trillion |

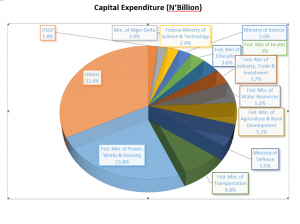

| – Capital Expenditure | ₦2.9 trillion | ₦2.2 trillion |

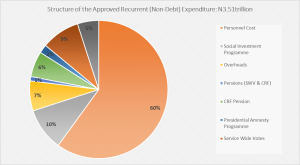

| – Recurrent Expenditure | ₦3.5 trillion | ₦3.0 trillion |

| – Statutory Transfer | ₦0.5 trillion | ₦0.4 trillion |

| – Debt service | ₦2.2 trillion | ₦1.8 trillion |

| Budget Deficit | (N1.950trillion) | (N2.356trillion) |

Capital Expenditure (N’Billion)

- It has become a regular trend over the years, most especially during the democratic dispensation, the continuous delay in passage of the National budget, which demonstrates lack of seriousness as a nation. We support the amendment of the Constitution to make budget passage a Constitutional issue. Non-passage of the budget by 31st December of every year should be equated to treason. National interest should over-ride partisan or political interests when it comes to the passage of the national budget.

- President Muhammadu Buhari signed the 2018 Budget of N9.12trillion 2018 into law on 20 June 2018, which was 22.6% higher than 2017 Approved budget. The signed 2018 budget came with a deficit of N1.95trn and net borrowing of N1.64trn. We expect that the budget deficit financing activities of the FGN may lead to an increase in yields in the domestic market from current levels. Corporates and governments may soon start borrowing at higher interest rates from the domestic market.

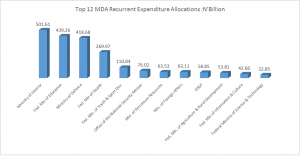

- A frightening trend is the quantum of Government’s recurrent expenditure. The 2018 budget shows that government’s recurrent expenditure as a percentage of total federal government expenditure stands at a staggering 68.50%, an increase from 68.27% in 2017. We do not think this is a healthy expenditure pattern; a clear indication that government is yet to accord the issue of infrastructural improvement the importance it deserves through adequate fiscal support.

We are very worried that for the third consecutive year, the cost of debt servicing keeps rising. In the last three years, the government had a budget of about N18.012trillion (2015: N4.493trilllion, 2016: N6.077trillion and 2017: N7.441trillion); of which debt service alone took an average of 23.71%, more than one-fifth – N18.012trillion, leaving N13.741 trillion for recurrent and capital expenditures.

The 2018 Budget shows that the domestic debt stood at N15.96trn, accounting for 70.28% of the total public debt, while the external debt stood at N6.75trn, accounting for 29.72% of the total public debt. The ratio of external debt to total debt at 29.72% is lower than the target of 40%. Meanwhile, the revenue of N813bn from the Federation Account Allocation Committee (FAAC) to the FGN in Q1 2018 was the highest in two years. It further shows that the ratio of domestic interest payment to the FGN revenue from the FAAC stood at 79% as at Q1 2018. The average in the last two years is 60%. This current rate is very high and unsustainable. We believe that measures to grow non-oil revenue will help to achieve and sustain a comfortable debt service to revenue ratio below 30%.

Specifically, the cost of servicing Nigeria’s debts on both the domestic and external fronts has risen, in contrast to the revenue earned by the government. The bigger concern is the possible unsustainability of such debt servicing.

Implications:

- Based on certain parameters in the budget, it is evident that the 2018 budget is centered on the reinforcement of the gains of the 2017 budget, which was aimed at reducing the country’s dependence on oil revenue and imports. It is projected that by shifting the country’s dependence to non-oil revenue, Nigeria’s economy will be steered to the path of steady growth.

To achieve this, the Government planned to:

- Develop infrastructure

- Increase investments in agriculture to attain food security and reduce importation

- Identify alternative means of funding new projects by continuing to pursue public private partnership

- Increase power generation with the Government’s focus on alternative sources of energy, thereby ending the nation’s longstanding dependence on oil revenues

Conclusions:

- Development is a function of investment. The present quantum of recurrent expenditure cannot drive development or national growth. We solicit for a conscientious effort at progressively reducing the recurrent expenditure profile to less than a quarter of the national budget.

- Though our debt level as a percentage of the GDP seems in order, we consider the debt to revenue ratio unhealthy and unsustainable. We, therefore, advise government to tame its appetite for more leverage. In fact, the World Bank in its recent Global Economic Prospects Report had noted with dismay that the current optimism over Nigeria’s economic recovery is tempered by concerns over huge debt servicing obligations and continuous foreign exchange controls.

- While we encourage efforts to improve non-oil revenue generation as the most realistic way to reduce the debt service/revenue ratio, as articulated in the Economic Recovery Growth Plan (ERGP), we, however, caution government not to raise revenue by increasing the tax rate for organised businesses and the working class. Alternatively, more people should be brought into the tax net by expanding the base. Nigeria’s tax to GDP ratio, which currently stands at 6 percent, is one of the lowest in the world and inconsistent with the goal of having a diversified, sustainable and inclusive economy. At least 15 percent of tax to GDP ratio is required to achieve sustained growth.

- We believe that the deregulation of the downstream oil sector portends a greater good for the country in the long run. Recent events have shown that the fuel subsidy regime is not sustainable, neither is it responsible. It is, in fact, bedevilled by high level of corruption. We request Government to do the responsible thing of deregulating the sector and enshrine transparency and competitiveness.

- As the country’s revenue challenges continues despite the relatively high crude oil price. This is reflected in the high ratio of debt to total revenue notwithstanding the low debt to GDP ratio. It is expected that there will be a supplementary budget to cater for other significant expenses such as fuel price subsidy, possible increase in minimum wage and spending by the Independent National Electoral Commission for the 2019 elections. These could result in more borrowing and increased pressure for tax revenue.

https://news.neca.org.ng/index.php/2018/07/30/2018-annual-general-meeting-interactive-session-with-executive-chairman-firs-mr-babatunde-fowler-held-on-17th-july-2018/

Federal High Court Rules on Taxability of Export Proceeds

Summary

On 4 May 2018, the Federal High Court (FHC) held that dividends distributed from export proceeds is liable to excess dividend tax, in the case between Olokun Pisces Limited (OPL or the Company) vs Federal Inland Revenue Service (FIRS). The basis of the FHC’s decision was that the Company failed to provide sufficient evidence to demonstrate that the dividends subjected to tax were paid out of export proceeds which is tax-exempt as prescribed under Section 23(1)(q) of the Companies Income Tax (CIT) Act.

Details

In 2013, the FIRS carried out a tax audit exercise on OPL in respect of its 2009 to 2012 years of assessment and found that the Company paid dividends to its shareholders although it had no total profits for the period. Thus, the FIRS, relying on the provisions of Section 19 of the CIT Act, raised an additional CIT liability of about N147 million on OPL. Section 19 of the CIT Act provides that dividends distributed by a company where it has no total profit or distributes dividends in excess of its total profits will be deemed as the total profits for the relevant tax year and subjected to CIT accordingly.

OPL challenged the additional assessment at the Tax Appeal Tribunal (Tribunal). However, the Tribunal ruled in favour of the FIRS. Dissatisfied with the ruling, OPL appealed to the Federal High Court.

OPL argued that the income from which the dividends were paid was exempt from tax under Section 23(1)(q) of the CIT Act. Section 23(1)(q) exempts the profits of any Nigerian company in respect of proceeds from export, provided that such proceeds are repatriated to Nigeria and are used exclusively for the purchase of raw materials, plant, equipment and spare parts.

The crux of the issues before the court was whether OPL had sufficiently proved that the said profits were exempt from tax under Section 23(1)(q) of the CIT Act. The FHC ruled in favour of the FIRS on the basis that OPL failed to adduce sufficient evidence to discharge the burden of proof for the purported exemption. Specifically, the FHC stated that OPL failed to prove that the said export proceeds were actually repatriated and used exclusively for the purchase of raw materials, plant, equipment and spare parts. Hence, the dividends paid out of the export proceeds was declared subject to tax under Section 19 CIT Act.

Implication

This FHC’s Judgment implies that dividends paid from export proceeds may be exempted from excess dividend tax. This suggests that companies with tax-exempt profits may now explore the argument against the taxation of dividends declared from such profits to the extent that the company paying dividends is able to prove that the profits from which the dividends is paid is tax-exempt. This deviates from the FHC’s position in its most recent ruling on the excess dividend tax case between Oando Plc and the FIRS (FHC//L/6A/2014) in which the Court ruled that Section 19 of the CIT Act has no regard for the source of dividend that will be deemed as total profits under that Section.

It is important to note that part of the Federal Executive Council’s approved tax reforms is an amendment of Section 19 of the CIT Act which aims to exclude dividends paid from already taxed retained earnings, exempt profits and franked investment income from excess dividend tax. We hope that the amendments will be speedily passed into law in order to address the issue of the applicability of Section 19 of the CIT Act.

PENALTY AND INTEREST FOR TAX DEFAULT: MATTERS ARISING

One of the easy means deployed by tax and regulatory authorities to remediate default is the imposition of penalty and interest on unremitted taxes or levies as stipulated by relevant laws. Needless to say, penalties are sacrosanct for defaults such as failure to send a tax return or pay tax liabilities as and when due even in developed economies such as the United Kingdom and the United States of America.

Timeline For Application Of Penalty And Interest

The Nigerian Tax Acts are replete with various provisions that support the imposition of penalty and interest for varying tax defaults. Amongst several other sections, the Personal Income Tax Act (PITA, Sections 74, 76, 77, 94 to 97); the Companies Income Tax Act (CITA, Sections 82, 92, 94 and 95); the Petroleum Profits Tax Act (PPTA, Sections 46, 51 to 55); the Federal Inland Revenue Service (Establishment) Act (FIRSA, Sections 40 to 49); and the Value Added Tax Act (VAT Act, Sections 25 to 37) contain provisions on one form of tax penalty or the other for differing tax defaults.

However, one controversial issue with the application of penalty and interest is when they should begin to apply to overdue tax payments. While the revenue authorities typically compute penalty and interest when issuing assessment notices for audit assessments and overdue tax payments, the relevant tax laws contain provisions that suggest that penalty and interest would only apply to overdue tax payments after the liabilities are deemed final and conclusive. The latter position is also supported by case law as detailed below.

In a Tax Appeal Tribunal (TAT) case between Weatherford Services S.D.E.R.L and the Federal Inland Revenue Service (FIRS), the FIRS had imposed penalty and interest on additional CIT assessments arising from a tax audit. However, the TAT ruled that penalty and interest on overdue tax should only start to run when the taxpayer does not object or appeal within two months, as provided under the CITA.

Culled—Andersen Tax (Tax Alert)

LEGAL OPINION: AN EMPLOYER CANNOT BE COMPELLED TO DECLARE REDUNDANCY

Mr Suraju Rufai (suing for and on behalf of all staff of VON Automobiles Nigeria Limited) vs. Bureau of Public Enterprises & 2 Ors, unreported Suit No: NICN/LA/18/2013 –

FACTS

- This case was transferred from the Federal High Court to the National Industrial Court; and was filed by the claimant for and on behalf of all staff of VON Automobiles Ltd. The claimant had in 2013 filed the action seeking the following reliefs:

- A declaration that the claimant and all other staff affected in this action are entitled to their gratuity and severance package as a result of the termination of their employment by privatization.

- A declaration that the defendants are entitled to pay every existing staff of the claimant 200% of their total gratuity benefit and severance package.

- The claimant’s salary for six months in lieu of notice.

- The claimant’s salary for short payment of 40 months which represents the claimant’s salary based on the calculation of Bureau of Public Enterprises official on the 2nd June 2008.

- The claimant’s salary for the overtime performed by the staff.

- Payment for staff unutilized annual leave for 2006, 2007 and 2008.

- The sum of N2,152,213.64 representing staff NSITF.

- The sum of N1,438,988 representing staff pension.

- The sum of N1,833,251.26 representing staff Tax Payee which was deducted from staff salaries.

- The Defendants entered an appearance and filed their Statements of Defence to the claim.

- At the trial, the claimant called two witnesses and the frontloaded documents were admitted. However, it was not dated, not signed and the source was unknown. The 2nd defendant’s frontloaded documents were admitted. The 1st and 2nd defendants were not in Court to cross-examine the 3rd defendant’s witness and so were foreclosed and the court ordered for written addresses.

A Case for the Claimant:

- The case for the claimant was that the claimant, Mr. Suraju Rufai, has the authority to represent all the staff (51 in all) of Volkswagen Nigeria both senior and junior staff of Volkswagen of Nigeria who has been listed in the documents tendered. To the claimant, Volkswagen of Nigeria employed their employees under various terms and conditions stated in the collective agreements.

- Volkswagen of Nigeria was privatized by the 1st defendant and handed over to the 2nd defendant in April 2009. The said 2nd defendant withheld staff salaries and owed the staff as a result of which the staff were disillusioned and the staff mandated their representatives to write the letters.

- That despite the letters, the 2nd defendant remained adamant and neither complied nor replied to the letters. However, the parties eventually reached an agreement on the severance package for the staff in 2008 but the 2nd defendant reneged on the agreed date of payment which was June 2008 and eventually paid the staff in February 2009.

- That between June 2008 and February 2009 staff were not paid their salaries. Eventually when payment was made the defendants did not follow the agreement/computations of 2008 but short paid the staff. The situation was conveyed to the 2nd defendant during the handing over.

- Due to the refusal of the 2nd defendant to pay the staff gratuity benefits, they caused their lawyer to write the 1st and 2nd defendants; and when there was no response from the defendant, the claimant filed this suit.

A Case for the Defendants

- To the 1st defendant, pursuant to the Shares Sales Agreement the 35% shares in VON were sold to the 2nd defendant who subsequently took over the company in July 2006. The shares were sold and the 2nd defendant was to take over all the liabilities of these shares.

- The 1st defendant’s position was thus that the issue of staff employment and remuneration was the responsibility of the 2nd and 3rd defendants. The 1st defendant, however, acknowledged it witnessed the payment of severance packages to staff.

- The 1st defendant continued that as an agency of the Federal Government saddled with responsibility of the Federal Government’s privatization drive, it only sold the Federal Government of Nigeria’s 35% shares in the 3rd defendant to the 2nd defendant; it did not do more than that. Accordingly, that the claimant has no cause of action against it.

- The 2nd defendant’s position was that the claimant and staff voluntarily retired from service and that it merely bought only the 35% shares sold by the BPE but did not take over all the outstanding liabilities of the 3rd defendant.

- That the 3rd defendant’s liabilities are limited by the amount unpaid on those shares. That the employees resigned voluntarily by a letter dated 16th August 2007. The 2nd defendant went on that it never dealt with the employees, who in any case were the responsibility of the 3rd defendant.

- That the employees were paid their entitlements and the 2nd defendant provided the funds for payment of the entitlements. The 2nd defendant admitted that some of the employees had their entitlements erroneously computed but those affected had been properly paid.

- That the 2nd defendant is only a shareholder of the 3rd defendant and not the successor of the 3rd defendant.

- To the 3rd defendant, each of its staff was employed under distinct and separate terms and conditions of employment.

- That the 3rd defendant was privatized by the 1st defendant and the Federal Government of Nigeria transferred its 35% interest in the 3rd defendant to the purchasers. That after the said sale of the shareholding interest of the Federal Government of Nigeria in the 3rd defendant, the 2nd defendant who represented the investors held a meeting with the former Management of the 3rd defendant on 5th July 2007 and informed them of the intention of the new Management of the 3rd defendant to retain all staff.

- However, that the claimant and other former staff of the 3rd defendant rejected the overture of the 2nd defendant and indicated their intention to disengage their services from the 3rd defendant. The 3rd defendant then denied that the employment of the claimant and other former employees of the 3rd defendant were terminated by the 3rd defendant.

- That upon the resolve of the claimant and other staff of the 3rd defendant to disengage from the employment of the 3rd defendant, the 2nd defendant, acting on behalf of the 3rd defendant engaged in discussion and negotiations with the representatives of the Staff towards payment of their salaries and entitlement.

- That the just and appropriate entitlements of the claimant and other former staff of the 3rd defendant were paid to them based on the mutual understanding between the parties. Accordingly, that the claimant and other former staff of the 3rd defendant who disengaged their services were not entitled to salaries for the months of February to April 2009 as they were paid their entitlements and salaries up to January 2009 and were not entitled to any further payment.

- That the claimant and other former staff of the 3rd defendant voluntarily disengaged their services and were not entitled to six months salary or any other sum at all.

- That the claimant and other staff of the 3rd defendant did not perform overtime and were not entitled to payment for overtime.

- That the claimant and other former staff of the 3rd defendant have been paid their NSITF and pension contributions and were not entitled any further payments in respect of any contributions, howsoever described.

ISSUES FOR DETERMINATION

- Whether the claimant’s case was properly constituted against the 3rd defendant in the circumstances of this case.

- Whether considering the facts and circumstances of this case, the claimants have discharged the requisite burden of proof to justify their claim against the 3rd defendant.

- Whether the claimant was entitled to any of the reliefs sought against the 3rd defendant.

JUDGMENT

The Court considered the processes filed and the submissions of counsel, and dismissed the case. It, however, held as follows:

- The law is that an unsigned and an undated document have no evidential value. See Global Soaps & Detergent Ind. Ltd v. NAFDAC [2011] All FWLR (Pt. 599) 1025 at 1047 and Udo & ors v. Essien & ors [2014] LPELR-22684(CA). Accordingly, the unsigned and undated documents had no evidential value and were discountenanced.

- By the Supreme Court decision in Gabriel Ativie v. Kabelmetal (Nig.) Ltd [2008] LPELR-591(SC); [2008] 10 NWLR (Pt. 1095) 399; [2008] 5 – 6 SC (Pt. II) 47, a claimant’s case would necessary be circumscribed by the reliefs. What this means is that the claimant’s pleadings must support the reliefs prayed for. This was not done in the matter. It was made worse by the fact that in making monetary claims, no specific pleadings as to the monetary sums were made by the claimant both in terms of the instrument entitling the claimant and how he came by the quantum of the sums he claimed. This was aside from the very illogicality of suing in a representative capacity. The case of NNPC v. Clifco Nigeria Ltd [2011] LPELR-2022(SC) enjoins that special damages are never inferred, they are exceptional and so must be claimed specially and proved strictly.

- In labour relations, the burden is on the claimant who claims monetary sums to prove not only the entitlement to the sums, but how he/she came by the quantum of the sums; and proof of entitlement is often by reference to an instrument or document that grants it ( Mohammed Dungus & ors v. ENL Consortium Ltd [2015] 60 NLLR (Pt. 208) 39), not the oral testimony of the claimant except if corroborated by some other credible evidence.

- In Mohammed Dungus & ors v. ENL Consortium Ltd [2015] 60 NLLR (Pt. 208) 39, this Court was quite specific that a claimant who makes no attempt whatsoever to indicate to the Court the exact provisions of the documents they frontloaded that grants them the entitlements they claim, merely frontloading same and saying that a right inures from it without indicating the clause, section, article or paragraph that grants the right is bound to fail; and counsel should not expect that it is the Court that will shop for the relevant article that substantiates the claim of his/her client.

- A claim for backlog of salaries cannot be entertained when the actual salary of the claimant(s) was not pleaded, as in the instant case. And by Honika Sawmill (Nig.) Ltd v. Holf [1992] 4 NWLR (Pt. 238) 673 CA, as between an employer and an employee, the onus is on the employee to prove that the employer employed him on a stipulated salary and that he worked for the employer during the relevant period before the duty devolves on the employer to prove not only that he paid the employee his salary for work done by the employee in the relevant period but also how much the salary that he paid the employee was.

- The claimant alluded to constructive dismissal. However, the case of the claimant, at least from his pleadings, is not one of constructive dismissal as this line of argument seems to suggest.

- The claimant placed a good deal of reliance on a document, which he referred to as a collective agreement. It is in fact, the senior staff handbook. Having to refer to it as a collective agreement means that the claimant does not even know what a collective agreement is. This aside, and for whatever it is worth, the claimant talked of a collective agreement without delineating as between the junior and senior staff that he represents, who the collective agreement binds and who it does not bind. The pleadings itself show that the claimant was a management staff of the 3rd defendant, meaning that the collective agreement cannot even apply to him unless he specifically pleaded and proved by concrete documentary evidence that he was a member of the trade union that negotiated and signed the collective agreement. See Mrs Bessie Udhedhe Ozughalu & anor v. Bureau Veritas Nigeria Limited unreported Suit No. NICN/LA/626/2014, the judgment of which was delivered on 20th March 2018, Aghata N. Onuorah v. Access Bank Plc [2015] 55 NLLR (Pt. 186) 17, Samson Kehinde Akindoyin v. UBN Plc [2015] 62 NLLR (Pt. 217) 259, Valentine Ikechukwu Chiazor v. Union Bank of Nigeria Plc unreported Suit No. NICN/LA/122/2014.

- The argument of the claimant that the defendants have a duty to declare a redundancy and thereafter follow the procedure outlined in the collective agreement, suggests a compulsion on the defendants to declare redundancy. An employer cannot be compelled to declare redundancy. That is a business decision it must make of its own volition. In any event, there is the point that reliefs – all relate to unpaid salaries and allowances. By Odinkenmere v. Bakolori (Nig.) Ltd [1995] 8 NWLR (Pt. 411) 52 CA, the question of payment of unpaid salaries and allowances are only relevant in cases of termination of appointment or dismissal but not in the case of redundancy. Additionally, by PAN v. Oje [1997] 11 NWLR (Pt. 530) 625 CA, redundancy benefits do not include gratuity benefits as the conditions applicable to redundancy are quite distinct from those applicable to retirement or other conventional mode of relieving an employee from active service, such as termination, resignation or dismissal. In other words, redundancy cannot be claimed simultaneously with gratuity.

- A look at the claimant’s reliefs e. the claims for six months in lieu of notice, short payment of 40 months representing the claimant’s salary based on the calculation of BPE official on 2nd June 2008 and overtime will show that they are personal to the claimant and not to all those he represents. How the claimant came by these entitlements and their quantum are not evident from the pleadings.

- In terms of the argument that the overtime the claimant and those he represents did was for essential/services dealing with security and engineering department staff, the pleadings do not even show who amongst the claimant and those he represents did what.

OPINION

- The state of the claimant’s pleadings did not support the claims of the claimant.

- An employer cannot be compelled to declare redundancy. That is a business decision it must make of its own volition.

Exceptional Customer Care & Zero Tolerance for Service Gaps

Date: 15 – 17 August 2018

Venue: NECA House, Alausa, Ikeja, Lagos

Time: 9:00am

Fee: Member: N115,500 Non-Member: 120,000

NECA Ibadan Geographical Group Meeting

Date: Thursday, 23rd August 2018

Venue: Vina International Limited Premises, Ibadan, Oyo State.

Time: 10:00am

52nd Advanced Course (Residential) on Human Resources Management and Labour/Employment Relations

Date: 17 – 21 September, 2018

Venue: Park Inn by Radisson, Abeokuta, Ogun State

Time: 9:00am

Fee: Member: N245,500 Non-Member: 250,000

Recent Comments