Business Essential Vol 3. No 10

Dear Esteemed Member,

As the high powered Presidential delegation returned from China and the post-summit euphoria subsides, Nigerians are struggling to understand one of the outcome of the engagement between the two nations: the currency swap transaction. The big question, therefore is that do people really understand what this means? Or is this another exercise that will end-up in a crisis of false expectations? We share our assumptions on the deal and its implication in this edition.

We also share a recent judgement of the Tax Appeal Tribunal (TAT) Lagos Division which held that a Nigerian company that receives services performed by a non-resident company should account for and pay Value Added Tax (VAT). You will recall that we had earlier shared a decision of the TAT Abuja division in Gazprom Oil and Gas v FIRS to the effect that non-resident companies not carrying on business in Nigeria are not required to register, charge nor include VAT on their invoices and that the Nigerian recipient company has no legal obligation to self-charge and remit the VAT.

Our regular Labour and Employment Review and upcoming Training Programmes in the month of April/May, 2016 were not left out

Have a pleasant reading.

Timothy Olawale

Editor

In This Issue:

- Nigeria-China New Deal: Economic Gains Or Losses’

- VAT Reverse Charge Now Applicable On Imported Services

- LABOUR & EMPLOYMENT LAW: Discipline (Mr. Adeola Akintoye Vs. Hotel Bon Voyage) (2014) 42 N.L.L.R. Pt 131, P. 354 NIC

- Upcoming Training Programmes

Nigeria-China New Deal: Economic Gains or Losses

This is not the first time Nigeria has attempted a countertrade agreement. In 1985, Nigeria signed three separate deals with Brazil, Austria and Italy. In addition, Nigeria had earlier tried to diversify its external reserves away from the US dollar monopoly. In 2011, erstwhile CBN Governor Mallam Sanusi Lamido Sanusi, converted 10% of the country’s external reserves into the Chinese Yuan. At the time, Nigeria’s $32bn reserves level was 79% in dollars with the rest largely held in Euros and Swiss francs.

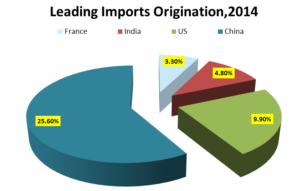

China is the leading trading partner of Nigeria. Nigeria imports several products from China, including, but not limited to raw materials, industrial machinery and motor vehicle spare parts. On the other hand, Nigerian exports are mainly crude oil. Therefore both in terms of volume, value and direction, the terms of trade are stacked against Nigeria.

Bilateral trade between Nigeria and China has grown rapidly in the last decade. Trade volumes have risen by 432.1% from $2.8 billion in 2005, to $14.9 billion in 2015. Last year, Nigeria accounted for 8.3% of the total trade volume between China and Africa, and 42% of the total trade between China and the Economic Community of West African States (ECOWAS). This showed that compared to the other countries above, Nigeria’s trade volume with China alone accounted for 18% of the total trade with Nigeria’s major trading partners.

The current deal is essentially a counter trade agreement (trade by barter) as it involves the exchange of crude oil for goods from China. A swap is traditionally defined as an exchange of one security for another to change the maturities of a bond portfolio or the quality of the issues in a stock or bond portfolio. On the other hand, an FX swap agreement is a contract in which one party borrows one currency from, and simultaneously lends another to, the second party.

Each party uses the repayment obligation to its counterparty as collateral and the amount of repayment is fixed at the FX forward rate as of the start of the contract. Thus, FX swaps can be viewed as FX risk-free collateralised borrowing/lending.

Our Assumptions

- It will not make the Naira stronger in the Forex markets because the impact on the currency pressure is neutral. This is because the swap deal does not increase the inflow of forex into the country.

- The deal will also have no effect on rising inflation rate, this is because the root cause of the spike in consumer prices is the scarcity of forex exchange and other cost push factors. The currency swap deal has not addressed this issue. Therefore, the problem of soaring inflation remains.

- The deal will boost bilateral trade volumes between Nigeria and China.

- It will also increase dependence on China for imports of raw materials and equipment.

- It guarantees China a significant portion of our Nigeria’s trade but our trade with the rest of the world will reduce due to lower foreign reserves.

- The agreement will allow Nigerian traders to transact business with the yuan instead of dollar

- You will see more Chinese cars, TV sets, smartphones and “tourists”

- Crude oil sales between Nigeria and China would be settled in Yuan/Naira and access to Yuan would also be easier

- The swap will eliminate challenges arising from transactions with the US dollar and promote business flexibility between Nigerian and China

Outlook

While the objective of the swap deal is to correct the trade imbalance, the reality is that the deal will increase the dependency complex and parasitic relationship between Nigeria and China. Despite its drawbacks and more important, it will provide a negotiating platform for Nigeria to extract better trade and investment concessions from other Western countries.

VAT Reverse Charge Now Applicable On Imported Services

Section 10 of the VAT Act provides that a foreign company carrying on business in Nigeria shall register with the Federal Inland Revenue Service (FIRS) using the address of its Nigerian counter-party. The section further provides that such foreign companies should include the relevant VAT on its invoice which the Nigerian counter-party should deduct and remit to the FIRS in the currency of transaction. In effect, when a foreign company provides a service to a Nigerian company while carrying on business in Nigeria, the foreign company is required to register for, and charge, Nigerian VAT on any invoice issued to the Nigerian entity. The Nigerian recipient is then expected to withhold the VAT and remit it to the FIRS.

The FIRS have often taken the view that when a foreign company enters into a contract with a Nigerian company, it becomes compulsory for the foreign company to register for, and charge Nigerian VAT.

If the foreign company did not register or charge Nigerian VAT, the FIRS has been known to impose on the Nigerian entity the obligation to self-charge the VAT and remit it to the FIRS. This is generally referred to as “reverse charge mechanism”.

The TAT, in Gazprom Oil and Gas Ltd v FIRS [Gazprom] held that foreign companies not carrying on business in Nigeria are not liable to register for/or charge VAT. Furthermore, it observed that where VAT is not charged then the Nigerian counter-party cannot be required to pay VAT to the FIRS. This, for a time appeared to settle the issue until this recent decision of the Lagos division of the TAT.

Facts of the case

In Vodacom Business Nig Ltd v. FIRS, the Appellant entered into a contract with a non-resident company [NRC] for the supply of bandwidth capacities. NRC neither included nor charged VAT on its invoice and as a result, the Appellant did not remit VAT to the FIRS. Consequently the FIRS assessed the transaction to VAT and issued an assessment notice.

The Appellant objected to the notice contending that the transaction was not subject to VAT because NRC was a foreign company with no physical presence in Nigeria. The Appellant also pointed out that under the contract it had with NRC, it is the Appellant who had the duty to provide the facilities and equipment necessary for transmitting and receiving the bandwidth signals. The FIRS rejected the objections and the Appellant appealed to the TAT.

The decision

The Tribunal raised one issue for determination which was whether the FIRS can charge VAT on the bandwidth capacities received by the Appellant under its contract with NRC?

In dismissing the appeal, the Tribunal considered the provisions of Sections 2, 3, 10, 46, 1st schedule to the VAT Act as well as the decision in Gazprom v FIRS and held that:

- By the provisions of Sections 2 and 46 of the Act, VAT is imposed on the supply of services.

- The decision reached in Gazprom was wrong because the TAT Abuja Division relied heavily on section 10 and did not consider section 2 of the Act which is the charging section. Accordingly section 10 is a mere administrative provision dealing with registration as opposed to liability to VAT. Therefore, section 2 was not dependent on the provisions of section 10.

- While agreeing that NRC was a foreign company and not liable to Nigerian VAT, the Tribunal held that the transaction triggered a taxable event and the Appellant was subject to VAT. The Tribunal also held that the Appellant had a duty to ensure that NRC was registered for VAT pursuant to section 10.

- Relying on the International VAT/GST Guidelines, the Tribunal held that the destination principle is applicable in this case. The destination principle provides that for consumption tax purposes, internationally traded services and intangibles should be taxed according to the rules of the jurisdiction of consumption. Therefore, bandwidth is an intangible which is subject to VAT.

- Finally, the Tribunal concluded that failure to pay tax would result in double non-taxation.

OPINION

- Rather than lay the issue to rest, this decision has reopened the age-old question of whether, under the VAT Act, a Nigerian company receiving services from a non-resident company is required to self-charge VAT.

- Also, conspicuously missing from the TAT’s analysis and judgment was any reference to whether the NRC was actually carrying on business in Nigeria. The TAT appears not to have considered this point in arriving at its judgment.

- Given that both the Abuja and Lagos Divisions of the TAT are of equal status, this decision raises the question of which of the two decisions taxpayers and other Tax Tribunals should follow. It is likely that the FIRS will adopt the latest ruling since it is in their favour.

- The implication is that until a higher court decides on which of the two decisions is right, we are likely to have a situation where different rules or principles are applied in different divisions. As a permanent solution, the legislature should take steps now to amend the VAT Act or re-enact a new VAT law which will among other things provide clarity of treatment regarding VAT on imported services as it is obtainable in other jurisdictions.

LABOUR & EMPLOYMENT LAW: Discipline (Mr. Adeola Akintoye vs. Hotel Bon Voyage) (2014) 42 N.L.L.R. Pt 131, P. 354 NIC

Facts:

- The claimant (Mr. Adeola Akintoye) was a Room Attendant in the defendant company. He was accused of theft. Following the allegation, the claimant was arrested and subsequently prosecuted in court for the alleged theft. However, upon the withdrawal of the suit by the defendant, the court struck out the suit and discharged the claimant.

- The claimant, who was neither suspended or his employment terminated, returned to work with the defendant following his discharge by the court.

- The defendant through its Human Resources Manager orally informed the claimant that his services were no longer needed by the company without paying him his accrued salaries and allowances or even his one month’s salary in lieu of notice as required by his letter of employment.

- The claimant filed a suit against the defendant, asking for:

- a declaration that the defendant’s refusal to restore him back to work after unsuccessfully prosecuting him for 5 months amounted to a wrongful termination of his employment;

- the sum of N255,000 being the total entitlement due to him from the defendant as salaries and allowances from January to May, 2012and one month’s salary in lieu of notice;

- interest on the said sum of N255,000 at the rate of 21% from June 2012 till the date of judgment and thereafter at the rate of 21% per annum until the sum is finally liquidated and;

- the sum of N500,000 as cost of the action

In response, the defendant contended that the claimant was upon an in-house investigation of the issue of theft, suspended and later terminated accordingly.

Issues

- Whether given the outcome of the claimant’s prosecution in court by the defendant, teh claimant was not entitled to the reliefs sought by in the suit.

The Judgement

On Right of employer to discipline an erring staff and exception thereto:-

An employer has the right to discipline an erring staff in the interest of the organisation or institution and suspension is one such disciplinary measure, although it may be otherwise if the contract of employment either expressly or impliedly rules out recourse to discipline by the employer

On whether right of suspension of employee amounts to breach of fundamental rights:-

The right of suspension of employee cannot amount to breach of the employee’s fundamental rights as it has no bearing with issues of fundamental right under the Constitution. See also: Longe vs. FBN (2010) 6 NWLR pt 1189 p. 1

On whether employer can suspend employee without pay in the absence of contractual right to do so:-

An employer has the right to suspend an employee when necessary, with or without pay or at half pay. Employers cannot suspend without pay where there is no express or contractual right to do so. The rationale is that in suspending an employee without pay, the employer has taken it up itself to assess its own damages for the employee’s misconduct at the sum which would be represented by the wages of the days the employee remains suspended.

On whether contract of employment still runs when employee is under suspension:-

When an employee is under suspension the contract of employment still runs and the employee is deemed to still be in the employment of the employer. In the instant case, the court held that all through to 10th May 2012 (the date the claimant was orally told his services were no longer needed), the claimant must be deemed to still be in the employment of the defendant.

On consequence of a discharge in a criminal case against as employee:-

In law, a discharge is a favourable termination of the case. In the instant case, the criminal case against the claimant was struck out. This means that the claimant was discharged. The court held that when the claimant was discharged of the accusation against him, the defendant should have paid him the balance of the salary owed him. Thus, the claimant was entitled to his full salary for the period of the interdiction which was from January to 10th May 2012

Final Judgment:-

The Court ruled in favour of the claimant and ordered the defendant to pay to the claimant within 30 days of the judgment, as follows:

- N129,677.41 being arrears of his salaries from January to 10th May 2012

- N64,838.70 being service charge from January to 10th May 2012

- N30,000 being one month’s salary in lieu of notice

- Cost of the suit at N50,000

OPINION:

An employer cannot dismiss or terminate his employee’s employment with retrospective effect with a view to denying him of his vested right to salary.

Upcoming Training Programmes:

Recent Comments