Business Essential No 22.

Dear Esteemed Member,

The need for continued guidance on business / economic matters in the face of the gruesome economic challenges of our time, occasioned by the current recession, cannot be over-emphasised. This is against the backdrop of your Association’s goal of working with business to bring about sustainability and competitiveness. It is in this light that we reviewed in this publication the policy options available to the country in hiking out of the economic doldrums. On a cheery note, the recent notice from Federal Inland Revenue Service (FIRS) on a special window availed corporate Businesses to avoid payment of penalty and interest on tax due between 2013 to 2015 should be of interest to organised businesses.

We also shared with you a recent protest letter to the Minister of Finance by your Association on “Unfair Sanctions On Public-Quoted Companies by the Securities And Exchange Commission (SEC)”, and another one from the Central Bank of Nigeria (CBN) on “Proper use of Bank Accounts. Our regulars were not left out.

Have a pleasant reading.

Timothy Olawale

Editor

In this Issue:

- Economic Recession: Policy Options For Economic Recovery

- Federal Inland Revenue Service (FIRS) Offers 3-Years Tax Waiver Of Penalty And Interest On Tax Liabilities

- NECA’s Protest Letter on Unfair Sanctions On Public-Quoted Companies by the Securities And Exchange Commission (SEC)

- Important Update On CBN Guidelines On Proper Use Of Bank Accounts

- Labour & Employment Law: Employees’ Handbook As Part of Terms of Employment: Mrs. Caroline Dennis Durugbor vs. Zenith Bank Plc (2014) 40 N.L.L.R. Pt 122, P.216. NIC

- Upcoming Training Programmes

|

Corporate Humour

|

ECONOMIC RECESSION: POLICY OPTIONS FOR ECONOMIC RECOVERY

By all definitions, Nigeria is in a recession, this can be illustrated as follows:

| Indicator | Stagflation | Recession |

| Increasing Inflation | Yes | No |

| Decreasing Inflation (Month on Month) | No | Yes |

| Prolonged Negative Growth | No | Yes |

| Declining Government Revenue/Spending | No | Yes |

| Declining Consumer confidence | Yes | Yes |

| Increasing unemployment | Yes | Yes |

| Falling aggregate demand | Yes | Yes |

| Declining stock market performance | No | Yes |

Source: FDC

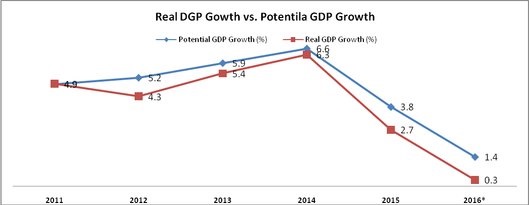

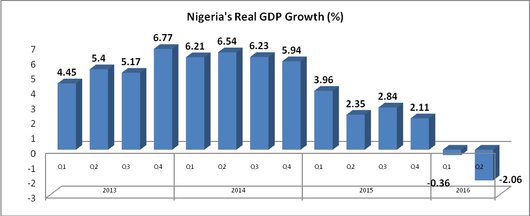

Source: NBS/NECA Research

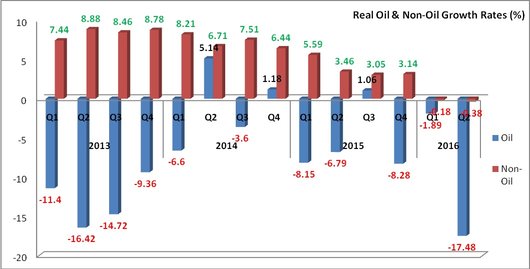

According to National Bureau of Statistics (NBS), the Nigerian economy has recorded two consecutive quarters of economic contraction. In Q1 2016, GDP growth was negative (-0.36%) and recently released Q2 2016 data reflects a larger contraction (-2.06%). A closer look at the breakdown of the Sectoral contribution to the GDP growth reflects that the oil sector shrunk by 17.48 percent, while non-oil sectors declined by 0.38 percent. All major economic sectors – manufacturing (-3.36 percent), construction (-6.28 percent), trade (-0.03 percent), transport (-5.34 percent), hotels and restaurants (-6.39 percent), finance and insurance (-10.82 percent), real estate (-5.27 percent) and government (-6.13 percent) – are in decline, with the exception of only agriculture (4.53 percent) and telecommunications (1.35 percent) which are still growing marginally.

Source: NBS/NECA Research

Source: NBS/NECA Research

Causes of economic recession

We identify three broad factors responsible for Nigeria’s recession, namely- Legacy, Policy and Political & Security factors.

- Legacy factors:

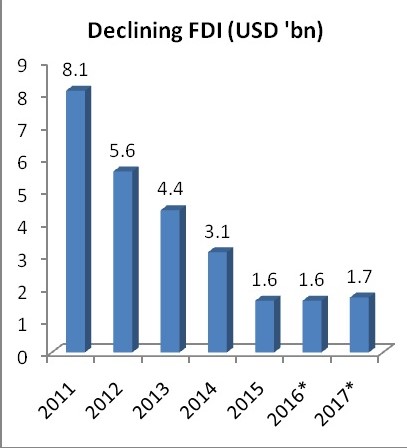

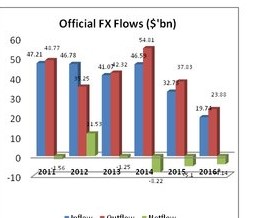

- These includes dependence on oil for government revenue (79.8 percent, 75.4 percent and 72.3 percent) and export (FX) income (96.89 percent, 95.2 percent and 95.4 percent) in 2012, 2013 and 2014, respectively. The collapse in oil prices from over $100 per barrel to about $50 recently meant the Nigerian economy would experience serious challenges. This was compounded by low sovereign savings with FX reserves having declined from over $65bn in 2007 to about $30bn by 2015 and about $24bn in Sept. 2016. Political risk associated with the 2015 elections also affected FDI and growth, with corruption also depleting resources and sub-optimising government spending.

- Policy factors:

- Include a governance vacuum resulting from non-appointment of a cabinet for 7 months in 2015; continuing lack of clarity over economic policy; and wrong policy choices, especially the fixed exchange rate system and failure to “deregulate” downstream petroleum until June 2016. Other major weaknesses include government not articulating a clear strategy for private capital; some policies have weakened the financial sector which is now unable to perform its intermediation role in financing private sector activities optimally and the widespread perception that the current economic cabinet is weak.

- The consequence of these policy failures has been low investor and market confidence from both domestic and foreign investors which has impacted FX flows, FDI, domestic investment, capital markets, and economic growth. Particularly debilitating has been the denial and policy incoherence over FX until policy changed in June 2016.

Source: EIU Source: CBN

- An unsustainable fixed exchange rate system resulted in loss of investor confidence, shutdown of FDI and portfolio investment, constrained domestic manufacturing, depleted FX reserves and distorted FX markets characterised by multiple exchange rates. Even now, while remittances are slowly recovering, FDI and portfolio flows remain subdued due to a persistent loss of confidence. While policy has changed towards a flexible FX regime, the continuing ban on 41 items in a supposedly market-based system signals lack of commitment to a market approach perpetuates multiple exchange rates and reinforces currency devaluation.

- In terms of fiscal policy, the budget relies exclusively on borrowing (N2.2 trillion) for fiscal stimulus in the absence of a private capital strategy. This is incongruous given that debt service is already over 25 percent of budget and up to 40 percent of government revenue.

- Continuing inconsistencies between monetary policy, which has pursued tightening through the Treasury Single Account (TSA) and higher CRR and MPR, and the fiscal stimulus strategy of the executive, sub-optimises policy. The big gap in policy appears to be absence of a strategy to leverage and optimise private capital.

Political and Security factors:

- These have also contributed to the recession. The impact of the Niger-Delta militancy (the economy lost income on appropriately 800,000 barrels of oil from February to June 2016); the impact of herdsmen/farmers conflicts our agriculture production across the county, but particularly in the north central, has also been very negative, as well as continuing, though reportedly reduced impact of Boko Haram’s activity on agricultural output and trade in the North East. The grave issue of internally displaced persons dislocated from their homes, farms and trades in that region also contributed to economic decline.

Policy Options for recovery

The policy options advocated can be categorised as follows:

- Leveraging on Private Capital:

There is the need to change our mind-set from a reliance on government borrowing to leveraging options for private capital. The assets being considered include scarce 4G Telecommunication spectrum, shares in Joint Ventures (JV) with multinational oil companies, stakes in the National Independent Power Plants (NIPPs), National Theatre and Stadiums, among others. We suggest:

- There is a need to explore sale and repurchase agreements on some selected assets. Part-sale of (say) 20 percent of government stake in NLNG and fast-tracking incorporated JV strategy for upstream oil JV operations and reduction of government share in them. Reducing government’s 55% equity in JV with Royal Dutch Shell, Chevron, ExxonMobil and Total by 10% could raise $50billion, while selling a 10% stake in its NLNG equity holdings may be able to bring in between $2billion and $4billion. Similarly, selling scarce 4G spectrum and stakes in the National Independent Power Plants (NIPPs) could also earn an addition $2billion. Other asset sales would obviously raise more money and even allow them to be managed well.

- Note: Presently, Nigeria gets most of its earnings in the JVs from taxes and not dividends from equity holdings, meaning that a slight reduction in its equity stake would not materially affect future earnings.

- privatisation and/or concessioning of major/regional airports and refineries;

- embarking on a high-level concerted Public Private Partnership strategy for infrastructure and raising the profile of Infrastructure Concession Regulatory Commission (ICRC) and Bureau of Public Enterprise (BPE);

- fast-track the passage into law the Petroleum Industry Bills

- deregulation of downstream oil sector with accompanying social intervention in public transportation; and

- tweaking pension fund investment guidelines to accommodate investment in infrastructure and mortgages by implementing the National Integrated Infrastructure Masterplan (NIIMP).

The objective of all these measures should be to raise about $15 billion from asset sales and other sources to shore up foreign reserves to calm investors, discourage currency speculation and stabilise the economy. These actions will also convince markets of government’s commitment to a private sector economy and will stimulate economic activity and improve efficiency.

- Monetary Policy:

- It may be necessary for both the Executive and CBN authority to agree on a policy of monetary easing to stimulate the economy and harmonise monetary and fiscal policy until economic recovery is attained.

- Monetary easing may have to be preceded by some level of currency stability given the current precarious position of the Naira.

- With respect to the ban on 41 items, it is important to immediately restore 95 HS code items (out of 680HS codes into which the 41 banned items may be categorised) as identified by the Organised Private Sector (OPS) as critical raw materials for industry to “Valid for FX” status.

Nigeria may also have a calm policy debate over whether it is expedient to obtain a stand-by facility with international monetary institutions to support and stabilise the currency and provide confidence to investors.

- Promote Exports:

- We also need strategies to promote exports which should focus on refined petroleum products and petrochemicals and incentives for building private refineries, agro-manufacturing and processing, mining, ICT and informal sectors (sports, music, film and entertainment).

- These require long-term policy certainty guaranteed by policy and law, export incentives such as resumption of the Export Expansion Grant (EEG), full downstream petroleum sector deregulation, export financing initiatives, doing business reforms and the “privatisation” of sport administration.

- Legislative Action: Priority Legislation

The National Assembly must also expedite action on identified priority legislation to spur economic growth including:

- Federal Competition and Consumer Protection Bill;

- Petroleum Industry Bill(s);

- review of Companies and Allied Matters Act (CAMA) and Investment and Securities Act (ISA);

- review of Customs and Excise Management Act;

- Nigeria Railway Authority Bill;

- National Transport Commission Bill;

- Nigerian Ports and Harbours Authority Bill;

- Federal Roads Authority Bill;

- National Roads Fund Bill;

- Secured Transactions in Movable Assets Bill;

- Nigerian Independent Warehouse Regulatory Agency Bill;

- National Development Bank of Nigeria Bill; and

- review and expunging the Land Use Act from the constitution.

- Government Revenue:

- Based on evidence, continued domestic borrowing by government is crowding out the private sector and affecting bank and non-bank financial institutions’ deposits, as well as capital markets. The government’s external borrowing plans were not materialising probably due to lack of policy clarity and issues of confidence.

- It is, therefore, essential that the legislature enacts new PIB(s) as soon as possible to stimulate new investment and boost oil revenue.

- In terms of taxation, it may be expedient to defer a VAT increase to 10 percent and reduction of Corporate Tax rate for 18 months.

- Current policy should focus on expanding the tax net and ensuring effective enforcement as well as an amnesty for non-compliant entities willing to start complying.

- Government should embrace privatisation and concessions to raise revenue and stimulate economic activity.

- It is also necessary for the President to constitute the National Procurement Council to improve procurement transparency and value-for-money.

- Finance and Credit

- We believe that monetary easing may be required to stimulate firms and households by reducing interest rates and cash reserve requirements, subject to first stabilising the slide in the value of the Naira. This is because current financial sector conditions are impeding private sector activities.

- It is also necessary to review and fine-tune the operations of the TSA to improve market liquidity and payment efficiency.

- In addition to easing pension fund investment guidelines to give attention to channelling funding into mortgages and infrastructure, it is necessary to address other issues impeding the mortgage sector including Land Use Act review, commercial courts/divisions, high interest rates and the operation of the National Housing Fund.

- Political/Security Actions:

- In terms of security and politics, government must continue efforts to restore normalcy in the North East and resolve the situation concerning IDPs. Political engagement and security measures to end sabotage of oil infrastructure in the Niger-Delta are also important. We doubt that the issue can be resolved exclusively through force.

- Government must also signal zero tolerance for herdsmen/farmer clashes in the North Central and across the country.

- Social Investment

Given the misery Nigerians are currently undergoing, government must intervene in the social sector.

- Recommended interventions include low interest rate loans through BOI to transport unions and investors to buy buses with government waiving import duties and charges;

- Support for fertilizer and agronomy for farmers to ensure relative food security; and

- Investments in teacher training, vocational and technical education and school infrastructure. Government may also pursue implementation of its proposed school feeding programme.

- Policy Leadership and Confidence:

- Government must also recognise that current economic performance is inextricably linked with issues of policy leadership and confidence.

- Government should launch a new economic reform programme and signal a bold commitment to investor-friendly economic direction based on attracting private capital from domestic and international investors.

- Government must also vigorously pursue and implement “Doing Business and Investment Climate” reforms as it proposes to do and some changes in personnel may be required.

- The President may also consider appointing a Chief Economic Adviser or Council of Economic Advisors and fill all important vacancies in Federal regulatory agencies and MDAs.

WAIVER OF PENALTY AND INTEREST ON TAX LIABILITY FROM 2013 TO 2015 BY THE FIRS

The attention of your Association has been drawn to information released by the Federal Inland Revenue Service (FIRS) on the above subject matter. The notice is to the effect that a special window has been availed corporate Businesses to avoid payment of penalty and interest on tax due between 2013 to 2015. Businesses/Taxpayers have, therefore, been invited to take advantage of the waiver which is in the exercise of the powers of the FIRS under its relevant laws. The details of the opportunity are as follows:

- the FIRS would grant a pardon stretching back to three (3) years (2013-2015) to all taxpayers in default, provided that such defaulting taxpayers:

- declares their indebtedness within the special window opened for 45 days only, commencing from 5thOctober 2016 to 24thNovember 2016

- presents a payment plan on the outstanding Principal Tax Liability acceptable to the Federal Board of Inland Revenue

- the waiver relates only to accumulated penalty and interest and not principal tax due.

- based on the waiver, part payment or full payment of undisputed tax liabilities should be paid, while the balance can be paid instalmentally. However, a reasonable amount of not less 25% should be paid on account.

Applicants who want to take advantage of the Special window should forward their application to: The Office of the Executive Chairman, Federal Inland Revenue Service (FIRS), 20 Sokode Crescent, Wuse Zone 5, Abuja.

In the light of the forgoing, we urge concerned/affected member-companies to take advantage of this special window, as the FIRS is prepared to deploy all legal means at its disposal, which include criminal prosecution of the Board and Management of defaulting Organisations, against tax defaulters after the expiration of the special window on the 24th November, 2016.

Opinion

The approved tax waiver is a commendable initiative at a time when many businesses are struggling with the discharge of their tax obligations. From tax administration perspective, it may lead to significant recovery of undisclosed tax debts and ultimately to the expansion of the tax base.

From the perspective of the taxpayers, the notice is quite short which means taxpayers have to complete their internal reviews and tax health checks very quickly.

Given that the waiver does not cover principal, the impact on income tax remediation will be minimal going by the Tax Appeal Tribunal (TAT) decision in the Weatherford case of 11 December 2014, where the TAT held that interest and penalty on overdue income tax should start to run when the taxpayer neither objects nor appeals an additional assessment within two months (and not from the date the tax should have been paid).

The Revised National Tax Policy recommends a framework for tax amnesty and it seems the FIRS is fully supportive of this and showing more commitment to encourage voluntary compliance.

After the expiration of the window, the FIRS may take an aggressive stance (including prosecution of key officers) if it is established that an entity failed to come clean for the periods between 2013 and 2015 in relation to any undeclared or unpaid tax obligations.

Therefore, all principal officers, especially Chairmen, Managing Directors, Chief Executive Officers, Executive and Non-Executive Directors, Chief Financial Officers and all company owners or their representatives should take advantage of this Special Window to avoid the full payment of penalties and interests due on tax between 2013-2015.

NECA’S PROTEST LETTER ON UNFAIR SANCTIONS ON PUBLIC-QUOTED COMPANIES BY THE SECURITIES AND EXCHANGE COMMISSION (SEC)

Our Ref: NECA/SELA/B.4

29th September, 2016

Mrs Kemi Adeosun

Honourable Minister of Finance

Federal Ministry of Finance (FMF)

Ahmadu Bello Way, Central Business District

Abuja

Dear Honourable Minister,

UNFAIR SANCTIONS ON PUBLIC-QUOTED COMPANIES BY THE SECURITIES AND EXCHANGE COMMISSION (SEC)

Who we are:

The Nigeria Employers’ Consultative Association (NECA) is the Voice of Business in Nigeria. It was formed in 1957 to provide a forum for Government to consult with private sector employers on labour and socio-economic policy issues. NECA’s primary function is to enthrone the private sector as a dependable engine of growth and development.

Our Concerns:

- a) Quarterly Filing of Returns

Our members were served with demand notices in various very huge sums as penalties for alleged failure to file Quarter 4 interim unaudited results for a number of years with threats of enforcement. The default by member-companies was not deliberate but based on the regulations and practice in the capital market on this issue.

By virtue of Rule 19.6 of the attached Nigerian Stock Exchange (NSE) which was approved by SEC as the apex regulatory authority in the capital market in Nigeria, Q4 financial statements are not required to be filed with the regulatory authorities by companies. For emphasis, NSE Rule 19.6 states that “An Issuer shall announce the financial statements for each of the FIRST THREE QUARTERS of its financial year immediately after the figures are available, but in any event not more than 30 days after the relevant financial period”. Pages 1 and 12 of the NSE Rules are relevant to this issue. This is the reason why companies file their unaudited financial statements for the first three quarters and file audited financial statements within 90 days after the end of the year. It is our view that SEC should not in one regulation exclude the filing of Q4 financial statements and subsequently decide to penalize companies for not filing the same returns without any express communication to the stakeholders mandating them to file Q4 financial statements. This is because SEC cannot have two conflicting regulations in the capital market on the same issue, as it would create avoidable confusion.

It is not the requirement that at the end of each financial year every public company must file both unaudited financial statements and audited financial statements with regulatory authorities. As you are aware, interim results are unaudited and subject to audit adjustments for accuracy and reliability. Unaudited Q4 interim results when cumulated with the earlier submitted Q1, Q2 and Q3 interim results should reflect a company’s performance for a year. However, when the audited results ends up being different from the interim unaudited results for the full year (now requested by SEC to be filed by companies) as a result of audit adjustments, it would create a serious problem. Having two sets of financial statements of the same company for the same period, one unaudited and the other audited in circulation at the same time will have confusing and misleading effects on investors and the investing public. This would have serious adverse effect on the integrity of the company and the capital market.

In order to resolve this issue, NECA led its members to dialogue with the Leadership of SEC on 22nd June 2016 to explain our position. Please find attached the Position Paper of NECA submitted to SEC during the meeting on this issue. The position of NECA was well received with a promise by SEC to revert to NECA with its decision on the request for withdrawal of penalties imposed on our members, after conferring with your office( since SEC currently does not have a Board to consider our request). We followed up about a month after the meeting through the attached reminder letters dated 19th July 2016 (with summary of the key decisions at our meeting on 22 June, 2016) and 31st August, 2016 without a feedback from SEC. We were, however, surprised that SEC, rather than revert to us as promised on its position on the matter, went ahead to slam penalties on our member-companies on the same subject matter.

Click here to read up the full content of the letter.

Important Update on CBN Guidelines on Proper use of Bank Accounts

The CBN has mandated that all customers of financial institutions are expected to utilize their accounts within regulatory guidelines.

These include the following:

- That all customers of financial institutions are expected to only use their accounts for their direct personal/company related transactions.

- That no customer of any financial institution is permitted to engage in any activity that could be perceived as international money remittance service (IMTO) or bureau de change (BDC) activities without the express approval of the CBN.

- That any customer who fails to adhere to these guidelines runs the risk of being reported not only to the CBN but subsequently to security agencies.

We would like to encourage you to be mindful of these directives when using your bank accounts and we will continue to provide updates regarding the proper use of your bank account.

LABOUR & EMPLOYMENT LAW

Employees’ Handbook As Part of Terms of Employment: Mrs. Caroline Dennis Durugbor vs. Zenith Bank Plc (2014) 40 N.L.L.R. Pt 122, P.216. NIC

Facts:

- The claimant (Mrs Caroline Dennis Durugbor) was a Deputy Manager in the defendant-company (Zenith Bank Plc) until 16th October 2007 when she voluntarily retired from the Bank.

- While in employment with the Defendant, she was presented with various outstanding performance awards, such as: “Star Performer” and “Most Deserved Award”, etc.

- The Claimant via a letter dated 17th September 2007 elected to voluntarily retire from the service of the Defendant, which letter the Defendant failed to reply to until three month later, after several pleas.

- The Defendant refused to pay her all her entitlements and other benefits opened to retirees of the defendant as contained in the Defendant’s Employees Handbook.

- The Claimant instructed her Lawyers to issue a demand notice on the defendant and the defendant replied the “Demand Notice” claiming that all the claimant’s pension contributions had been remitted to her pension account while ignoring the issue of her entitlements as contained in the Employees Handbook which is a binding contract between them. A final demand notice was issued by her Lawyers and the defendant still refused and or neglected to pay her the entitlements.

- The claimant then filed an action against the defendant claiming among others, the sum of N25 million being outstanding indebtedness in respect of her entitlement.

- The defendant filed alongside his Statement of Defence, a counter-claim seeking the sum of N1, 141,617.74 being the claimant’s indebtedness to the defendant as a loan facility granted her in the course of her employment with the defendant.

Issues

- Whether the defendant’s counter-claim has merit and should succeed, especially in view of admission of liability made by the claimant.

The Judgement

On whether letter of appointment alone can contain terms of employment between employer and employee:-

Letters of appointment generally in this nation are very short; often one or two-page documents which by their nature do not and cannot contain all the conditions of service. The terms and conditions of employment set out in a company’s handbook; form the basis of the contract of employment between the company and its employees. In the instant case the Handbook contains the terms and conditions of service of the Defendant.

On whether non-tendering of letter of employment is fatal to claimant’s case:-

The effect of the absence of letter of employment of a Claimant in an action for wrongful termination/dismissal will depend on the nature of evidence adduced before the court. Failure of a claimant to tender his letter of appointment will not be fatal to his case if he/she is able to show by evidence that his/her claims are based on the Handbook and not the Letter of Appointment.

On Whether a Staff Handbook must be signed and dated to be binding:-

The law is not that two sides must sign an agreement to make it valid, more so when this is a Standard Form Contract which, by its nature, is only expected to be signed by only one of the parties to it. In the instant case, from the compulsory signing of the acknowledgment form contained at the end of the Handbook by every employee, it follows that the sail has been taken out of the argument of the defendant’s Counsel that the Handbook is not binding because it was not signed.

As to the second leg of the argument that the Handbook is undated and as such it is not binding, this argument cannot also hold water in that the acknowledgment portion where the employee is to sign contains a column for date of signing which the employee must fill. It follows that the Handbook takes effect on each individual employee and the employer on the date such employee signs it. The fact that the Bank (Defendant) is the author of the Handbook and therefore the terms contained therein is not in dispute and the person it wants the Handbook to bind has signed it: that is sufficient.

On whether Handbook is a Collective Agreement:-

By virtue of section 47 of the Trade Disputes Act, the Handbook of any company or organisation is not a collective agreement within the contemplation of the Law; it is not an agreement entered by an employer or its representative and a trade union or its representative.

On Independence of a Counter-Claim:-

A Counter-Claim by law has its independent and separate existence from the main suit. In the instant case, since it is invariably the fault of the claimant to prove her entitlement to the relief being claimed in the main suit to the hilt, albeit via her counsel (Lawyer), the court cannot hold the hands of the defendant from getting judgment on the counter-claim. The Claimant must consequently honour her indebtedness to the defendant.

Final Judgment

- The claimant did not prove her case (even though parties could amend the papers filed in court), however, the cost of N85, 000 was assessed against the Claimant and in favour of the Defendant.

- The Defendant, in its counter-claim, laid claim to the fact that the Claimant owed it the sum of N1, 141,617.74, which was not denied by the Claimant.

- The court gave judgment on the counter-claim in favour of the defendant in the sum of N1, 141, 617.74 against the claimant.

OPINION:

- Where an employer promises to pay his workers certain benefits, such an employer shall be held liable once it is shown that the employer duly made such promises.

Theme Planning for Golden Years in Retirement: Connecting to a Qualitative Future after Work Life.

Date: 12th – 14th October, 2016

Venue: NECA Learning Centre

Fee: N110,500 (NECA Members) N115,500 (Non-NECA members)

Time: 9:00am – 4:00pm

Coaching, Counselling & Monitoring Development Skills for Organisational Effectiveness

Date: 26th – 28th October, 2016

Venue: NECA Learning Centre

Fee: N110,500 (NECA Members) N115,500 (Non-NECA members)

Time: 9:00am – 4:00pm

For further details please contact Adewale (08069720364) adewale@neca.org.ng Visit www.neca.org.ng

| For Advert Placement: kindly contact Timothy Olawale on tim@neca.org.ng, 08033435439 |

Recent Comments