BUSINESS ESSENTIAL: DECEMBER EDITION

Dear Esteemed Member,

As the year comes to a close, we are aware economic matters are very paramount in the mind of members. We have, therefore, devoted this edition to review the general macroeconomic variables in the closing year, 2017 and gave an insight / outlook for 2018 with their implications to Businesses

We also examined the Organised Private Sector (OPS)’s view on the Petroleum Industry Governance Bill (PIGB) 2016. Our columns on Law Report Review / Legal Opinion, Upcoming Meetings of various Expert Committees in 2018 and recent General Circulars released were not left out.

Wishing you a Merry Xmas and Happy New Year in advance.

Have a pleasant reading.

Timothy Olawale

Editor

In this Issue:

- Review of General Macroeconomic Variables and Implication to Businesses

- Press Release: The Petroleum Industry Governance Bill (PIGB) 2016: Need To Avoid Some Costly Mistakes

- Pictorial: OPS Press Conference On Petroleum Industry Governance Bill (PIGB)

- Law Report Review / Legal Opinion: Employment Relationship Is Key To The Jurisdiction Of The National Industrial Court

- General Circulars: Introduction Of Enterprise Rights’ Protection Fund

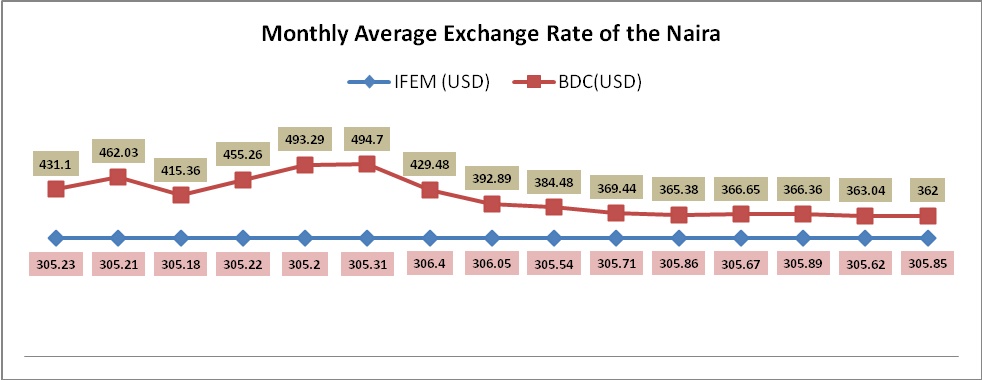

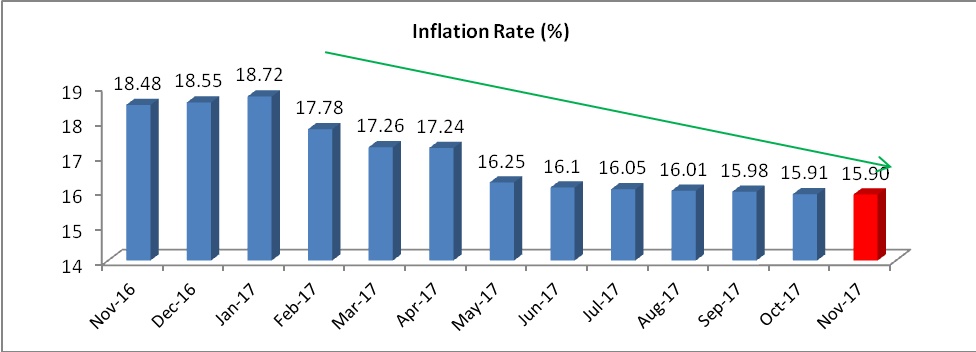

Source: NBS/NECA Research

Source: NBS/NECA Research

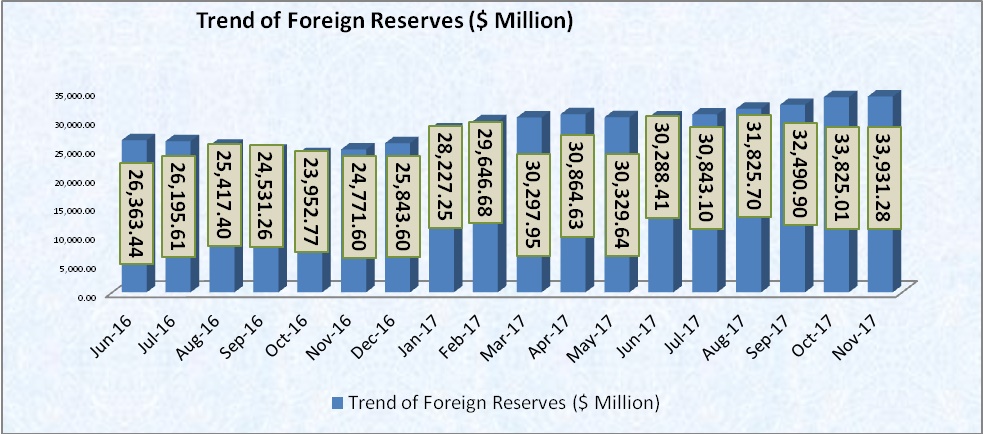

Source: NBS/NECA Research

Source: NBS/NECA Research

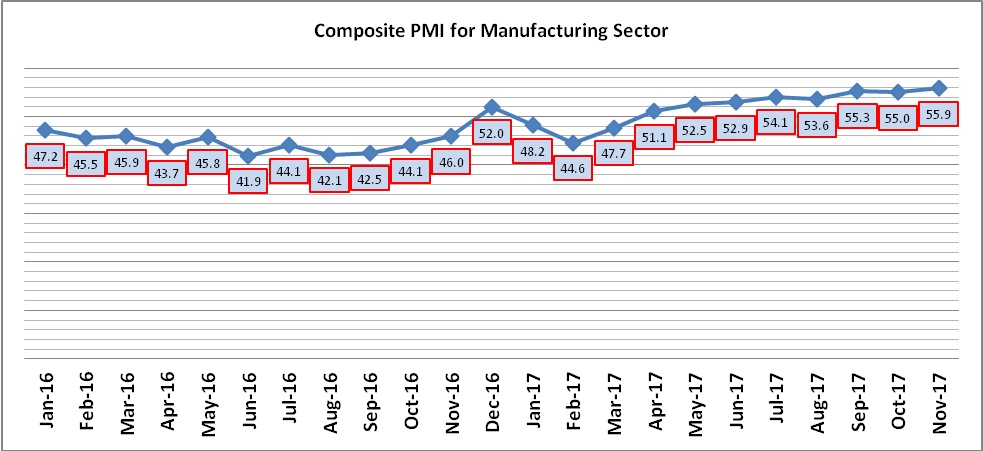

Source: NBS/NECA Research

Source: NBS/NECA Research

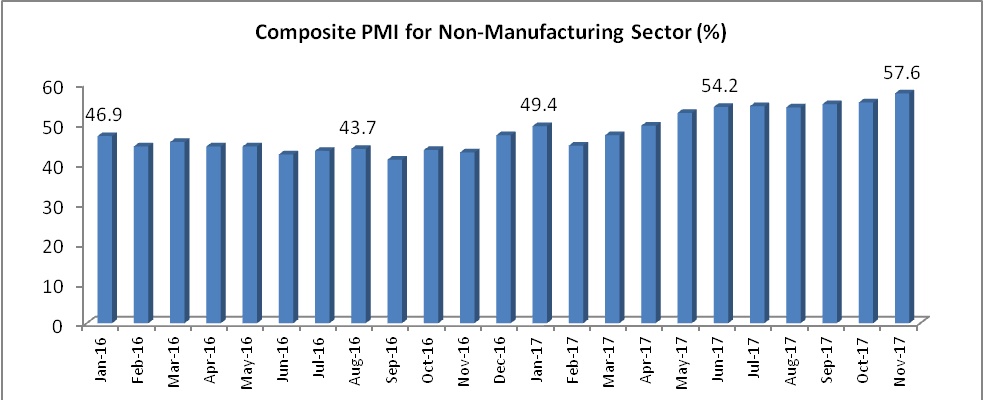

NB: composite PMI above 50 points indicates that the manufacturing/non-manufacturing economy is generally expanding, 50 points indicates no change and below 50 points indicates that it is generally contracting. The subsectors reporting growth are listed in the order of highest to lowest growth, while those reporting contraction are listed in the order of the highest to the lowest contraction.

Source: NBS/NECA Research

Source: NBS/NECA Research

BUSINESS IMPLICATIONS:

- Global economic growth prospects have improved modestly due to stronger US growth expectations, exit of some large economies (e.g. Brazil and Russia) from recession, and rising commodity prices.

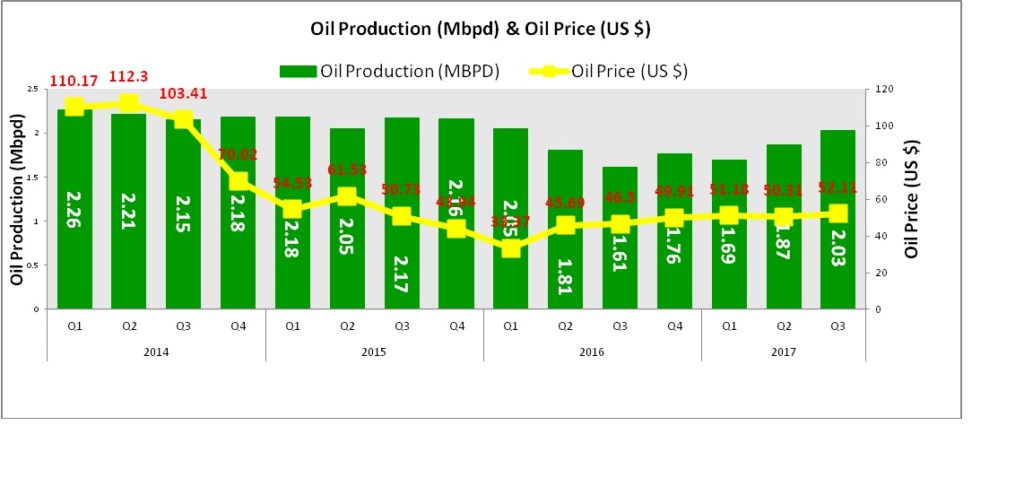

- Oil prices have surged to $60pb beyond 2017 expectations, offering Nigeria some respite and suggesting a better economic outlook in 2018.

- Two key areas of positive policy impact have been doing business reforms that resulted in Nigeria moving up 24 places on World Bank Doing Business rankings; and greater FX liquidity aided by rising oil prices.

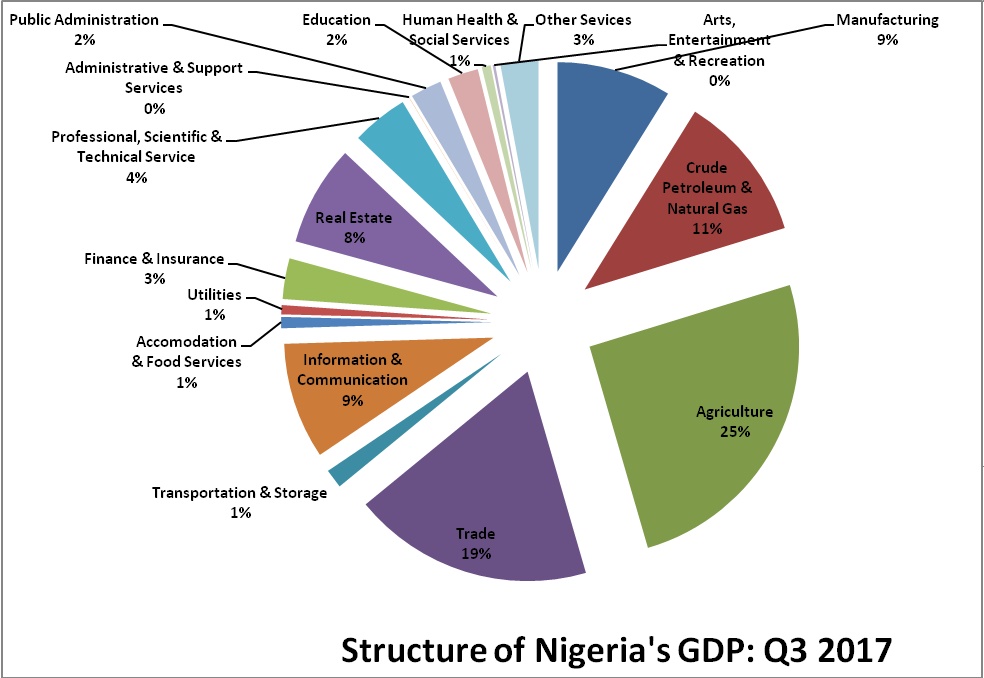

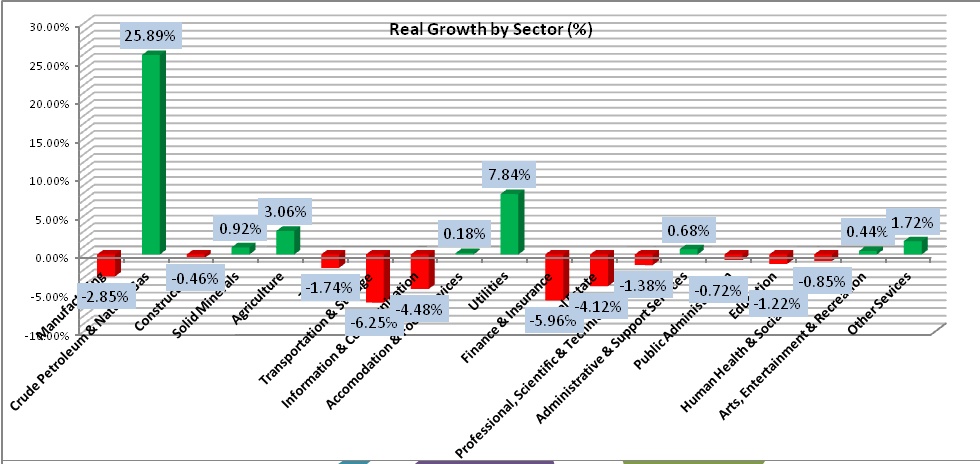

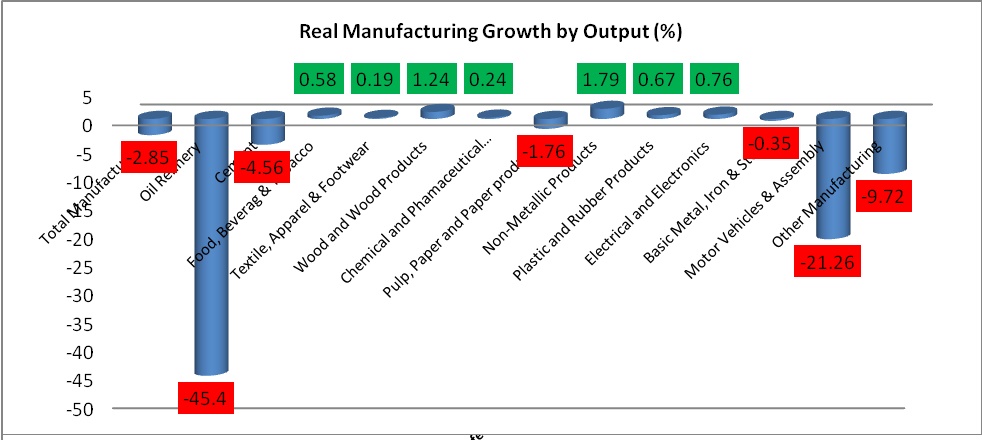

- The PMI generally suggests a better outlook for manufacturing and non-manufacturing GDP, even though these expectations were yet to manifest in Q3 GDP. The current growth numbers remain essentially about oil prices and production.

- The positive macroeconomic elements include oil price and production volumes, moderating inflation (though domestic food inflation remains high), higher FX reserves and stable FX rates, rising PMIs and modest enhancements in capital flows. All of these suggest a better macroeconomic outlook in 2018, though Nigeria may have missed an opportunity for policy reforms.

- The outlook for oil and gas sector in Nigeria has improved with the OPEC-Russia production cutbacks holding; oil prices reaching $60 per barrel; the truce in the Niger-Delta continuing to hold; and government appearing more willing to adopt private capital structures to fund oil and gas activities.

- However risks remain with continuing threats from the Niger-Delta, especially as political activities intensify; and with global oil prices. Substantive oil and gas sector reform and legislation also remains outstanding.

- Nigeria is on the way to economic recovery after two quarters of growth but for the non-oil economy, it may yet be a long and patient walk rather than a quick dash! The GDP recovery in both Q2 and Q3 are firmly oil sector driven and in Q3, the non-oil economy returned into recession.

- The outlook for 2018 may however be considered better as oil sector effects diffuse into other sectors as a result of higher government revenue and FX stability. This expectation is supported by PMI data and declining inflation.

- The beginnings of another political cycle towards 2019 however suggest that aggressive policy may not be very likely. Increased election year spending may however improve the level of economic activity.

Press Release: The Petroleum Industry Governance Bill (PIGB) 2016: Need To Avoid Some Costly Mistakes

- INTRODUCTION

The Organised Private Sector (OPS), comprising the Manufacturers Association of Nigeria (MAN), Nigeria Employers Consultative Association (NECA), Nigerian Association of Chambers of Commerce, Industry, Mines & Agriculture (NACCIMA), National Association of Small and Medium Scale Enterprises (NASME) and National Association of Small Scale Industries (NASSI), has been engaging Government in Policy dialogue on macro-economic issues of cross-cutting nature since 1997.

The OPS:

- represents businesses and enterprises of all sizes in all sectors of the economy;

- has a membership strength of over 15, 000 enterprises in Nigeria;

- has a formidable Organization structure that is connected to the grassroots enterprises whose voices and interest guide our modus operandi.

We have watched with disappointment over the past 10 years the inability of Nigeria to drive reform in the oil and gas industry that will position our country as the preferred destination for investment in that sector of the economy. One of the reasons for this development is, of course, the failure of successive governments to articulate the appropriate legal framework that will underpin this reform. At some point in time, all efforts at achieving that descended into confusion as we had countless number of versions of the Petroleum Industry Bill (PIB) before the National Assembly, with no one in particular in the know of which version of the bills the National Assembly was deliberating on.

It, therefore, comes as a refreshing relief when this dispensation of the National Assembly came up with the Petroleum Industry Governance Bill (PIGB), which, to the best of our knowledge, is the only bill before the National Assembly to jump start the long needed reform in the Oil and Gas Sector. We commend the National Assembly for bringing sanity to an otherwise confused and conflictual dispensation of reform initiative that characterized the past.

OUR OBSERVATIONS

It is gladdening to note that the focus of the legislature is to enthrone reforms that would ensure greater transparency and accountability in the Nigerian oil and gas industry. We, however, do not agree with the following propositions in the bill:

- Establishment of a Single Regulator

A cursory look at some of the provisions of the PIGB revealed the likely emergence of the Petroleum Regulatory Commission (PRC) – an omnibus or humongous commission that will be empowered to regulate the entire petroleum sector. We do not share the views of the National Assembly on creation of a behemoth regulator for a sector that is not necessarily homogenous in its activities and deliverables. Our reasons are, as follows:

- The idea of a single regulator for the whole sector runs contrary to industry standards which by default already provide for an Upstream and Downstream Regulator.

- The responsibilities expected to be handled by the proposed Commission is too wide. It cuts-across various value chains in a key sector of the economy. For Instance, the weight and measures functions is expected to be solely vested in the Commission and all government agencies exercising powers and functions in relation to the petroleum industry would be required to consult with the Commission. The bureaucratic bottlenecks that will arise would clearly negate the ease of doing business policy vision being pursued by the present Administration. We believe that an omnibus regulator will further result in cumbersome and constant delays in securing the necessary approvals to conduct business.

- A single regulator will create complexities and challenges for operators in the petroleum value chain because the structure, operation and nature of the downstream are totally different from that of the upstream sector.

- There are different operators on the petroleum sector value chain with multifarious and diverse objectives – ranging from guarding against systemic risk to protecting the individual consumer from fraud. These diverse objectives will be too complex for a single regulator to effectively manage. A downstream regulator should focus on all commercial & technical activities in the downstream sector, while an Upstream regulator should oversee the technical & commercial activities in the upstream sector.

- An all-powerful single regulator will not be able to technically examine and appreciate the regulatory, commercial and other operating environment issues from the deserved different dimensions and from the different viewpoints of the stakeholders.

- A single unified regulator is effectively a regulatory monopoly which in the long run will promote the usual monopolistic related inefficiency. A particular concern about a monopoly regulator is that its functions by default would be more rigid and extremely bureaucratic than of specialized agencies regulating the downstream and upstream separately.

- A single regulator will not spur competitiveness nor enhance the contribution of Upstream and Downstream sectors to the national economy.

- Productivity and effective handling of the sub-sectors within the Petroleum Industry: The creation of a single regulator implies placing enormous responsibilities on a single entity of Government especially with regards to the complexities of the Upstream and Downstream sectors which require astute efficiency and monitoring to achieve the required productivity. A single regulator would not be able to effectively handle the enormous challenges and complexities of the Petroleum Industry as well as the vast sub sectors within its value chain.

In consideration of all the above, we hereby submit that it is unsuitable to concentrate too much power in one body in a sector where there are different players. Moreover, creating an omnibus commission to regulate the downstream and upstream with the same checklist and yardstick will not be industry-friendly. Moreover, contemporary economic order favours decentralization as it brings about specialization, competitiveness and quality delivery. What is required is a slim, yet focused robust framework for effective institutional governance of the Nigeria Petroleum Industry.

- Inappropriate Governance Structure

The Bill proposes the establishment of Boards for the Commercial Entities. However, the composition of these boards did not reflect appropriate balance of powers to ensure effective Board oversight; reduce the risk of executive-led decision-making; and promote adequate independence of the board to minimise undue government interference.

Recommendations:

- Establishment of a Single Regulator

We strongly canvass for the creation of two regulatory bodies each focusing on the downstream and upstream sectors of the Industry and on the entire gamut of technical and commercial issues in each of the sub-sectors.

Being mindful of need to merge and streamline the number of existing regulatory agencies in the face of dwindling revenue of Government; we hereby affirm that there is no need creating another regulatory agency that will further swell the list of existing agencies with similar functions and duplicated mandates. Specifically, we canvass a simplified arrangement where the Petroleum Products Pricing Regulatory Agency (PPPRA) which has been saddled with the responsibility of commercial regulation since 2003 and has the relevant experience, structure and personnel, should be strengthened to continue to superintend the downstream sector of the Petroleum Industry while the Department of Petroleum Resources (DPR) oversees the upstream sector.

We strongly recommend a reform in this direction, particularly if it realized that in 2003, Government in its wisdom having taken into cognizance the decay and inefficiency that characterized the downstream sector established the Petroleum Products Pricing Regulatory Agency (PPPRA) as a separate and distinct regulatory body to oversee the downstream sector. This singular act has to a large extent restored the commercial viability of the sector through private sector investment. Therefore, history and economic reasoning is on the side of two regulator- model for the petroleum sector because in the recent past, the single regulator-model has been tried and found to be inefficient and unsuccessful.

- Inappropriate Governance Structure

It is necessary to increase the ratio of non-executive to executive directors and provide specific criteria to guarantee the independence of the non-executive directors. Also, the composition on the Board should be reviewed to include Stakeholders to represent the interests of the Organised Private Sector and the Organized Labour.

- CONCLUSION

The OPS appreciates the efforts, time and diligence of the Lawmakers in the development of the Bill. We, however, hope that due consideration will be given to our recommendations before the Lawmakers finalise action on the bill.

Once again, we commend the efforts of the National Assembly for steps taken on the Petroleum Industry Governance Bill 2016.

Oshinowo Segun Ajayi-Kadir Emmanuel Cobham, mni

DG, NECA DG, MAN DG, NACCIMA

PICTORAL: OPS PRESS CONFERENCE ON THE PETROLEUM INDUSTRY GOVERNANCE BILL

L-R: Engr. R.I Odiah (Chairman, MAN Economic Policy Committee), Mr. Segun Ajayi-Kadri (MAN, DG), Mr. O.A Oshinowo (NECA DG,) Mrs Rebecca Ajibade (Rep. NACCIMA DG)

Law Report Review / Legal Opinion:

Employment Relationship Is Key To The Jurisdiction Of The National Industrial Court: Facco West Africa Limited vs. Muyiwa Oluwatosin Ojewusi & 1 or, unreported Suit No. NICN/LA/534/2014

FACTS

The claimant had filed this action on 13th November 2014 vide a Writ of Complaint accompanied by other originating processes praying for the following reliefs –

(1) An order that the first defendant shall pay the sum of N320,000.00 to the claimant company forthwith being hotel accommodation and transport expenses collected from the claimant company by the first defendant in February and March 2012 for trips to some parts of Northern Nigeria which the first defendant never made.

(2) An order that the first and second defendants shall pay the sum of N569,000.00 to the claimant company forthwith being the commission which the first defendant colluded with the second defendant to collect from the claimant company, cashed with the aid of the second defendant and converted to the use of the defendants without the second defendant rendering any service to the claimant company.

(3) As an alternative to claim 2 above, an order that the claimant company shall retain and sell the first defendant’s Car in its custody to offset part of the claimant company’s money wrongly converted to personal use by the first and second defendants as stated in claim 2 above.

(4) An order that the first defendant shall pay the sum of N333,684 to the claimant company forthwith being commission which the first defendant collected from the claimant company in his personal name as commission due to one Salem Kareem Bolaji but which sum the first defendant converted to his personal use with the aid of the said Salem Kareem Bolaji and without the said Salem Kareem Bolaji rendering any service to the claimant company.

(5) An order that the first defendant shall pay the sum of N640,000 to the claimant company forthwith being the unspent part of the sum of N840,000 given to the first defendant by the claimant company to rent an apartment for the company in Abuja which sum the first defendant converted to his personal use and has failed and refused to refund to the claimant company.

(6) Cost of this action in the sum of N500,000.

However, the Court noted that from the pleadings of the claimant, the 1st defendant is first said to be a freelancer who was later made a permanent employee. There was no evidence of the letter of employment, thus raising the issue whether there was actually an employment relationship between the parties capable of activating the jurisdiction of the Court.

ISSUES FOR CONSIDERATION

- a) Whether the complaint before the Court was competent after filing the complaint without the letter of appointment of the 1st defendant.

- b) Whether the non-attachment of a letter of appointment to the complaint before the Court affects the competence of the Court to hear the complaint before the Court.

JUDGMENT

- a) The issue was whether the suit was competently before the Court – an issue that can only be determined if the relationship between the parties was one of an employment relationship since the Court has jurisdiction over contracts of service, not contracts for See Mr. Henry Adoh v. EMC Communications Infrastructure Limited [2015] 55 NLLR (Pt. 189) 546 NIC

- b) There was nothing on the record (e.g. the letter of employment) authenticating the claimant’s pleadings and to show that the relationship between the parties was one of an employment relationship. The Supreme Court had in Shena Security Co. Ltd v. Afropak (Nig.) Ltd & ors [2008] 18 NWLR (Pt. 1118) 77 SC; [2008] 4 – 5 SC (Pt. II) 117 at pages 128 – 130 in laying down the factors that should guide Courts in determining whether a contract was one of service or for service, stressed the factor of the payment of salaries as opposed to fees or commissions.

- c) The argument of the claimant was that a letter of employment was unnecessary in determining the relationship, whether an employment was one or not, between the parties. This may be so to the extent that a contract of employment may be in any form, and it may be inferred from the conduct of the parties, if it can be shown that such a contract was intended although not expressed. See Johnson v. Mobil Producing (Nig.) Unltd [2010] 7 NWLR NWLR (Pt. 1194) 462.

- d) The Labour Act Cap in section 7 is quite clear that not later than three months after the beginning of a worker’s period of employment with an employer, the employer shall give to the worker a written statement specifying the particulars of the terms of employment. This was not done in this case.

- e) Without the terms and conditions of the employment, how can the rights, privileges and obligations of the parties be ascertained? In Bukar Modu Aji v. Chad Basin Development Authority & anor [2015] LPELR-24562(SC), it was held that waving the flag of a breach of the constitutional right to fair hearing does not provide any saving grace once the conditions of service are not pleaded and brought before the Court by a claimant who is complaining of wrongful termination of or dismissal from employment.

- f) In other words, the claimant must first plead and prove his conditions of service before any talk of breach of fair hearing can even be entertained. The claimant in the instant suit was claiming for sums of money advanced to the 1st and or 2nd defendant as expenses, commission and unspent sums which the defendants misused. Without the conditions of service authenticating the relationship between the parties, how was the Court to determine the extent of the claimant’s rights to recover as claimed?

- g) The claimant argued that the subject matter of the case was within the jurisdiction of the Court as the fact stated in the statement of facts clearly shows that it was an action to recover money from an employee by a former employer. The jurisdiction of the Court (NIC) is over labour and employment matters. However, an employment relationship has not been shown to exist between the claimant and the defendants. The feature of an employment relationship required to vest jurisdiction was lacking and so prevented the Court from exercising its jurisdiction.

FINAL JUDGMENT

It was held that the claimant did not show to the satisfaction of the Court that the relationship between the claimant and the defendants was one of a contract of service. Thus, the Court lacks the jurisdiction to hear and determine it. The suit was struck out as being incompetent

OPINION

The claimant has not successfully shown to the Court that there was an employment relationship between it and the defendants to activate the jurisdiction of the Court.

Did you miss the Circular on the Enterprise protection Fun? Please, find it HERE

Committee of Human Resource & Learning Experts (CHRLE)

Date: Wednesday, 17th January, 2018

Venue: NECA House

Time: 9:30am

Committee of Legal Advisers and Company Secretaries (COLACS)

Date: Thursday, 8th February, 2018

Venue: NECA House

Time: 10:00am

Electricity Distribution Companies Meeting (DISCOS)

Date: Monday, 12th February, 2018

Venue: NECA House

Time: 10:00am

NECA Ibadan Geographical Group Meeting (IGG)

Date: Thursday, 22nd February, 2018

Venue: Rom Oil Mills Limited, Ibadan-ijebu-Ode Road, Idi Ayunre

Junction, Ibadan

Recent Comments