Business Essential: September Edition

We welcome you to September 2018 edition of Business Essentials. As you would have observed, issues on Taxation is taking centre stage globally and countries are taking steps to make their tax administration system more robust and business friendly.

In this edition, we reviewed the Post-BEPS (Base Erosion and Profit Shifting) Era and how certain countries have began to amend their tax laws to curb harmful tax practices. Two of such countries, Mauritius and the Netherlands were examined. The guidelines issued by the Federal Inland Revenue Service on the utilisation of Withholding Tax were also reviewed.

The Insurance industry is witnessing some reforms that have placed it on the path of growth but with consequences for businesses. The Sector has continued to enjoy steady improvement as disclosed by the Bureau of Public Enterprises (BPE). These and our regular Law Report Review, Upcoming Learning & Development programmes and other activities at the Secretariat were not left out.

Have a pleasant reading.

Timothy Olawale

Editor

In this Issue:

- Overview of the Nigerian Economy: Politics, Insecurity and Implications for Business.

- Post-BEPS (Base Erosion and Profit Shifting) Era: Implications for Investment through Tax-Friendly Jurisdictions

- FIRS Issues Guidelines on Utilization of Withholding Tax

- BPE: Insurance Premium Increased by N255bn in 10 Years

- Law Report Review / Legal Opinion:

Overview of the Nigerian Economy: Politics, Insecurity and Implications for Business.

GDP data revealed that the economic recovery faltered in the second quarter. The slowdown was chiefly driven by lower oil output and despite strengthening momentum in the non-oil segment of the economy. Although activity in the oil sector dropped markedly on an annual basis, the impact on overall growth was partially mitigated by higher global energy prices throughout the quarter.

On a more positive note, non-oil sector activity accelerated in the second quarter, led by the booming services industry. However, the improvement should be taken with a pinch of salt: Growth within the non-oil sector came entirely on the back of an impressive performance by the telecommunications sector, while activity in other sectors remained broadly stagnant. Moreover, available third-quarter data appears rather downbeat, signalling that the recovery likely has a way to go yet. The PMI fell markedly in July and remained broadly unchanged in August and September as new orders and output growth decelerated somewhat.

The recovery should speed up next year, on the back of easing inflationary pressures, greater foreign exchange rate allocation and higher global oil prices coupled with a gradual recovery in domestic oil production. Nevertheless, significant downside risks to the outlook persist: Political uncertainty will remain elevated in the run-up to the 2019 elections, while the lethargic implementation of structural economic reforms will continue to undermine growth prospects.

As we move closer to the 2019 general elections, Nigeria’s leadership will struggle to deal with a range of challenges to political and economic stability. Campaigning ahead of the 2019 elections will complicate the situation as politicians focus on shoring up support (and undermining opponents) rather than more prudent policy reforms. Economic growth will be constrained by the weak policy environment and dire infrastructure provision. The prospects for 2020-22 are slightly stronger, with elections out of the way and oil prices strengthening. Of concern also is the insecurity that has become synonymous with elections in Nigeria. All these have a negative effect on the economy and might affect the growth that has been achieved.

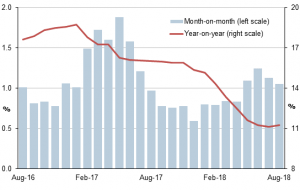

Nigeria Inflation Chart

CPI and Inflation Report August 2018

The consumer price index, (CPI) which measures inflation increased by 11.23 percent (year-on-year) in August 2018. This is 0.09 percent points higher than the rate recorded in July 2018 (11.14) percent and represents the first year on year rise in headline inflation following eighteenth consecutive disinflation in headline inflation.

Increases were recorded in all COICOP divisions that yielded the Headline index.

On the month-on-month basis, the Headline index increased by 1.05 percent in August 2018, down by 0.08 percent points from the rate recorded in July 2018 (1.13) percent).

The percentage change in the average composite CPI for the twelve months period ending August 2018 over the average of the CPI for the previous twelve months period was 13.55 percent, showing 0.4 percent point from 13.95 percent recorded in July 2018.

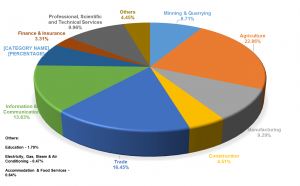

SECTOR CONTRIBUTION TO GDP

POST- BEPS (Base Erosion and Profit Shifting) Era: Implications for Investment through Tax-Friendly Jurisdictions

Introduction

With the execution of the Organisation for Economic Cooperation and Development (OECD)’s Multilateral Instrument (MLI) by a number of countries (including Nigeria) in 2017, certain countries have begun to amend their tax laws to curb harmful tax practices.

The OECD Report on Action 5 of the Base Erosion and Profit Shifting (BEPS) Project recommended measures to be adopted by countries engaged in harmful tax practices, otherwise known as tax havens.

These recommendations are gradually being adopted by some popular tax-friendly jurisdictions like Mauritius and the Netherlands, as both countries have agreed to change some of their local laws in order to tackle BEPS. Although Nigeria is a signatory to the MLI, not much has been done in this regard as the instrument is yet to be ratified in Nigeria. However, this does not insulate Nigerian businesses from the ripple effect of Post-BEPS legislative changes in other jurisdictions, particularly Mauritius and the Netherlands.

Nigeria relies largely on foreign direct investments (FDI) for its economic growth. According to the National Bureau of Statistics, Nigeria recorded FDI of over $261.4 million in the second quarter of 2018 alone. Some of these investments were from European entities and a number of these investors typically do not invest directly in Nigeria but prefer to route such investments through tax-friendly jurisdictions for tax optimization purposes. Hence, changes in the tax regimes of these tax-friendly jurisdictions will have significant impacts on Nigerian investments that have one connection or the other with these jurisdictions.

We discussed in this edition some of the changes made in Mauritius and the Netherlands in line with the OECD recommendations as well as their impacts for Nigerian businesses and investment structures.

Changing Tax Laws

A number of companies adopt the approach of investing through tax-friendly jurisdictions like Mauritius and the Netherlands partly because the Nigerian tax regime does not altogether favour the establishment of Holding Companies (HoldCos). For instance, the provisions of the Companies Income Tax Act on “excess dividends tax” at 30% impact companies that receive dividends from their investments in offshore subsidiaries.

Given the changes in the tax laws of these tax-friendly jurisdictions, investors need to continually evaluate the impact on their investment structures and develop sustainable strategies for managing their tax affairs. We have highlighted some of the reforms in Mauritius and the Netherlands as well as their potential impacts as follows:

Mauritius

In 2017, Mauritius became a signatory to the MLI and agreed to amend some of its local laws to tackle BEPS. Prior to now, Mauritius had favoured two categories of companies i.e. Global Business License Category 1 (GBL 1) companies and Global Business Licence Category 2 (GBL 2) companies. GBL 1 favoured HoldCo structures. This licence granted such companies certain treaty benefits such as an 80% deemed foreign tax credit which reduced the effective tax rate of such companies from 15% to 3%. GBL 2 granted a full tax exemption to GBL 2 companies.

Whereas the Nigerian tax regime does not completely favour the operation of HoldCo structures, the guidelines on foreign exchange seem to encourage the establishment of offshore HoldCo structures. Hence, investors seeking to set up HoldCos would rather pick a tax friendly jurisdiction such as Mauritius to set up such HoldCos.

More so, Nigerian investors have, in the past, benefited from Mauritius GBL 2 category given that dividends repatriated from offshore to Nigeria are exempt from tax.

However, investors may need to reconsider their investment structures as the Mauritian Prime Minister has announced some significant proposed tax reforms via the recent Mauritian budget speech. The Mauritian Finance (Miscellaneous Provisions) Bill (Finance Bill 2018) which was presented in July 2018 also contains certain changes to the Mauritian tax regime and the global business sector.

Some of the reforms include the following:

- Cancellation of the 80% deemed foreign tax credit regime available to GBL 1 Companies effective 31 December 2018. Such companies will now move from a deemed foreign tax credit regime to a partial exemption regime and will simply operate as Global Business Corporations (GBC) effective 1 January 2019. Under the partial exemption regime, a GBC that derives its income from the sources below will enjoy an 80% tax exemption on such income (an effective tax rate of 3%) while other income will be subject to tax at the standard rate of 15%: foreign sourced dividends and profits attributable to a foreign permanent establishment; ii. interest and royalties; and iii. provision of specified financial services.

This would suggest that the full income from other sources apart from those specified will be liable to tax. Companies that have enjoyed benefits from the Mauritian deemed credit system by structuring their operations in such a way that losses incurred within their groups were beneficial to the group as a result of the Mauritian inclusion in the mix may need to re-evaluate such structures with the change from the credit system to the exemption system.

The Mauritian government is also set to introduce a “substantial activities requirement” which must be satisfied by companies seeking to enjoy partial exemption (except banks licensed by the Financial Services Commission (Commission).

- GBL 2 which currently grants full income tax exemption to companies will no longer be issued effective January 2019. However, companies that have been issued licences prior to 16 October 2017 will enjoy the current tax exemption until June 20212. It would appear that a category of companies known as “Authorised Companies” will be introduced in place of GBL 2 companies as the proposed amendments in the Finance Bill 2018 seek to replace the “GBL 2 companies” with “Authorised Companies” where the phrase occurs in the Financial Services Act.

In effect, companies that previously operated as GBL 2 companies will be required to apply for an “authorisation” to be able to operate as “Authorised Companies”. According to the Finance Bill 2018, a company shall apply to the Commission for an authorization where the majority of its shares or voting rights or the legal or beneficial interest in such a company are held or controlled by a person who is not a citizen of Mauritius, and such a company proposes to conduct or conducts business principally outside

Mauritius or with such category of persons as may be specified; and has its place of effective management outside Mauritius. Although there are no indications that the full tax exemption which GBL 2 companies currently enjoy would apply to Authorised Companies, an Authorised Company would be deemed to be conducting business outside Mauritius even when it engages in certain transactions in Mauritius. It is hoped that the Mauritian government will provide further clarification in this regard.

The Netherlands

The Netherlands is famous for being a tax-friendly jurisdiction for corporate tax planning. Although the Dutch corporate tax rate is fairly comparable to other European countries, Dutch resident multinational companies can legally negotiate special tax arrangements with the Dutch tax authorities which may result in significantly lesser taxes.

One of the tax benefits of investing in the Netherlands is the Dutch “Participation Exemption” (PE) System. The PE fully exempts certain qualifying shareholdings (of 5% or more) in Dutch companies from corporate tax on all dividends, capital gains and other benefits derived.

Several conditions have to be met in order to qualify for this exemption. These conditions are aimed at determining the motive for such investments and ascertaining that they are not merely “portfolio investments”. The PE system gives rise to certain hybrid-mismatch arrangements in which entities exploit the differences in the tax treatment of these instruments in various jurisdictions.

The Netherlands currently applies a “minimum substance requirement” for financial services companies to enjoy certain tax benefits. Among other things, companies seeking to enjoy tax treaty benefits must have at least a 50% Dutch resident board of directors, qualified staff available for implementation and administration of the company’s transactions to ensure management decisions are made in the Netherlands. These requirements also apply to certain Dutch HoldCos and the failure to meet these requirements could result in denial of treaty benefits.

On 23 February 2018, the Dutch State Secretary of Finance published a policy letter stating the government’s intentions to tackle tax evasion and tax avoidance. The letter states the government’s intention to introduce anti-abuse rules targeting hybrid- mismatches into the Dutch tax law. The proposed legislation will either result in denial of the deduction of payments that are not taxed due to hybrid-mismatch or the inclusion of income that was otherwise not taxed due to the hybrid-mismatch.

In the policy letter, the Dutch government proposed additional substance requirements for Dutch HoldCos in international structures and Dutch financial services companies. The first additional criterion requires companies seeking to claim treaty benefits to have incurred annual wage costs of at least €100,000 with respect to its holding, financing and leasing function. The second additional criterion requires the company to have an office space at its disposal for a period of at least 24 months for performing its holding, financing or leasing activity.

Given that the Netherlands is another favourable tax jurisdiction for many multinationals to set up HoldCos, the above development may result in an increase in the costs for maintaining a Dutch group company. However, it is only fair and reasonable that companies that set up entities in seemingly favourable tax jurisdictions ensure that such entities hold proportionate economic substance.

Takeaways

Recent tax developments in the one- time tax-friendly jurisdictions now beckon necessary review of operating structures for companies given the obvious implications of the ongoing changes for businesses. Nigerian investors, as well as foreign investors with Nigerian destinations, typically have investment vehicles that traverse the tax-friendly jurisdiction to enhance optimality in tax planning. Thus, it is necessary to evaluate individual group structures to highlight the specific impacts of the changes to existing and proposed group structures.

Notwithstanding the need for case-by-case evaluations and situation-specific advice, it is good to note the following general implications for businesses:

- It may be necessary for some Nigerian businesses that have traditionally used Mauritius GBL 2 companies for tax planning purposes to restructure their businesses and either apply to continue operations as GBCs or Authorised Companies under the new regime in Mauritius. However, this will largely depend on the applicable tax treatment to these categories of companies. In certain instances, such companies may need to consider alternative business structures in other favourable jurisdictions to ensure that they continue to enjoy certain tax benefits.

- Nigerian businesses with HoldCos in countries like Mauritius or the Netherlands will need to ensure that such HoldCos meet the increased substance requirement in these jurisdictions to enjoy applicable tax benefits.

- With the issuance of Nigeria’s Income Tax (Country by Country Reporting) Regulations which provides for the automatic exchange of financial information of multinational enterprises that meet a required financial threshold, the exchange of information across international borders will provide Nigerian tax authorities with information regarding taxpayers’ arrangements/transactions in tax-friendly jurisdictions. need to align with appropriate legal framework while considering the growing requirement for tax morality.

It is important for taxpayers to engage subject matter experts to manage their tax exposures and ensure that they meet up with local and global regulatory requirements.

Culled from Andersen Tax (Tax Alert)

FIRS Issues Guidelines on Utilization of Withholding Tax Credits

Summary

Further to the commencement of the ongoing review and reconciliation exercise on taxpayers’ Withholding Tax (WHT) credit balances by the Federal Inland Revenue Service (FIRS), some FIRS stations have now issued some guidelines on the utilization of WHT credit notes. The guidelines require taxpayers who wish to file tax returns and apply for Tax Clearance Certificates to submit to the FIRS, evidence of payment of all assessed taxes. The guidelines also highlight certain compliance requirements for the utilisation of WHT credits.

Details

In respect of WHT credits utilisation, the guidelines are as follows:

- Taxpayers who have submitted original WHT credit notes are required to write letters requesting the FIRS to utilize the credits to offset their Companies Income Tax (CIT) liabilities;

- Where physical credit notes cannot be found, taxpayers are required to submit the following:

- Letter of request to the relevant tax office to utilize the credits on FIRS’ web portal to offset the CIT liabilities;

- Police report (if missing) or/and sworn affidavit with passport photograph stating why the company could not access its original WHT credit notes;

- Letter of undertaking stating that the company will not utilize the said WHT credits in future; and

- Contract award letters relating to the WHT credits.

Implication

Although the additional guidelines provided by the FIRS on the utilisation of WHT credits by taxpayers are not contained in either the CIT Act or the WHT Regulations, the FIRS (Establishment) Act grants an omnibus power to the FIRS to carry out any activity that it deems necessary for the full discharge of its functions. However, it is expected that the FIRS would exercise its discretionary power in a reasonable manner. For instance, requesting documents such as contract award letters before validating WHT credits that were originally granted by the FIRS appears to be an unnecessary and cumbersome process.

Furthermore, the requirement for manual notifications and provision of supports such as police reports and/or sworn affidavits in the case of missing WHT credit notes may not have been necessary, if the FIRS had real-time database of taxpayers’ WHT records as it now intends to do after completing the ongoing process.

Nonetheless, the on-going review and reconciliation exercise of taxpayers’ WHT credit positions is a good opportunity for taxpayers to reconcile their records with the FIRS and it is advisable that those with unutilised WHT credits take full advantage of the exercise.

Culled from Andersen Tax (Tax Alert)

BPE: Insurance Premium Increased by N255bn in 10 Years

The insurance sector in Nigeria has continued to enjoy steady growth with premiums increasing from N75 billion to over N300 billion between 2005 and 2015, the Director General of the Bureau of Public Enterprises (BPE), Mr. Alex Okoh has disclosed.

Speaking as a special guest at the investiture ceremony of the 23rd Chairman of the Nigerian Insurers Association (NIA), Mr. Tope Smart in Lagos, Okoh said spurred by the potential growth in the sector, foreign investors had acquired substantial equity in local insurance companies.

A statement issued by BPE’s Head, Public Communications, Amina Tukur Othman, said Okoh listed the foreign investors as Old Mutual of South Africa which has substantial investments in Oceanic Insurance, Sanlam Insurance in FBN Life Assurance, Greenoaks Global Holdings of the United Kingdom in Ensure Insurance Plc (former Union Assurance).

Others are NSIA Participation of South Africa in ADIC Insurance and AXA of France with substantial investments in Mansard Insurance.

Okoh maintained that despite this, there was still much room for improvement in growth in the sector in Nigeria as the country by the 2016 statistics, is 10th in Africa with 0.27 per cent insurance penetration premiums as a percentage of Gross Domestic Product (GDP) compared to South Africa, Namibia and Mauritius with 14.27 per cent, 6.87 per cent and 6.4 per cent respectively.

The BPE DG adduced reasons for this to include; lack of consumer trust, low implementation of compulsory insurance and lack of adequately skilled professionals.

“Whilst the foregoing may make for bleak reading, a number of factors, including: The emergence of a middle class with increased spending power, a large youth population who are technology savvy, and increasing female empowerment thus enabling women to make spending decisions, all make the sector ripe for growth.

“And the possibility of achieving this growth can become a reality with the right policy formulation, a sustained sensatisation programme to educate the population on the benefits of insurance, engaging the support of other sectors including the telecoms sector to increase market penetration for insurance,” he said.

He announced that the federal government’s privatisation programme in the insurance sector is set to continue with the public offer of Nigeria Reinsurance Corporation which would open soon and solicited the support of the Association to make the offer a success.

Okoh informed the gathering that the Bureau had privatised some insurance enterprises which include: Niger Insurance Corporation, through Initial Public Offer (IPO); Nigeria Reinsurance Corporation, through core investor sale; and National Insurance Corporation of Nigeria also through core investor sale.

While commending the chairman on his election as the 23rd chairman of the association, Okoh described him as a man who throughout his career has demonstrated a high degree of integrity, professionalism, capability and deep commitment to the insurance industry.

He expressed the hope that the new chairman would bring the same level of commitment and diligence to his new position and “will achieve even greater success”.

Law Report Review / Legal Opinion:

CONDONATION OF EMPLOYEE’S MISCONDUCT BY EMPLOYERS

Ayotunde Arijenja George vs. First Bank of Nigeria Plc (2014) 41 N.L.L.R Pt. 126 P.264

FACTS

- The Claimant had, on 16th June 2011, instituted an action against the Defendant at the National Industrial Court.

- The Claimant was employed by the defendant on 12/4/05 as Banking Assistant on terms and conditions, which were also contained in the defendant Employees’ Handbook.

- The Claimant was posted to one of the branches of the defendant.

- By a letter titled ‘’Disengagement’’ and dated 15/10/09, the defendant terminated the claimant’s employment without giving the claimant any prior notice of the said termination. However, the claimant was paid one month’s salary in lieu of notice contrary to the claimant’s letter of employment and the terms and conditions of his employment.

- Upon the termination, the defendant only paid 50% of the total terminal benefits to the claimant and promised to pay the remaining 50% after 3 months.

- After the said 3 months and the refusal by the defendant to pay the outstanding terminal benefit of the claimant, the claimant wrote a letter to the defendant’s bank, asking for the outstanding terminal benefit.

- In response to the claimant’s letter, the defendant made some criminal allegations against the claimant. It was stated that the claimant was involved in and found guilty by the Disciplinary Committee of the Bank for an offence of fraud relating to some ATM withdrawals made from a deceased customer’s account.

Hence, the institution of this action, wherein, the claimant claimed against the Defendant, among others, the following reliefs:

- A declaration that the defendant’s letter dated 15/10/09 to the claimant titled ‘’Disengagement’’ purporting to terminate the Claimant’s employment with the Defendant without an opportunity to be heard on the allegations contained in the defendant’s letter of 1/7/10 is unlawful, wrongful, illegal, invalid, null and void, and incapable of having any legal consequence.

- The sum of N1,065,058.00 (one, million, sixty-five thousand and fifty-eight Naira only) being the special damages resulting from the Claimant’s outstanding benefits illegally, unlawfully and wrongfully withheld by the defendant with interests thereon.

- A declaration that the defendant’s Disciplinary Committee cannot lawfully reach a just determination of the case of illegal withdrawal through ATM card from a deceased customer’s account as contained in the Defendant’s letter of 1/7/10 against the claimant without due process of fair hearing in accordance with the Defendant’s Procedures and Internal Rules as contained in the defendant’s Employees’ Handbook.

- An order of Court setting aside the purported termination of the claimant’s employment and nullifying the defendant’s letter to the claimant.

- An order of Court for the Defendant to pay the Claimant all salaries, allowances and entitlements as from 15/10/09 with reasonable adjustments of promotion factored in, to the date of judgement.

- An order of court converting the claimant’s disengagement into retirement and damages in the payment of the Claimant’s salary, allowances, benefits and pensions from 15/10/09 till the date of disengagement to the date of judgement with due promotion adjustment factored in, with interest thereon.

- An order of injunction restraining the said defendant from giving effect and /or continuing to give effect to any of the decisions of the defendant’s Disciplinary Committee.

- N2 million damages for loss of earnings, interest and or profits on the said N1, 065,058.00 from 15/10/09 up to the date of Judgement.

- N10 million being general damages payable to the claimant for unjustifiable and unfair breach of contract of employment.

ISSUES FOR DETERMINATION

- Whether it was lawful for the defendant to withhold the balance of the claimant’s disengagement entitlements when the defendant discovered the claimant’s act of negligence after her services had been terminated.

- Whether an employee that received a salary or payment after employment is brought to an end can make a successful claim against the determination of her appointment.

JUDGMENT:

In its judgment, the court held that:

- Where an employee accepts salary or payment after employment is brought to an end, the person cannot be heard complaining that his contract of employment was not properly determined.

- Furthermore, where an employee receives his terminal benefits after his employment is brought to an end, he cannot be heard to complain later that his contract of employment was not properly determined.

- On whether Employer who elects to retain employee after fraudulent act can subsequently dismiss him on same, the court held that “if after the knowledge of fraud committed by an employee, the employer elects to retain him in his services, the employer cannot at any subsequent time dismiss him on account of that which he has waived or condoned.” See: Ekunda vs. University of Ibadan (2000) 12 NWLR pt 681, p.220; ACB vs. Nbisike (1995) 8 NWLR pt 416, p.725

- On Employee’s power of resignation and impropriety of employer resurrecting what has been buried, the court held that “there is absolute power to resign and no discretion to accept such notice, thus, an employer cannot on just at his whims and caprices resurrect that which has been buried”. See: Adefemi vs. Abegunde (2004) 15 NWLR pt. 895 p. 1

The court further went on to hold that the claimant’s case only succeeds in part and held as follows:

- It declared that the defendant’s Disciplinary Committee cannot lawfully and legally reach a just determination of the case of illegal withdrawal through ATM from a deceased customer’s account as contained in the defendant’s letter against the Claimant.

- The Defendant was restrained from giving effect and or continuing to give effect to any of the decisions of the defendant’s Disciplinary Committee made.

- The defendant shall within 30 days of the Judgement pay to the claimant the sum of N1,065,058.00 being the outstanding balance of the claimant’s entitlement. Failing this, the said sum shall thereafter attract an interest of 15% per annum up to such time it is fully paid.

- Cost of this action was put at N50,000 only to be paid to the claimant by the defendant within 30 days of this judgement.

OPINION:

Parties are bound by their Agreement. Furthermore, where there are processes and procedures to be followed, it is expected that parties would allow such processes to be followed/complied with.

Recent Comments