B.E – August 2019 Edition

Welcome to the August 2019 edition of Business Essentials.

In this edition, we reviewed the International Monetary Fund (IMF) which revised downwards its global economic growth forecast to 3.2% for 2019, noting that the global growth remains sluggish and this downward revision reflects the trade tensions mainly between the US and China, Brexit-related uncertainty and the effect of rising geopolitical tensions on energy prices. Given the intensified downside risks to global growth, it is unlikely we will see a strong rally in the price of crude oil. Major central banks are expected to take an accommodative monetary policy stance.

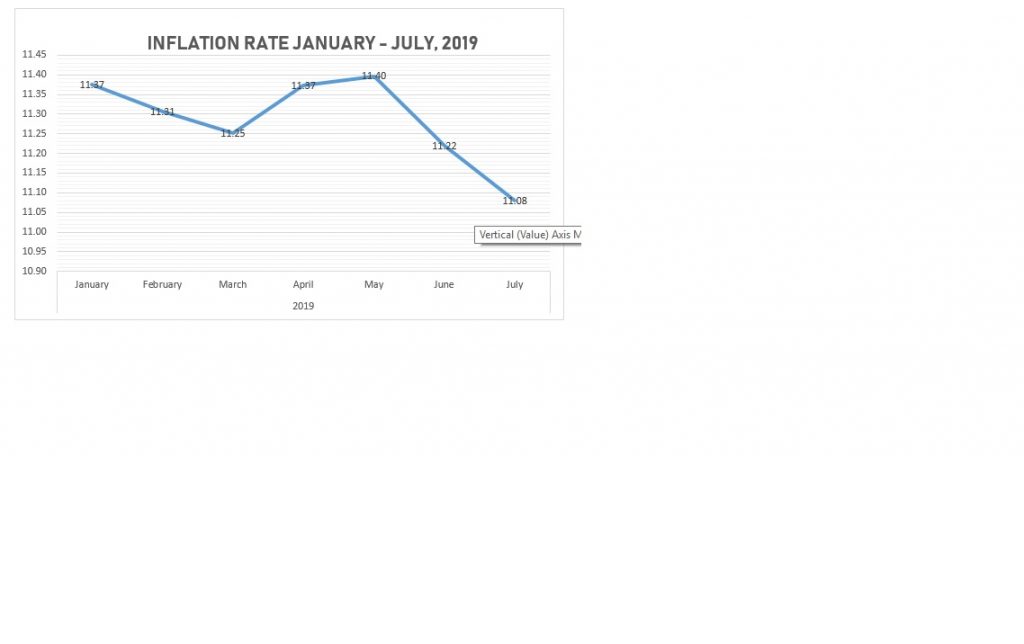

In the Nigerian macroeconomic environment, the inflation rate dropped to 11.08% from 11.22% making its second consecutive month decline, and the lowest rate recorded since February 2016, attributed largely to harvest season. The Manufacturing and Non-Manufacturing PMI increased at a faster rate in July 2019 compared with the June levels. The overall Manufacturing PMI was 57.6 points in July, a higher growth rate than 57.4 points recorded in June 2019. This was attributed to the pickup in the expansion of new orders, raw material inventory and new export orders. However, production levels and the employment level expanded at a slower pace than in June 2019.

We also shared a column on regulatory authorities’ approvals and the application of arm’s length principle in the country. The article examines situations where conflicts could arise, assesses their impact for the taxpayers and the country, reviews the practices in other jurisdictions and makes recommendations on how to resolve these conflicts for the benefit of all stakeholders including the FIRS.

Our regular Law Report Review, Upcoming Learning & Development programmes and other activities at the Secretariat were not left out.

Have a pleasant reading.

Wale-Smatt Oyerinde

Editor

In this Issue:

- Review of Global Economic Developments

- Macroeconomic Environment: July CBN Manufacturing Purchasing Manager Index, Business Expectation Survey, July Consumer Price Index

- Tax: Regulatory Authorities’ Approvals and the Application of Arm’s Length Principle in Nigeria: The Need for Coherence

- Law Report Review / Legal Opinion

Review of Global Economic Developments

The International Monetary Fund (IMF) revised downwards its global economic growth forecast for 2019, noting that the global growth remains sluggish. This downward revision is a reflection of trade tensions mainly between the US and China, uncertainties surrounding Brexit and the effect of rising geopolitical tensions on energy prices. The IMF added that GDP announcements so far this year, as well as softening inflation, point to weaker-than-expected global activity. Consequently, the IMF revised downwards its global growth forecast for 2019 and 2020 by 0.1% from its forecast in April 2019 to 3.2% and 3.5% respectively. The projected pick up for 2020 assumes stabilization in currently stressed emerging markets and developing economies, as well as progress to be made towards resolving trade policy differences. The fund however, revised upward the growth forecast for Nigeria for 2019 from the forecast released in April 2019.

The risks to the forecast in 2019 are mostly tilted to the downside and have intensified since April 2019. The major downside risks include:

- Increase in trade and technology tensions, resulting in slow investment

- Disinflationary pressures that increase difficulties in debt service and make adverse shocks more persistent.

- Geopolitical tensions

Given the intensified downside risks to global growth, it is unlikely we will see a strong rally in the price of crude oil. Major central banks are also expected to take an accommodative monetary policy stance.

| Global Economic Growth Rate (Actual vs. Forecast) | ||||||

| The difference from April 2019 WEO Update | ||||||

| 2017A | 2018E | 2019F | 2020F | 2019F | 2020F | |

| Global | 3.8% | 3.6% | 3.2% | 3.5% | -0.10% | -0.10% |

| Advanced Economies | 2.4% | 2.2% | 1.9% | 1.7% | 0.10% | 0.00% |

| USA | 2.2% | 2.9% | 2.6% | 1.9% | 0.30% | 0.00% |

| Japan | 1.9% | 0.8% | 0.9% | 0.4% | -0.10% | -0.10% |

| Euro Area | 2.4% | 1.9% | 1.3% | 1.6% | 0.00% | 0.10% |

| Emerging Market and Developing Economies | 4.8% | 4.5% | 4.1% | 4.7% | -0.30% | -0.10% |

| China | 6.8% | 6.6% | 6.2% | 6.0% | -0.10% | -0.10% |

| India | 7.2% | 6.8% | 7.0% | 7.2% | -0.30% | -0.30% |

| United Kingdom | 1.8% | 1.4% | 1.3% | 1.4% | 0.10% | 0.00% |

| Nigeria | 0.8% | 1.9% | 2.3% | 2.6% | 0.20% | 0.10% |

| South Africa | 1.4% | 0.8% | 0.7% | 1.1% | -0.50% | -0.40% |

Source: IMF World Economic Outlook (WEO) Update, July 2019

Many Central Banks in both advanced and developing countries are adopting an expansionary monetary policy stance in order to stimulate economic growth. The monetary policy strategies in each country differ. The Federal Open Market Committee (FOMC) of the US Federal Reserve System cut the interest rate in July 2019, the interest rate cut since 2008. The Bank of Japan maintains a negative policy rate (the anchor interest rate). The European Central Bank (ECB) maintains the interest rate at zero. The Bank of England (BoE) maintains the interest rate at 0.75%, which is considered low compared with the historical average of 3.89% between 2006 and 2009. The Reserve Bank of South Africa lowered its interest rate in July 2019. The Central Bank of Nigeria (CBN) also lowered its interest rate in March 2019 and has indicated its preference for a low interest rate, causing yields on fixed income securities to drop. These strategies have created easy money (low cost of funds) in the global financial market and by extension, in Nigeria.

Individuals, companies and governments can now borrow money, both from the local and foreign financial markets, cheaper than in the last few months. It was observed that many banks and other credit providers in Nigeria have recently begun aggressively pushing credit to their customers. Some companies are also refinancing their existing debt obligations at lower interest rates. The Federal Government of Nigeria (FGN) is also refinancing maturing debt obligations and taking on new debt at cheaper rates because of the low interest rate environment. Foreign portfolio investors are aggressively investing in fixed income securities with reasonable yields because of the low interest rates in advanced countries and the expectation of a further interest rate cut, particularly in the US, before the end of 2019. There is a warning that current developments in the global financial market may change, leading to rising interest rates and possible capital flight, particularly from developing countries. Therefore, companies and countries need to build buffers to protect themselves.

If the current trade tensions between the US and China subside and the economic growth in the two countries returns to an upward trend, there may not be a need for excessive expansionary monetary policy. Central banks in the US, UK, India, and South Africa increased their interest rates last year, following prospects of a stronger global economic outlook. Developments in the US and China affect the global economy as the two countries account for about 40% of the global economy in terms of Gross Domestic Product (GDP). The US, the Euro Area, China, Japan, the UK and India collectively account for about 69% of the global economy. Therefore, economic and financial market signals in these regions will have a direct impact on the global economy and financial market. If the economic outlook of these region improve, the low interest rate may change and there may be capital flight from Nigeria. This could damage the Nigerian economy and financial market unless there are buffers in place to counter the negative implications that may follow.

The low yield on fixed income securities in Nigeria is already impacting on the total Foreign Portfolio Investment (FPI) through the Investors’ and Exporters’ Foreign Exchange Window (I&E FX window). Between January and July 2019, Nigeria recorded the lowest FPI through the I&E FX window in July, both in absolute number and as a ratio to the total. Although we had always advocates for Foreign Direct Investment (FDI) because FPI may be regarded as ‘hot money’, FPI can help in a way to increase the stock of foreign exchange in the country. This would help to increase foreign exchange stability and curtail inflationary pressure arising from cost-push effects.

Companies may wish to issue debt capital at this moment to expand business operations and create additional lines of business that can generate improved earnings for them. In doing this, it may be important to provide FX hedging mechanisms for foreign loans. When the financial market becomes tight again with rising interest rates, companies may then modify their capital structure in favour of equity capital and hopefully their earnings would have grown in order to eliminate the dilutive effect of increased equity capital on return on equity. The FGN may also take advantage of the current low interest rate to access long-term debt and channel it specifically towards building the capacity of the economy to generate more revenue. Investment in infrastructure, security, education, healthcare and other forms of a social safety net would improve the productivity of the country and provide an opportunity for government to increase future tax revenue. This strategy should increase the stock of foreign exchange in the country and may reduce the inflation rate.

The current low interest rate should not be seen as an opportunity for individuals, companies and governments to increase deadweight debt. Otherwise, the consequences could be very grave. On the contrary, the low interest rate regime should be seen as an opportunity to access long-term funds that can be used to improve the wellbeing of the economy in order to generate increased revenue for all the economic agents. It should be noted that the low interest rate will not last forever, so enjoy it while it lasts!

MACROECONOMIC ENVIRONMENT:

Manufacturing Purchasing Manager Index

The CBN Manufacturing PMIin the month of July stood at 57.6 index points, indicating expansion in the manufacturing sector for the twenty-eighth consecutive month. The index grew at a faster rate when compared to the index in the previous month. The manufacturing Purchasing Managers Index (PMI) is an indicator of economic health for the manufacturing sector. The purpose of the PMI is to provide information about current business conditions to company decision makers, analysts and purchasing managers. A PMI above 50 points indicates that the manufacturing sector is generally expanding while a reading below 50 points indicates a contraction.

Thirteen out the Fourteen sub-sector survey recorded in the following order: petroleum & coal products; transportation equipment; cement; printing & related support activities; paper products; food, beverage & tobacco products; furniture & related products; fabricated metal products; non-metallic mineral products; plastics & rubber products; primary metal; chemical & pharmaceutical products; and electrical equipment. While the Textile, apparel, leather & footwear subsector recorded decline in the review period month.

At 58.9 points, the production level index for the manufacturing sector grew for the twenty-ninth consecutive month in July 2019. The index indicated a slower growth in the current month, when compared to its level in the month of June 2019. At 57.2 points, the new orders index grew for the twenty-eighth consecutive month, indicating increase in new orders in July 2019. At 58.9 points, non-manufacturing inventory index grew for the twenty-seventh consecutive month, indicating growth in inventories in the review period. Of the seventeen surveyed subsectors, 15 recorded higher inventories, while 2 recorded declining inventories in July 2019

In a separate development, the Central Bank of Nigeria (CBN) in a recent press release clarified the proposed policy on FX restriction to milk importers. It reiterated a planned restriction of access to the Nigerian Foreign Exchange market by importers of milk with the objectives of ensuring forex savings, job creation and investments in the local production of milk.

BUSINESS EXPECTATION SURVEY

The Central Bank of Nigeria (CBN) monthly Business Expectations Survey (BES) expressed optimism on Nigeria’s macro economy in July 2019 according to the report which was posted on the apex bank’s website. The Business Expectations Survey was conducted with a sample size of 1050 businesses nationwide with response rate of 97.4 per cent covering services, industrial, wholesale/retail trade, and construction sectors. The respondent firms were made up of small, medium and large corporations covering both import-and export-oriented businesses

On the Business Outlookrespondents expressed optimism on the overall confidence index (CI) on the macro economy in the month of July 2019 at 28.1 index points. The business outlook for August 2019 showed greater confidence on the macro economy with 64.1 index points. Similarly on Employment and Expansion Plans,the opinion of the respondents firms indicated a favourable business outlook in next month. The employment outlook index by sector showed that the services sector indicates higher employment expansion plans in the next month, with an index of (27.0 points) followed by wholesale/retail trade (21.0 points), industrial sector (20.6 points) and construction sector (5.9 points).

On the Expectations on Economic Growth Rate, Respondents anticipate better economic conditions as their index of economic growth rose in the short run with an index of 33.3, 48.7 and 60.6 points for the current month, next six months and next twelve months, respectively. Respondent firms’ expressed satisfaction with the management of inflation by the Government with a positive net satisfaction index of 6.0 in July 2019. The net satisfaction index is the proportion of satisfied less the proportion of dissatisfied respondents.

CONSUMER PRICE INDEX (CPI), JULY, 2019

The CPI recorded the lowest growth since January, 2016. The consumer price index, (CPI) which measures inflation increased by 11.08 percent (year-on-year) in July 2019. This is 0.14 percent points lower than the rate recorded in June 2019 (11.22 percent).

On month-on-month basis, the Headline index increased by 1.01 percent in July 2019. This is 0.06 percent rate lower than the rate recorded in June 2019 (1.07) percent. The percentage change in the average composite CPI for the twelve months period ending July 2019 over the average of the CPI for the previous twelve months period was 11.29 percent, compared to 11.29 percent recorded in June 2019.

The urban inflation rate increased by 11.43 percent (year-on-year) in July 2019 from 11.61 percent recorded in June 2019, while the rural inflation rate increased by 10.64 percent in July 2019 from 10.87 percent in June 2019. On a month-on-month basis, the urban index rose by 1.07 percent in July 2019, down by 0.03 from 1.10 percent recorded in June 2019, while the rural index also rose by 0.96 percent in July 2019, down by 0.09 from the rate recorded in June 2019 (1.05) percent.

The corresponding twelve-month year-on-year average percentage change for the urban index is 11.64 percent in July 2019. This is less than 11.65 percent reported in June 2019, while the corresponding rural inflation rate in July 2019 is 10.97 percent compared to 10.99 percent recorded in June 2019.

Source: Central Bank of Nigeria, National Bureau of Statistics, FSDH, Proshareng.com

TAX: Regulatory Authorities’ Approvals and the Application of Arm’s Length Principle in Nigeria: The Need for Coherence

One of the key objectives of the Income Tax (Transfer Pricing) Regulations, 2018 (NTPR) as captured in regulation 2(e) is to provide taxable persons with certainty of transfer pricing treatment in Nigeria. The attainment of this objective should lead to improvement in the ease of doing business in Nigeria and ultimately help to attract the much-needed Foreign Direct Investments (FDI) into the country. Notwithstanding the above, certain provisions in the NTPR and the application of the arm’s length principle by the tax authority appears to be contrary to the objective noted above.

For instance, Regulation 5(8) of the NTPR provides that the FIRS is not obliged to accept the value reported for customs duty purposes when considering the income tax implications of a non-arm’s length importation. This means that even after valuation by the Nigerian Customs Services (NCS) and subsequent duty payments, the FIRS could still subject such transactions to the arm’s length principle. Similarly, the Federal Inland Revenue Service (FIRS) still subjects related party transactions approved by the National Office for Technology Acquisition and Promotion (NOTAP) to the arm’s length test. In the instances described above, where the FIRS is able to sustain a TP adjustment, it will create a risk of double taxation thereby negating the lofty objective and goals described above.

This article examines situations where these conflicts could arise, assesses their impact for the taxpayers and the country, reviews the practices in other jurisdictions and makes recommendations on how to resolve these conflicts for the benefit of all stakeholders including the FIRS.

The Issues

Prior to the introduction of the NTPR, Regulation

15 (a) and (b) of the repealed Income Tax (Transfer Pricing) Regulations No.1 2012, relieved connected persons from the requirements to prepare contemporaneous documentation where:

(a) “the controlled transactions are priced in accordance with the requirements of a Nigerian statutory provisions; or

(b) the prices of connected transactions have been approved by other Government regulatory agencies or authorities established under the Nigerian law and satisfactory to the Service to be at arm’s length”.

While the provision in 15(a) did not create any ambiguity in terms of its application, the implementation of 15(b) by the FIRS created some risks for taxpayers. Transactions involving technical services, management services, trademark and tradenames etc. of which their pricing have been hitherto reviewed and approved by NOTAP were still being subjected to the arm’s length test and the FIRS in some instances raised additional assessments on account of those transactions.

In the upstream Oil and Gas industry, the Department of Petroleum Resources (DPR) and the Nigerian National Petroleum Corporation (NNPC) also approve certain prices. For instance, related party costs incurred by a company in a joint venture arrangement with the NNPC will have to be approved by the NNPC. This is also the case in the financial services sector where the Central Bank of Nigeria (CBN) and the National Insurance Commission also fix certain prices or fees for some categories of transactions in that sector. It is clear that these regulatory bodies have over the year’s exercised control over the pricing of some transactions within the industry they regulate.

Experience has shown that the FIRS does not in all cases agree with the approvals by these Regulatory bodies. This is further amplified by the deletion of Regulation 15(b) in the NTPR and the introduction of a provision that enables the FIRS set aside customs valuation for determining the arm’s length price.

These practices by the FIRS create uncertainty for taxpayers in Nigeria who are unsure whether a NOTAP approval for instance, will be acceptable for Transfer Pricing (TP) purposes. The resulting implication of the FIRS’ action is that it will create double taxation risk for taxpayers who have relied on Regulatory approvals for the pricing of their controlled transactions. This is definitely in contrast with another objective of the NTPR (Regulation 2(c)) which is to reduce the risk of economic double taxation.

Examples from other jurisdictions

The challenges described above are not peculiar to Nigeria. However, other jurisdictions have devised means of dealing with the challenges in a manner that meets the twin objectives of compliance with the arm’s length principle and minimizing double taxation risks for taxpayers. Some of the jurisdictions reviewed include:

- Canada- Canada’s customs authorities consider TP documentation as an acceptable basis for customs valuation. The related entities should be able to demonstrate that the relationship did not influence the import price; i.e the transactions are carried out at arm’s length. This can be demonstrated by comparing the related transaction with unrelated transactions under similar circumstances. The import price can also be demonstrated as uninfluenced with evidence of genuine bargaining and the ability of the importing entity to establish its ability to freely acquire the same goods from independent suppliers.

- South Africa- The South Africa Reserve Bank (SARB) requires Multinational Enterprises seeking to pay management fees to a related party to submit as part of its documentation a TP documentation. This ensures that appropriate reviews from the perspective of both the arm’s length principle and exchange controls are done before an approval is granted. Once this is done, it is unlikely that the tax authority will disagree with such approvals by SARB. This way, the risk of double taxation is minimized for the taxpayer.

- United Kingdom- In order to ensure coherence between the revenue authority and customs, Her Majesty Revenue and Customs (HMRC) was formed in 2005 from a merger of the Inland Revenue and Her Majesty’s Customs and Excise. This merger has ensured an alignment of strategies between both agencies in order to ensure that the right taxes are paid by taxpayers.

The way forward

It is imperative for regulatory authorities responsible for approving prices, to work in a collaborative manner for the benefit of the economy. Given that the FIRS has the responsibility for administering federal taxes, it should take the lead in this respect.

The FIRS can consider engaging other regulatory bodies to adopt TP methodologies when setting or approving prices for related party transactions. This process will involve extensive discussions and training of these agencies. For instance, with respect to NOTAP approvals, the desired outcome will be such that once a taxpayer has obtained a NOTAP approval, it shouldn’t be subject to review by the FIRS. In order to achieve this, both NOTAP and FIRS will have to work together with respect to pricing of the related party transactions such that they can reach a mutually acceptable decision. The process of reaching this decision should have established a set of mutually acceptable methodologies taking into account both the objectives of the relevant regulatory agency as well as TP considerations.

With respect to customs, the World Customs Organization (WCO) recently issued the 2018 edition of the Guide to Customs Valuation and Transfer Pricing (‘‘ 2018 Guide”). The 2018 Guide summarized the principles of customs valuation and TP, and also provided guidance on how to use TP documentations during customs valuation. It also provides insights and practical experiences of some countries which can facilitate a more sophisticated understanding by WCO members regarding this topic. The 2018 Guide is expected to enhance the certainty level of handling a customs valuation case and to help establish a more consistent method to determine taxation obligations on a more precise basis. This document can serve as a guide to the FIRS in reaching a mutually acceptable position with the customs in the interest of the tax payers and the entire economy.

Another option is for the FIRS to accept all pricing approvals issued by the governmental regulatory agencies. This will create more certainty for taxpayers and eliminate the risk of double taxation which is consistent with the objective of the NTPR.

Conclusion

Nigeria must continue to improve the ease of doing business to attract the much-needed investment (local and foreign). One of the indices used to measure ease of doing business is the ease of paying taxes. We can therefore not overemphasize the need for governmental agencies to work in a collaborative manner such that taxpayers are certain of their compliance obligations and double taxation risks are eliminated or mitigated at the least.

Exposition by AndersenTax

LAW REPORT REVIEW / LEGAL OPINION:

AN EMPLOYER CANNOT BE COMPELLED TO DECLARE REDUNDANCY

Mr Suraju Rufai (suing for and on behalf of all staff of VON Automobiles Nigeria Limited) vs. Bureau of Public Enterprises & 2 Ors, unreported Suit No: NICN/LA/18/2013 –

FACTS

1. This case was transferred from the Federal High Court to the National Industrial Court; and was filed by the claimant for and on behalf of all staff of VON Automobiles Ltd. The claimant had in 2013 filed the action seeking the following reliefs:

a) A declaration that the claimant and all other staff affected in this action are entitled to their gratuity and severance package as a result of the termination of their employment by privatization.

b) A declaration that the defendants are entitled to pay every existing staff of the claimant 200% of their total gratuity benefit and severance package.

c) The claimant’s salary for six months in lieu of notice.

d) The claimant’s salary for short payment of 40 months which represents the claimant’s salary based on the calculation of Bureau of Public Enterprises official on the 2nd June 2008.

e) The claimant’s salary for the overtime performed by the staff.

f) Payment for staff unutilized annual leave for 2006, 2007 and 2008.

g) The sum of N2,152,213.64 representing staff NSITF.

h) The sum of N1,438,988 representing staff pension.

i) The sum of N1,833,251.26 representing staff Tax Payee which was deducted from staff salaries.

2. The Defendants entered appearance and filed their Statements of Defence to the claim.

3. At the trial, the claimant called two witnesses and the frontloaded documents were admitted. However, it was not dated, not signed and the source was unknown. The 2nd defendant’s frontloaded documents were admitted. The 2nd defendant’s frontloaded documents were admitted. The 1st and 2nd defendants were not in court to cross-examine the 3rd defendant’s witness and so were foreclosed and the court ordered for written addresses.

Case for the Claimant:

4. The case for the claimant was that the claimant, Mr. Suraju Rufai, has the authority to

represent all the staff (51 in all) of Volkswagen Nigeria both senior and junior staff of Volkswagen of Nigeria who has been listed in the documents tendered. To the claimant, Volkswagen of Nigeria employed their employees under various terms and conditions stated in the collective agreements.

5. Volkswagen of Nigeria was privatized by the 1st defendant and handed over to the 2nd defendant in April 2009. The said 2nd defendant withheld staff salaries and owed the staff as a result of which the staff were disillusioned and the staff mandated their representatives to write the letters.

6. That despite the letters, the 2nd defendant remained adamant and neither complied nor replied to the letters. However, the parties eventually reached an agreement on the severance package for the staff in 2008 but the 2nd defendant reneged on the agreed date of payment which was June 2008 and eventually paid the staff in February 2009.

7. That between June 2008 and February 2009 staff were not paid their salaries. Eventually when payment was made the defendants did not follow the agreement/computations of 2008 but short paid the staff. The situation was conveyed to the 2nd defendant during the handing over.

8. Due to the refusal of the 2nd defendant to pay the staff gratuity benefits, they caused their lawyer to write the 1st and 2nd defendants; and when there was no response from the defendant, the claimant filed this suit.

Case for the Defendants

9. To the 1st defendant, pursuant to the Shares Sales Agreement the 35% shares in VON were sold to the 2nd defendant who subsequently took over the company in July 2006. The shares were sold and the 2nd defendant was to take over all the liabilities of these shares.

10. The 1st defendant’s position was thus that the issue of staff employment and remuneration was the responsibility of the 2nd and 3rd defendants. The 1st defendant, however, acknowledged it witnessed the payment severance packages to staff.

11. The 1st defendant continued that as an agency of the Federal Government saddled with responsibility of the Federal Government’s privatization drive, it only sold the Federal Government of Nigeria’s 35% shares in the 3rd defendant to the 2nd defendant; it did not do more than that. Accordingly, that the claimant has no cause of action against it.

12. The 2nd defendant’s position was that the claimant and staff voluntarily retired from service and that it merely bought only the 35% shares sold by the BPE but did not take over all the outstanding liabilities of the 3rd defendant.

13. That the 3rd defendant’s liabilities are limited by the amount unpaid on those shares. That the employees resigned voluntarily by a letter dated 16th August 2007. The 2nd defendant went on that it never dealt with the employees, who in any case were the responsibility of the 3rd defendant.

14. That the employees were paid their entitlements and the 2nd defendant provided the funds for payment of the entitlements. The 2nd defendant admitted that some of the employees had their entitlements erroneously computed but those affected had been properly paid.

15. That the 2nd defendant is only a shareholder of the 3rd defendant and not the successor of the 3rd defendant.

16. To the 3rd defendant, each of its staff was employed under distinct and separate terms and conditions of employment.

17. That the 3rd defendant was privatized by the 1st defendant and the Federal Government of Nigeria transferred its 35% interest in the 3rd defendant to the purchasers. That after the said sale of the shareholding interest of the Federal Government of Nigeria in the 3rd defendant, the 2nd defendant who represented the investors held a meeting with the former Management of the 3rd defendant on 5th July 2007 and informed them of the intention of the new Management of the 3rd defendant to retain all staff.

18. However, that the claimant and other former staff of the 3rd defendant rejected the overture of the 2nd defendant and indicated their intention to disengage their services from the 3rd defendant. The 3rd defendant then denied that the employment of the claimant and other former employees of the 3rd defendant were terminated by the 3rd defendant.

19. That upon the resolve of the claimant and other staff of the 3rd defendant to disengage from the employment of the 3rd defendant, the 2nd defendant, acting on behalf of the 3rd defendant engaged in discussion and negotiations with the representatives of the Staff towards payment of their salaries and entitlement.

20. That the just and appropriate entitlements of the claimant and other former staff of the 3rd defendant were paid to them based on the mutual understanding between the parties. Accordingly, that the claimant and other former staff of the 3rd defendant who disengaged their services were not entitled to salaries for the months of February to April 2009 as they were paid their entitlements and salaries up to January 2009 and were not entitled to any further payment.

21. That the claimant and other former staff of the 3rd defendant voluntarily disengaged their services and were not entitled to six months salary or any other sum at all.

22. That the claimant and other staff of the 3rd defendant did not perform overtime and were not entitled to payment for overtime.

23. That the claimant and other former staff of the 3rd defendant have been paid their NSITF and pension contributions and were not entitled any further payments in respect of any contributions, howsoever described.

ISSUES FOR DETERMINATION

(1) Whether the claimant’s case was properly constituted against the 3rd defendant in the circumstances of this case.

(2) Whether considering the facts and circumstances of this case, the claimants has discharged the requisite burden of proof to justify their claim against the 3rd defendant.

(3) Whether the claimant was entitled to any of the reliefs sought against the 3rd defendant.

JUDGMENT

The Court considered the processes filed and the submissions of counsel, and dismissed the case. It, however, held as follows:

1. The law is that an unsigned and an undated document has no evidential value. See Global Soaps & Detergent Ind. Ltd v. NAFDAC [2011] All FWLR (Pt. 599) 1025 at 1047 and Udo & ors v. Essien & ors [2014] LPELR-22684(CA). Accordingly, the unsigned and undated documents had no evidential value and were discountenanced.

2. By the Supreme Court decision in Gabriel Ativie v. Kabelmetal (Nig.) Ltd [2008] LPELR-591(SC); [2008] 10 NWLR (Pt. 1095) 399; [2008] 5 – 6 SC (Pt. II) 47, a claimant’s case would necessary be circumscribed by the reliefs. What this means is that the claimant’s pleadings must support the reliefs prayed for. This was not done in the matter. It was made worse by the fact that in making monetary claims, no specific pleadings as to the monetary sums were made by the claimant both in terms of the instrument entitling the claimant and how he came by the quantum of the sums he claimed. This was aside from the very illogicality of suing in a representative capacity. The case of NNPC v. Clifco Nigeria Ltd [2011] LPELR-2022(SC) enjoins that special damages are never inferred, they are exceptional and so must be claimed specially and proved strictly.

3. In labour relations, the burden is on the claimant who claims monetary sums to prove not only the entitlement to the sums, but how he/she came by the quantum of the sums; and proof of entitlement is often by reference to an instrument or document that grants it (Mr. Mohammed Dungus & ors v. ENL Consortium Ltd [2015] 60 NLLR (Pt. 208) 39), not the oral testimony of the claimant except if corroborated by some other credible evidence.

4. In Mr. Mohammed Dungus & ors v. ENL Consortium Ltd [2015] 60 NLLR (Pt. 208) 39, this Court was quite specific that a claimant who makes no attempt whatsoever to indicate to the Court the exact provisions of the documents they frontloaded that grants them the entitlements they claim, merely frontloading same and saying that a right inures from it without indicating the clause, section, article or paragraph that grants the right is bound to fail; and counsel should not expect that it is the Court that will shop for the relevant article that substantiates the claim of his/her client.

5. A claim for backlog of salaries cannot be entertained when the actual salary of the claimant(s) was not pleaded, as in the instant case. And by Honika Sawmill (Nig.) Ltd v. Holf [1992] 4 NWLR (Pt. 238) 673 CA, as between an employer and an employee, the onus is on the employee to prove that the employer employed him on a stipulated salary and that he worked for the employer during the relevant period before the duty devolves on the employer to prove not only that he paid the employee his salary for work done by the employee in the relevant period but also how much the salary that he paid the employee was.

6. The claimant alluded to constructive dismissal. However, the case of the claimant, at least from his pleadings, is not one of constructive dismissal as this line of argument seems to suggest.

7. The claimant placed a good deal of reliance on a document, which he referred to as a collective agreement. It is in fact, the senior staff handbook. Having to refer to it as a collective agreement means that the claimant does not even know what a collective agreement is. This aside, and for whatever it is worth, the claimant talked of a collective agreement without delineating as between the junior and senior staff that he represents, who the collective agreement binds and who it does not bind. The pleadings itself show that the claimant was a management staff of the 3rd defendant, meaning that the collective agreement cannot even apply to him unless he specifically pleaded and proved by concrete documentary evidence that he was a member of the trade union that negotiated and signed the collective agreement. See Mrs Bessie Udhedhe Ozughalu & anor v. Bureau Veritas Nigeria Limited unreported Suit No. NICN/LA/626/2014, the judgment of which was delivered on 20th March 2018, Aghata N. Onuorah v. Access Bank Plc [2015] 55 NLLR (Pt. 186) 17, Samson Kehinde Akindoyin v. UBN Plc [2015] 62 NLLR (Pt. 217) 259, Mr. Valentine Ikechukwu Chiazor v. Union Bank of Nigeria Plc unreported Suit No. NICN/LA/122/2014.

8. The argument of the claimant that the defendants have a duty to declare a redundancy and thereafter follow the procedure outlined in the collective agreement, suggests a compulsion on the defendants to declare redundancy. An employer cannot be compelled to declare redundancy. That is a business decision it must make of its own volition. In any event, there is the point that reliefs – all relate to unpaid salaries and allowances. By Odinkenmere v. Bakolori (Nig.) Ltd [1995] 8 NWLR (Pt. 411) 52 CA, the question of payment of unpaid salaries and allowances are only relevant in cases of termination of appointment or dismissal but not in the case of redundancy. Additionally, by PAN v. Oje [1997] 11 NWLR (Pt. 530) 625 CA, redundancy benefits do not include gratuity benefits as the conditions applicable to redundancy are quite distinct from those applicable to retirement or other conventional mode of relieving an employee from active service, such as termination, resignation or dismissal. In other words, redundancy cannot be claimed simultaneously with gratuity.

9. A look at the claimant’s reliefs i.e. the claims for six months in lieu of notice, short payment of 40 months representing the claimant’s salary based on the calculation of BPE official on 2nd June 2008 and overtime will show that they are personal to the claimant and not to all those he represents. How the claimant came by these entitlements and their quantum are not evident from the pleadings.

10. In terms of the argument that the overtime the claimant and those he represents did was for essential/services dealing with security and engineering department staff, the pleadings do not even show who amongst the claimant and those he represents did what.

OPINION

a) The state of the claimant’s pleadings did not support the claims of the claimant.

b) An employer cannot be compelled to declare redundancy. That is a business decision it must make of its own volition.

Recent Comments