BUSINESS ESSENTIALS Vol. 4, No. 14

Dear Esteemed Member,

We welcome you to an interesting edition of our regular Business Essentials. In this edition, we reviewed the general macroeconomic situation in the country, showing positive. With the signing into law of the 2017 national budget, we hope the positive trends should continue and further translate to economic growth and development.

We also touched on the need for an appropriate framework for corporate governance and Government’s Economic Recovery and Growth Plan (ERGP), with a focus on the ailing energy sector. It remains to be seen with regards to government’s ability to meet the ambitious targets it has set.

Our regular Labour and Employment Law Review and Upcoming Training Programmes were not left out.

Have a pleasant reading.

Timothy Olawale

Editor

In this Issue:

- Review Of Current Macroeconomic Development: Indices All Looking Positive

- Building an Appropriate Framework for Corporate Governance

- Review of the International Monetary Fund (IMF) report of the Article IV Consultation on Nigeria

- Pictorial: NECA’s Delegation at the 106th International Labour Conference, Geneva, Switzerland

- Upcoming Training Programmes

Rely on Others to Improve Yourself

There’s a common misconception that individual development needs to happen…individually. Nothing could be further from the truth. Despite our common cultural notion of “self” improvement, the most successful efforts to self-improve have other people at their core. If you’re looking to gain a new skill or break a bad habit, seek out people (both inside and outside your organization) who are looking to do the same, and meet regularly. You can also join online learning communities, discussion groups, or courses.

By exchanging empathy, success stories, and “Watch out for…” insights, you can build the confidence and commitment to push through setbacks and accelerate the adoption of new behaviours. You can also help each other out of ruts. Most important, you create a sense of ownership over one another’s success that results in momentum for change.

Adapted from” “Why Self-Improvement Should Be a Group Activity,” by Ron Carucci

Review Of Current Macroeconomic Development: Indices All Looking Positive

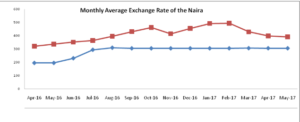

The average Brent crude oil price for early part of 2017 is $50/barrel, improving from average of $43.55/barrel in 2016, this portends a positive outlook for the Nigerian economy; the External Reserves is also experiencing marginal monthly increase since October 2016, $23,952.77million to $30,983.70 in May 2017; inflation figure have also demonstrated gradual decrease from the peak of 18.72% in January 2017 to 17.2% in April 2017 (marking the third consecutive month the inflation rate has fallen). The Exchange rate movement is also showing good signs of recovery/divergence.

Capital Market: Recent development in the Capital Market indicated significant improvement from February 2017 till date. Concerned about the increasing External debt profile, particularly, from States with very low Internal Generating Revenue (IGR).

The average Brent crude oil price for early part of 2017 is $50/barrel, improving from average of $43.55/barrel in 2016, this portends a positive outlook for the Nigerian economy; the External Reserves is also experiencing marginal  monthly increase since October 2016, $23,952.77 million to $30,983.70 in May 2017; inflation figure have also demonstrated gradual decrease from the peak of 18.72% in January 2017 to 17.2% in April 2017 (marking the third consecutive month the inflation rate has fallen). The Exchange rate movement is also showing good signs of recovery/divergence.

monthly increase since October 2016, $23,952.77 million to $30,983.70 in May 2017; inflation figure have also demonstrated gradual decrease from the peak of 18.72% in January 2017 to 17.2% in April 2017 (marking the third consecutive month the inflation rate has fallen). The Exchange rate movement is also showing good signs of recovery/divergence.

In a nutshell:

- Global growth prospect are marginally higher

- Domestic inflation is falling

- FX policy is better even though we haven’t reached full market re-flexibility; rate arbitrage gap is tightening, and reserves are growing

- Oil prices still significantly higher than budget benchmark

- Capital markets are rising

- However, debt sustainability is an issue, debt servicing is high relative to revenue earning capacity.

Our major concern:

- When will strong Economic Recovery Growth Plan (ERGP) implementation commence and we hope that political risk would not topple the apple cart?

Taking a look at the recently passed National Budget by the Legislators, vis-a-vis what was proposed, we observed the following:

| Budget Indicators | 2017 | 2016 | % Growth | ||

| Budget Proposal | Budget Passed | Budget | Budget Proposal | 2016 Budget | |

| Total Budget (N’Bn) | 7,298.51 | 7,441.18 | 6,060.68 | 1.95 | 22.78 |

| Statutory Transfers (N’ Bn) | 419.02 | 434.41 | 351.37 | 3.67 | 23.63 |

| Debt Services | 1,841.35 | 1,841.35 | 1,475.32 | 0.00 | 24.81 |

| Capital Expenditure (Exclusive of Statutory Transfers) | 2,058.99 | 2,177.87 | 1,587.60 | 5.77 | 37.18 |

| Recurrent Expenditure (Non Debt) | 2,979.15 | 2,987.55 | 2,646.39 | 0.28 | 12.89 |

| Oil Production (mbpd) | 2.2 | 2.2 | 2.2 | 0.00 | 0.00 |

| Oil Benchmark Price ($/bbl) | 42.5 | 44.50 | 38 | 4.71 | 17.11 |

| Exchange Rate (N/$) | 305 | 305 | 197 | 0.00 | 54.82 |

| Projected Revenue | 4,941.57 | 5,084.18 | 3,855.74 | 2.89 | 31.86 |

| – Oil Revenue | 1,985.00 | 2,078.49 | 820 | 4.71 | 153.47 |

| – Non-Oil Revenue | 1,373.00 | 1,373.00 | 1,454.69 | 0.00 | -5.62 |

| – Independent Revenue | 807.57 | 807.57 | 1,505.88 | 0.00 | -46.37 |

| – Recoveries | 565.10 | 565.10 | 350.33 | 0.00 | 61.31 |

| Others | 210.90 | 210.9 | 0.00 | ||

| Projected Deficit | 2,360 | 2,357 | 2,221.94 | -0.13 | 6.08 |

| Domestic Borrowing | 1,254 | 1,254 | 984 | 0.00 | |

| Foreign Borrowing | 1,067 | 1,067 | 900 | 0.00 | |

| Projected Deficit (% of GDP) | 2.18 | 2.18 | 2.16 | 0.00 | |

| Debt Services (% of Budget Revenue) | 37.26 | 36.22 | 38.26 |

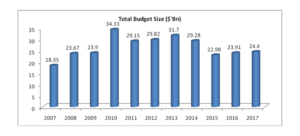

Budget Size in USD

Budget Breakdown

| Ministry | 2017 (N Million) | 2016 | % Growth | ||

| Budget Proposal | Budget Passed | Budget (N’ Million) | Budget Proposal | 2016 Budget | |

| Power, Works and Housing | 529,337.59 | 553,713.86 | 422,964.93 | 4.61 | 30.91 |

| Transportation | 262,000.00 | 241,709.00 | 188,674.68 | -7.74 | 28.11 |

| Health | 51,315.56 | 55,609.88 | 28,650.34 | 8.37 | 94.10 |

| Education | 50,433.49 | 56,720.97 | 35,433.49 | 12.47 | 60.08 |

| Defence | 140,000.00 | 139,294.92 | 130,864.44 | -0.50 | 6.44 |

| Interior | 63,261.06 | 63,760.56 | 61,713.28 | 0.79 | 3.32 |

| Water Resources | 85,146.31 | 104,245.80 | 46,081.12 | 22.43 | 126.22 |

| FCT Administration | 37,297.12 | 30,397.12 | 29,297.12 | -18.50 | 3.75 |

| National Security Adviser | 43,209.20 | 47,209.20 | 32,084.09 | 9.26 | 47.14 |

| Agriculture | 91,649.99 | 103,793.20 | 46,173.96 | 13.25 | 124.79 |

| Industry, Trade and Investment | 80,856.95 | 81,726.97 | 5,886.33 | 1.08 | 1288.42 |

| Information & Culture | 8,380.25 | 9,546.25 | 6,071.50 | 13.91 | 57.23 |

| Science & Technology | 37,331.18 | 41,699.66 | 27,006.18 | 11.70 | 54.41 |

| Niger- Delta | 33,692.50 | 34,201.50 | 19,440.33 | 1.51 | 75.93 |

In 2017 Budget, the National Assembly published the breakdown of its budget, first of its kind. Below is the breakdown of the National Assembly Budget

| Breakdown of National Assembly Budget | ||||

| Office | Total Personnel Costs (N’ Billion) | Total Overhead Costs (N’ Billion) | Total Capital (N’ Billion) | Total Allocation (N’ Billion) |

| Management | 6.71 | 6.19 | 2.01 | 14.92 |

| Senate | 1.86 | 25.11 | 4.43 | 31.40 |

| House of Representatives | 4.92 | 39.64 | 4.49 | 49.05 |

| NASS Service Commission | 0.96 | 1.14 | 0.31 | 2.42 |

| Legislative Aides | 8.92 | 0.53 | 0.15 | 9.60 |

| PAC- Senate | 0.00 | 0.12 | 0.00 | 0.12 |

| PAC-House of Reps | 0.00 | 0.14 | 0.00 | 0.14 |

| General Services | 0.00 | 11.77 | 0.82 | 12.58 |

| NASS Legislative Institute | 0.42 | 1.23 | 2.73 | 4.37 |

| Service Wide Vote | 0.00 | 0.00 | 0.00 | 0.39 |

| Total | 23.79 | 85.88 | 14.94 | 125 |

- Even though a N1.4Trillion increase in Naira terms to 2016 Budget, 2017 budget is flat in Dollar terms

- Major budget assumptions now look fairly reasonable.

- Increased percentage allocation to CAPEX is positive, continuing trend under current government

- Structural dependence on borrowing remains a concern, while debt/GDP is low, debt servicing ratios tending towards unsustainable. The imperative is greater leverage of private capital.

- Budget deficit is large and growing!

- NASS has acceded to requests to reveal budget line items-now to review the detail…but remember NASS budget is only 1.6% of total budget! It’s the executive that spends the real money; and that’s where budgetary reforms are most valuable.

……………………………………………………………………………………………………………………………………………………..

Building an Appropriate Framework for Corporate Governance

Building an appropriate framework for Corporate Governance varies so significantly from one part of the world to another that one would require much more time and space to discuss all of the different manifestations and their consequences. In this column, we will therefore, be selective in our approach: we will endeavour to identify the principles involved, attempt to establish a link between good corporate governance and organisational success and suggest an appropriate framework in the Nigerian situation for the future.

The appropriate framework for good governance will be considered in the context of the following practical key concerns. These concerns can broadly be compartmentalised into:

Basic Issues dealing with the fundamentals of accountability, transparency, probity, financial and other control structures, ethics, etc

Corporate Governance is typical of some disciplines in which legislation is able to capture only the conceptualisation of what is to be practised. The substance of corporate governance usually emerges when conceptualisation is applied to the reality of situations faced by practitioners.

For instance, the statute requires the board of directors to perform or take action on particular duties with ‘due diligence’ but whenever there is a problem the opinions of very respectable people often differ. For example, how deep into petty information should the director dig in the determination of due diligence? As many long-suffering management staff will confirm, there is often only a very thin line between exercising ‘due diligence’ and becoming an insufferable nuisance to executives who are anxious to get on with more urgent work. To what extent, therefore, can one arrive at definitions which would meet with universal agreement and approval? What appropriate framework would be acceptable world-wide or for that matter Nigeria-wide? Besides, what defence can a director offer to a court which questions the diligence with which he probed allegations of misconduct concerning the Chairman of his board? These are not hypothetical questions, and many ‘innocent’ corporate executives have discovered this to their consternation.

There are other areas in which the law does not offer much clarity. The Companies and Allied Matters Act (CAMA) 1990 states, in section 63 (3), that ‘ the business of the company shall be managed by the board of directors’ but in giving the meaning of the word, ‘director’ CAMA defines directors in section 244 as ‘ persons duly appointed by company to direct and manage the business of the company.

Are the directors there to direct or to manage- or both? What is quite clear is that the business of the organisation must be run in a way which has some real potential for achieving stated objectives.

The law acknowledges that both the board and management have important roles to play in this process, and the spirit of the legislation is that both the directing-which is the focus of the board- and the managing-the task of the executives-should be complementary to each other. Governance and management should be mutually reinforcing in working for the best corporate performance.

If both board and management had a perfect understanding of this fact, their working relationship would be free of all unnecessary tension. Corporate governance is now widely accepted as being concerned with improving stakeholder performance.

According to this view, corporate governance is all about accountability, boards disclosure, investor involvement and so on. There are guidelines and principles associated with good governance, best expounded in the UK by the Cadbury Committee in the well-received ‘Cadbury Report’ since adopted by many organisations both locally and internationally. Others are the OECD ‘principles of Corporate Governance’ and the South African ‘King’s Report’ now in its 2nd edition.

Good Corporate Governance

The board may be said to be practising good corporate governance if it gives priority to these issues:

- Making sure that the company offers a fair return for each stakeholder’s input. This is actually good business, to ensure that investors, employees, suppliers and other contributors to the company’s activities receive fair returns for their efforts.

- Making the company (i.e management) perform to high business and ethical standards

- Ensuring the proper balance in the management of different interests.

As we have already observed, the tension between the expectations of stakeholders may produce conflict. Such tension is often the root cause of the notorious ‘boardroom crisis’ which has preceded the disintegration of many a board of directors. The practice of good corporate governance should enable the board to keep conflict situations to a minimum, and to make effective arrangements for speedy and quiet resolution when conflicts do arise.

……………………………………………………………………………………………………………………………………………………..

Review of the International Monetary Fund (IMF) report of the Article IV Consultation on Nigeria

Every year, the International Monetary Fund (IMF) holds bilateral discussions with its members and gave detailed report of the Consultation. Below is our review of the Report and Recommendations:

The report recognised that the country entered into recession in 2016, with growth contracting by 1.5%, oil receipts dominates fiscal revenue and exports with an annual inflation rate doubled to 18.6%, reflecting hikes in electricity and fuel tariffs, a weaker naira and accommodation monetary conditions (broad money expanding at 19% year-on-year).

On recent development in the fiscal side, low oil prices and reduced production curtailed oil revenue, widening the fiscal deficit, despite a sharp decline in capital expenditures. The International trade experienced declining imports which outweighed the fall in exports, contributing to a trade surplus, which helped move our current account balance to a surplus. However, capital inflows remained depressed.

The period under review indicated that Gross International reserves strengthened to $27billion (minus cumulative inflows from FX swap and FX forwards outstanding). Despite the move towards greater exchange rate liberation, FX restrictions kept the wedge between the parallel and interbank exchange rates at over 50%. While the spread between Eurobond and the US government securities (basis points) remain elevated.

As the CBN’s sales of forex declined and monetary policy stance eased, liquidity in the banking sector increased and money market rate fell sharply below the MPR before increasing more recently. Despite the monetary easing, credit to the private sector, which grew by 22 % year-on-year in December, and it remained relatively flat after correcting for changes in the exchange rate. Meanwhile, non-performing loans (NPL) doubled and capital adequacy ratios declined.

IMF’s Position/Recommendations:

- Growth would pick up only slightly to 0.8 percent in 2017, mostly reflecting some recovery in oil production and a continuing strong performance in agriculture. Policy uncertainty, crowding out, and FX market distortions would be expected to drag activity.

- Accommodative monetary policy would keep inflation in double digits. Financing constraints and banks’ risk aversion would crowd out private sector credit and increase the Federal Government’s already high debt service burden.

- A continued policy of prioritizing exchange rate stability would lead to an increasingly overvalued exchange rate, leading to deterioration in the non-oil trade balance and gross reserves below adequate levels.

- Recognized that the Nigerian economy has been negatively impacted by low oil prices and production. It commended the efforts already made by the authorities to reduce vulnerabilities and enhance resilience, including by increasing fuel prices, raising the monetary policy rate, and allowing the exchange rate to depreciate. However, in light of the persisting internal and external challenges, they emphasized that stronger macroeconomic policies are urgently needed to rebuild confidence and foster an economic recovery.

- Welcomed the countries’ Economic Recovery and Growth Plan (ERGP), which focuses on economic diversification driven by the private sector, and government initiatives to strengthen infrastructure—including the recently adopted power sector recovery plan. However, they underlined that without stronger policies these objectives may not be achieved.

- Emphasized the need for a front-loaded, revenue-based fiscal consolidation starting in 2017, to reduce the federal government interest payments-to-revenue ratio to sustainable levels.

- Underscored that priority should be given to increasing non-oil revenue, including through raising VAT and excise rates, strengthening compliance, and closing loopholes and exemptions.

- Administering an independent fuel price-setting mechanism to eliminate fuel subsidies, strengthening public financial management, and developing a well-targeted social safety net would also support the adjustment.

- Stressed the need to contain the fiscal deficit of state and local governments, including through improved transparency and monitoring.

- Underscored that external adjustment is necessary to protect foreign currency buffers and reduce vulnerabilities. They commended the recent easing of some exchange restrictions and urged the authorities to remove the remaining restrictions and multiple currency practices, thus unifying the foreign exchange market and helping regain investor confidence.

- Emphasized that these policies should be supported by tighter monetary policy and fiscal consolidation to anchor inflation expectations and to limit the risk of exchange rate overshooting, as well as structural reforms to improve competitiveness.

- Welcomed the steps to strengthen banking sector resilience through stronger prudential requirements. With asset quality declining, they recommended further intensifying bank monitoring, enhancing contingency planning, and strengthening resolution frameworks.

- Encouraged quickly increasing the capital of undercapitalized banks and putting a time limit on regulatory forbearance.

- Emphasized that ambitious structural reforms are key to achieving a competitive, investment-driven economy that is less dependent on oil.

- Priority should be given to improving infrastructure, enhancing the business environment, improving access to financing for small enterprises, and strengthening governance and anti-corruption efforts. Timely and effective implementation of these measures would promote sustainable and inclusive growth.

- Welcomed progress in improving the quality and availability of economic statistics and encouraged further efforts to compile sub-national fiscal accounts.

NECA’s Delegation at the 106th International Labour Conference, Geneva, Switzerland

L-R Mr. Timothy Olawale, Mr Larry Ettah, NECA President, Mrs Esther Akinnukawe, MTN, Mr Lekan Sanni, Vitafoam, Calister Azogu, Agip and Mr Segun Oshinowo, Director-General, NECA (right)

July 19-21, 2017 Business Communication When: July 19-21, 2017 |

July 23-25, 2017 Facilitation Course for Managers When: July 23-25, 2017 |

Recent Comments