BUSINESS ESSENTIAL VOL. 3 NO 26

Dear Esteemed Member,

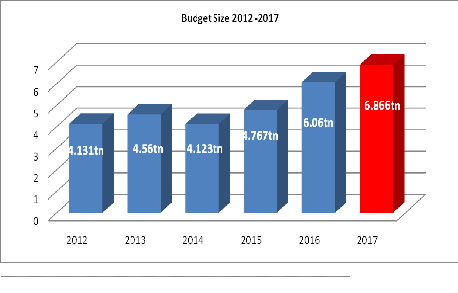

As you are probably aware, the Federal Executive Council (FEC) approved preparations for the 2017 budget, the Medium Term Expenditure Framework (MTEF) and Fiscal Strategy Paper (FSP) for 2017-2019, which estimated that the nation’s economy will grow at an average of 3.73 per cent in the next three years. The document also showed a proposal of N6.87tn budget for 2017. We did an analytical review of the document with emphasis on what it portends for Organised Businesses. We also shared a recent report from International Labour Organisation (ILO), on Non-standard employment around the world with highlights of policies needed to improve quality of non-standard jobs.

The regular Labour and Employment Law Review, Upcoming Training Programmes and a recent circular on the agreement of the Organised Private Sector (OPS) with Lagos State Water Regulatory Commission (LSWRC) were not left out.

Have a pleasant reading.

Timothy Olawale

Editor

In this Issue:

- Understanding The Medium Term Expenditure Framework (MTEF) And Fiscal Term Paper 2017-2019

- Regulatory Reforms And Other Policies Needed To Improve The Quality Of Non-Standard Jobs

- General Circular: Organised Private Sector (OPS)’s Agreement With Lagos State Water Regulatory Commission (LSWRC)

- LABOUR & EMPLOYMENT LAW: Collective Agreement (National Union of Hotels and Personal Services Workers (NUHPSW) (For and on behalf of the NUHPSW- Warri Branch; NUHPSW Escravous/Swamp Branch and NUHPSW Lagos Branch) vs. Outsourcing Services limited (2014) 40 N.L.L.R. Pt 121, P.82. NIC

- Upcoming Training Programmes

UNDERSTANDING THE MEDIUM TERM EXPENDITURE FRAMEWORK (MTEF) AND FISCAL TERM PAPER 2017-2019

- Macro-Economic Framework Overview

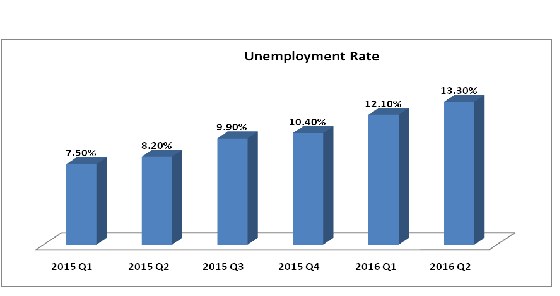

- Unemployment Rate: The unemployment rate is rapidly increasing although with the new “flexible” foreign exchange regime and fiscal injections, manufacturers should hopefully be able to get industrial inputs, create more jobs and ease off other constraints related to production.

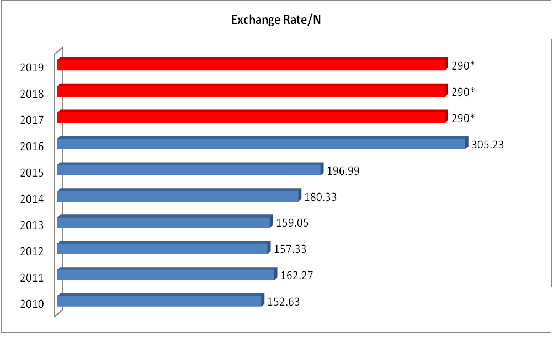

Inter-Bank Exchange Rate: The Government’s Projection of N290/$1 may be difficult to achieve with an increasingly smaller foreign reserves. However, with the budding cash-raising upfront oil deal worth $15bn with India, 22% projected increase in oil production as oil companies begin lifting the force majeure on fields that were shut down as a result of militancy in the Niger Delta, the Naira exchange rate projection of N290/$1 seems realistic in the short term.

- Fiscal Framework

2017 PROPOSED MTEF

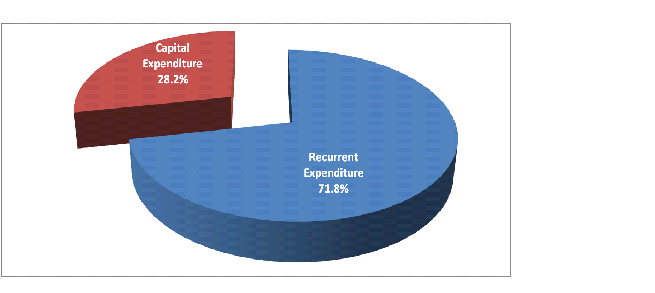

71.8% of the proposed N6.87tn budget may be committed to recurrent items including salaries, debt servicing and overhead costs. The FG plans to spend 28.2% of the proposed 2017 budget of N6.87tn on capital projects including rail, roads, office buildings etc. While MDAs will develop their budget around this fiscal framework.

Source: Budget Office/NECA Research

- Revenue

- Company Income Tax: The Federal Government is hoping that with the increment in collection efficiency and expansion of its tax base by approximately 700,000 companies, revenue projections of N902bn will be achieved in 2017. FG’s share of company income tax was however, N162bn (Jan-June 2016) as against a target of N433bn.

- Custom And Excise Duties: The Federal Government’s projected share of revenue from Customs and Excise duties is approximately 17% lower than 2016 target of N326.44bn. With the introduction of the Common External Tariff (CET), the gradual removal of import adjustment tax and expected decrease in annual average duty rate, government revenue from the port of entry is expected to reduce significantly.

- Share Of Oil Revenue: The Federal Government is projecting a 91% increase in revenue from oil on the back production topping 2.2million barrel per day, exchange rate Trending at N290/$1 and price staying above $42.5 per barrel.

- Independent Revenue: For 2017, the FG expects some N1.2tn from independent revenue sources. So far, the actual receipt was only N106.6bn (Jan- June 2016) despite projecting annual income from independent revenue source at N1.51tn for 2016. The hope that the TSA will plug the loopholes and squeeze significant revenue is failing in terms of actual revenue receipt. Government will need to do more to ramp up revenue. At N1.2tn, we believe the projection is overly optimistic.

- Expenditure

The strategy of the Federal Government in 2017 suggests that the government is following up with its expansionary fiscal policy adopted last year and plans to spend over N6.86tn in fiscal year 2017, a N806bn increase over 2016 level.

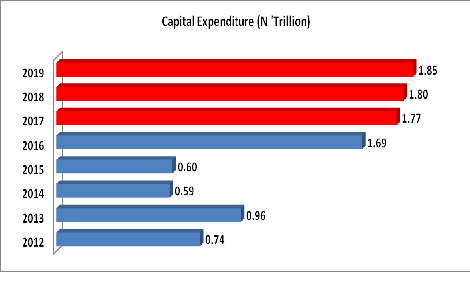

- Capital Expenditure: The 2017 estimated Capital Expenditure at N1.77tn suggests that government is ramping up spendings. Government will need to direct spendings towards developmental projects as against administrative projects if its goal is to lift the economy out of recession.

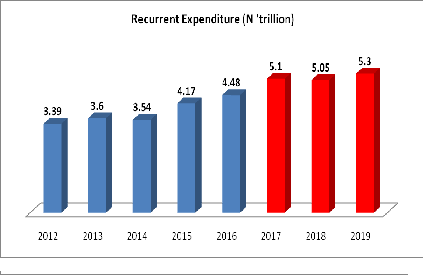

- Recurrent Expenditure: The Federal Government in 2017 plans to increase spendings on recurrent items by 13.8% to N5.1tn on the back of increasing cost of debt servicing, overhead and personnel cost.

Source: Budget Office/NECA Research

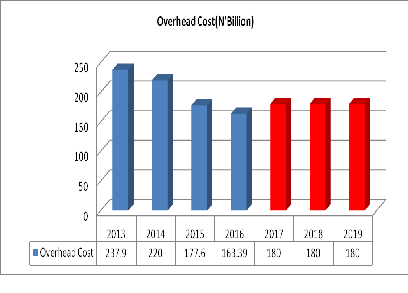

- Overhead Cost: Overhead costs in 2017 is projected at N180bn as against the estimated N163bn in 2016.

Source: Budget office/NECA Research

- Debt Servicing Cost: Amount spent servicing outstanding debt was approximately N828bn, N941bn & N1.06tn in 2013, 2014 & 2015 respectively. 71.8% of the proposed N6.87tn budget may be committed to recurrent items including salaries, debt servicing and overhead costs. The cost of servicing FG’s debt is entering an uncharted territory now projected at N1.64tn in 2017. FG’s revenue from the oil sector is not sufficient to “service” existing debt, hence, the need to expand the tax base.

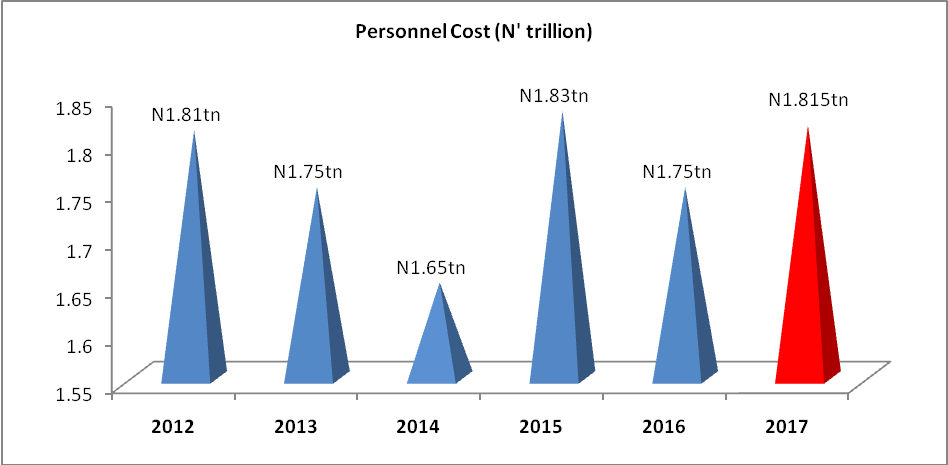

- Personnel Cost:

43.5% of Federal Government’s revenue will go into payment of salaries and allowances of government workers.

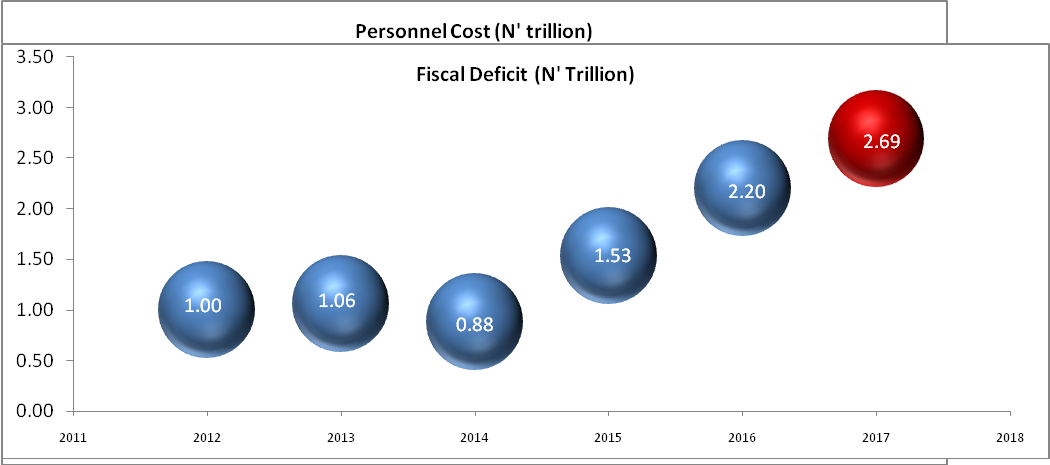

- Fiscal Deficit

- Implications for Business: GDP Growth: In reality, Nigeria’s economy is currently facing a classical case of “stagflation”. This situation largely occurs when a country’s Gross Domestic Product (GDP) is falling or stagnant, while unemployment and inflation are rising, all simultaneously. As recent data from the National Bureau of Statistics (NBS) indicate, Nigeria’s GDP growth decelerated by 0.36 percent and 2.1 percent in the first and second quarters of 2016, respectively. It further contracted by 2.24% in the third quarter of 2016, making it the 3rd consecutive quarter of increasing negative growth. The Federal Government had earlier made pronouncements and policy decisions to reflate the economy by way of stimulus packages.

- The Federal Government plans to drive policies that will foster macroeconomic stability by managing inflation downwards, provide critical infrastructure to lower the cost of doing business and a more predictable and market reflective exchange rate. The Government also plans to improve its planning and budget preparation and execution strategies and pursuing an aggressive non-oil revenue generation mechanism.

Effect:

- The GDP growth target for 2017 was placed at 3.02%, inflation target at 12.92% and private consumption expenditure projected to increase from N80.048 billion for 2017 to N91,955 billion for 2019, however, consumption is currently at record low with cash crunch and non-payment of salaries. The low consumption pattern would impact negatively on Businesses with resultant low sales/purchases of goods and services, due to shrinking purchasing power. This will lead to increase in stock inventory in the coming years, as prices of goods and services increases. It is obvious that the MTEF projections have started on a shaky note. This is because, the 0.35 per cent average yearly growth may not hold.

- Although the MTEF further provides that GDP figures is expected to increase from N108,734 billion in 2017 to N118,793 billion in 2018 and N129,773 billion in 2019, this is without any analysis of how they arrived at these figures. The macroeconomic targets and figures make no sense. The document provides no figure for the Inflation Rate for the next three fiscal years? Will interest rate be in the single or double digits for it to be consistent with economic growth that can move Nigeria out of recession? Ways and means of shoring up the External Reserves and the Excess Crude Account (ECA)/ Sovereign Wealth Fund (SWF), all these information were not available in the document, ordinarily would aid Business/Investors in planning its activities.

OPINION

- We suggest the harmonisation of fiscal and monetary policy. We have noted how the MPC routinely calls for support from the fiscal side to boost the economy. For countries like Nigeria that is struggling with the slump in commodity prices, it is advisable to allow the exchange rate to absorb fully the resulting pressures. This advice is likely to fall on deaf ears of the Federal Government, which is in a hurry to risk a bona fide float for fear that official reserves are exhausted without the required external boost to inflows.

- However, the World Economic Outlook of the IMF predicted that Nigeria’s economy will have an annual growth of 0.6% in 2017.

- Value Added Tax/Company Income Tax, Custom And Excise Duties etc: In the wake of the dwindling revenue accruing from the sales of Crude Oil and other variants, gradual removal of import adjustment tax and expected decrease in annual average duty rate, government revenue from the port of entry is expected to reduce significantly and the projection to increase collection efficiency and expansion of the tax base, Businesses will be overwhelmed with overzealous officers from the relevant tax/revenue collecting agencies in the course of the year, which could hamper on the smooth running of Businesses. It is believed that not all taxes can be pass-down to the customers.

Effect

- With the implementation of the Common External Tariff for ECOWAS in 2016 and the projected full implementation for 2019, it is likely that the VAT rate of 5% be reviewed to between 10% – 20% in the course of the year. However, increasing the VAT at this period would be detrimental to Businesses as demand has remained relatively flat with the shrinking purchasing power.

- Private entities will continue experiencing more revenue loss, which was averaged 10 – 25% in 2016, challenged with increasing net finance cost, continued witnessing increasing loss before tax (declining profits), huge forex translation loss amongst others.

OPINION:

- That Government should develop strategic initiatives to ensure effective taxation by improving tax collection systems, widening the tax net by bring in more corporate institution into tax compliance and systematic tax audit should be explored. However, this must be supported by effective utilisation of tax revenue evidenced by specific areas of economic development.

- The Capital Market: One of the most classic macroeconomic inquiries is the effect of public capital investment on economic growth. While many analysts debate the magnitude, evidence has shown a statistically significant positive relationship between infrastructure investment and economic performance.

- Although Fiscal strategy in the last two years has seemingly included efforts to correct the imbalance between recurrent and capital spending, but there is no reason except a miracle happens, to expect any change in this trend through 2017.

OPINION

- As government is proposing investments in infrastructure development such as Power, Transportation etc, this would assist in reducing the high operation cost of many quoted companies and therefore boost gross margin. This could enhance Foreign Indirect Investments by re-awakening the interest of foreign fund managers to the Nigerian Capital Market.

- The overflow effect of government spending on disposable income, saving and consumption would impact the turnover of quoted company and boost corporate earnings to the interest of shareholders, and the investing community.

Conclusions

- If Revenue projections are 100% accurate, Government plans to borrow N2.69trillion (deficit) in 2017. We believe some underlying revenue assumptions (VAT, CIT and Independent Revenue) are somewhat overly optimistic. It is uncomfortable that the Federal Government is planning to borrow funds at high lending rate to meet recurrent expenditure commitment.

- The 2017- 2019 MTEF document defers from previously seen presentations, in the sense that it does not include a detailed 2016 budget performance report ( in terms of comprehensiveness) as at Q3 2016.

- The projections show that the Federal Government continues to expand its debt and this will keep increasing the debt service costs. These costs could be up to 40% of the actual revenues, an alarming index despite a low debt-to-GDP ratio. A recent downgrade of Nigeria’s credit ratings further down in the junk category was because of the risky expansion of debt without attendant massive revenue growth.

- The targets for revenues are really optimistic. Therefore, without serious overhaul of the tax system and waiver structure, we don’t foresee more than a 70% performance.

- The capital expenditure growth is encouraging but careful interest must be on the line items to ensure that they provide a balanced social and economic support for the economy currently in recession.

- The MTEF document shows that Nigeria might borrow in order to afford even her recurrent expenditure. This is a worrisome trend, as it shows oil revenue and tax receipts are no longer enough to pay salaries, run overheads and service debts.

- Nigeria has a serious revenue challenge and the huge hope on the Treasury Single Account is currently being dimmed despite the bogus projections for independent revenues in the medium-term. Aggressive recovery of loot, sales of national assets, rise in oil prices coupled with stable oil production and astronomical spike in tax revenues are key factors to make these revenue projections realistic.

REGULATORY REFORMS AND OTHER POLICIES ARE NEEDED TO IMPROVE THE QUALITY OF NON-STANDARD JOBS

According to a recent report from International Labour Organisation (ILO), on Non-standard employment around the world: Understanding Challenges, shaping prospects, highlights the policies needed to improve the quality of non-standard jobs. The report finds that there has been a rise in non-standard forms of employment (NSFE) globally, including increases in temporary work, part-time work, temporary agency work and subcontracting, dependent self-employment and disguised employment relationships.

“Non-standard forms of employment are not new, but they have become a more widespread feature of contemporary labour markets. We need to make sure that all jobs provide workers with adequate and stable earnings, protection from occupational hazards, social protection and the right to organize and bargain collectively,” said Deborah Greenfield, ILO Deputy Director-General for Policy, “and that employees know the identity of their employer.”

Non-standard jobs can provide access to the labour market. In addition, while they can provide some flexibility to workers and employers, the report cautions that NSFE is often associated with greater insecurities for workers. In countries where NSFE are widespread, workers risk cycling between non-standard jobs and unemployment. Workers in temporary jobs can face wage penalties of up to 30 per cent compared with standard workers performing similar jobs.

In some cases, particularly where contractual arrangements have blurred the employment relationship, there is evidence that workers have difficulty exercising their fundamental rights at work, or gaining access to social security benefits and on-the-job training. Injury rates are also higher among workers in NSFE.

NSFE can have important and underappreciated consequences for businesses. “Short-term cost and flexibility gains from using NSFE may be outweighed by longer-term productivity losses. There is evidence that firms that use NSFE more, tend to underinvest in training, both for temporary and permanent employees, as well as in productivity-enhancing technologies and innovation,” said Philippe Marcadent, Chief of the unit that produced the report.

“Widespread use of NSFE may reinforce labour market segmentation and lead to greater volatility in employment, with consequences for economic stability. Research shows that temporary and on-call workers have more difficulty getting access to credit and housing, leading to delays in starting a family,” he added.

The report identified key trends in NSFE. In industrialized countries, the diversification of part-time work into “very short hours” or “on-call” work, including “zero-hours” contracts (with no guaranteed minimum hours), has parallels with casual work in developing countries. In the UK, 2.5 per cent of employees were on zero-hours contracts at the end of 2015. Ten per cent of the workforce in the US have irregular and on-call work schedules, with the lowest-income workers the most affected.

In Bangladesh and India, nearly two-thirds of wage employment is casual; in Mali and Zimbabwe, one of three employees is casual. In Australia, where casual employment is a specific employment category, one out of four employees is casual.

Asian countries have witnessed the growth of various forms of dispatched, agency, subcontracted or outsourced work. In Indian manufacturing, contract labour reached 34.7 per cent in 2011–12, up from negligible levels in the early 1970s.

Although NSFE has become more widespread, the report found there are important divergences in the use of NSFE among firms, even within the same country and industry. Among private-sector firms in over 150 countries, more than half of enterprises did not use temporary labour, whereas around 7 per cent used it intensively (with more than half of their workforce on temporary contracts).

The report advances four policy recommendations to improve the quality of non-standard jobs:

- First, plugging regulatory gaps – including policies that ensure equal treatment among workers regardless of their contractual arrangement; policies establishing minimum guaranteed hours and limiting the variability of working schedules; legislation and enforcement to address employment misclassification; restricting some uses of non-standard employment to address abuse, and assigning obligations and responsibilities in employment arrangements that involve multiple parties.

- Second, strengthening collective bargaining – including by building the capacity of unions to represent workers in NSFE and extending collective agreements to cover all workers in a sector or occupational category. In addition, all workers must have access to freedom of association and collective bargaining rights.

- Third, strengthening social protection by eliminating or lowering thresholds on minimum hours, earnings or duration of employment; making systems more flexible with regards to contributions required to qualify for benefits, allowing for interruptions in contributions and enhancing the portability of benefits. These changes should be complemented by universal policies guaranteeing a basic level of social protection.

- Fourth, instituting employment and social policies that support job creation and that accommodate workers’ needs not only for training, but also for family responsibilities such as childcare and elder care.

GENERAL CIRCULAR TO LAGOS-BASED MEMBER COMPANIES

ORGANISED PRIVATE SECTOR (OPS)’s AGREEMENT WITH LAGOS STATE WATER REGULATORY COMMISSION (LSWRC)

The Directors-General of NECA, MAN and NACCIMA met with the Executive Secretary of Lagos State Water Regulatory Commission (LSWRC) at NECA House on 11th November, 2016 to discuss concerns of the OPS on the activities of the Commission with regards to the implementation of the Lagos State Water Sector Law of 2004.

Both parties have now agreed, as follows:

- The OPS is not averse to a Regulatory Framework, the focus of which should be sustainable development within the context of an enabling environment for Enterprise to thrive. Hence, it welcomed the new law and would cooperate with the Agency for a reasonable and meaningful implementation.

- The OPS would encourage its members to comply with the law by following the procedure for the registration of their boreholes with the appropriate authority.

- While both Licences and permits would apply to companies whose lines of business are strictly on sale of water to the public, other companies or businesses outside that group will only obtain permits for their boreholes

- Payment for water abstraction would only apply for now to water producers based on rates already agreed with the Water Producers Association (copy of the agreement is available at the NECA Secretariat for members).

- The extension of this provision to Beverage producers is currently stepped down for future discussion and agreement.

We hereby urge members to bear the following in mind in their relationship with the LSWRC.

LABOUR & EMPLOYMENT LAW: Collective Agreement (National Union of Hotels and Personal Services Workers (NUHPSW) (For and on behalf of the NUHPSW Warri Branch; NUHPSW Escravous/Swamp Branch and NUHPSW Lagos Branch) vs. Outsourcing Services limited (2014) 40 N.L.L.R. Pt 121, P.82. NIC

Facts:

- The claimant and defendant entered into a Collective Agreement in June 2008 which was signed and registered at the Federal Ministry of Labour & Productivity, Abuja

- Another Agreement was signed between the parties on 30th October 2008

- The Claimant approached the Court for interpretation of some provisions of the Collective Agreement. Specifically, it seeks an interpretation of the claimant’s members on gratuity, annual increment, hours of work/overtime and the right of the claimant to negotiate on behalf of its members.

Issues

- Whether a contract of employment or a Collective Agreement can be devoid of a saving clause or expires during the pendency of the employment.

- Whether the Collective Agreement between the claimant and the defendant was still valid and subsisting

- Whether the claimant can enforce their rights (if any) under the expired Collective Agreement which is devoid of a saving clause.

- Whether the Collective Agreement entered into by parties thereto is the contract of employment for the employees of the defendant who are members of the claimant and/or whether the Collective Agreement is justiceable

The Judgement

On Definition of Collective Agreement:-

A Collective Agreement under section 48 of the Trade Disputes Act has been defined as any agreement in writing for the settlement of disputes and relating to terms of employment and physical conditions of work concluded between:

- a) An employer, a group of employers or organisations representing employers, or the duly appointed representative of any body of employers, on the one hand ; and

- b) One or more trade unions or organisations representing workers, or duly appointed representative of any body of workers, on the other hand.

Section 91 of the Labour Act on the other hand defines Collective Agreement as an agreement in writing regarding working conditions and terms of employment concluded between:

- a) An organisation of workers or an organisation representing workers (or an association of such organisations) of the one part; and

- b) An organisation of employers or an organisation representing employers (or an association of such organisations) of the other part.

On meaning of contract of employment:-

Contract of employment means any agreement, whether oral or written, express or implied, whereby one person agrees to employ another as a worker and that other person agrees to serve the employer as a worker.

On distinctions between Collective Agreement and Contract of Employment:–

A Collective Agreement and a Contract of Employment are two different agreements. The contract of employment is the legal basis of employment between the employee and the employer. It is a contractual one governed by the terms and conditions agreed by the parties. A Collective Agreement on the other hand is one between an employer or group of employers and one or more trade unions or workers organisations relating to working conditions and terms of employment. Collective Agreements usually have a limited application time while the contract of employment inures until it is determined by either party or effluxion of time.

On whether a provision in a Collective Agreement supersedes member’s individual contracts of employment:–

A provision in a Collective Agreement does not supersede member’s individual contracts of employment with the employer as they must be in employment first before they can be members of a trade union.

On whether a Collective Agreement is justiceable and enforceable:–

Section 254C (1) of the 1999 Constitution as amended has conferred the National Industrial court with exclusive jurisdiction “relating to the determination of any question as to the interpretation and application of any Collective Agreement.” The power of interpretation and application of a Collective Agreement approximates to the power to declare as to the nature of rights, privileges and obligations existing under the Collective Agreement. By virtue of the constitutional powers of interpretation and application, a Collective Agreement is justiceable and enforceable.

On effect of absence of a saving clause in a Collective Agreement:–

Where there is no saving clause in a Collective Agreement to keep it alive until such a time a new one is drawn up by the parties, the Collective Agreement expires on the due date written on such Collective Agreement. In the instant case, there was no saving clause in the Collective Agreement.

On whether interpretation jurisdiction of court can be used to adjudicate substantive trial issues:–

Where the interpretation jurisdiction of the court is activated, it cannot be used to adjudicate substantive trial issues which require evidence being called.

Final Judgment

The court held that the Collective Agreement between the parties had lapsed and was not in operation. Consequently, there was no Collective Agreement to be interpreted. The suit was dismissed.

OPINION:

- Parties are bound by their Agreements.

- Employers should carefully go through Agreements before signing them.

Download the 2017 Training Calendar HERE

- Available Discounts for Early Payment.

- Discounts for 3 participants and above.

- Register to confirm nomination and a place on the programme

- TBA – To Be Announced

For further details please contact Adewale (08069720364) adewale@neca.org.ng Visit www.neca.org.ng

| For Advert Placement: kindly contact Timothy Olawale on tim@neca.org.ng, 08033435439 |

Recent Comments