Business Essential Vol 3. No 17

Dear Esteemed Member,

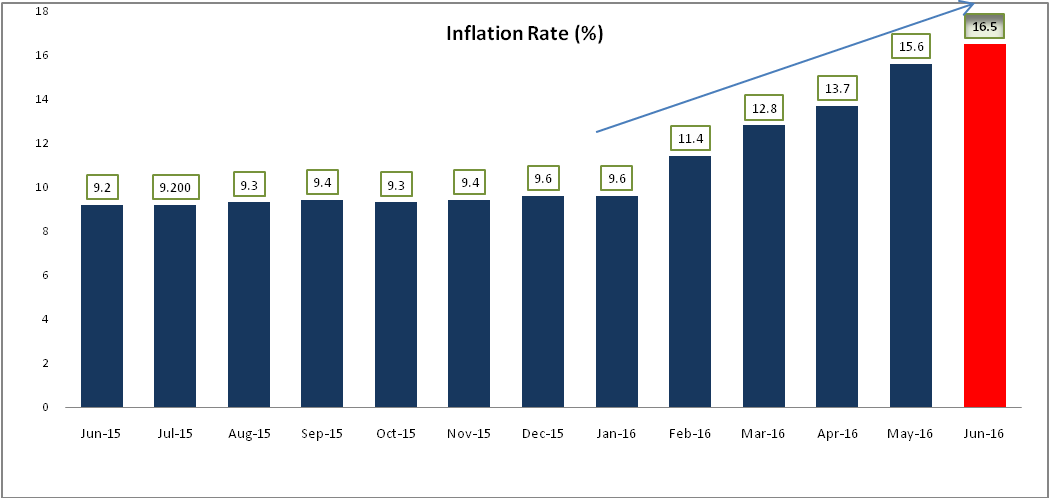

The signals had been visible and harped all along that economic recession was imminent in Nigeria.It is no longer news that Government acknowledged we are in “technically in a recession”. Our situation is not unconnected with a combination of factors: plunging oil revenues and weakened investors’ confidence. The recently released inflation figure for the month of June, 2016 further underscored the nation’s economic reality – it plunged to a record 16.5%, highest in 11 years (since 2005). We, therefore, reviewed, in this edition, the implication of the rising inflation to the economy.

We also share a recent development at the Secretariat: the unwholesome picketing by the rouge / self styled faction of Nigeria Labour Congress (NLC). The regular Labour and Employment Law Review, Upcoming Training Programmes and recent activities of the Association were not left out.

Have a pleasant reading.

Timothy Olawale

Editor

In this Issue:

- Inflationary Trajectory Continues

- Press Release: NECA Denies Allegation On The Use Of Thugs To Dislodge Picketers

- NECA’s Meeting With the Executive Secretary, Lagos State Water Regulation Commission

- Premium Motor Spirit (Petrol) & Automotive Gas Oil (Diesel) Prices Across the Nation as at June, 2016

- Labour & Employment Law: Stay of Execution (Ifeoma Nwako Vs. Bellview Airlines Limited) (2014) 45 N.L.L.R. Pt 146, P. 676 NIC

- Upcoming Training Programmes

Advert

INFLATIONARY TRAJECTORY CONTINUES

Headline inflation in the country had been a loose cannon, defying most rules of economic gravity and logic. The root cause of the near hyper inflation rate can be traced to supply shocks at-times attributable to artificial scarcity compounded by uncertainty in the forex markets. Contrary to predictions by most economic analysts of a stem in the rise of inflation figure for the month of June, the figure released by National Bureau of Statistics (NBS) recently indicated a relatively strong increase for the fifth time in a row. The Headline index increased by 16.5% (year-on-year), 0.9% points higher from rates recorded in May (15.6%). This revealed that the country’s inflation figure in the month of June, 2016 is the highest level in 11 years, the 8th highest inflation rate in Africa and 7.5% higher than the 9.0% target in 2016 National Budget.

Source: NBS, NECA Research

Africa Ranking:

| Country | Inflation Rate | Rank |

| South Sudan | 309.6 | 1st |

| Angola | 31.8 | 2nd |

| Central Africa Republic | 25.58 | 3rd |

| Malawi | 21.50 | 4th |

| Zambia | 19.72 | 5th |

| Mozambique | 19.72 | |

| Ghana | 18.40 | 7th |

| Nigeria | 16.48 | 8th |

Major factors driving the Increase:

- Increased prices of both domestic and imported food products (Bread, cereals, fish, meat, vegetables & fruits)

- Electricity: Power supply from national grid down to 2,828MW – this led to high demand of petroleum products (diesel/petrol) to power generating sets

- Liquid fuel (kerosene)

- Furniture and furnishings

- Passenger Transport by Road

- Fuels and Lubricants for personal Transport equipment

Possible Impact of rising inflation on the economy

The high inflationary environment would have various impacts on policies, the markets and various economic agents. Some of these impacts include:

- Money market

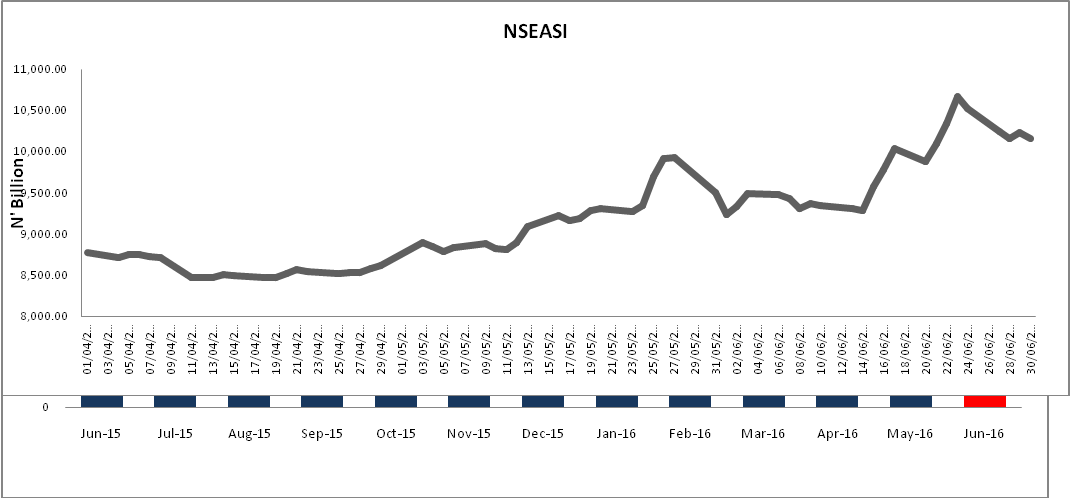

The July 25 – 26 meeting of the Monetary Policy Committee (MPC) is expected to consider the consequence of the defying high inflation on investor returns. A tighter monetary environment (hiking interest rates) could result in investors shifting to the fixed income market due to attractive interest rates. The interbank overnight lending rate rose for the second consecutive week last Friday (15th July, 2016) to an average of 15 per cent from 10 per cent a week ago, as banks scrambled for liquidity to settle bond purchases. It was observed that payment for bonds significantly reduced the level of cash in the market, leading to a sharp rise in the cost of borrowing among commercial lenders.

On a contrary, lowering the interest rate will have a negative impact on the market due to some recent activities in the market: effect of the action against the Board of Skye Bank, this has led to a further segmentation of the industry along the lines of perceived risks; the impact of the N1.3trillion debit for the $4.02billion forward sale.

Source: RTC, NECA Research

Given the underperformance of the stock market with a negative YTD return, we expect capital outflow from the Nigerian bourse, as investors become attracted to high interest fixed income instruments.

- Exchange Rate

The naira is still trying to find its true value in the transition from an imperfect towards a more efficient forex market. The apparent lack of liquidity in the spot market is hampering the effective development of a forward and futures market. The market will be awaiting the outcome of the next Monetary Policy Committee direction. It will also be looking forward to CBN’s willingness and ability to settle the 90-day forward contracts entered into on June 20th; maturing on September 17th.

PRESS RELEASE: NECA DENIES ALLEGATION ON THE USE OF THUGS TO DISLODGE PICKETERS

The Nigeria Employers’ Consultation Association (NECA) has observed that a section of the Press had linked it to the use of thugs and hoodlums to dislodge the illegal picketing of its premises by the unlawful faction of the Union led by Joe Ajaero. In a reaction at the weekend, the Director General of NECA, Mr. Olusegun Oshinowo noted that “NECA is a law abiding organisation that will not resort to lawlessness to dislodge lawlessness. This, actually, informed our decision to invite the Police and the DSS to protect us and our premises when we got wind of the Joe Ajaero faction’s plan to picket us.” He added that “Our own investigation on the identity of those that came to dislodge Ajaero and his cohorts has revealed three possibilities as follows:

- In-fighting among hoodlums and thugs hired by Ajaero over distribution of money paid them to carry out the illegal picket

- Another group of Ajaero’s hired hoodlums who felt left out of the largesse, after an initial mobilisation, and then decided to undermine the illegal picketing

- A counter action by the legal and recognised NLC to stop Ajaero from further acting in the name of NLC and parading himself its President.”

These are all possible leads as we welcome the appropriate authority to investigate the cause of this mayhem, which ordinarily would not have occurred if Ajaero has respected the industrial relations laws of Nigeria and the law enforcement agencies present in NECA have acted decisively by dispersing the picketers who were very unruly and in fact paralysed vehicular and human movement in the entire Ikeja neighbourhood. We again affirm that trade unionism and union immunity is not a license for anyone to brazenly trample on the rights of other economic actors and breach public order.

According to Mr. Oshinowo, “In the light of the current decadent state of Industrial Relations practice in Nigeria as evidenced by the kind of action perpetrated against NECA by the Joe Ajaero’s illegal faction of the Union, NECA would once again want to call on the Federal Government of Nigeria as a matter of urgency to summon a summit of the social partners for the purpose of setting in motion the much-needed reform of our Industrial Relations’ System.”

NECA’S MEETING WITH THE EXECUTIVE SECRETARY, LAGOS STATE WATER REGULATION COMMISSION

Mr. Timothy Olawale, Director-NECA, with other delegation from NECA at a meeting with Executive Secretary, Lagos State Water Regulatory Commission, Mr. Ahmed Kabiru on Water Regulation in Lagos State.

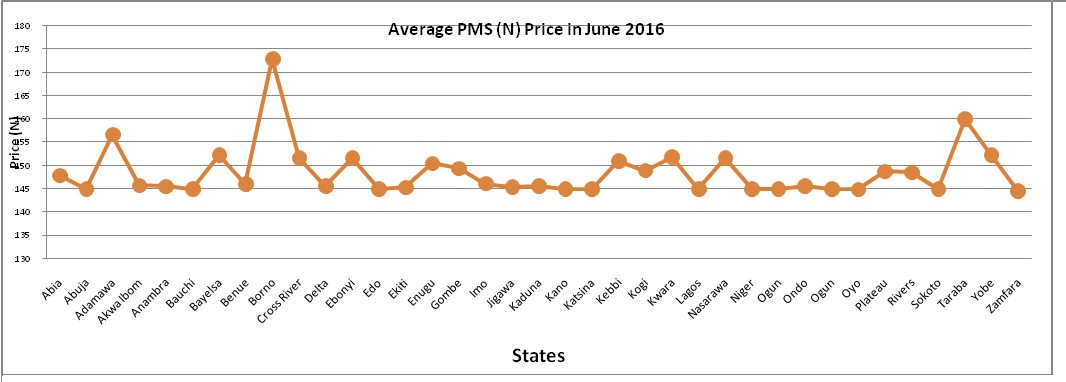

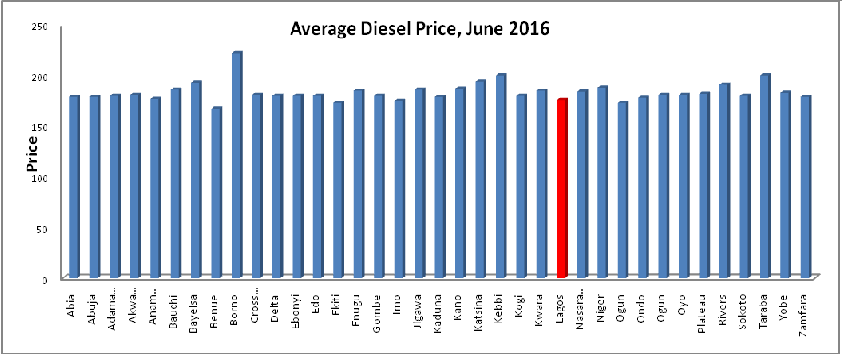

Premium Motor Spirit (Petrol) & Automotive Gas Oil (Diesel) Prices Across the Nation as at June, 2016

Average Premium Motor Spirit (Petrol) Price across the Nation

| State | Jan-16 | Feb-16 | Mar-16 | Apr-16 | May-16 | Jun-16 |

| Abia | 129.33 | 112.15 | 146.13 | 191.67 | 147.29 | 147.9 |

| Abuja | 99.6 | 92.7 | 104.9 | 107 | 145 | 145 |

| Adamawa | 93.5 | 111.87 | 133.5 | 138.5 | 145 | 156.67 |

| Akwa Ibom | 119.78 | 100.37 | 148 | 180 | 146.25 | 145.71 |

| Anambra | 119.78 | 100.37 | 136.47 | 193.85 | 147.08 | 145.53 |

| Bauchi | 117.29 | 94.19 | 156.47 | 128.57 | 151.25 | 145 |

| Bayelsa | 96.43 | 120.06 | 146 | 186.25 | 161.67 | 152.22 |

| Benue | 121.67 | 104.81 | 131.71 | 134.5 | 162.27 | 146 |

| Borno | 96.43 | 87.86 | 87 | 179.33 | 152.14 | 173 |

| Cross River | 115.21 | 116.65 | 160.36 | 167.83 | 157.5 | 151.67 |

| Delta | 98.5 | 87.5 | 132.09 | 178 | 147.92 | 145.57 |

| Ebonyi | 132.14 | 104.5 | 155 | 166.43 | 165 | 151.67 |

| Edo | 100.33 | 86.5 | 129.7 | 194.29 | 146.25 | 145 |

| Ekiti | 106.06 | 96.63 | 127.5 | 202.78 | 156.39 | 145.31 |

| Enugu | 128.26 | 101.37 | 144.56 | 178.1 | 149.4 | 150.42 |

| Gombe | 99.94 | 99.4 | 151.67 | 182.22 | 149.38 | 149.38 |

| Imo | 134 | 102.15 | 143.96 | 203.48 | 147.2 | 146.09 |

| Jigawa | 104.68 | 98.53 | 143.06 | 170.6 | 145.31 | 145.36 |

| Kaduna | 95.72 | 90.63 | 139.73 | 146.33 | 144.62 | 145.63 |

| Kano | 99.03 | 90.35 | 124.27 | 165.11 | 145 | 145 |

| Katsina | 95.5 | 87.95 | 155.58 | 129.41 | 148.42 | 144.92 |

| Kebbi | 117.05 | 111.79 | 139.75 | 165.15 | 147.25 | 150.95 |

| Kogi | 127.11 | 111.3 | 148.5 | 182 | 148.46 | 148.89 |

| Kwara | 112.63 | 98.8 | 134.29 | 189.57 | 156.67 | 151.87 |

| Lagos | 91.06 | 87.03 | 90.08 | 92.59 | 144.75 | 145 |

| Nasarawa | 120.5 | 99.05 | 166.6 | 172 | 160.63 | 151.67 |

| Niger | 112.25 | 94 | 121.56 | 150.58 | 145 | 145 |

| Ogun | 92.46 | 86.53 | 114.98 | 163.53 | 145.94 | 145 |

| Ondo | 120.06 | 102.73 | 124.5 | 195.47 | 146.24 | 145.59 |

| Ogun | 100.53 | 89.63 | 109.78 | 193.85 | 145.29 | 145 |

| Oyo | 91.42 | 87.23 | 111.22 | 113.65 | 145.22 | 144.85 |

| Plateau | 147.5 | 93.11 | 123.5 | 133.36 | 145 | 148.75 |

| Rivers | 102.5 | 106.71 | 133.7 | 174.29 | 150 | 148.5 |

| Sokoto | 110.5 | 111.76 | 160 | 163.33 | 147.14 | 145 |

| Taraba | 120.67 | 111.67 | 153.3 | 117.14 | 161.11 | 160 |

| Yobe | 96.78 | 122.888 | 145.54 | 183.75 | 164.17 | 152.27 |

| Zamfara | 91.59 | 89.95 | 143.17 | 114.54 | 145 | 144.47 |

| Average | 109.7 | 99.7 | 135.6 | 162.9 | 150.28 | 148.54 |

Source: NBS, NECA Research

Source: NBS, NECA Research

| Premium Motor Spirit (Petrol) | Automotive Gas Oil (Diesel) | |||

| States with Highest Average Prices | Naira | States with Highest Average Prices | Naira | |

| Borno | 173 | Borno | 222 | |

| Taraba | 160 | Taraba | 200 | |

| Adamawa | 157 | Kebbi | 200 | |

| States with Lowest Average Prices | Naira | States with Lowest Average Prices | Naira | |

| Zamfara | 144 | Ogun | 173 | |

| Plateau | 145 | Imo | 175 | |

| Oyo | 145 | Lagos | 176 |

Source: NBS, NECA Research

OPINION

- The price of diesel has increased from an average of N160.29 (Jan.), N147.78 (Feb), N146.19 (Mar.) N152.15 (Apr.), N148 (May) to N183.41 (June). In some location, it was as high as N222 (Borno State) in June, 2016.

- The sharp increase in price of diesel in recent times could likely be associated with the worsening energy situation which resulted in high demand for the product. The impact of the rising cost of diesel is having its toll on the cost of transporting goods and services across the country.

- Another possibility is that importers of the products could not find adequate FX for importation of the products and a likelihood of a switch, from Diesel and Kerosene to Premium Motor Spirit (Petrol).

LABOUR & EMPLOYMENT LAW: Stay of Execution (Ifeoma Nwako vs. Bellview Airlines Limited) (2014) 45 N.L.L.R. Pt 146, P. 676 NIC

Facts:

The judgment debtor/applicant by a motion on notice prayed for an order staying the execution of the judgment of the court delivered on 10th January 2013, pending the hearing and determination of the appeal against the said judgment of the Court at the Court of Appeal.

The applicant also prayed for an order of injunction restraining the judgment creditor from commencing and/or continuing any enforcement proceedings or actions in respect of, pertaining to, or flowing from the said judgment of the National Industrial Court.

Issues

- Whether the National Industrial Court should grant a stay of execution of its judgment.

The Judgement

On principles guiding the grant of application for stay of execution:-

By the provision of section 47 of the National Industrial Court Act, 2006 – where permitted by this Act or any other Act of the National Assembly, an appeal to the Court of Appeal from the decision of the National Industrial Court shall not operate as a stay of execution but the court may order a stay of execution either unconditionally or upon the performance of such condition as may be imposed in accordance with the Rules of Court.

A stay of execution will only be granted if and only if the court is satisfied that there are special or exceptional circumstances to warrant doing so. See: Olojede vs. Olaleye (2010) 4 NWLR pt. 1183, p. 1

On the basis for competence and validity of an application for stay of execution:-

An application for a stay of execution of judgment pending appeal is predicated on the existence of a valid appeal before the Court of Appeal. Before an application for stay of execution can be competent and valid, an appeal from the decision sought to be stayed must first of all be filed by the party applying for the stay of execution.

In the instant case, there was no evidence before the court that there was a valid appeal at the Court of Appeal. What was exhibited by the applicant was a mere notice of appeal without more. There was no appeal number, etc to show the existence of an appeal before the Court of Appeal. A mere intention to appeal without more cannot avail the applicant. The absence of a valid appeal against the judgment of the court renders the application seeking its stay incompetent. See: Mobil Oil Ltd vs. Agadaigho (1988) 4 SC 273

On whether substantial and impressive grounds of appeal can warrant the grant of stay of execution:-

Where an applicant has wonderful, substantial, impressive and arguable grounds of appeal, it is not a special circumstance for granting a stay. In other word, it is not every case where grounds of appeal raise point or points of law that stay of execution will be granted. The applicant in the case herein has not shown exceptional circumstances to warrant the exercise of such discretion in its favour. See: T.S.A. (Industries) Ltd vs. Kema Investment Ltd (2006) All FWLR pt. 300, p. 1564

Final Judgment:-

It was held that the applicant did not show exceptional circumstances to warrant the exercise of the court’s discretion in its favour. The application for a stay of execution was refused and dismissed.

OPINION:

The decisions of the National Industrial Court are based, largely on facts and circumstances of each case than on legal technicalities

Effective Conflict Management, Grievance Resolution and Arbitration Procedures

Date: 27th – 29th July, 2016 (3 Days)

Venue: NECA Learning Centre

Fee: N110,500 (NECA Members) N115,500 (Non-NECA members)

Trends in Reward Management for Organisational Competitiveness

Date: 10th – 11th August, 2016 (2 Days)

Venue: NECA Learning Centre

Fee: N82,500 (NECA Members) N87,500 (Non-NECA members)

Getting the Best from Outsourced-Service Providers

Date: 24th – 25th August, 2016 (2 Days)

Venue: NECA Learning Centre

Fee: N82,500 (NECA Members) N87,500 (Non-NECA members)

For more details Visit www.neca.org.ng

Recent Comments