BUSINESS ESSENTIAL VOL 3. NO 12.

BUSINESS ESSENTIALS Vol. 3 No 12

Dear Esteemed Member,

In this edition, we attempted a succinct discussion on Nigeria’s GDP growth, currency valuation, and policy choices to set each of these on a desirable course. This was informed by a cacophony of voices on the nation’s economic indices and the need for a clearer picture of the exact situation.

Following the recently released figure by the National Bureau of Statistics (NBS), we reviewed the rising inflation figure and its implication for the economy. Our regular Labour and Employment Law Review and Upcoming Training programmes were not left out.

Have a pleasant reading.

Timothy Olawale

Editor

In this issue:

- Understanding Macroeconomic Concepts For Business Enlightenment: GDP Growth, Currency Valuation and Policy Choices

- Rising Inflation Rate: Challenge to the Economy

- PMS Average Monthly Prices: Actual / reported paid by households across the 36 States and FCT.

- LABOUR & EMPLOYMENT LAW: Joinder of Party (Ifeanyi Ogbuagu vs. Mobitel Limited) (2014) 49 N.L.L.R. Pt 161, P. 256 NIC

- Upcoming Trainings Programmes

UNDERSTANDING MACROECONOMIC CONCEPTS FOR BUSINESS ENLIGHTENMENT: GDP GROWTH, CURRENCY VALUATION AND POLICY CHOICES

- GDP GROWTH:

In National Income Accounting, there are two primary measures of a country’s economic production activity. The Gross National Product (GNP) measures the aggregate of all production activities engaged in by citizens of a country regardless of their location or residence, while the Gross Domestic Product (GDP) is a measure of production activities conducted within the geographical boundaries of a country. The difference between the two is called ‘net income from abroad‘ and could be negative or positive. In recent decades as a result of increased globalization of production, the GDP has become the preferred measure as it more accurately captures the effects and effectiveness of both fiscal and monetary policies.

The GDP is the aggregate value of all final goods and services produced in an economy within a specified period usually a year or a quarter. It captures the expenditures by households (C for consumption), firms (I for investment) and government (G for government expenditure). It also makes an adjustment for the component of that aggregate that is either produced or consumed in other countries. This is captured as ‘net exports’ and calculated as ‘exports-minus-imports’ or total value of exports less total value of imports. Imports in this sense is unit price multiplied by quantity which means significant drops in the price or production volume of major export products could result in a drop in the economy’s aggregate production.

The measurement of GDP focuses more on quantum of production while attempting to hold domestic prices constant. This is to adjust for the effects of short-term inflation and allow both cross-country and time series comparison of actual changes in production. Usually GDP over a period of time is measured using what is known as constant prices or the price level for a reference year (called the base year). In the case of Nigeria, 1984 was the base year for some time into the late 1990s. This was later changed to 1990 and remained so until 2014 when the base year was changed to 2010. An official change of the base year to account for longer-term price movement is what is called re-basing of the GDP.

When GDP is measured at constant prices, the resulting aggregate value is called ‘real GDP’ and when it is measured at current prices (not adjusted for short-term inflation), the resulting measure is called nominal GDP. Economic growth is therefore defined as “the percentage change in real GDP“. Now when the National Bureau of Statistics (NBS), announced on Friday, May 20 that the Nigerian economy recorded a growth of -0.36% during the first quarter of 2016, it meant just that. Suggesting that our GDP has reached a 25-year low is patently misleading. What reached a 25-year low is the GDP growth rate!

To the heart of the matter, that Nigeria’s GDP shrank is real cause for worry. Beyond the drop in both crude oil prices, the matter speaks volume of the quality of economic choices (or non-choices) by both the fiscal and monetary authorities in the country. GDP growth is usually decomposed into three main components: growth in labour force + growth in the stock of capital + growth in the productivity of both capital and labour. In a country where the population is estimated to grow at 2.75% per annum (0.685 per quarter), there is clearly growth in availability of labour. Hence, we can say with all confidence that this negative growth comes from shrinkage of available capital (both financial and physical) and the declining level of productivity in Nigeria’s major cities.

- CURRENCY VALUATION

An aspect of capital shortage we cannot ignore is the lack of sufficient foreign currency. Yes, the government can print naira notes but can it do the same of any other currency? No. When it comes to foreign currency, we can only earn or buy. If we borrow, we’ll have to repay some day, and maybe soon depending on the tenor of the debt. With the current artificially high value of the naira (N197 to a dollar), both investors and speculators know that the naira is significantly over valued which means they will rather hold US dollars rather than convert same into a vulnerable and ‘soon-to-be devalued’ currency as the naira. If you’re in their shoes, would you sell $1 million dollar for N197 million when you know that simply by waiting for few months or a year, you can sell the same $1 million for between N260-285 million?

Formally, currency values are estimated using valuation models and based on hard facts: a country’s earnings of foreign exchange and its import demand. When a currency is determined to be overvalued or undervalued, investors and speculators expect that over time, it will find its true level. They however pay some attention to the country’s ability to defend its currency. The strongest indicator of this ability is the size of the country’s reserves of foreign currency (popularly called ‘foreign reserves) relative to its monthly import bill. A country with reserves large enough to support over 12 months of import has a larger capacity to defend its currency than one whose reserves can barely support 4 months of import demand. Hence when foreign currency earnings are low, and the foreign reserves are small, investors know that it’s only a matter of time for a depreciated currency to be formally devalued- all the tough talk and grandstanding notwithstanding.

During the intervening period, foreign investors will ‘technically starve’ such a country of foreign funding and would you blame them? When you invest in a country, you’re taking on both currency risk and market risk. So if the market goes up 15% in 6 months you’ve done well but not if the currency goes down 30% or even more over the same period. So if you’re the investor, what would you do? The consequence of all this is that Nigerian producers have very limited access to foreign currency to import vital equipments and production inputs. And the result is scaled down operations and shut-down of factories and loss of jobs. There is also the added impact of investors who were already here but who have decided to take their funds out (again in dollars). If I must mention, the Yuan deal with China will make no lasting difference unless we have items to export to China on a sustainable basis. Why? The problem is not with the dollar, it is with the naira. So yuan is no cure. And by the way, Nigeria is not short of dollars so to speak. We are short of foreign currency in whatever name it is called.

- POLICY CHOICES

In addition to the capital matter are inefficiencies in most of our cities: the endless fuel queues (intermittent for nearly 9 months), the lack of sufficient grid energy (we reached zero megawatts transmission at least 5 times in the past 90 days), the absence of efficient mass transit in the face of urban congestion with hundreds of thousands of man hours expended on commuting or driving within our cities. And then there is the issue of renewed militancy in the Niger Delta. We couldn’t have expected that all this would not one day catch up with our productivity and growth. Surely it would. And really, it has. There are only about 39 days to the end of another quarter and there is not much to suggest that it would not be another quarter of negative growth by which time the economy would officially be in a recession- the first to be witnessed by most Nigerians younger than 30.

We do hear policy makers continue to say the economy’s fundamentals remain strong. True that is not in doubt. Yet to keep bragging on a bright future without making the hard choices and the sacrifices to realize the promise will only keep that potential where it rightly belongs- in the distant future.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

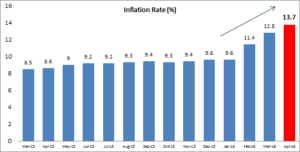

Rising Inflation Rate: Challenge to the Economy

The National Bureau of Statistics (NBS) released the Consumer Price Index (which measures inflation), for the month of April 2016, spiked to a record 13.7%, the highest level since August 2010. This inflation figure is a continuation of the trend of price spiraling that has become a source of concern to policy makers and the government. Headline inflation has spiked by 2.8% since February after a gradual but consistent climb in the CPI since 2015. April’s inflation data showed that the month-on-month increase in consumer price level slowed down by 0.6% from 2.2% in March to 1.6% in April. A high interest rate environment has grave implications for a country that is grappling with slow growth and an under performing stock market.

Source: NBS, NECA Research

Factors driving inflation rate

Inflation expectations have been pessimistic based on recent developments that have become more turbulent than usual, especially policy uncertainty and drifting.

- A 67.6% increase in petrol prices from N86.50 to N145 per litre

- Severe fluctuation in exchange rate, which has seen the naira depreciate to as low N355/$

- Persistent power shortages

Manufacturer and investor sentiments are also tilting towards the negative as these structural bottlenecks in the power, distribution, logistics and energy sectors have influenced stakeholder inflation expectations.

According to National Bureau of Statistics, it shows that the core index was the main driver of the jump in April’s inflation rate. Higher fuel prices and electricity costs pushed the core index rate to 13.4% in April, 1.2% higher than in March. Imported inflation also had an inflationary impact on the core index as forex scarcity persisted. Food inflation increased by 13.2%, 0.4% higher than that of March. With the exception of fruits and tubers, other food groups increased during the month with the rise in imported food prices being a significant factor.

Furthermore, the inflationary impact was more severe in the urban areas than in the rural areas. The urban index increased by 1.6%, from 13.5% in March to 15.1% in April. The rural index increased to 12.8% from 12.0% in March.

In May 2016, a cumulative mix of a spike in the pump price of petrol, government spending and a 9.3% decline in exchange rate value from April 2016’s average of N322/$, illustrate a possible exaggeration of price movement. Nonetheless, in the medium to long term, rates should reflect market realities.

Possible Impact of rising inflation on economy

The high inflationary environment would have various impacts on policies, the markets and various economic agents. Some of these impacts include:

- Fixed Income and Money market

The May meeting of the Monetary Policy Committee (MPC) is expected to consider the consequence of high inflation on investor returns. A tighter monetary environment (hiking interest rates) could result in investors shifting to the fixed income market due to attractive interest rates. In addition, the Nigerian Inter-bank Offered Rate (NIBOR) and T-bill rates would be expected to increase.

- Stock market

Given the under performance of the stock market with a negative YTD return of (6.35%), we expect capital outflow from the Nigerian bourse, as investors become attracted to high interest fixed income instruments.

- Monetary Conditions

The average opening position of banks in April of N423.58bn, confirms a situation of excess liquidity in the system. That coupled with petrol prices now at N145, a weak currency and inflationary pressures intensifying, the Nigerian labour union is agitating for an increase in minimum wage to N56,000. This is a 211% increase from the N18,000 minimum wage, which took effect in March 2011. Meanwhile, the cumulative average inflation rate between 2011 and 2015 is 48.6%. An increase in minimum wage will increase money supply, stoking inflationary pressures.

OPINION

- On Inflation: Given the depreciation of the naira due to forex shortages, higher petrol prices, budgetary disbursements and reduced food supply due to planting season, we expect headline inflation to increase in May. Though increased spending in capital projects would have the countercyclical effect by increasing output, Nigeria would likely start benefitting from such investments in the medium to long term.

- Monetary Policy Committee (MPC)

The economy is extremely nervous about the possible outcomes of the MPC meeting in May. This is because of a confluence of negative developments ranging from a sharp fall in the production of oil, deepening external reserves, spiralling inflation and sharply lower GDP growth. There has hardly been a time in the history of Nigeria that the Central Bank has been faced with such stark and hard choices. Unfortunately, there is no silver bullet. We expect a cocktail of measures or a sequence of steps aimed at controlling inflation, maintaining currency stability and stimulating growth. The order in which these decisions will be taken is a subject of great uncertainty and anticipation.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

PMS Average Monthly Prices: Actual / reported paid by households across the 36 States and FCT.

| State | Apr-15 | May-15 | Jun-15 | Jul-15 | Aug-15 | Sep-15 | Oct-15 | Nov-15 | Dec-15 | Jan-16 |

Feb-16 |

Mar-16 | Apr-16 |

| Abia | 105 | 102.33 | 111.67 | 108.75 | 110.25 | 91.88 | 92.56 | 146.59 | 126.33 | 129.33 | 112.15 | 146.13 | 191.67 |

| Abuja | 93.6 | 97.75 | 97.25 | 94 | 94.6 | 92 | 108.2 | 102.75 | 114.76 | 99.6 | 92.7 | 104.9 | 107 |

| Adamawa | 103.5 | 115 | 122.5 | 103.5 | 105.17 | 92 | 87 | 103.5 | 93.5 | 93.5 | 111.87 | 133.5 | 138.5 |

| Akwa Ibom | 99.4 | 113 | 109 | 107.14 | 106 | 118.5 | 92.75 | 137.13 | 122 | 119.78 | 100.37 | 148 | 180 |

| Anambra | 103.56 | 119.33 | 106 | 105.6 | 102.62 | 92.53 | 89.53 | 131.13 | 122 | 119.78 | 100.37 | 136.47 | 193.85 |

| Bauchi | 107.33 | 117.5 | 121.67 | 102.17 | 109.86 | 93.25 | 87 | 91.33 | 117.29 | 117.29 | 94.19 | 156.47 | 128.57 |

| Bayelsa | 106.5 | 105.5 | 155 | 152.86 | 132.43 | 119.83 | 111 | 130 | 154 | 96.43 | 120.06 | 146 | 186.25 |

| Benue | 124.63 | 137.22 | 115.88 | 115 | 113 | 94 | 90.8 | 135.57 | 121.67 | 121.67 | 104.81 | 131.71 | 134.5 |

| Borno | 110.8 | 125.83 | 104.57 | 105.4 | 107.5 | 92.75 | 90.83 | 120.56 | 123.56 | 96.43 | 87.86 | 87 | 179.33 |

| Cross River | 117 | 123.73 | 117.7 | 118.4 | 97.32 | 99 | 105.8 | 140.4 | 137.7 | 115.21 | 116.65 | 160.36 | 167.83 |

| Delta | 100.8 | 96 | 106.4 | 99.75 | 96.63 | 98.73 | 87 | 92.2 | 100.14 | 98.5 | 87.5 | 132.09 | 178 |

| Ebonyi | 103.86 | 113.13 | 115.71 | 105 | 106.43 | 94.86 | 93.43 | 125.14 | 129.38 | 132.14 | 104.5 | 155 | 166.43 |

| Edo | 97.33 | 97.2 | 94.45 | 95.2 | 97.88 | 88.77 | 90.3 | 106.78 | 97.67 | 100.33 | 86.5 | 129.7 | 194.29 |

| Ekiti | 97.83 | 129.42 | 113.16 | 109.35 | 107.44 | 87.5 | 87 | 97.41 | 127.05 | 106.06 | 96.63 | 127.5 | 202.78 |

| Enugu | 106.65 | 119.6 | 115 | 115.74 | 112.73 | 91.78 | 93.87 | 123.13 | 127.06 | 128.26 | 101.37 | 144.56 | 178.1 |

| Gombe | 93.78 | 106.5 | 104.38 | 99.67 | 98.33 | 93.6 | 90.33 | 113.14 | 101.29 | 99.94 | 99.4 | 151.67 | 182.22 |

| Imo | 100.64 | 101.48 | 116.57 | 109.65 | 110.93 | 95.65 | 88.06 | 126.5 | 136.36 | 134 | 102.15 | 143.96 | 203.48 |

| Jigawa | 101.25 | 123.2 | 109.13 | 102.33 | 106.5 | 87 | 90.88 | 127.07 | 117.2 | 104.68 | 98.53 | 143.06 | 170.6 |

| Kaduna | 100.87 | 112.53 | 113.87 | 94.93 | 97 | 93.71 | 91.64 | 112.36 | 121.6 | 95.72 | 90.63 | 139.73 | 146.33 |

| Kano | 94 | 109.07 | 104.23 | 91.5 | 92.57 | 86.53 | 89.06 | 93.63 | 93.14 | 99.03 | 90.35 | 124.27 | 165.11 |

| Katsina | 105.91 | 116.72 | 97.78 | 95.2 | 96.64 | 88 | 87 | 91.5 | 89.17 | 95.5 | 87.95 | 155.58 | 129.41 |

| Kebbi | 117.91 | 121.85 | 115.91 | 111.63 | 105.21 | 93.33 | 100.24 | 114.14 | 125.63 | 117.05 | 111.79 | 139.75 | 165.15 |

| Kogi | 114.29 | 128.33 | 115.75 | 114.33 | 96.56 | 93.22 | 107.22 | 146.67 | 127.11 | 111.3 | 148.5 | 182 | |

| Kwara | 97.83 | 137.86 | 125 | 105.29 | 95.8 | 89.6 | 98 | 113.33 | 112.63 | 112.63 | 98.8 | 134.29 | 189.57 |

| Lagos | 90.33 | 149.13 | 102.63 | 92.33 | 86.5 | 89 | 89.94 | 103.84 | 89.8 | 91.06 | 87.03 | 90.08 | 92.59 |

| Nasarawa | 105.56 | 126.67 | 126.08 | 110.37 | 103.8 | 94.2 | 102.5 | 105.4 | 128.07 | 120.5 | 99.05 | 166.6 | 172 |

| Niger | 116.89 | 122.5 | 138.33 | 114.57 | 113.57 | 93.89 | 97.29 | 104.89 | 112.25 | 112.25 | 94 | 121.56 | 150.58 |

| Ogun | 94.65 | 125.86 | 96.8 | 93.5 | 95.29 | 87 | 90.71 | 91.33 | 117.12 | 92.46 | 86.53 | 114.98 | 163.53 |

| Ondo | 94.25 | 137.64 | 106.19 | 103.67 | 105.72 | 89.41 | 87 | 101.65 | 125.41 | 120.06 | 102.73 | 124.5 | 195.47 |

| Ogun | 96.58 | 129.07 | 106.4 | 109.44 | 95.81 | 89.26 | 87.99 | 102.19 | 118.29 | 100.53 | 89.63 | 109.78 | 193.85 |

| Oyo | 95.84 | 121.65 | 95.06 | 99.16 | 88.72 | 87.72 | 90.35 | 106.68 | 112.88 | 91.42 | 87.23 | 111.22 | 113.65 |

| Plateau | 94.67 | 122.6 | 105.43 | 103.13 | 94.71 | 92.5 | 90.29 | 123.5 | 147.5 | 147.5 | 93.11 | 123.5 | 133.36 |

| Rivers | 98.71 | 100.33 | 110.57 | 113.38 | 99.71 | 102.8 | 100.14 | 139.5 | 116.5 | 102.5 | 106.71 | 133.7 | 174.29 |

| Sokoto | 106 | 118.44 | 112.83 | 105.5 | 113.75 | 87 | 93.6 | 104.29 | 103 | 110.5 | 111.76 | 160 | 163.33 |

| Taraba | 132.86 | 129.23 | 118.33 | 120 | 112.13 | 124.63 | 104.37 | 114.37 | 163.33 | 120.67 | 111.67 | 153.3 | 117.14 |

| Yobe | 122.5 | 132.67 | 115.14 | 120.5 | 119.63 | 119.78 | 98.43 | 123.73 | 123.73 | 96.78 | 122.888 | 145.54 | 183.75 |

| Zamfara | 95.33 | 98.27 | 93 | 109.75 | 106.86 | 91.35 | 93.39 | 104.78 | 109 | 91.59 | 89.95 | 143.17 | 114.54 |

| Average | 104.0 | 118.2 | 112.1 | 107.0 | 104.1 | 95.1 | 93.6 | 113.7 | 119.6 | 109.7 | 99.7 | 135.6 | 162.9 |

Source: National Bureau of Statistics (NBS), April 2016

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

LABOUR & EMPLOYMENT LAW: Joinder of Party (Ifeanyi Ogbuagu vs. Mobitel Limited) (2014) 49 N.L.L.R. Pt 161, P. 256 NIC

Facts:

- The claimant (Ifeanyi Ogbuagu) caused a complaint to be filed against the defendant (Mobitel Limited) claiming the following reliefs:

- A declaration that the claimant was in a contract of services with the defendant and as such was entitled to the rights and privileges relating to his employment

- A declaration that the last monthly salary and entitlements due to the claimant from the defendant was only received for the month of December 2004 and none has been paid to date

- The sum of N9,540,681.41 against the defendant being salary in arrears between January 2005 and June 2008, as well as pension, gratuity

- A notice of joinder of parties dated 9th January 2014 was filed by the defendant/applicant praying for the following;

- An order joining Engineer K. E. Anadu and Mr. Alaba Odunlami (for themselves and the former shareholders of Mobitel Limited) as defendants in the suit

- And for such further orders as the Honourable Court shall deem fit to make in the circumstances

Issues

- Whether Agents of a disclosed principal and party to a suit can be joined as party to that suit.

The Judgement

On purpose of joinder of party in suit:-

It is the law of common place that the purpose of joining a particular person as a party is to ensure that the person is bound by the result of the action and that the question to be settled is one that cannot be efficiently and completely settled unless he is a party. The only reason which makes it necessary to make a person a party to an action is that such a person should be bound by the result of the action and the question to be settled. In other words, there must be a question in the action which cannot be effectually and completely settled unless such a person is a party.

On what an applicant seeking to be joined as a party in a suit must do:-

For the court to exercise its discretion to order a joinder of party to a suit, the applicant must satisfy the court that he is a party whose presence before the court is necessary to enable the court effectually and completely adjudicate upon and settle all the issues involved in the cause or matter. Where an applicant seeking to be joined establishes that he has an interest in the subject matter of the action and/or in the eventual result of such action, the application for joinder may be granted.

On the right of a person to be joined in a suit:-

The law allows a person interested in a proceeding to be joined either as plaintiff or as defendant depending on his interest

Final Judgment:-

The Court considered the application for joinder of Engineer K. E. Anadu and Mr. Alaba Odunlami (for themselves and the former shareholders of Mobitel Limited) as defendants in the suit, and dismissed it on the grounds that they acted as agents or representatives of the defendant in the suit. It is trite that the acts of a disclosed principal would be deemed to be acts or actions of the principal.

OPINION:

The court has rightly stated and interpreted the law. However, the defendant if it so wish may call them as its witnesses in the suit if their testimonies or evidence would help its case.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

50TH ADVANCED COURSE ON HUMAN RESOURCES MANAGEMENT, LABOUR & EMPLOYMENT RELATIONS

Date: 6 – 10 June, 2016

Duration: 5 Days

Venue: Channel View Hotel, Calabar, Cross River

Course fee: N225,000

TRAIN THE TRAINER COURSE

Date: 14 – 16 June, 2016

Duration: 3 Days

Venue: NECA House

Course fee: N115,000

For further details please contact Adewale (08069720364) adewale@neca.org.ng Visit www.neca.org.ng

Recent Comments