B.E October 2019 Edition

Welcome to the October 2019 edition of Business Essentials.

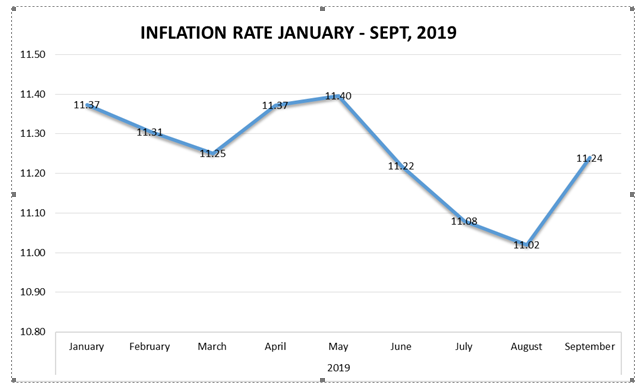

In this edition, we reviewed the macroeconomic indicators vis the Consumer Price Index, which increased 1.04% on a month-on-month basis in September, up from August’s 0.99% rise, mainly driven by growing food prices. The Inflation rate rose from its over three year low of 11.0% in August, 2019 to 11.24% in September. The Manufacturing Purchasing Managers’ Index (PMI) of the Central Bank of Nigeria (CBN), stood at 57.7 index points, indicating expansion in the manufacturing sector for the thirtieth consecutive month. Thus, the PMI climbed further above the 50-threshold that separates expansion from contraction in business condition, pointing to solid growth in the private sector.

We also shared a column on the judgment of the Federal High Court upholding the powers of the Lagos State Government to charge and collect Consumption Tax from hotels, restaurants and event centres within the state. The Court also restrained the Federal Government from collecting Value Added Tax (VAT) on goods consumed in hotels, restaurants and event centres.

Our regular Law Report Review, Upcoming Learning & Development programmes and other activities at the Secretariat were not left out.

Have a pleasant reading.

Wale-Smatt Oyerinde

Editor

In this Issue:

- Macroeconomic Environment: September CBN Manufacturing Purchasing Manager Index, Business Expectation Survey, August Consumer Price Index

- Tax: Federal High Court Upholds State Government’s Powers to Collect Consumption Tax

- Law Report Review / Legal Opinion: Deduction Of Employee’s Loans From Terminal Benefits

NIGERIAN MACRO-ENVIRONMENT

- NBS CONSUMER PRICE INDEX (CPI), SEPTEMBER, 2019

The CPI peaked to the highest since May, 2019. The consumer price index, (CPI) which measures inflation increased by 11.24 percent (year-on-year) in September 2019. This is 0.22 percent points higher than the rate recorded in August 2019 (11.02 percent).

The urban inflation rate increased by 11.78 percent (year-on-year) in September 2019 from 11.48 percent recorded in August 2019, while the rural inflation rate increased by 10.77 percent in September 2019 from 10.61 percent in August 2019. On a month-on-month basis, the urban index rose by 1.13 percent in September 2019, up by 0.09 from 1.04 percent recorded in August 2019, while the rural index also rose by 0.96 percent in September 2019, up by 0.03 from the rate recorded in August 2019 (0.93) percent.

The corresponding twelve-month year-on-year average percentage change for the urban index is 11.63 percent in September 2019. This is higher than 11.62 percent reported in August 2019, while the corresponding rural inflation rate in September 2019 is 10.94 percent compared to 10.95 percent recorded in August 2019.

On a month-on-month basis, the urban index rose by 1.13 percent in September 2019, up by 0.09 from 1.04 percent recorded in August 2019, while the rural index also rose by 0.96 percent in September 2019, up by 0.03 from the rate recorded in August 2019 (0.93) percent. The corresponding twelve-month year-on-year average percentage change for the urban index is 11.6 percent in September 2019. This is higher than 11.62 percent reported in August 2019, while the corresponding rural inflation rate in September 2019 is 10.94 percent compared to 10.95 percent recorded in August 2019.

CBN SEPTEMBER MANUFACTURING PURCHASING MANAGER INDEX & BUSINESS EXPECTATION SURVEY.

The Manufacturing PMIin the month of September stood at 57.7 index points, indicating expansion in the manufacturing sector for the thirtieth consecutive month. The index grew at a slower rate when compared to the index in August. Thirteen of the 14 surveyed subsectors reported growth in the review month in the following order: cement; petroleum & coal products; food, beverage & tobacco products; transportation equipment; printing & related support activities; chemical & pharmaceutical products; furniture & related products; fabricated metal products; nonmetallic mineral products; electrical equipment; textile, apparel, leather & footwear; plastics & rubber products; and primary metal. The paper products subsector recorded decline in the review period

On production, the index for the manufacturing sector grew at 58.5 for the thirty-first consecutive month in September 2019. The index indicated a slower growth in the current month, when compared to its level in August 2019. Eleven of the 14 manufacturing subsectors recorded increased production level, 1 remained unchanged, while 2 recorded decline.

On the employment level, index for September 2019 stood at 56.6 points, indicating growth in employment level for the twenty-ninth consecutive month. Of the 14 subsectors, 7 reported increased employment level, 4 reported unchanged employment level while 3 reported decreased employment in the review month.

In a related developments, the overall businesses expressed optimism on Nigeria’s macro economy in September 2019 according to the Central Bank of Nigeria (CBN) monthly Business Expectations Survey (BES). The report, which was posted on the apex bank’s website stated: “at 28.6 index points, respondents’ overall confidence index (CI) on the macro economy in the aforementioned period was more optimistic when compared to its level of 28.1 index points recorded in July 2019.”

At 26.7 index points, respondents expressed optimism on the overall confidence index (CI) on the macro economy in the month of September 2019. The business outlook for September 2019 showed greater confidence on the macro economy with 59.0 index points.

The optimism on the macro economy in the current month was driven by the opinion of respondents from services (14.2 points), industrial (9.7 points), wholesale/retail trade (2.1 points) and construction (0.6 points) sectors. For next month, the major drivers of the optimism were services (32.1points), industrial (20.3 points), wholesale/retail trade (4.9 points) and construction (1.8 points) sectors

Further analysis showed that the positive business outlook in September 2019 was driven by businesses that are neither import- nor export-oriented (21.0 points), both import- and export-oriented (4.3 points), import-oriented (2.9 points), and those that are export-related (0.3 point).

Sources: Central Bank of Nigeria, National Bureau of Statistics, Proshareng.com

TAX: Federal High Court Upholds State Government’s Powers to Collect Consumption Tax

Summary

On 3 October 2019, the Federal High Court (“FHC” or “the Court”), sitting in Lagos, upheld the powers of the Lagos State Government to charge and collect Consumption Tax from hotels, restaurants and event centres within the state. The Court also restrained the Federal Government from collecting Value Added Tax (VAT) on goods consumed in hotels, restaurants and event centres. This decision was reached in the case between The Registered Trustees of Hotel Owners and Managers Association of Lagos (Hotel Owners) v Attorney General of Lagos State (AG Lagos).

According to the Court, Consumption Tax on hotels, restaurants and event centres is in the purview of the State Government based on the 1999 Constitution and the Taxes and Levies (Approved List for Collection) Act (Taxes and Levies Act). Thus, the provisions of the VAT Act in respect of consumption of goods and services in hotels, restaurants and event centres are inconsistent with the Constitution and the Taxes and Levies Act, and are therefore void.

Details

The VAT Act was introduced in 1993 to impose and charge VAT at 5% on the value of goods and services supplied in Nigeria. The VAT Act is administered by the Federal Inland Revenue Service (FIRS). Consequently, Hotel Owners have been compliant with the provisions of the VAT Act and have been remitting VAT at 5% to the FIRS.

In 2009, the Lagos State Government enacted the Hotel Occupancy and Restaurant Consumption Law of Lagos State (Consumption Tax Law). The Consumption Tax Law imposes Consumption Tax at 5% on the value of goods and services consumed in hotels, restaurants and event centres within Lagos State. Thus, consumers of goods and services in hotels, restaurants and event centres suffer both Consumption Tax and VAT on the same tax base, amounting to double taxation.

Following this development, the Hotel Owners instituted an action in the FHC, seeking a declaration that the Consumption Tax Law of Lagos State is inoperable and of no effect because the VAT Act has fully covered the field on the subject of Consumption Tax.

The Court, however, ruled in favour of the Lagos State Government upholding the powers of the State Government to charge and collect Consumption Tax. In reaching this decision, the Court relied on the 1999 Constitution and held that Consumption Tax on goods and services consumed in hotels, restaurants and event centres is a residual matter which is within the exclusive legislative competence of a State Government.

The Court further held that under the Taxes and Levies Act, Consumption Tax arising from transactions involving the sale of goods and services in hotels, restaurant or event centres is to be collected by the State Government. The Court also stated that since the Taxes and Levies Act (as amended in 2015) was enacted after the VAT Act of 1993, its provisions have tacitly repealed any provisions of the VAT Act concerning hotels, restaurant and event centres and should thus prevail. The Court therefore restrained the FIRS from collecting VAT on transactions relating to the consumption of goods and services in hotels, restaurants and event places in Lagos.

Implications

This Judgment implies that transactions involving supply of goods and services consumed in hotels, restaurants and events centres should not be liable to VAT. However, such transactions should be liable to Consumption Tax at 5%, payable to the State Government.

It is important to note that the FHC, sitting in Abuja, reached a contrary decision in the case between Nigeria Employers Consultative Association & Anor v Kano State Inland Revenue Service in 2018. In that case, the FHC restrained the Kano State Government from imposing Consumption Tax on transactions involving goods and services which are already subject to Value Added Tax. Thus, the Judgment of the FHC, sitting in Lagos, in the Hotel Owners Case has created a clear conflict on the actual position of the FHC on the issue.

Notwithstanding, it is pertinent to note that the Supreme Court upheld the constitutional powers of the Lagos State Government to enact the Consumption Tax Law in the case between Attorney General of the Federation v Attorney General of Lagos State in 2013. However, while the FHC has taken a further step to restrain the Federal Government from collecting VAT on transactions which are covered by the Consumption Tax Law, the Supreme Court was silent on the validity of the VAT Act with respect to such transactions.

Given the apparent conflicts generated by the FHC’s decisions and the constitutional nature of the issues therein, we expect a higher court to provide additional clarification on this issue in order to curb incidences of multiple taxation in the Nigerian business environment and also to ensure consumers and businesses are clear about their obligations under the law. This is because multiple taxation and uncertainty in the applications of our laws are major disincentives to investments and have an overall negative impact on the business environment. This issue therefore needs to be addressed speedily.

In the meantime, taxpayers are to be mindful of this development in the tax administration system and should engage with their consultants to evaluate the implications of this case on their businesses and take necessary steps to operate within the ambits of the applicable laws.

Exposition by Andersen Tax

………………………………………………………………………………………………………

LAW REPORT REVIEW / LEGAL OPINION:

DEDUCTION OF EMPLOYEE’S LOANS FROM TERMINAL BENEFITS:

Mrs. Adebola Ogunsanwo vs. Polaris Bank Limited, unreported Suit No. NICN/LA/164/2014

CASE FOR THE CLAIMANT

- The Claimant a former employee of the Defendant, during her employment with the defendant, took a Mortgage Loan of N11.5 Million, which was agreed by parties to run for 10 years at an interest rate of 5% per annum.

- The claimant claimed that as at the time the defendant terminated her services, she had repaid the sum of N7.1 Million.

- She also took a personal loan of N2.2 Million and same was to expire in August 2015. At the time her services were disengaged, the sum of N1,995,096.08 (One Million, Nine Hundred and Ninety-Five Thousand, Ninety-Six Naira, Eight Kobo) was left as outstanding balance yet unpaid to the defendant.

- The claimant claimed that after her employment was terminated, the defendant calculated the sum of N3,200,793.98 as her severance package, and six months’ salary as payment in lieu of notice.

- The claimant states that although it was a term of agreement that the said Mortgage Loan would expire in 2017, the defendant went ahead to remove it from the six months salary in lieu of notice paid to her without her consent.

- The claimant further stated that the defendant also removed the balance of the personal loan despite the fact that the said personal loan had not yet expired.

- The claimant claimed that the only amount of money she was paid by the defendant after the latter had made the unauthorized deductions referred to from the purported gratuity calculated by the defendant was N785,532.98.

- The claimant averred that having worked for the defendant for the number of years as she did, she was entitled to be paid her full gratuity and other terminal benefits.

- The claimant stated that the sum of N3,200,793.83 calculated as her gratuity and six months’ salary payment in lieu of notice was contrary to what was contained in the Additional Net Financial Position prepared by the defendant on 18th September 2013.

- The claimant claimed that going by the Additional Net Financial Position as at September 18, 2013 (which was not conceded) she was entitled to be paid the sum of N22,564,558.87 made up of her gross entitlement of N21,779,025.89 and other credit of N3,294,695.75.

- The claimant claimed that it was the customary practice of the defendant to write off outstanding mortgage and personal loan in view of a staff’s exemplary performance.

- That the sum of N3,200,793.98 calculated by the defendant did not represent her full terminal benefits. That there was need to know the quantum of her terminal benefits and whether it was in line with her contract of employment and customary practice of the defendant.

- The claimant claimed that she was also entitled to N107,520 Skye Bank shares, which represented the monetary balance of her bonus over the years held on her behalf by the Skye Bank Staff Share Trust Fund.

- That the refusal of the defendant to give her its Staff Handbook after she was placed in their employment was in furtherance of the defendant’s premeditated plans to avoid paying the claimant her rightful terminal benefits and as such constitutes a constructive fraud.

CASE FOR THE DEFENDANT

- It is the case of the defendant that the deduction of the Mortgage loan from the claimant’s terminal benefit was done in keeping faith with the policy of the defendant which required that all indebtedness of any of its ex-staff to be deducted and or netted off against any entitlement.

- The defendant claimed that the deduction made from the claimant’s terminal pay was done in consonance with the terms and conditions of the claimant’s employment. That the claimant agreed that her terminal benefit should be applied to defray the loans she obtained whilst in employment, also that the claimant authorized the defendant to debit her account without further recourse to the claimant.

- The defendant claimed that the claimant’s terminal benefit was correctly computed and she was paid the amount that was due to her and in conformity with the employment terms.

- The defendant claimed that the assessment and calculation of gratuity was regulated by the defendant’s Gratuity and Retirement Benefits Policy accepted and agreed by the claimant, that the gratuity in the defendant was calculated based on 40% of the Annual Total Emolument (ATE) of an entitled employee at the employee’s grade at the time of exit from the defendant.

- The defendant stated that the Employee’s ATE comprised the employee’s basic salary, transport allowance, housing allowance, and meal/lunch allowance.

- The defendant claimed that the gratuity was not calculated based on the gross salary or additional net financial position of any of the employee as erroneously claimed by the claimant.

- The defendant stated that entitlement to gratuity in the defendant was based on the continuous employment in the defendant for the period of 5 years. The defendant stated that the period of 5 years of continuous employment entitled eligibility to gratuity in the defendant and the said period was not considered in the computation of gratuity.

- The defendant claimed that gratuity was calculated based on the period in excess of the eligibility period of 5 years

ISSUES FOR DETERMINATION

- Whether the claimant has established her claim on preponderance of evidence required in civil case.

- Whether having been paid all her entitlements, the claimant was still entitled to any further benefit from the defendant.

COURT’S DECISION

After considering the arguments of the parties, the court held as follows:

- The claimant’s case was that she was short paid her terminal benefits in that the said terminal benefits ought to have been calculated on the basis of her earlier work since 1998 with banks acquired by the defendant in 2006 vide a merger of that year.

- The claimant took two loans from the defendant: a mortgage loan and a personal loan. This fact was not in doubt. The complaint of the claimant, however, was that when the defendant disengaged her, it decided to use her terminal benefits to offset the two loans without her consent.

- Secondly, that by common practice, the defendant ought to have waived the balance of the outstanding loans given her exemplary performance as the Business Development Manager while employed by the defendant. The rule is that evidence of customary practice must come from other than the person asserting its existence. See: Queen v. Chief Ozogula [1962] WNLR 136, Adeyemi & ors v. Alhaji Shitu Bamidele & ors [1968] 1 All NLR 31, Orlu v. Gogo-Abite [2010] LPELR-2769(SC); [2010] 8 NWLR (Pt. 1196) 307 SC. The claimant’s evidence was insufficient to prove her claim on this point and so was dismissed.

- On the question of the defendant offsetting the two loans using the claimant’s terminal benefits. The argument of the claimant was that the loans should be allowed to run their full course irrespective of the fact that she was disengaged by the defendant. The claimant, however, seems to forget that the two loans incured to her in virtue of her employment. They are accordingly employment loans governed by the terms and conditions of the claimant. In the defendant’s Employee Handbook 2011, the defendant’s employee loan philosophy was laid out with the defendant recognizing the employee’s requirement for lump sum payments to meet personal obligations; to which effect the employee loan scheme was put in place. The loan repayments under the scheme are to be deducted from both monthly and quarterly remuneration.

- In the handbook, repayment of car loan, personal loan, share loan, credit loan and other types of advances becomes due upon retirement. The handbook also stated that: “Retiring staff shall be availed their gratuity benefits, less of their financial obligations to the Bank. This provision excludes Mortgage Loan, which shall not be deducted at source, upon Retirement”. Thus, offsetting of the claimant’s personal loan from her terminal benefits was not in error and it did not require the consent of the claimant.

- The offsetting of the mortgage loan from the claimant’s terminal benefits, however, goes contrary to the handbook; under which, mortgage loan was not to be deducted at source upon retirement. Thus, the Relief that touches on mortgage loan was granted.

- The claimant averred that she was entitled to 107,520 Skye Bank shares, which represented the monetary balance of her bonus over the years on her behalf by Skye Bank Share Trust Fund. She relied on the defendant’s letter of 25th September 2013. This was upheld and granted by the court.

- On the claim of N46,280,430.00 as balance of the gratuity and other terminal benefits being owed by the defendant from 1998 when the claimant became employed by Prudent Merchant Bank Plc to 17th of July 2013 when her employment was terminated by the defendant after deducting the sum of N785,532.98 that was paid to the claimant.

- It was held that the claimant did not prove that her employment was a continuous one. Thus, the claim for the balance of gratuity from 1998 failed. In any event, gratuity is calculated by reference to salary. There was no pleading as to this by the claimant in her pleadings. The claim for gratuity is a claim for special damages, which by law must be particularized and proved by concrete evidence. See: 7UP Bottling Company Plc v. Augustus [2012] LPELR-20873(CA) and NNPC v. Clifco Nigeria Ltd [2011] LPELR-2022(SC). The claimant in the instant case accordingly did not state to this Court in terms of its pleadings how she came by the sum of N46,280,430. See Mr. Mohammed Dungus & ors v. ENL Consortium Ltd [2015] 60 NLLR (Pt. 208) 39

In conclusion, the Court made the following declaration and orders that:

- the arbitrary deduction of the sum of N4.2 Million as balance of the claimant’s Mortgage loan by the defendant from her gratuity was wrongful, unlawful, void and of no effect whatsoever.

- the defendant shall refund within 30 days of the judgment the said deduction made in respect of the balance of the claimant’s Mortgage loan and revert to the terms of the Mortgage Agreement forthwith.

- the defendant shall release within 30 days of this judgment the 107,520 Skye Bank shares being and representing the monetary balance of the claimant’s bonus over the years held on her behalf by the defendant’s Bank Staff Share Trust Fund and the Share certificate in respect of same.

OPINION

Employers are advised to ensure necessary clauses are provided in their Handbook, which govern the issues of loan and its repayments/deductions as well as the operation of the loan upon the retirement or termination of an employee.

NEW: PAY FOR MEMBERSHIP SUBSCRIPTION ONLINE

Do you know that your company can pay for its membership dues, training programmes and purchase any of our books online right from the comfort of your office? You do not have to wait anymore to get that cheque in or head to the bank for a transfer.

Get 10% on your company’s subscription for the year 2020 now!!!!. To get this discount pay now, follow the link: PAY SUBSCRIPTION.

Recent Comments