Business Essential March 2018 Edition

Dear Esteemed Member,

Welcome to this month’s edition of Business Essentials. In this edition, we reviewed the performance of Nigeria’s economy in 2017 including relevant economic indices. We also shared an update from the Secretariat on developments around the newly signed Lagos State Land Use Charge Law.

In our Legislative Observatory, we discovered an untoward foul-play in the recently passed Federal Competition and Consumer Protection Bill. We have raised our concern and communicated to the appropriate quarters. We will keep you abreast of developments.

We also x-rayed the recent signed Presidential Executive Order for Planning and Execution of Projects, Promotion of Nigerian Content in Contracts and Science, Engineering and Technology.

Have a pleasant reading.

Timothy Olawale

Editor

In this Issue:

- The Nigerian Economy: 2017 Review and 2018 Outlook

- General Circular: An Update On The New Land Use Charge Law Of Lagos State.

- The Federal Competition And Consumer Protection Bill: Progress Made So Far

- Presidential Executive Order for Planning and Execution of Projects, Promotion of Nigerian Content in Contracts and Science, Engineering and Technology

- PICTORIAL: NECA/LIRS Interactive Session On “Taxation and Its Administration in Lagos State: Innovations & Development

- Law Report Review / Legal Opinion: Judgment of the National Industrial Court: When an Action is Statute-Barred

- Upcoming Meetings of various Expert Committees

The Nigerian Economy: 2017 Review and 2018 Outlook

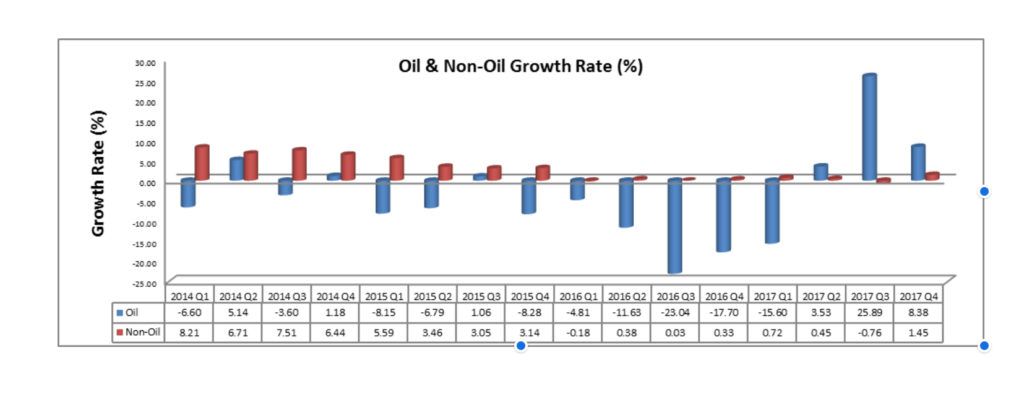

The Nigerian economy has benefitted from rising oil prices and higher production. Several macroeconomic indicators are trending positive, signalling the end of recession period and resumed GDP growth, stable exchange rates and growing FX reserves, etc.

However, there are also significant negatives, including persistent low growth and/or continuing contraction in non-oil economic sectors, poor manufacturing performance, sharply rising unemployment, high domestic food inflation and the fuel subsidy conundrum. In addition, there are concerns over fiscal sustainability. Political risk is also rising!

Business Implication:

Recently released Q4 GDP confirmed that the Nigerian economy grew by 1.92% in Q4 2017 and recorded full year 2017 growth of 0.83%, exactly in line with the IMF’s projection.

All things considered, the economy should record incremental improvements in 2018 over 2017 with a GDP growth range of 2.0%-3.5% expected. However, the recovery is not (yet) policy- driven and broad-based, but powered by the oil sector. Risks therefore remains around global oil markets, the security situation in the Niger-Delta, fiscal sustainability, policy and politics.

Nigeria has created an economic structure in which it benefits from higher oil prices (in one instance – federal and sub-national revenue streams) and suffers in the other instances through the oil subsidy scheme.

At the best of time, the fuel subsidy scheme destabilizes downstream oil sector operations and limits growth and efficiency in the sector; it also tends to deliver low value-for-money.

The problem is worse at this time because there is no formal oil subsidy scheme. The “subsidy” is being arbitrarily applied by the NNPC in a manner that is not transparent, probably unconstitutional and prone to corruption!

CONCLUSIONS

Global economic growth prospects have improved modestly due to stronger US growth expectations, exit of some large economies (e.g. Brazil and Russia) from recession, and rising commodity prices.

Oil prices have surged to $60-70pb beyond 2017 expectations, offering Nigeria some respite and suggesting a better economic outlook in 2018. We would expect increased diffusion effects of oil sector growth in 2018, through budgets and government spending; oil sector procurement, wage and CSR growth; and oil sector support for the external sector.

Two key areas of positive policy impact have been, doing business reforms that resulted in Nigeria moving up 24 places on WB DB rankings; and greater FX liquidity aided by rising oil prices.

The positive macroeconomic elements includes rising oil price and increased production volumes, moderating inflation (though domestic food inflation remains high), higher FX reserves and stable FX rates, rising PMIs and modest enhancements in capital flows. All of these suggest a better macroeconomic outlook in 2018.

The outlook for oil and gas sector in Nigeria has improved with the OPEC-Russia production cutbacks holding; oil prices reaching $60-70 per barrel; the truce in the Niger-Delta continuing to hold; and government appearing more willing to adopt private capital structures to fund oil and gas activities.

However, risks remain with continuing threats from the Niger-Delta, especially as political activities intensify.

…………………………………………………………………………………………………..

Our Ref: NECA/SELA/D.2

14th March, 2018

TO: All Lagos State-Based Member-Companies

Dear Sir/Madam,

AN UPDATE ON THE NEW LAND USE CHARGE LAW OF LAGOS STATE

As you are well aware, your Association, NECA, has been leading the Organized Private Sector’s (OPS) advocacy initiatives against the insensitive provisions in the new Land Use Charge Law of Lagos State. Our objections have been communicated to Government and the Public through Advertorials, Press releases, Media interviews, among others.

Your Association has made progress in drawing the attention of the Lagos State Government to the obnoxious nature of the law. This has led to their direct engagements with NECA representatives in discussions with a view to finding a way out of the quagmire that they have found themselves.

In the light of the foregoing, and in consideration of on-going engagement at the level of the Organized Private Sector (OPS) with the Lagos State Government, and impending broad-based meeting of the OPS with Lagos State Government in the coming week, we once again, urge members not to be in a hurry to honour the outrageous demand notices, pending the outcome of engagements.

As earlier communicated, members that have been served with the outrageous 2018 Land Use Charge Demand Notice should, urgently, send a protest letter to the Office of the Honourable Commissioner of Finance and put NECA in copy. Based on informal discussion with the government, the penalty for late payment as contained in the law will be waived for the 2018 obligation.

Thank you.

Yours faithfully,

Timothy Olawale

For: Director-General

………………………………………………………………………………………………….

THE FEDERAL COMPETITION AND CONSUMER PROTECTION BILL: PROGRESS MADE SO FAR.

PREAMBLE

In 2014, a Bill on Federal Competition and Consumer Protection was presented at the National Assembly, subsequently, Nigeria Employers’ Consultative Association (NECA) through the technical support of a development partner, Enhancing Nigerian Advocacy for a Better Business Environment (ENABLE2), a DFID-funded programme, worked together in forming a Private Sector Coalition on the Competition and Consumer Protection Bill (PSCCPB).

The PSCCPB comprises a number of private sector organizations, including the Nigerian Employers’ Consultative Association (NECA), Manufacturers Association of Nigeria (MAN), Nigerian Association of Chambers of Commerce, Industry and Agriculture (NACCIMA), National Competitiveness Council of Nigeria (NCCN), Nigerian Economic Summit Group (NESG) and a host of other organizations.

The Coalition met severally, starting from 2014, to analyze the Bill and to understand how it affects their respective sectors/industries as well as to make suggestions on how to improve on the content of the Bill. The coalition presented its Position Paper at various Public Hearings of the National Assembly, conducted sensitization programmes – organized walk show, visits to various media Houses, etc.

We commend the overall intention and objectives of the Bill as being laudable as well as the attempt by the Bill to introduce anti-competition, anti-trust and anti-monopoly legislation. However, there are few provisions in the Bill, which are of concern to the Organized Private Sector (OPS) and worthy of further dialogue. These concerns were canvassed at the Public Hearings.

The Federal Competition and Consumer Protection Bill 2017 was passed by the National Assembly in December, 2017 and has since been sent to the President for assent.

We observed that some retrogressive forces went behind the stakeholders after the public hearing on the Bill to insert a 0.5% tax on companies to fund the establishment of a planned Commission/Agency that will undertake responsibilities under the law.

At the last count, there are over 55 Taxes and levies of all sorts imposed on enterprises from the Local Government to the Federal Government level. In fact, this represents just a conservative estimate. The question is how can businesses grow and create jobs under this draconian fiscal framework. The truth is that enterprises and businesses are being unwittingly strangulated by a hostile, unfriendly and very unreasonable tax and levy regime.

ABUSE OF PROCESS

While the Private sector welcomed and, in fact, actively supported the introduction of a dispensation where an Institution will exist to promote fair, efficient and competitive markets in the Nigerian economy, at no time, during the public hearing on the Bill, did we discuss the imposition of 0.5% profit after tax on all companies operating in Nigeria, as a source of funding the Commission. This provision was not contained in the draft bill that was exposed to the public. So, what could have been the source of this obnoxious provision that seeks to further drain life out of a struggling and comatose private sector that is still laboring under the unbearable weight of multiple and overlapping taxes and levies? This surreptitious insertion is a fraudulent act, which we seriously frown at. We do not support it. We will not accept it. If not removed, it may signify the death knell for this intended dispensation as the private sector will not pay an unnecessary additional levy/tax. We implore Government to fund this Agency from the existing fiscal framework.

The OPS PRAYERS

We wish to let Mr. President know that there is a fraudulent element in the procedure adopted by the National Assembly in forwarding the said bill for his assent.

The obnoxious provision on funding, which was surreptitiously inserted, is too fundamental not to have been contained in the draft bill exposed to the public.

We urge Mr. President in the interest of this economy and sustainable development of Nigeria to withhold assent to the Federal Competition and Consumer Protection Bill 2016.

The Bill should be sent back to the National Assembly for proper procedural compliance.

…………………………………………………………………………………………………..

Presidential Executive Order for Planning and Execution of Projects, Promotion of Nigerian Content in Contracts and Science, Engineering and Technology

Recently, President Muhammadu Buhari signed another Executive Order (EO5) in his resolve to reform the administrative and regulatory environment. This is expected to complement the earlier four (4) Executive Orders in effectively placing the country on the path to its envisioned place in the global community of advanced economies.

In May and June 2017, the Vice President, Professor Yemi Osinbajo SAN GCON (as Acting President) signed the first four Executive Orders with focus on:

The promotion of transparency and efficiency in the business environment designed to facilitate the ease of doing business in the country,

Support for local content in public procurement by the Federal Government, and

Timely submission of annual budgetary estimates by all statutory and non-statutory agencies, including companies owned by the Federal Government.

The Voluntary Assets and Income Declaration Scheme (VAIDS), which offers tax amnesty (until March 31, 2018) to tax payers who have defaulted in their tax obligations in the past.

Thrust of the Executive Order (EO5):

The Executive Order No. 5 (EO5) directed all Ministries, Departments and Agencies (MDAs) of government to engage indigenous professionals in the planning, design and execution of national security projects and maximise in-country capacity in all contracts and transactions with science, engineering and technology components. The Executive Order took effect immediately (signed February 2, 2018).

The main objectives of the EO5 are the harnessing of domestic talents and the development of indigenous capacity in science and engineering for the promotion of technological innovation needed to drive national competitiveness, productivity and economic activities which will invariably enhance the achievement of the nation’s development goals across all sectors of the economy.

The EO5 makes certain specific directives which include the following:

All procuring authorities shall give preference to Nigerian companies and firms in the award of contracts, in line with the Public Procurement Act, 2007;

Where expertise is lacking, procuring entities shall give preference to foreign companies and firms with demonstrable and verifiable plan for indigenous capacity development, prior to the award of such contracts;

MDAs shall engage indigenous professionals in the planning, design and execution of national security projects and consideration shall only be given to a foreign professional, where it is certified by the appropriate authority that such expertise is not available in Nigeria;

Nigerian companies or firms duly registered in accordance with the laws of Nigeria, with current practising licence shall be lead in any consultancy services involving Joint Venture (JV) relationships and agreements, relating to Law, Engineering, ICT, Architecture, Procurement, Quantity Surveying, etc.;

MDAs shall ensure that before the award of any contract, Nigerian counterpart staff are engaged from the conception stage to the end of the project and shall also adopt local technology that meet set standards to replace foreign ones;

The Ministry of Interior is prohibited from giving visas to foreign workers whose skills are readily available in Nigeria;

The Federal Government shall introduce Margin of Preference (“MoP”) in National Competitive Bidding, in the evaluation of tenders, from indigenous suppliers of goods manufactured locally over foreign goods (MoP shall be 15% for both international competitive bidding for Goods and domestic contractors for national competitive bidding for Goods. For Works for domestic contractors, the MoP shall be 7.5%);

Foreign companies or firms shall not be engaged in contracts for Works, Goods, and Services in the country in violation of the standard international best practices as provided for under relevant statutes such as the Companies and Allied Matters Act (CAMA), Council for Regulation of Engineering (COREN) Act, Chartered Institute of Purchasing and Supply Management Act, Public Procurement Act, and the National Information Technology Development Agency (NITDA) Act as well as other relevant Nigerian laws and regulations on acquisition of technology and conduct of public procurement;

MDAs shall ensure that all professionals practising in the country are duly registered with the appropriate regulatory bodies in Nigeria, and shall ensure, in collaboration with the Head of the Civil Service of the Federation, that all foreign professional certificates are domesticated with the relevant professional bodies before being considered for any contract award or employment in Nigeria;

Agreements involving any Joint Venture and Public Private Partnership (PPP) between a foreign firm and a Nigerian firm, for technology acquisition or otherwise, shall be registered with the National Office for Technology Acquisition (“NOTAP”) in accordance with the provisions of the NOTAP Act, before such contract are signed by the MDAs;

A Nigerian company or firm shall not be disqualified from an award of contract by any MDA on the basis of the year of incorporation except on the basis of qualification, competence and experience of the management in the execution of similar contracts;

NOTAP shall develop, maintain and regularly update a Data Base of Nigerians with expertise in science, engineering, technology and other fields of expertise while the Ministry of Interior shall take into consideration the NOTAP Data Base together with other similar data from the Nigerian Academy of Engineering; Nigerian Content Development and Monitoring Board; Federal Ministry of Science and Technology and other relevant Ministries; in determining the availability of local skilled manpower in Science, Technology and Innovation (STI) for the grant of Expatriate Quota;

Where qualifications and competence of Nigerians are either unavailable or unascertainable, the Ministry of Interior shall ensure that Expatriate Quota for projects, contracts and programme are granted in line with the provisions of the Immigration Act and other relevant laws, and may create special immigration classification to encourage foreign expatriates (particularly from African countries) to reside and work in Nigeria for the purpose of sharing knowledge with Nigerian professionals; and

The Federal Inland Revenue Service (FIRS) and the Ministry of Finance shall ensure that tax incentives are granted to existing machine tools companies (including foundry, machine shop, forge shop, and indigenous artisans) to boost local production of their products while tax incentives may be granted to Small & Medium Enterprises and foreign firms for the utilisation of local raw materials that are authenticated by the Raw Materials Research and Development Council (RMRDC).

OPINION

There are certain things the EO planned to achieve, which includes:

Ensure more collaboration between MDAs and Standard Organisation of Nigeria (SON);

Strategically emphasises the importance of competence and approved Codes & Standards for the indigenous professionals being encouraged by its directives;

Emphasizes punishment for any violation of its provisions- shall be as stipulated in the Public Service Rules and other relevant laws, including those governing public procurement and professional practice in Nigeria; as well as

Establishes the Presidential Monitoring and Evaluation Council (PMEC) – with the President as Chairman and the Vice President as Alternate Chairman – to monitor progress of the implementation of the Executive Order.

We believe that the Executive Order (EO5) has laid foundation for the gradual take-off of the envisioned industrial, diversified and self-sustaining economy with 100 percent in-country capacity utilisation and development.

Like the Local Content Act, we observed that there may be need to give statutory flavour to the EO5 in the near future in order to achieve maximum impact. This could be done by incorporating provisions of the EO5 in an Executive Bill to be enacted into law by the National Assembly.

…………………………………………………………………………………………………

Law Report Review / Legal Opinion: Judgment of the National Industrial Court: When an Action is Statute-Barred

Alhaji Summonu Adetunji Omole vs. Nigeria National Petroleum Corporation & 1 Or Unreported Suit No. NICN/LA/820/2016

FACTS

The claimant filed the suit by way of a complaint dated and filed on 28th December 2016. By the statement of claim, the claimant claimed against the defendants jointly and severally for:

(1) That the purported letter of termination of the claimant’s appointment as Security Officer Grade II and as a pensionable staff of the Nigerian National Petroleum Corporation and the contemporaneous contract appointment offered to the plaintiff by the 1st defendant both letters dated the 4th day of December, 1988 are ultra vires, unconstitutional, null and void.

(2) That the claimant’s appointment as a permanent and pensionable staff of the 1st and 2nd defendants from or about 15th July 1979 still subsists and is valid with all the attached rights, salaries obligation and privilege unimpaired until he attains the statutory age of 60 years and for specific order restoring the claimant thereto.

(3) That the purported termination of the contract appointment of the claimant if ever there was one, by the 2nd defendant’s letter dated 14th of March, 1990 is ultra vires, unconstitutional, illegal, null and void and of no effect and for a specific order restoring the claimant thereto.

(4) That the purported termination of the pensionable appointment of the claimant by the 1st defendant is wrongful and amount to wrongful dismissal being in breach of the rules of natural justice and also contrary to civil service rules and 1999 Constitution, the claimant being a public officer.

ALTERNATIVELY

(5) An order for the payment of (N100,118,546.40) One Hundred Million, One Hundred and Eighteen Thousand, Five Hundred and Forty-Six Naira and Forty Kobo to the claimant by the defendants jointly and severally as special and general damages suffered by the claimant and in consequence of the wrongful dismissal or wrongful termination, whichever is applicable.

The defendants entered formal appearance, filed their defence processes and then filed a preliminary objection praying that the suit be dismissed. The grounds upon which the preliminary objection was based are: the suit was statute-barred; and the claimant did not comply with the statutory provisions requiring the issuance of a pre-action notice, thus rendering the suit incompetent.

Case for the Defendants

On whether the suit was statute-barred, the defendants referred to section 12(1) of the NNPC Act Cap 320 LFN 1990 which provides 12 months as the limitation period within which suits against NNPC can be brought. That from the originating processes, the claimant indicated that he was wrongfully disengaged from the employment of the defendants on 4th December 1986 and on same date issued with a contemporaneous contract appointment. That by implication, the cause of action arose in December 1986; and since the instant suit was filed on 28th December 2016, a clear 30 years after the cause of action arose, the suit must be statute-barred. The defendants referred to number of case law authorities: Egbe v. Adefarasin [1987] 1 NWLR (Pt. 47) 1, Madukola v. Nkemdilim [1962] 2 SCNLR 341, Tukur v. Governor of Gongola State [1987] 4 NWLR (Pt. 117) 517, Jeric (Nig) Ltd v. UBN Plc [2000] 12 SC (Pt. II) 133 and Sandra v. Kukawa Local Government [1991] 2 NWLR (Pt. 179) 379.

On the issue of pre-action notice, the defendants referred to section 12(2) of the NNPC Act which enjoins a pre-action notice on one month to the NNPC before a suit can be commenced against it. There was no evidence in the claimant’s processes before this Court showing compliance with the pre-action notice requirement of section 12(2) of the NNPC Act; neither was a copy filed in Court in line with Order 3 Rule 23(1) of the NICN Rules 2017. The defendants relied on a number of cases: Dominic E. Ntiero v. NPA [2008] LPELR-SC.39/2001, Barclays Bank Ltd v. CBN [1976] 6 SC 175 and Eze v. Ikechukwu [2002] 18 NWLR (Pt. 799) 348. The defendants concluded by urging that the suit be struck out or dismissed.

Case for the Claimant

The claimant reacted by filling a counter-affidavit and a written address. The claimant submitted a sole issue for determination: whether this suit can be statute-barred having complied with the section 12(1) of the NNPC and when the cause of action arose in 1990 and the claimant instituted action at the Lagos High Court which was one of the courts constituted to entertain such a matter. To the claimant, the case of action arose on 14th March 1990 when the defendants terminated the claimant’s appointment in 1990. The claimant’s counsel gave a pre-action notice to the defendants before suing at the Lagos High Court as per Suit No. LD/1476/90 – which pre-action notice was sufficient for the instant suit. Secondly, that since the Constitution was made to operate prospectively; the claimant had to commence the instant suit in this Court as held in Aremo II v. Adekanye [2004] 13 NWLR (Pt. 891) 572 ratio 2.

For these reasons, the claimant concluded by urging that the preliminary objection of the defendants be discountenanced and the claimant allowed to proceed with the trial of this suit.

JUDGMENT

The Court held that the claimants’ case succeeds in terms of the following declarations and orders:

a) In determining whether a matter is statute-barred, courts are called upon to ascertain what the cause of action is, when it arose and when the suit was filed. If the period between the date the suit was filed and when the cause of action arose is more than the limitation period, the matter is said to be statute-barred. From the processes filed, the court found and held that the suit was statute-barred.

b) The claimant argued that he first filed an action at the Lagos High Court (Suit No. LD/1476/90) before filing the suit. Although he brought in this argument in terms of his submission that the pre-action notice he served for purposes of the Lagos High Court Suit should suffice for purposes of the instant suit, in his oral adumbration of his written address, the claimant’s counsel suggested that (and this is the context in which his written submission about the Constitution having prospective effect was made) he had to file the instant suit because the Third Alteration to the Constitution divested the Lagos High Court of jurisdiction in Suit No. LD/1476/90, and the Lagos High Court had no power to transfer the case to this Court. This argument must fail since Echelunkwo John & 90 ors v. Igbo-Etiti LGA [2013] 7 NWLR (Pt. 1352) 1 at 14 – 17 held that State High Courts have the power to transfer labour/employment cases pending before them to the National Industrial Court. The argument of the claimant in opposition to the preliminary objection was lame and unconvincing and so must fail.

c) In the whole, the court found and held that the suit was statute-barred; and on this ground alone the case was liable to be dismissed. See NPA Plc v. Lotus Plastics Ltd [2005] 19 NWLR (Pt. 959) 158, which held that where a Court makes the finding that a matter is statute-barred, the proper order to make is one of dismissal.

d) The preliminary objections of the defendants succeed. The suit was accordingly dismissed.

OPINION

Parties are expected to comply with certain requirements (Facts and Law) before instituting an action in Law. The preliminary objection was decided based on a mixture of Law and Facts.

…………………………………………………………………………………………………

PICTORIAL: NECA/LIRS Interactive Session On “Taxation and Its Administration in Lagos State: Innovations & Developments

Key Conclusions

At the end of the Interactive Session, the following conclusions were reached:

There would be continuous interaction, sustenance of the forum and engagement between the Association and Lagos State Internal Revenue Service (LIRS).

The interactive session would be institutionalized and hold twice every year.

LIRS would expeditiously attend to issues and challenges faced by

NECA member-companies as regards tax administration in Lagos State.

The next interactive session had been fixed for Wednesday, 17th October, 2018 at 11.00am at NECA House

…………………………………………………………………………………………………

Learning and Development Programmes and Upcoming Meetings of various Expert Committees

Nigerian Labour, Employment and Current Social Laws: Knowledge & Application

Date: Wednesday 18th – Friday 20th April, 2018

Venue: NECA House, Alausa, Ikeja, Lagos State

Course fee: Member: N115,000.00 Non-Member: N120,000.00

Committee of Human Resources & Learning Experts (CHRLE)

Date: Wednesday, 16th May, 2018

Venue: NECA House, Alausa, Ikeja, Lagos

Time: 9:30am

Committee of Legal Advisers and Company Secretaries (COLACS)

Date: Thursday, 10th May, 2018

Venue: NECA House, Alausa, Ikeja.

Time: 10:00am

NECA Ibadan Geographical Group Meeting

Date: Thursday, 24th May, 2018

Venue: P& G Ibadan Office, Oluyole Estate, Ibadan

Time: 10:00am

Recent Comments