Business Essentials November 2017 Edition

Dear Esteemed Member,

We welcome you to yet another interesting edition of our monthly Business Essentials. In this edition, we reviewed the general macroeconomic situation in the country, showing positive trends. We hope the positive trends should continue and further translate to economic growth and development.

We also reviewed the:

- recent Government’s circular on Export Expansion Grant (EEG) for the benefit of export-oriented businesses;

- outcome of our meeting with the Executive Chairman, Federal Inland Revenue Service (FIRS);

- Press release on Consumption Tax in Kano State as another form of duplication of taxes.

We closed the edition with our columns on Upcoming Meetings of various Expert Committees, News from International Employers Organisation (IOE)/International Labour Organisation (ILO), General Circulars and Legislative Observatory, etc.

Do have a pleasant reading.

Timothy Olawale

Editor

In this Issue:

- Review of General Macroeconomic Variables and Implication to Businesses

- Current Government Policies And Implication on Business: Revised Guideline for Export Expansion Grant (EEG) Scheme

- Press Release: Government Strangulates Business With VAT At Federal Level, State Governments

- News from International Employers Organisation (IOE)/International Labour Organisation (ILO): Appointments at the ILO

- Law Report Review / Legal Opinion: Supreme Court Says Court Of Appeal Had Exclusive Appellate Jurisdiction Over All Decisions Of The NICN

- Upcoming Meetings of various Expert Committees

- General Circulars: Meeting with the Executive Chairman, FIRS on Property Valuation & Assessment

- Legislative Observatory: A Bill for an Act to Repeal the National Housing Fund Act CAP N45 LFN 2004 for Related Matters

- Upcoming Training Programmes

Review of General Macroeconomic Variables and Implication to Businesses

Source: NBS/NECA Research

Source: NBS/NECA Research

IMPLICATIONS:

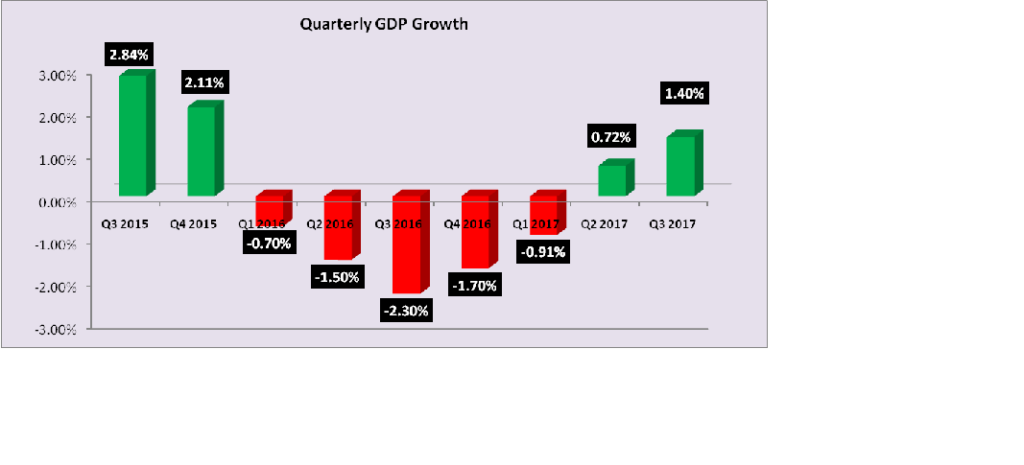

- According to the National Bureau of Statistics (NBS), the Gross Domestic Product (GDP) figure for the third quarter of 2017 came in strong at 1.40% (year-on-year) in real terms, with a revision of the second quarter figure from 0.55% to 0.72% (following revision by NNPC to oil output). Consequently, year-to-date real GDP growth stands at 0.43% which shows the tepidness of the country’s economic recovery. The Nominal GDP and Real GDP were valued at N29.83trillion and N18.03 trillion respectively.

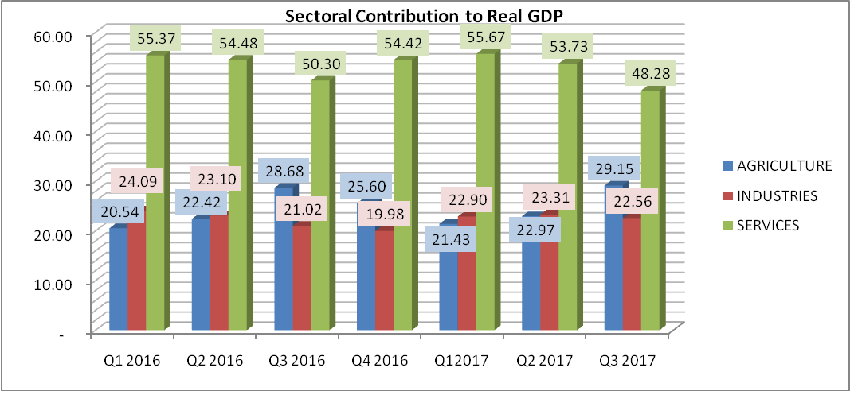

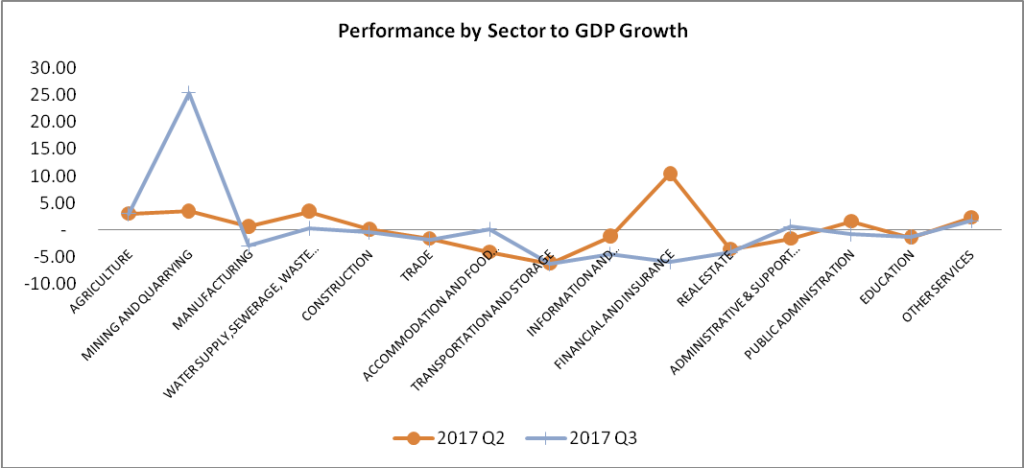

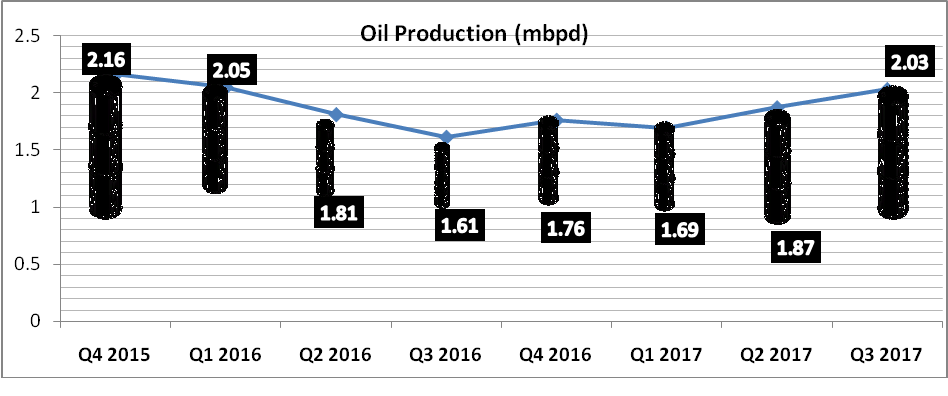

- Average daily oil production in the period under review was 2.03 million barrels per day, higher than the average production in second quarter of 1.87mbpd by 0.15million barrels. The Oil sector expanded by 26% year-on-year in the quarter to lift the country’s GDP putting oil sector’s contribution to GDP at 10.04% compared to the 8.09% in the previous quarter. However, the non-oil sector has not recovered from earlier cyclical shock.

- In contribution by activities of sectors, the slowdown in the growth of discretional items such as food and textiles suggest lean consumption as firm struggle to manage stock. Sectors such as information technology, transportation and accommodation which were resilient in period of negative downturn are already displaying weakness as they seem to be running out of growth. Moreover the 49% slump in oil refining in the third quarter of 2017 do add to the concern as it can influence our balance of payment negatively.

- Overall on the GDP growth, although it’s cherry to note that there is uplift in the quarterly cycle, the figures mask structural weakness in the economy which could be deceptive as the growth is largely oil induced, with most of the other sectors of the economy still experiencing negative growth. With the renewed threats from militants in the Niger Delta, we are cautious about the likelihood of reaching the 2.3million barrels per day mark as projected in the 2018 Budget.

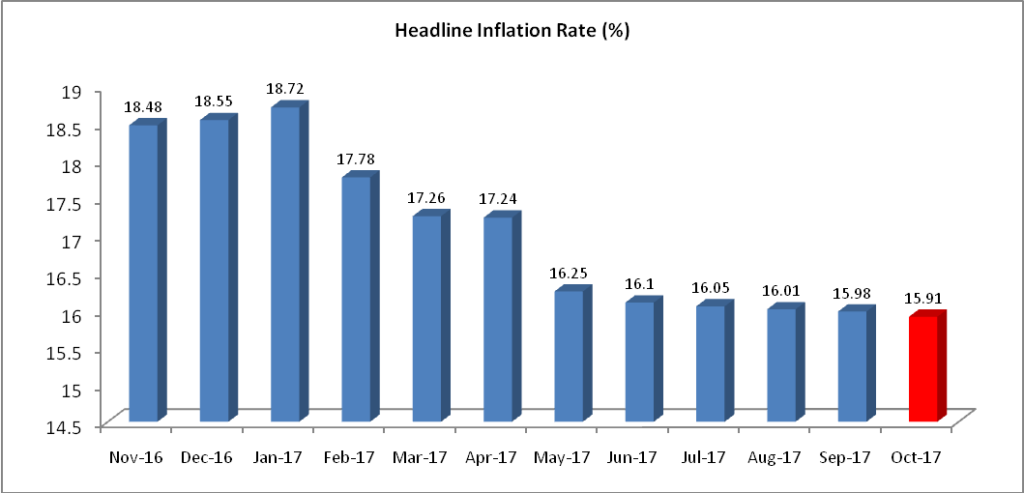

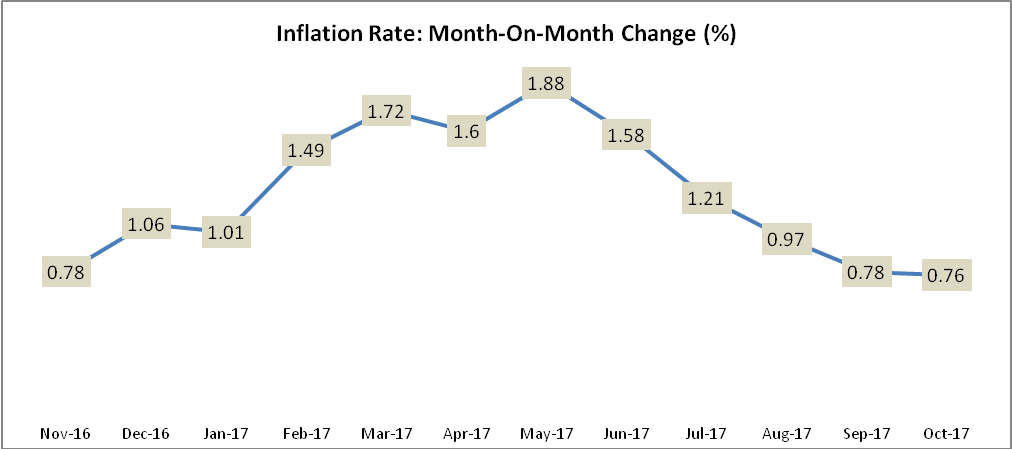

- Inflationary pressures in the economy continued to moderate with headline inflation (year-on-year) receding for the ninth consecutive month to 15.91% in October 2017 from 15.98% in September 2017. Food inflation fell marginally to 20.31% from 20.32% in September, while core inflation increased slightly to 12.14% from 12.12% during the same period. These developments were attributable to the contraction in money supply, favourable but dwindling base effects, and the relatively stable naira exchange rate. In spite of the marginal decline in food inflation in October, we noted that the rate remained high, traceable to cross border sales, distribution bottlenecks, high prices of farm inputs and supply shortages.

……………………………………………………………………………………………………………………………………………….

Current Government Policies: Revised Guideline for Export Expansion Grant (EEG) Scheme

The Export Expansion Grant (‘EEG’ or ‘the Scheme’) is one of the export incentives introduced by the Federal Government through the Export (Incentives and Miscellaneous Provisions) Act, No 18 of 1986 as amended by the Export (Incentives and Miscellaneous Provision) Act, No 65 of 1992, Cap. E19 Laws of the Federation of Nigeria (LFN). It is a post-shipment incentive designed to improve the competitiveness of Nigerian products and commodities and expand the country’s volume and value of non-oil exports.

The Export Expansion Grant Scheme is a vital incentive required for the stimulation of export oriented activities that will lead to significant growth of the non-oil export sector and the diversification of the economy. The scheme was suspended in 2014 to ensure a review and redesign in order to prevent abuse and ensure that the scheme is fit for purpose.

Prior to the suspension of the scheme, the incentive was granted in form of a negotiable duty credit certificate (NDCC) utilisable by exporters for payments of import and excise duties. The NDCC has now been replaced with the Export Credit Certificate (ECC). To facilitate implementation, a budgetary provision of N20Billion was made in the 2017 budget for settlement of the grant.

The Federal Government set out the following revised guidelines to ensure affordability and sustainability of the scheme:

- Eligibility:

- An intending beneficiary must be registered with the Corporate Affairs Commission

- An eligible exporter must be registered with the Nigerian Export Promotion Council (NEPC)

- An eligible exporter shall be a manufacturer producer or merchant of products of Nigerian origin for the export market (i.e. the products must be made in Nigeria)

- An eligible exporter must have carried out formal export with its export proceeds repatriated into a domiciliary account in Nigeria and confirmed by the Central Bank of Nigeria.

- An exporter-company shall submit its baseline data which includes audited Financial Statement, information on operational capacity and Export Expansion Plan (EEP) to NEPC.

- Validity for EEG Application

- Qualifying export transaction must have satisfied all formal export requirements and the proceeds fully repatriated within 300 days, calculated from the date of export and as approved by the EEG Implementation Committee.

- Automation and Use of Technology

The use of technology shall be incorporated into the country’s export procedures and in the processing of claims to promote transparency and improve confidence in the export documentation generated. Also, scanners and weigh bridges shall be urgently installed in all ports as part of the automation process to amongst others, eliminate the possibility of false claims by exporters.

- Documentation

Pending the commencement of the automation of export procedures and incentives processing, whereby all applications shall be forwarded to NEPC via a web based electronic platform, all applications for Export Expansion Grant (EEG) to NEPC must be submitted in duplicate along with the scanned copies in a flash drive, with the following export documents attached:

- Forms NXP duly certified by processing bank; Nigeria Customs Service and the Pre-Shipment Inspection Agents;

- Bill of Lading;

- Final Commercial Invoice;

- Single Goods Declaration (SGD) Forms, duly endorsed by Nigeria Customs Service, both at front and back;

- Evidence of full repatriation of export proceed (CBN confirmation of repatriation of proceeds by exporter);

- Clean Certificate of Inspection (CCI) to include quality certificate;

- NEPC non-oil Export Certificate

- Certificate of Manufacturer (where applicable)

- Scanning Report

- Any other documentation as may be required by NEPC from time to time.

- Incentive Rate

The scheme would operate the ‘‘Weighted Eligibility Criteria’’ in assessing applications for EEG. A company’s EEG assessment would be conducted once yearly and the determined rate will apply throughout the year. The Weighted Eligibility Criteria has four bands: 15%, 10%, 7.5% and 5%. The following template will be used in assessing the incentive rate of the EEG applicant.

- Determination of Export Performance- Eligibility Criteria

| Eligibility Criteria | Company Data | Threshold | Weight | Company Score |

| Local Value Added | 30% | 20% | ||

| Local Content | 70% | 20% | ||

| Employment (Nigerians) | 500 | 10% | ||

| Export Growth | 5% | 35% | ||

| Capital Investment | 10% | 15% |

Total Weight= 100%

A new entrant into the EEG Scheme shall provide three year prior period financial statements, where applicable. Newly incorporated companies should submit their current year management account and projected financial statement for its assessment. However, to encourage export of value added and processed/manufactured products, exporters shall be divided into four categories.

- EEG Rate applicable to the 4 categories of exporters

| Scoring Key | Fully Manufactured (end of process/ready for consumption) | Semi Manufactured products (inputs into further processing) | Processed/Intermediate Products | Merchants/Primary Agricultural Commodities (including commodities and Solid minerals) |

| Score Band | EEG Rate % | EEG Rate % | EEG Rate % | EEG Rate % |

| ≥ 70% | 15 | 10 | 7.5 | 5 |

| ≥ 50% | 10 | 7.5 | 5 | 3 |

| ≥ 25% | 7.5 | 5 | 3 | 2 |

| ≥ 5 % | 3 | 1 | 1 | 1 |

| ≤ 5% | 0 | 0 | 0 | 0 |

Exporters whose activities/products fall into more than one category shall have their EEG rate for each different category determined by the application of their eligibility criteria score to the appropriate activity/product score table for EEG rates. The rates then determined are applied to appropriate NXPs.

- Monitoring The Impact of the Scheme

All participants in the scheme must present an Export Expansion Plan (EEP) as a prerequisite for participating in the scheme. This will be used as a basis of monitoring the export expansion program of beneficiaries and determining their continued eligibility for the scheme.

- Settlement of Claims

The grant computed shall be settled by issuing negotiable tax credit to the beneficiaries. This will promote the formalization and inclusion of the Scheme’s participants and third parties in the tax net. The instrument which shall be known as Export Credit Certificate (ECC), in order to reflect the changes in the characteristic of the revised scheme, will be used to settle all Federal Government taxes such as Company Income Tax, VAT, WHT, etc and the following:

- Purchase of Federal Government Bonds

- Settlement of credit facilities by Bank of Industry, NEXIM Bank and CBN intervention Facilities

- Settlement of AMCON liabilities

The certificate shall be valid for two years and transferable once to final beneficiaries.

- Procedure for Issuance and Utilization of ECC

Upon approval of claims by the EEG Implementation Committee and subsequent approval by the Honourable Minister of Finance, the Export Credit Certificate (ECC) shall be issued by the Nigerian Export Promotion Council and countersigned by the Budget Office of the Federation/Federal Ministry of Finance.

- Administration of EEG Scheme

The EEG Scheme shall be domiciled in NEPC and administered in conjunction with the EEG Implementation Committee (EEG IC). The clean list of applicants to whom NEPC have been issued shall be forwarded to the Federal Ministry of Industry, Trade and Investment and Federal Ministry of Finance upon issuance.

There shall be an EEG Inter-Ministerial Committee (EEG IMC) to review the activities of the EEG Scheme. The Committee shall meet twice a year.

In order to effectively fund the administration of the scheme, the EEG beneficiaries shall pay 2% of the value of EEC approved by the EEG IC upon collection of the Certificate and 4% cost of collection upon utilization.

- Outstanding Claims

All outstanding claims in respect of transactions between the suspension of the Scheme and its subsequent lifting will be proceed under the new reviewed EEG guidelines (i.e. exports made with Bill of Lading dated on or after 1st January, 2014).

Effective Date: These guidelines take effect from 1st January, 2017.

……………………………………………………………………………………………………………………………………………….

Press Release: Government Strangulates Business with VAT at Federal Level, State Governments

Nigeria Employers’ Consultative Association (NECA) has expressed its displeasure at attempts by Government to strangulate Businesses through multiple taxes and duplication of taxes and levies in the country.

It specifically took umbrage at the enactment of Kano State Revenue Administration (Amendment) Law 2017, which imposed a Consumption tax payable by Consumers of goods and services bought or rendered in any hotel, restaurant, eatery, bakery, takeaway, suya spot, shopping mall, store, event centre and other similar businesses in the State.

Reacting to the incident, Mr. Olusegun Oshinowo, the Director-General of NECA, noted that: “the imposition of Consumption Tax by Kano State amounted to a duplication of Value Added Tax (VAT), which our Laws frown against, as stated by the Supreme Court in the case of Attorney General of Ogun State vs. Aberuagba and Ors.

“We do not agree with the imposition of such tax due to the existence of Value Added Tax (VAT) in the country. This is because VAT is a consumption tax collectible by the Federal Government (and shared among the states) in respect of sale of goods and provision of services within the Federation”.

Mr. Oshinowo averred that in response, NECA had instituted an action challenging such imposition by Kano State Government.

The Director-General explained further that “the cause of the recent development is the Taxes and Levies (Approved List for Collection) Act (Amendment) Order 2015, which several States are misinterpreting and now leveraging to enact Laws that clearly amount to and promote duplication of taxes. This trend is spreading like wide fires going by the recent actions of Kogi and Delta States, just to mention but a few.

“Mr Oshinowo averred that this initiative is killing business, wealth creation and entrepreneurship. It is equally a clear disincentive to foreign direct investment”.

Mr. Oshinowo stressed that: “while the private sector is not opposed to taxation, it is, however, against illegality and unreasonable taxes through imposition of multiple taxes as well as duplication of taxes. The private sector will not accept a duplication of VAT in any guise irrespective of the name given to it by the state governments”

He drew attention to the judgment of the Supreme Court in the case of Attorney General of Ogun State v. Alhaja Ayinke Aberuagba, where the court affirmed, as follows “… a State House of Assembly has power to make…. Law, ….such law should not be inconsistent with any law validly made by the Federation and should not make Sales Tax Law (Consumption Tax Law) where any law validly made by the Federation has covered the field”.

……………………………………………………………………………………………………………………………………………..

News from International Employers Organisation (IOE)/International Labour Organisation (ILO): Appointments at the ILO

Ms Samuel-Olonjuwon becomes ILO Assistant Director-General/Regional Director for Africa

Ms Samuel-Olonjuwon

We are delighted to share with you the recent appointment of Cynthia Samuel-Olonjuwon of Nigeria as Assistant Director-General and Regional Director for Africa by the International Labour Organisation (ILO). A statement from ILO office in Geneva, Switzerland, said its Director-General, Guy Ryder, after having duly consulted the Officers of the Governing Body, appointed Cynthia Samuel-Olonjuwon of Nigeria as Assistant Director-General and Regional Director for Africa, in Abidjan, Côte d’Ivoire with effect from November 10, 2017.

Appointed Deputy Regional Director for Africa with effect from 15 July 2016, Ms Samuel-Olonjuwon joined the ILO in 1995, where she has held different positions in the field and Geneva, including Chief of the ILO Programming Unit for Africa and Deputy Director of the ILO Office in Pretoria.

As a member of the senior management team of the ILO Regional Office for Africa for more than nine years, she has played an important role in the development and implementation of regional strategies to deliver quality programmes, fostering opportunities for cooperation, particularly with the African Union and Regional Economic Communities, and alliance building throughout the region.

Born in 1961, Ms Samuel-Olonjuwon holds a BSc in Sociology and was awarded a Masters’ Degree in Industrial and Labour Relations from the University of Ibadan in 1982. With more than 32 years work experience, she had worked as Assistant Director in the Nigeria Employers’ Consultative Association (NECA). She had also worked as a lecturer on gender, industrial sociology and group dynamics at the Ahmadu Bello University.

Ms Samuel-Olonjuwon was appointed to the Board of the International Sociological Association (Research Committee on Women in Society) from 1986 to 1990. She has significant experience in leadership and management.

Until her new position, Samuel-Olonjuwon was the Deputy Regional Director for Africa, a post she held since July 15, 2016. She joined the ILO in 1995, where she held different positions in the field and Geneva, including Chief of the ILO Programming Unit for Africa and Deputy Director of the ILO Office in Pretoria. She has been a member of the senior management team of the ILO Regional Office for Africa for more than nine years.

She has played an important role in the development and implementation of regional strategies to deliver quality programmes, fostering opportunities for cooperation, particularly with the African Union and Regional Economic Communities, and alliance building throughout the region. With more than 32 years experience in the world of work, she had worked as Assistant Director of the Nigeria Employers’ Consultative Association (NECA). She also worked as a lecturer on gender, industrial sociology and group dynamics at the Ahmadu Bello University, Zaria.

Ms Samuel-Olonjuwon was appointed to the Board of the International Sociological Association (Research Committee on Women in Society) from 1986 to 1990. She has significant experience in leadership, management and strategic partnerships to promote decent work and development outcomes at regional, sub-regional and national levels.

Law Report Review / Legal Opinion: Supreme Court Says Court Of Appeal Had Exclusive Appellate Jurisdiction Over All Decisions Of The NICN

Facts:

- The Court of Appeal in Lagos had in 2014 referred to the Supreme Court an appeal in the case of Mainstreet Bank Ltd vs Victor Anaemen Iwu (SC/ 885/14).

- The case was consolidated with a related appeal in the case of Coca-Cola Nig. Ltd vs Titilayo Akinsanya, in which the Court had in 2013 held that there was no right of appeal against the decision of the NICN, except as limited in Section 243(2)-(4) of the 1999 Constitution.

- The appellate court had referred the appeal to the Supreme Court, seeking a resolution of the substantial question of law on the finality of its decisions.

- The issue of finality of the decisions of the Industrial Court had generated a lot of controversy in the legal profession among Litigants, Employees, Employers of Labour and the Academia with several appeals awaiting the outcome of the decision of the Apex Court on the issue.

Issues:

Whether the Court of Appeal, as an appellate court created by the Constitution of the Federal Republic of Nigeria, has the jurisdiction, to the exclusion of any other court of law in Nigeria, to hear and determine appeals arising from decisions of the NICN

Decision:

In its judgment on June 30, 2017, a panel of Justices of the Supreme Court, presided by Justice Mary Peter-Odili, held that there was no constitutional provision divesting the Court of Appeal of jurisdiction to hear appeals emanating from the NICN.

The apex court also held that the right of appeal was not limited to fundamental rights cases.

Before now, some users of the NIC believed that only appeals on the grounds of breach of fundamental rights could be appealed. But the Supreme Court held that the Court of Appeal had exclusive appellate jurisdiction over all decisions of the NICN.

The apex court held among others, that the jurisdiction of the Court of Appeal to hear and determine all civil appeals on decisions of the NIC was not limited to only fundamental human rights.

The Supreme Court further ruled that, “The lower court, that is, the Court of Appeal, has the jurisdiction, to the exclusion of any other court in Nigeria, to hear and determine all appeals arising from the decisions of the trial court.

“No constitutional provision expressly divested the said Court of Appeal of its appellate jurisdiction over all decisions on civil matters emanating from the trial court.

“And, as a corollary, the jurisdiction of the court to hear and determine all civil appeal on decisions of the National Industrial Court is not limited to only fundamental human rights.”

Opinion:

The Supreme Court in SC/ 885/14: held that the Court of Appeal has the jurisdiction to hear all Appeals from the National Industrial Court, that there is no constitutional provision divesting the Court of Appeal of jurisdiction to hear all appeals from the National Industrial Court and that the Right of Appeal is not limited to Fundamental Rights Cases. This is settled law and a welcomed development in our Labour and Employment Jurisprudence /Law.

The Judgment of the Supreme Court is attached.

Upcoming Meetings of various Expert Committees

- NECA Ibadan Geographical Group Meeting (IGG)

Date: Thursday, 30th November, 2017

Venue: Oriental Foods Nigeria Limited, Ibadan-Lagos Expressway, Ibadan

Time: 10:00am

- NECA Governing Council Meeting (GC)

Date: Thursday, 7th December, 2017

Venue: NECA House

Time: 9:30am

General Circulars: Meeting with the Executive Chairman, FIRS on Property Valuation & Assessment

Our Ref: NECA/SELA/H.1

2nd November 2017

To: All Members

Dear Sir/Madam,

MEETING WITH THE EXECUTIVE CHAIRMAN, FIRS ON PROPERTY VALUATION & ASSESSMENT

As you are aware, your Association had earlier informed you on the FIRS’ activities on Property Valuation / Assessment and the follow-up Tax demand notices for year 2016 from the Service. Our scheduled meeting with the Executive Chairman, FIRS, Mr. Tunde Fowler and his management team under the platform of the Organised Private Sector (OPS) was held on 1st November 2017 in Abuja. The meeting provided the opportunity to seek clarification on the Tax demand notices and to table other germane issues to business. Please, find as follows key conclusions at the meeting:

- The FIRS clarified that it never undertook any property evaluation. Instead, in an attempt to widen its tax net, it had utilised properties’ record obtained from States’ Land Registries to identify registered corporate offices for the purpose of capturing businesses that never paid taxes, never filed any form of returns and (or) whose tax payments followed no logical sequence.

- Any tax compliant member-company that does not fall into the above category / outside the target businesses above must have erroneously received the tax demand notes. Such company needed not worry, but should send in an objection letter to FIRS immediately on the assessment to enable the Service vacate / discharge the demand note.

- Companies are urged to visit the Land Registry in the states that they are situated to certify that their property was appropriately documented.

- Highlights of other issues raised are, as follows:

- a) Outstanding refunds of Withholding Tax (WHT) – FIRS had made representation to the Federal Ministry of Finance and the Federal Executive Council. The sum of N2B provisions had been approved for release every month to offset WHT refunds. It is expected that all outstanding would be paid off in 2017 or by 1st quarter of 2018. Member-companies with outstanding refunds should, therefore, commence the process for payment immediately.b) Outstanding VAT – FIRS has also started clearing outstanding VAT refunds. Receipts are now being transmitted /downloaded via e-platform for ease of processing.

- c) Local governments’ illegal tax/levies nuisances on the roads – FIRS had made arrangements with the Inspector General of Police to deal with the scourge. Once such roadblocks are encountered, a call should be made to FIRS citing the location and FIRS, on its part, would take necessary actions to interdict such recalcitrant operatives within a one hour period.

d) Establishment of a clearing desk for all issues of concern, complaints and non adherence to agreements/understandings by FIRS field officers had been created in the Service. The contact person is Mr Faramade Ogunsanya, Director for Efficiency. He can be reached on: 08033236244.

The OPS resolved that the Secretariat should commit the above understandings reached into writing for transmission to the FIRS Chairman to elicit his concurrence or otherwise in writing. Other arms of the OPS would be copied the letter and carried along on further developments.

Thank you.

Yours faithfully,

Timothy Olawale

For: Director-General

……………………………………………………………………………………………………………………………………………….

Legislative Observatory: Some Bills on Our Radar

- A Bill for an Act to Repeal the National Housing Fund Act CAP N45 LFN 2004 for Related Matters

First Reading: 20/07/2017

Observations on the Bill:

- Section 4 (1) Contribution by Nigerian Workers: There is an increase in the minimum threshold of income earners captured under the scheme from N3,000 to N10,000 and above per annum

- Section 7 (1) Deduction by the Employers from Salary of Workers: increase from N3,000 to N18,000 and above per annum (not consistent with section 4).

- Section 21 Offence and Penalty for the failure by an Employer to deduct or pay deductions: The penalty for failure to deduct is to be increased from N50,000 to N5,000,000 in case of corporate bodies while an individual who is a staff in the employment of an employer and who is authorized to make deduction or payment to bank, will be liable to a fine of N50,000 instead of the existing N20,000 or a prison term of five years or to both such a fine and imprisonment.

- Self-employed persons who fail to make deductions or deduct and fail to remit to the Bank will be liable to a fine of N50,000 as there was no amount stated before or imprisonment for a term of one year or to both fine and imprisonment.

- Criminalizes persons that obstructed the deduction and remittance of NHF. The penalty for this will be increased to N20,000 (from current N5,000) or imprisonment for a term of one year or to both such fine and imprisonment.

- Section 22 Offence of making false statement or misrepresentation: attract a fine of N30,000 from current N10,000 or to imprisonment for a maximum of three (3) years or to both of such fine and imprisonment.

- Section 23 Failure to produce document: imposes a penalty of N1,000,000 for corporate body (currently N50,000) and N50,000 for an individual (from current N5,000) or imprisonment for a term of one year or to both such fine and imprisonment.

Action by the Secretariat:

We will continue to monitor developments on the Bill, although we observed that the current Act and the proposed Bill have not addressed the grey area of section 4 and 7 wherein section 4 stipulates that contribution should be 2.5% of “basic monthly salary” and section 9 provides for 2.5% of “monthly salary”. The increase in penalties and prison terms for default are meant to serve as a deterrent for non-compliant employers.

Other Bills on our Legislative Radar:

- A Bill for an Act to Repeal the External Trade Letters of Credit (Control) Act, Cap. F24 LFN, 2004 and Related Matters (HB. 17.09.1152)

First Reading: 28th September 2017

- A Bill for a Act to Repeal the Counterfeit and Fake Drugs and Unwholesome Processed Foods (Miscellaneous Provisions) Act Cap C34, LFN, 2004 and for Related Matters (HB. 17.09.1099)

First Reading: 26th September, 2017

- A Bill for An Act to Establish the Nigerian National Employment Trust Fund and Related Matters (HB. 17.07.1081)

First Reading: 25th July 2017

Recent Comments