BUSINESS ESSENTIALS Vol 3 No 19

Dear Esteemed Member,

While the nation awaits the formal response of the Parliament to the request for emergency powers from the National Assembly to enable President Muhammadu Buhari push polices that would revitalize the economy, the reality from the Foreign Exchange market revealed the persistence of non-availability of the FX for users, especially the real sector of the economy. We reviewed in this edition the Monetary Policy approach of the Central Bank of Nigeria (CBN) aimed at ensuring stability and availability of the FX for users, especially the real sector of the economy. We also shared a recent circular of Federal Inland Revenue Service on eligibility for receipt of Tax Clearance Certificate as part of our continued enlightenment information on taxation matters.

Your Association as a critical stakeholder in the economy is not just lamenting the parlous state of the economy but is actively involved in proffering solutions – on how to get the nation’s economy out of the woods. A recent Press Release on how Government can revive the economy was shared for your update. The regular Labour and Employment Law Review, Upcoming Training Programmes and recent activities of the Association were not left out.

Have a pleasant reading.

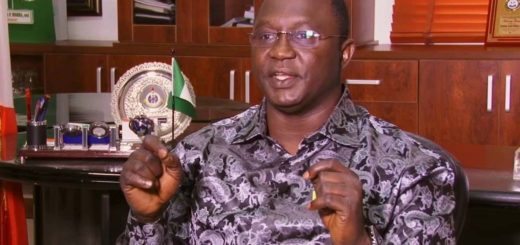

Timothy Olawale

Editor

In this Issue:

- A View On CBN’s Monetary Policy Approach

- Tax Clearance Certificate: FIRS Notice For Eligibility

- Press Release: NECA COUNSELS GOVERNMENT ON REVIVAL OF THE ECONOMY

- LABOUR & EMPLOYMENT LAW: Probation (Lake Chad Research Institute vs. Mallam Kolo Mohammed, 2014) 44 N.L.L.R. Pt 138, P. 1. Court of Appeal

- Upcoming Training Programmes

A VIEW ON CBN’S MONETARY POLICY APPROACH

With Nigeria’s economy under serious strain due to oil price and production shocks, persistent foreign currency shortages, and slow growth, the Monetary Policy Committee (MPC) resolved in May 2016 to quit defending the Naira and finally took the peg off its exchange value against the greenback. This came after sixteen (16) painful reserves’ depleting months of fighting to keep the dignity of the Naira.

In a previous effort to curb demand for FX, the CBN had banned forty one (41) items from being imported. This act had, had no real effect on the existential nature of Nigeria’s need for USDs to function. With the same aim in mind, the Federal Government partially deregulated the downstream petroleum sector by removing the subsidy it granted to petroleum product marketers, while setting a price ceiling on premium motor spirit via a price modulation system – a move that was aimed at easing the weight of providing FX facilities to marketers. The summary of Nigeria’s 2016 Fiscal and Monetary policy direction have thus revolved around the FX conundrum.

The MPC’s May resolution was greeted with a sigh of relief by Nigerians who understood what it meant and very cautious optimism by international investors and market players. In reality, not many people had been getting FX at the pegged exchange rate, as the invisible hand remained at work over-time to make sure, by all means, that the market returned to, or reached equilibrium; ensuring that the real incapability of the CBN to provide FX was evident in the parallel market. It’s been two months and a few days since the actual implementation of the flexible exchange regime introduced; and the general fear of the situation is that the policy resolution might have been expired or worse, dead on arrival. The novelty of the situation that existed two month ago has fizzled out and has consequently been replaced with confusion, unanswered questions and impatience from investors (local and international).

The Central Banking System of any country should be the apex body dictating, regulatory and stabilizing force of the economy. The CBN seems to be doing all but stabilizing the economy. Concerning the FX market, it is in fact calling a spade, a desert fork and expecting everyone to go along with it. The first concern with the new FX policy lies in the rules of engagement, where the CBN purposely set requirement levels it knows only a few banks and other participators comfortably meet. The effect of this rhetoric meant that before it opened, the market had already been restricted to only primary dealers who are capable of buying in tranches of five hundred thousand (500,000) dollars or upwards. A market that actively establishes high barriers to entry does not economically sound like a free one.

Furthermore, there had been interventions by the CBN as the regime is designed, which makes it evident that the market is still suffering serious liquidity issues and the CBN is desperately trying to manage its “free” float. CBN’s management of the naira arises from its concern about supposed inflation that the high cost of FX will create, which is understandable but unfounded since many still get FX above the interbank market rates. In addition, inflation in Nigeria is an exogenous variable that can scarcely be controlled by the CBN, its levels are a direct function of the local interactions and global performances of one commodity; Oil. Since, the country is dependent on the FX that oil revenue provides; inflation exposure is something the economy will always have to deal with. At this point in Nigeria’s economic history, trying to micro manage the foreign exchange situation is the tactical equivalent of pouring water in a basket or better still pushing a boulder up a hill, as the CBN simply does not have the capacity to maintain the position it is trying to assume in the market.

In a free market, it is imperative to let the forces of demand and supply interact uninterruptedly – let the market find its balance. Macroeconomic problems and complexities have always been the major challenges facing the Nigerian economy, but this time the CBN seems not to understand its role in the impending situation or even the graveness of the situation. In many of its MPC communiqués over the past year, the CBN has recognized severally the macroeconomic shocks that have battered the Nigerian economic space but gone ahead to underestimate the extent of the economic slowdown in Nigeria. The tightening of FX controls and lax monetary policy over the past sixteen to eighteen months have had adverse effects of the economy.

There are other policy tools available to the apex bank that it can use to stabilize and stimulate the economy. One that especially comes to mind is the interest rate. A more conservative cost of borrowing might see the economy stimulated into more activity. The point being made is not an argument for more expansionary or conservative monetary policies, but one to show that there is Central Banking beyond the exchange rate. The metrics availed to us courtesy the Nigerian Bureau of Statistics shows that the current inflation rate is at 16.5%, moving up 0.9% from May’s 15.6%. The CBN may have misused its opportunity to contain the damage done by macroeconomic shocks, during the sixteen months where it refused to loosen up FX controls. In essence, the CBN needs to get rid of the internal price ceiling it has set for the Naira as soon as possible and look towards other methods of Central Banking; if at all it hopes to attract any foreign investment that will help Nigeria in this period. If there’s one thing that we know about investors, it is that they hate uncertainty, and that’s where the market space is right now. It is uncertain.

Current GDP in Nigeria is in the negative at minus zero point three six (-0.36), going by the way Q2 2016 has turned out, results may be just as bad or even worse by the time we see the numbers. According to recent IMF forecasts, Nigeria’s GDP by the end of the year will be down by one point eight (-1.8), this meaning that the country would be in a recession. For Fiscal or Monetary policy to be effective, either of the two has to be timely and proactive, not reactionary. Fiscal and Monetary policy also have to be free from political sentiments, that’s not the signal being received from the CBN, it seems the Nigerian Federal Government might be having undue influence over the CBN, and in other words, the thirteenth member of the MPC may be the President. This situation is hampering the effectiveness of the bank and its God given right to independence.

TAX CLEARANCE CERTIFICATE: FIRS NOTICE FOR ELIGIBILITY

The Federal Inland Revenue Service (FIRS) recently issued a public notice on what taxpayers need to know with respect to applications for tax clearance certificate (TCC). The Notice states that the FIRS is obligated to issue TCC to qualifying taxpayers not later than two weeks from the date of application. Applicants for a TCC must be registered with valid tax identification number and must have filed necessary returns to date including Companies Income Tax (CIT) and Value Added Tax (VAT).

The TCC issued by the FIRS confirms to the holder that all tax liabilities established either by self-assessment or government assessment up to the immediate past year has been settled by the taxpayer. The FIRS further stated that if a TCC application is not issued within two weeks of the application, the taxpayer should contact the Director of the Efficiency Unit of the FIRS.

Any complainant is to furnish the Efficiency Unit with information relating to the past three years on status and amount of all the relevant taxes, and the nature of assessments that gave rise to the liabilities, that is, whether self-assessment, audit assessment or debt management office assessment.

This public notice is meant to inform taxpayers of their rights and obligations around obtaining a TCC from the FIRS.

OPINION

There is usually a delay in obtaining TCC from the FIRS. This public notice reinforces the 2-week timeframe for the issuance of a TCC. This is consistent with the provisions of the Companies Income Tax Act (CITA). However the law does not require a taxpayer to prove full compliance with other taxes to be eligible for a TCC. The requirement is limited to Companies Income Tax.

It is not clear whether the FIRS will withhold a TCC where there is an ongoing tax audit or a disputed unpaid tax liability. In a recent case involving Bottlers who were denied TCC as a result of VAT assessments raised by the FIRS, the Federal High Court ruled in favour of the Bottlers. It will be interesting to see how the Efficiency Unit of the FIRS will respond to taxpayers on some of these issues going forward. We encourage taxpayers to take advantage of this means to resolve any challenges they face when processing TCC.

Advertisement

PRESS RELEASE

NECA COUNSELS GOVERNMENT ON REVIVAL OF THE ECONOMY

The Nigeria Employers’ Consultative Association (NECA) has commended government’s initiative and efforts to revamp the country’s economy and stimulate growth, in the face of the global economic downturn. The Association specifically applauded the Federal Government’s courage in embracing the policy of deregulation of petroleum products, renewed interest in revamping the rail system, guided liberalisation of the foreign exchange market, etc. which, in due time, would impact positively on the economy both in the short and long term. It therefore pleaded with Nigerians to be patient with the government. <<Read More>>

LABOUR & EMPLOYMENT LAW: Probation (Lake Chad Research Institute vs. Mallam Kolo Mohammed, 2014) 44 N.L.L.R. Pt 138, P. 1. Court of Appeal

Facts:

- The respondent – Mallam Kolo Mohammed, a retired soldier, was employed on contract by the appellant – Lake Chad Research Institute, as an Assistant Security Officer. His employment was, thereafter, converted to a permanent and pensionable one but the confirmation was subjected to two-year probation.

- After the two years probation, the respondent was issued with a query which he responded to. The respondent was subsequently issued a letter of suspension from duty pending the outcome of an investigation.

- Without getting the outcome of the said investigation, the respondent was issued another letter, terminating his appointment with the appellant on the ground that his service during the two-year probationary period was not found satisfactory.

- The respondent filed an action against the appellant on the ground that since he received the letter of suspension on an alleged investigation, he was never brought before any investigatory panel nor was the outcome of the investigation communicated to him. He also claimed that his termination was not in accordance with the Civil Service Rules. The respondent’s action against the appellant was for the suspension and the subsequent termination of his employment.

- At the conclusion of the hearing, the trial Judge gave judgment in favour of the respondent. Being dissatisfied with the judgment, the appellant filed an appeal against the judgment to the Court of Appeal.

Issues

- Whether or not the respondent’s appointment was duly confirmed, before he was terminated by the appellant.

The Judgement

On whether dismissal of employee for misconduct can be retrospective:-

Misconduct on the part of any employee, which is inconsistent with the fulfilment of the express or implied conditions of service, may justify the dismissal although, such dismissal, should not be retrospectives.

On what claim for entitlements accrued before effective date of dismissal should be founded on:-

An employee may be justifiably dismissed on misconduct which is inconsistent with the fulfilment of the express or implied conditions of service. Where an employee claims for entitlements which have accrued to him before the effective date of such dismissal, his claim should be founded in a claim of debt, not as damages for wrongful dismissal.

On whether fair hearing must involve oral representation:-

Fair hearing, does not mean necessarily, oral representation. It is enough if it is in writing.

On relevancy of motive in termination of employment:-

An employer need not show any motive or give any reason for terminating the employment. Motive does not vitiate the validity of the exercise of a right of an employer. The exercise is totally independent of the motive that prompted the exercise. In the instance case, the appellant, having found the respondent’s work/services, during the period of his probation, to be unsatisfactory, and it exercised its discretion in terminating instead of dismissing the respondent; it was not the business of the court to enquire into the motive for the exercise of such discretion.

On right and discretion of employer to determine appointment of employee under probation:-

Where an employee is on probation as temporary staff by virtue of his terms of employment, which state also that appointment will be confirmed subject to his being “found suitable”, the employer reserves the right and discretion to determine if the employee was not found suitable. The employer in this case, namely the appellant was therefore entitled and rightly exercised this right, when it determined and communicated to the respondent that his appointment had been terminated, his performance during the probationary period having been found unsatisfactory.

Final Judgment

The Court of Appeal held that the appeal was meritorious and succeeds. It, however, set aside the judgment of the lower court as “unjustified, and not supported by the law in the circumstances”.

OPINION:

It is settled law that a Court must confine itself to the clear words and contents of the document(s) before it.

Theme: Getting the Best From Outsourced Service Providers

Date: 24 – 25 August 2016

Course Fee: Members: N82,500 Non Member: N 87,500

Venue: NECA Learning Centre, Plot A2, Hakeem Balogun Street, Alausa, Ikeja, Lagos

Time: 8:30am – 5:00pm

Theme: Customers Relationship Management: A Pragmatic Approach to Service Delivery

Date: 7th – 9th September, 2016 (3 Days)

Venue: NECA Learning Centre

Fee: N110,500 (NECA Members) N115,500 (Non-NECA members)

Time: 9:00am – 4:00pm

Theme: 50th Advanced Course On Human Resources Management, Labour & Employment Relations.

Date: 19th – 23rd September, 2016

Venue: GREEN LEGACY RESORT, ABEOKUTA, OGUN STATE

Fee: N225,000(NECA Members), NON-MEMBERS: N235,000

For further details please contact Adewale (08069720364) adewale@neca.org.ng Visit www.neca.org.ng

| For Advert Placement: kindly contact Timothy Olawale on tim@neca.org.ng, 08033435439 |

Recent Comments