Business Essential July Edition

Welcome to the July 2019 edition of Business Essentials.

In this edition, we gave an overview of the Central Bank of Nigeria’s (CBN) 5-year policy direction, which amongst other things, promises to facilitate access to financial services and also increase inclusion rate. We examined the Manufacturing Purchasing Managers Index report of the CBN in the month of June, which indicated an expansion in the manufacturing sector for the twenty-seventh consecutive month, theNBS Consumer Price Index for June 2019 and the CBN Monetary Policy Committee (MPC)meeting outcome, which saw all parameters retained.

The rising debt portfolio of Nigeria continues to be a major concern and despite warnings by Financial Analysts on the unsustainability of the increasing debts, the trend does not appear to be coming to an end soon as successive governments have, over the years, spent a large chunk of the country’s revenue to service debts. Recently released data by the Debt Management Office revealed that Nigeria has spent a total of N7.04 trillion to service both domestic and external debts under President Muhammadu Buhari’s administration. We examined the concerns around this development and the likelyimplications if not curbed.

The power sector despite being one of the most critical sectors of the economy continues to be bedevilled with several challenges such as such as energy theft, dilapidated distribution infrastructure, collection losses, huge debts, amongst others. We discussed the urgent need for tax perks for the sector and other issues to be addressed to ensure that the industry achieves its objective of delivering power to Nigerians and Nigerian businesses.

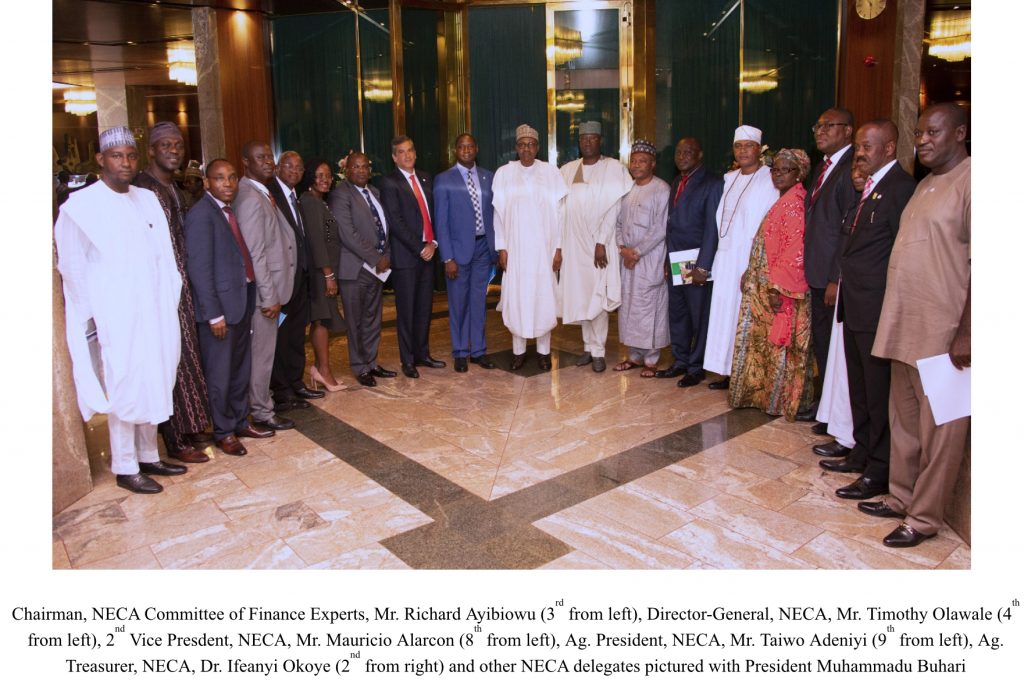

Also in this edition are pictures from the visit of NECA delegation to President Muhammadu Buhari on 17th July, 2019.

Our regular Law Report Review, Upcoming Learning & Development programmes and other activities at the Secretariat were not left out.

Have a pleasant reading.

Wale-Smatt Oyerinde

Editor

In this Issue:–

- CBN 5-Year Policy Direction, June CBN Manufacturing Purchasing Manager Index, CBN MPC Report, NBS June Consumer Price Index

- Increasing Debt Profile: Implications as Debt Servicing Gulps N7.04 Trillion Under President Buhari’s Administration

- Tax: Perks or Plagues to the Nigerian Power Sector

- Pictorials: Courtesy Visit by NECA Delegation to President Muhammadu Buhari at Aso Villa on Wednesday, 17th July, 2019

- Law Report Review / Legal Opinion

CBN 5-YEAR POLICY DIRECTION, JUNE CBN MANUFACTURING PURCHASING MANAGER INDEX, CBN MPC REPORT, NBS JUNE CONSUMER PRICE INDEX.

The Central Bank of Nigeria (CBN) governor, Godwin Emefiele recently unveiled a 5-year policy direction of his new tenure promising to facilitate access to financial services to all Nigerians, thereby raising the financial inclusion rate in the country. The apex bank helmsman stated that although the results recorded in the last five years of his administration were re-assuring, the pace of GDP growth remains fragile, and is below the rate of annual population growth at 2.7%. The Governor affirmed that the recovery from recession has not resulted in a significant reduction in unemployment rate and most importantly, the recovery has not translated to a substantial increase in credit to the private sector by financial institution.

Mr. Emefiele highlighted the vision of the bank under his management for the next five years, he said, the Bank will work closely with the fiscal authorities to target a double digit growth; bring down inflation to single digit; and accelerate the rate of employment. The Governor averred that the Bank will preserve domestic macroeconomic & financial Stability, foster development of a robust payments system infrastructure that will increase access to finance, work with Deposit Money Banks to improve access to credit especially youth with entrepreneurial skills in the creative industry. The CBN Chief also stated that the Bank will focus in diversifying the economy through intervention programmes in the agriculture, manufacturing sector and grow the external reserves. The Governor confirmed that the apex bank is set to recapitalize the Nigerian commercial banks. The aim is to re-position the Nigerian banks among the top 500 banks in the world, while also reducing the risks and the possible impact of any economic crises on the financial sector. Implementing these measures will help to insulate the economy from potential shocks in the global economy.

In a related development, the Manufacturing Purchasing Managers Index report of the CBN in the month of June stood at 57.4 index points, indicated an expansion in the manufacturing sector for the twenty-seventh consecutive month. The index grew at a slower rate when compared to the index in the previous month. At 59.3 points, the production level index for the manufacturing sector grew for the twenty-eighth consecutive month in June 2019. The index indicated a faster growth in the current month, when compared to its level in the month of May, 2019 while the employment level index for June 2019 stood at 57.5 points, indicating growth in employment level for the twenty-sixth consecutive month.

At 58.2 points, the business activity index grew for the twenty-seventh consecutive month, indicating expansion in non-manufacturing business activity in June 2019. Fourteen subsectors recorded growth in business activity, 2 remained unchanged while 1 recorded decline in the review month.

A PMI above 50 points indicate that the manufacturing sector is generally expanding, while a reading below 50 points indicates a contraction. Twelve of the subsectors surveyed recorded growth during the month, while the non-metallic mineral products and primary metal subsectors recorded decline in the period under review.

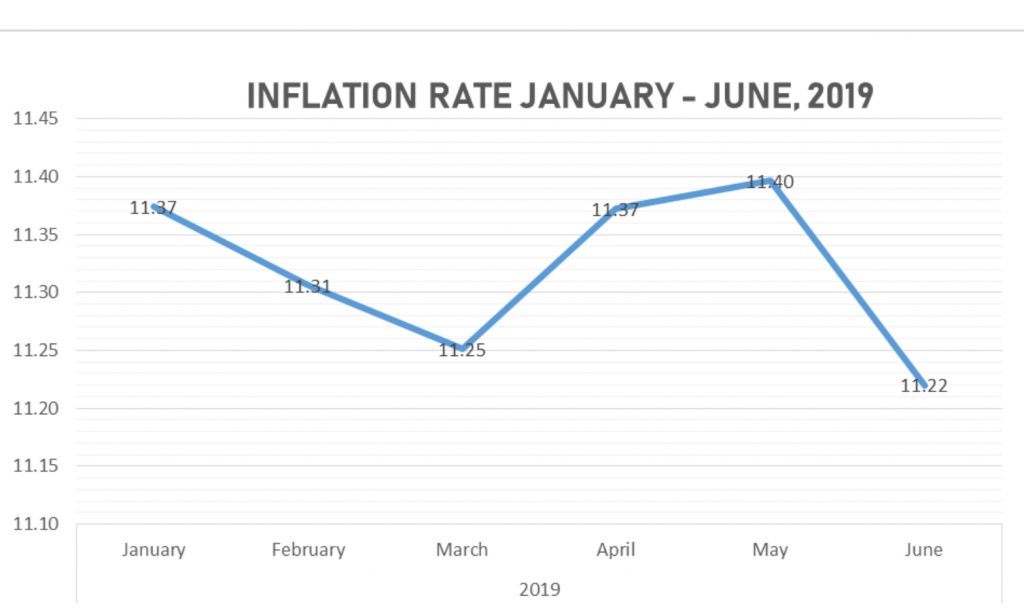

THE NBS CONSUMER PRICE INDEX (CPI), JUNE, 2019

The Consumer Price Index rose at a slower pace in June to the lowest level since July, 2018(11.14%). The reduction in the rate was fuelled by decline in core inflation and moderation in food prices. The CPI, which measures the composite changes in the prices of consumer goods and services purchased by households over a period rose by 11.22% on year-on year basis in June 2019. This represents 0.18 percent points lower than the rate value recorded in May 2019(11.40%). Core inflation maintained downward trend in absence of any major shock in key CPI components like power and energy costs.

The urban inflation rate increased by 11.61percent (year-on-year) in June 2019 from 11.76 percent recorded in May 2019, while the rural inflation rate increased by 10.87 percent in June 2019 from 11.08 percent in May 2019. On a month-on-month basis, the urban index rose by 1.10 percent in June 2019, up by 0.05 from 1.15 percent recorded in May 2019, while the rural index also rose by 1.05 percent in June 2019, up by 0.02 from the rate recorded in May 2019 (1.07) percent.

The corresponding twelve-month year-on-year average percentage change for the urban index was 11.65 percent in June 2019. This is less than 11.66 percent reported in May 2019, while the corresponding rural inflation rate in June 2019 was 10.99 percent compared to 10.98 percent recorded in May 2019.

The composite food index stood at 13.56 percent in June 2019 compared to 13.79 percent in May 2019. This rise in the food index was caused by increases in prices of Bread and cereals, Meat, Oils and fats, Potatoes, yam and other tubers, Fish, Vegetables and fruits. On month-on-month basis, the food sub-index increased by 1.36 percent in June 2019, down by 0.05 percent points from 1.41 percent recorded in May 2019.

CENTRAL BANK OF NIGERIA MPC REPORT

The Monetary Policy Committee (MPC) met on the 22nd and 23rd of July, 2019 in a fragile domestic economic recovery and noted that the global environment is overwhelmed with vulnerabilities and financial fragilities. The Committee noted the continued but moderate expansion in the economy as indicated by the Manufacturing and Non-Manufacturing Purchasing Managers’ Indices (PMI), which grew for the 27th and 26th consecutive months in June 2019. The indices stood at 57.4 and 58.6 index points, respectively, in June 2019.

The Committee averred that the downside risks to the growth projections to include low credit to the private sector; high unemployment; delayed intervention of fiscal policy as well as low revenue and fiscal buffers, amongst others. The continued intervention by the Bank in the real sector is, however, expected to partly ameliorate the downside risks only in the short-run, while sound fiscal policy is expected to drive growth in the medium to the long-run.

The Committee noted the constrained growth in the monetary aggregates as an indication of weak financial intermediation in the banking system and called on the Management of the CBN to sustain the various initiatives of the Bank to improve lending to the private sector in Nigeria. The Committee welcomed the moderation in headline inflation (year-on-year) to 11.22 per cent in June 2019 from 11.40 per cent in May 2019 and expects that with the commencement of the harvest season, food prices will further decline. It thus, however, advised that the security challenges in some parts of the country should be addressed urgently to increase agricultural produce in order to sustain the downward trend in inflation. The MPC reiterated its commitment to ensure the maintenance of price stability.

The Committee welcomed the continued stability in the foreign exchange market and the steady accretion to external reserves, which stood at US$44.88 billion as at July 19, 2019, representing a 0.38 per cent increase from US$44.71 billion at the end-June 2019. On the domestic economy, output growth in 2019 is expected to remain weak, peaking at 2.27 per cent, while inflation is projected at 11.37 per cent by the CBN staff projections by end-2019. The underlying arguments in favour of this forecast include: favourable oil prices; stable exchange rate; moderate inflationary pressures; enhanced flow of credit to the private sector; sustained CBN interventions in the real sector; effective implementation of the Economic Recovery and Growth Plan (ERGP); building fiscal buffers; and improved security in the food producing areas of the country.

In its considerations, the Committee noted the need to boost output growth through sustained increase in consumer credit and mortgage loans and granting loans to our Small and Medium Enterprises companies. The MPC called on the fiscal authorities to expedite action on expanding the tax base of the economy to improve government revenue and stem the growth in public borrowing. It further urged the fiscal authorities to build fiscal buffers to avert macroeconomic downturn in the event of a decline in oil prices.

The Committee also called on the Bank to intensify efforts to encourage Nigerians in the diaspora to use official sources for home remittances, noting that the effort will complement other measures geared towards improving Nigeria’s current account balance. It enjoined the Bank to consider introducing incentives such as the reduction of charges on diaspora home remittances into Nigeria.

On the African Continental Free Trade Agreement (AfCFTA), the Committee urged the Federal Government to put in place measures to aid the economy in realising the benefits and full potentials of that Agreement. In particular, it noted the need to resuscitate moribund industries in Nigeria and improve key infrastructure in order to strengthen the productive base of the economy, create job opportunities as well as boost exports.

In consideration of the foregoing, the Committee decided unanimously by a vote of all members present to retain the Monetary Policy Rate (MPR) at 13.5 per cent and to hold all other policy parameters constant. The decision was informed by the conviction of members that key macroeconomic indicators are trending in the right direction.

Consequently, the MPC unanimously voted to:

I. Retain the MPR at 13.5 per cent;

II. Retain the asymmetric corridor at +200/-500 basis points around the MPR;

III. Retain the CRR at 22.5 per cent; and

IV. Retain the Liquidity Ratio at 30 per cent.

Sources: Central Bank of Nigeria, National Bureau of Statistics, Business Day Newspaper, www.proshare.ng

………………………………………………………………………………………………………………………………………………………………………………………………………………

INCREASING DEBT PROFILE: IMPLICATIONS AS DEBT SERVICING GULPS N7.04 TRILLION UNDER PRESIDENT BUHARI’S ADMINISTRATION

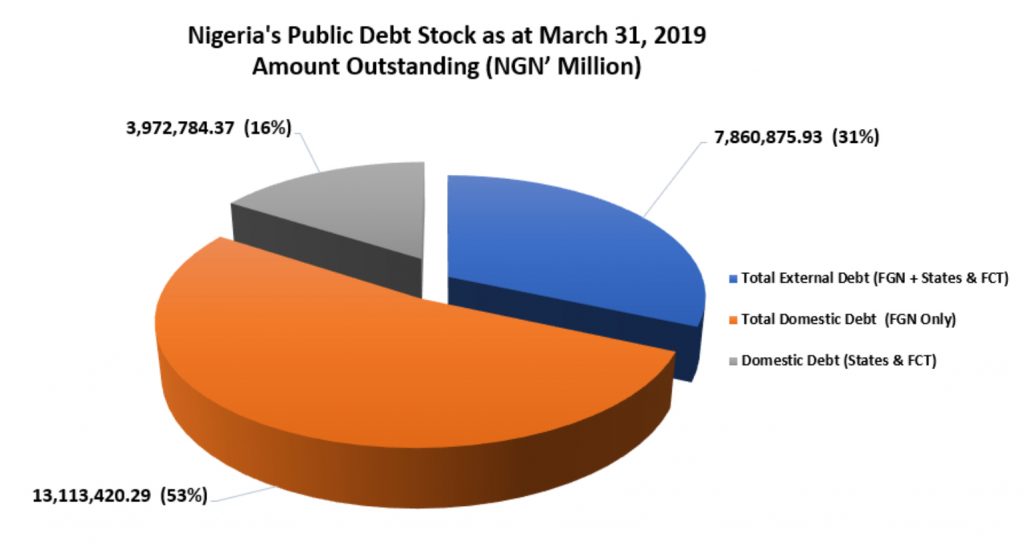

Nigeria’s rising debt profile is fast becoming a worrisome trend. Successive governments have, over the years, spent a large chunk of the country’s revenue to service debts. Analysis of data obtained from the Debt Management Office shows that Nigeria has spent a total of N7.04 trillion to service both domestic and external debts under President Muhammadu Buhari’s administration alone.

Nigeria’s rising debt and the cost of servicing them has elicited wide-spread criticisms in recent times, with many people calling on the Government to do something. Note that since President Buhari assumed office in 2015, the country’s debt profile has increased by almost 107% in naira value. In the first quarter of 2015, Nigeria’s total public debt stood at N12.4 trillion or $64.2 billion, while it rose to N24.9 trillion or $81.27 billion in March 2019. Further disaggregation of Nigeria’s total public debt showed that N7.86trn or 31.51% of the debt was external while N17.08trn or 68.49% of the debt was domestic.

What this means is that Nigeria’s total debt has more than doubled since the President assumed office. Below are more details:

- External debt service gulped a total of N931 billion or US$2.1 billion in the last 5 years

- Commercial loans take the biggest share of Nigeria’s total external debt servicing amounting to US$1.58 billion

- In just one year (2017-2018), total external debt service increased by over 200%.

- Nigeria paid the sum of $464 million or 142 billion to service external debt in 2017, while the figure rose significantly to $1.47 billion or 451.8 billion in 2018.

- Just like external debt, domestic debt servicing has also been gulping over N6.1 trillion in the last 5 years.

- The total amount spent on servicing Nigeria’s domestic debt in 2015 was N1 trillion. Fast forward, the figure on an annual basis rose to 1.79 trillion in 2018 representing a 76% increase.

The high cost of debt: Loans are not intrinsically bad in themselves. However, as the popular saying goes, “there’s no free lunch, not even in Freetown”. Consequently, debt instruments that are given to the government of a country often come with terms and conditions (such as interest repayments plans) that are difficult to meet.

Agreed, debts can also be flexible, with a wide range of financial conditions that are specifically tailored to meet a country’s overall debt management strategy. Yet, there are many things to worry Nigerians in view of the country’s public debt profile;• The possibility of a foreign creditor taking over the country’s assets due to the inability to repay loans.• The possibility of launching the country into another recession if the debt profile is not properly managed.• Considering how much President Buhari’s Government has spent on debt servicing so far, analysts are worried that the country’s debt profile will hit a new high due to bad economic policies and realities.

In January 2019, the International Monetary Fund (IMF) had warned that global debt had reached an all-time high of $184tn in nominal terms, the equivalent of 225 per cent of Gross Domestic Product in 2017, warning of “a legacy of excessive debt”.

Although Nigeria’s debt servicing has gulped over 28% of the country’s debt stock, it will not be fair to blame it all on bad government policies. Recall, that Nigeria nosedived into economic recession during the onset of the current administration, and it took a strategic increase in government expenditure and other beneficial policy measures to rescue the country’s ailing economy. Below are some of the measures-• In a bid to tackle shrinking growth, the government initiated the Economic Recovery Growth Plan (EGRP) and growth plan in 2017• The crux of ERGP provides for effective collaboration and coordination with the States to ensure that the Federal and State Governments work towards the same goals.• During the full-blown recession period, several states defaulted in paying salaries to the workers while poverty soars in the land. Following this, the Buhari’s administration intensified debt borrowing and offered bail-out to almost 30 states in the country.

In the meantime, there could be more debt on the way. This is because evidence suggests that Nigeria is broke and at the edge of bankruptcy. As President Buhari’s administration is desperate for growth, it will be needing funds to facilitate the growth plan and as such, may have to rely on debt. After all, debt sourcing appears to be a very potent tool in the hands of the current administration.

Source: Nairametrics

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………

TAX: PERKS OR PLAGUES TO THE NIGERIAN POWER SECTOR

Power, regardless of its source, remains a critical factor for economic and industrial development in any country. Unfortunately, the Nigerian power sector is yet to deliver on its mandate of supplying uninterrupted power to Nigerians and Nigerian businesses despite government’s investments in the sector over the years. In its efforts to improve service delivery in the sector, the Federal Government of Nigeria decided to unbundle and privatize the Power Holding Company of Nigeria (PHCN). This process was completed in November 2013.

The objectives of the exercise were to foster competition, increase power supply efficiency and boost the amount of investments coming into the sector. Nonetheless, there remains significant roadblocks in the path to uninterrupted power supply despite government efforts to push the sector forward.

However, the fundamental problems of the sector are not insurmountable; neither do they lack pragmatic and sustainable solutions. While some of the issues within the sector are regulatory in nature, some of the critical issues faced by companies within the sector stem from faulty due diligence and feasibility studies carried out during the acquisition. In addition, tax which was not necessarily an issue for the government-owned entity turned out to be part of the quagmires to resolve post-privatization.

Indeed, there are arguments for using tax to change the narrative by creating tax perks to spur investments in the sector. Thus, this article highlights some of the key tax issues, possible resolutions and potential tax considerations that could facilitate rapid growth of the sector.

General Problems of the Nigerian Power Sector

Distribution companies in the power sector have not been relieved of challenges such as energy theft, dilapidated distribution infrastructure, collection losses, and huge debts which was further exacerbated by the devaluation of the Naira in 2016 and has led to an astronomical increase in the balance of foreign currency denominated loans.

Although the Transmission Company (TransCo) was strategically left in the hands of the government, it has been reported that it has limited capacity to transmit power supplied by the generation companies (GenCos) who are sometimes able to produce beyond the TransCo’s capacity. The GenCos are not left out of the challenges as their performances are also closely hinged on the success of the distribution segment of the sector.

Unfortunately, tax which could have been a veritable fiscal tool for engineering the success of the sector creates additional problems for companies operating in the sector. Whereas, the country has clear roadmaps with specific tax provisions for critical sectors such as mining, gas production and utilization, etc., there are currently no specific fiscal guidelines that could help clear the doubts of power companies or exempt them from general tax provisions that negatively impact their businesses. Thus, the subsisting tax issues in the power sector may not be unconnected to the fact that such specific fiscal policies are not available to guide operations within the sector.

Consequently, there is an urgent need to address the following tax issues amongst others, to ensure that the industry achieves its objective of delivering power to Nigerians

a. Minimum Tax: The minimum tax provision is one of the anti-avoidance strategies that applies to companies during years in which they do not declare taxable profit or where the tax payable is less than the minimum tax. Although, there are exceptions to the provision, most companies operating in the power sector are significantly affected by the minimum tax provision because they do not meet the requirement for exemption.

Thus, while many of the power companies are currently making huge losses. They are still liable to minimum tax because of their huge net assets and revenue. If properly monitored the benefit obtained from the exemption from minimum tax paid by some Discos could be utilized in addressing metering gaps and other infrastructural challenges plaguing the sector.

b. Value Added Tax in the Power Sector Value Chain: Gas constitutes major supply for the gas-base power plants used in generating the bulk of electricity in Nigeria. Given that the Value Added Tax (VAT) Act does not exempt natural gas from VAT, generating companies currently incur VAT on the gas supplied by the gas producing companies. However, they are unable to charge output VAT paid electricity suppliers to the gas producing companies Thus, they are unable to recover the output VAT paid to the gas suppliers and this is against the underlying VAT principle that the tax should be borne by the final consumers.

In 2018, a VAT modification Order was drafted to address the above problem. Based on the draft order, gas supplies to generation companies shall be exempted from VAT. In addition, the supply of electricity would not be liable to VAT along the value chain but for the last stroke of the chain between the distribution companies and customers. Although, the Order is yet to be signed, it appears that certain Gencos no longer pay input VAT on gas. Thus, there is a risk that the authority may take a different view during their reviews.

Providing Tax Perks to the Nigerian Private Sector

There is an urgent need to sign the VAT Modification Order into law to exempt gas supplies to GenCos from VAT. This would reduce the tax cost of doing business and potentially attract some investments into the Nigeria power sector. The federal Government may also want to consider exempting companies operating in the power sector from minimum tax subject to satisfactory performance in line with theprovisions of Section 23 (2b) of the Companies income Tax Act (CITA), as amended. The section provides that ‘’the president may exempt by order from tax all or any profit of any company or class of companies from any source, on any ground which appears to it sufficient.’’

The Electric Power Sector Reform Act (EPSRA) can be amended to incorporate certain tax incentive provisions for the power sector as is the case with the Nigeria Minerals and Mining Act (NMMA) 2007 which details the tax incentives specific to companies operating in the Mining sector. For instance, the NMMA provides some import duty exemptions as well as a special basic for the claim of capital allowance in the Mining Sector.

One power subsector that can benefit from consolidated and specific tax incentives, such as mining highlighted above, is the renewable energy subsector. The government realizing that renewable energy projects typically involve huge capital outlay and have long gestation periods, recently included renewable projects as part of the industries that qualify for pioneer Status Incentive (i.e tax holiday) where the projects proposed are located in economically disadvantaged areas. In addition, certain solar equipment may be exempt from VAT and Custom Duties, depending on the Nigeria Customs Service HS-Code.

However, there may be a need to consolidate these incentives and expand the scope of such incentive to address the specific challenges of the subsector. For instance, some tax credit could be given to companies that utilize renewable energy source rather than other power sources that result in environmental pollution and are dependent on imports. This could be achieved by granting concession to encourage the fabrication and manufacturing of equipment required for renewable energy projects in Nigeria, rather than relying on imports.

Since mini-grids that run on renewable energy source are flexible, easy to use and adaptable to local needs and conditions, incentivizing investments in this subsector should help address the inadequacy of diverse energy source being encountered in the Nigeria Power Sector.

Conclusion

Although studies have shown that tax incentives are not usually the primary factors in making investment decision, they remain very vital in ensuring that investments are productive and sustainable. Taxation should not be seen only from the prism of immediate government revenue but rather as a means to foster economic development through consolidated and specific tax provisions that would incentivize investment in the power sector.

While some perceive tax as one of the distressing plagues of the Nigeria power sector, the seeming plague cloud be turned into perks by adopting some of the above recommendations. The existing incentives, though fragmented, should be consolidated and advertised to potential investors during roadshows. This way, the power sector can attract substantial investments, increased productivity and most importantly, begin the journey to generating enough power to satisfy and support the expected economic development.

The power sector is already awash with several operational inhibitors. Adverse or incoherent tax policy should not add to the burden for the burden for the companies that are trying to navigate the challenging business climate.

Exposition by AndersenTax

PICTURES OF COURTESY VISIT BY NECA DELEGATION TO PRESIDENT MUHAMMADU BUHARI AT ASO VILLA ON WEDNESDAY, 17TH JULY, 2019

LAW REPORT REVIEW / LEGAL OPINION:

COURT CANNOT IMPOSE EMPLOYEE ON UNWILLING EMPLOYER

Okwara Agwu & Ors v. Julius Berger Nigeria Plc (2019) LPELR-47625(SC) – Suit No: SC.197/2011

FACTS OF THE CASE

- The Appellants herein were staff of the Respondent – Company before they were declared redundant.

- The Respondent-Company had industrial problem with its workforce that led to the closure of its activities on June 16, 1999. By a circular dated June 28, 1999, the respondent informed its workers that payment of salaries, wages and redundancy benefit for the period ending on June 15, 1999 will be made on June 30, 1999, July 2, 1999 and July 3, 1999.

- The respondent’s workers felt threatened by the circular as they did not know who would be declared redundant. They collectively filed an action in court in a representative capacity on the July 1, 1999, it was not accompanied with a Statement of Claim.

- The workers also filed a motion on notice, in which they sought for an injunction to restrain the company. The processes were served on the respondent.

- As a follow up, the Lawyers to the appellants wrote two letters dated 1st July 1999 to the respondent, warning it of the consequences of declaring any of the workers redundant during the pendency of the suit and the motion on notice.

- The Respondent ignored the Court processes and went on to declare the appellants’ redundant and paid their entitlements which they collected.

- After a futile attempt to commit the respondent for contempt of Court and invoking the interference of the police in the activities of the respondent, Lawyers to the appellant, by a motion on notice filed on the 4th of October 2000 at the High Court of the Federal Capital Territory.

- The High Court ruled – deeming the Appellant as the employees of the Respondent.

- An appeal was filed in the Court of Appeal against the decision of the High Court. There, the Court of Appeal set aside the decision of the High Court and also ordered for a retrial of the substantive suit before another Judge

- Dissatisfied with the decision of the Court of Appeal, the appellant appealed to the Supreme Court.

ISSUES FOR DETERMINATION:

a) Whether the Court of Appeal was correct to have ordered for a retrial of the substantive suit before another Judge when it is obvious that the Respondent took Laws into its hand in order to foist upon the trial Court a fait accompli by declaring the appellants redundant during the pendency of the Appellants suit and motion on notice seeking for injunctive orders to restrain the respondent from declaring the appellants redundant pending the determination of the substantive suits.

RESOLUTION OF ISSUES

The Supreme Court held, among others:

The Respondent was aware of the pending suit, by reason of the service of the Court processes on it and that since it failed to stay action pending the determination of the suit, the best option opened to the appellant was to initiate contempt proceedings against the Respondent.

- A Court will not compel an unwilling employer to retain employees it does not need. The only thing a Court can do is to order for payment of all entitlement of the employees, based on the provisions of the contract of employment.

- Conclusively, the Court held that the order made by the trial Court deeming the Appellant as the employees of the Respondent was beyond its powers, and the Court of Appeal was right when it set those orders aside.

OPINION

Parties in the workplace are expected to respect the contents of their Employment Contracts. Employers are also urged to act within the law and avoid actions that would lead to contempt.

Recent Comments