usiness Essential June 2018 Edition

Dear Esteemed Member,

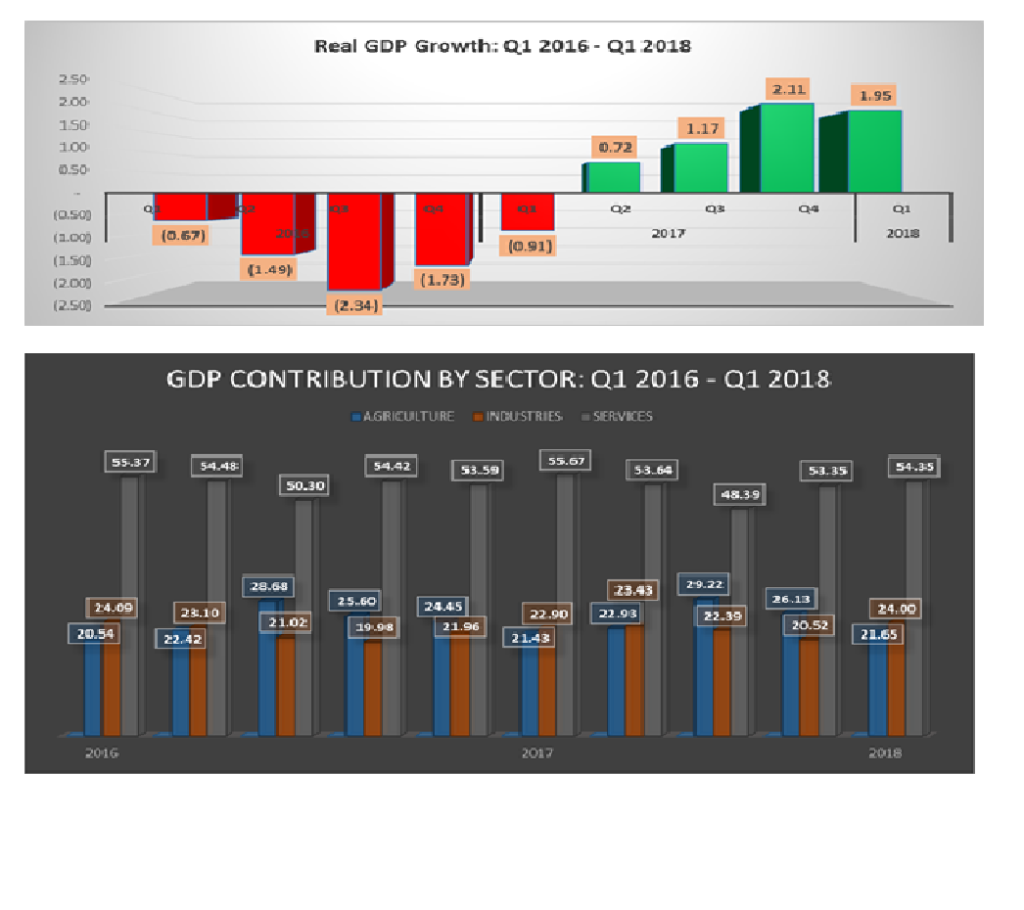

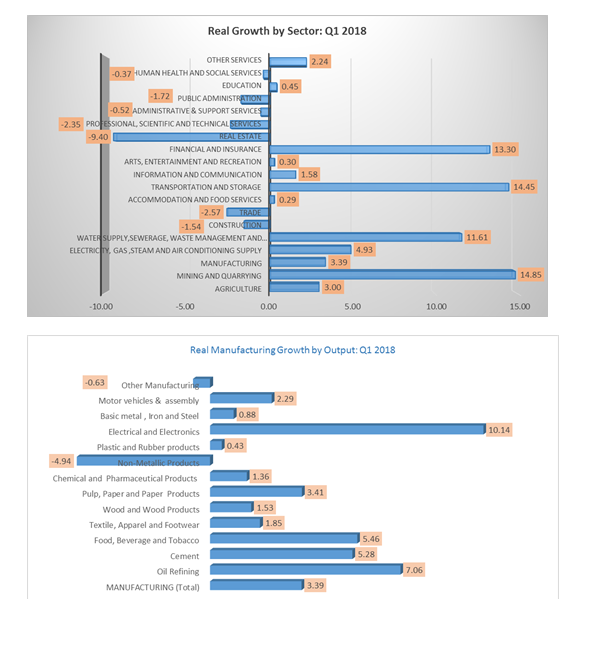

In this edition of the Business Essentials, we reviewed the Q1 2018 GDP Report of the National Bureau of Statistics (NBS). The growth pattern in the first quarter of 2018 indicated that the major drivers of the recovery were within the mining & quarrying, agricultural, financial & insurance and manufacturing sectors, while crude oil production dominated the mining & quarrying sector (accounting for 99.28%), crop production dominated the agricultural sector (accounting for 87.32%). However, the growth trajectory recorded in the past four quarters decelerated in Q1, 2018, recording 1.95% compared with the growth rate of 2.11% recorded in the last quarter of 2017.

We also shared a paper by International Organisation of Employers’ (IOE) on “State policy responses on human Rights due Diligence”, economic benefits of the recently signed Executive Orders and proposed amendments, which we believe will improve the ease of doing business in the country.

Our regular Law Report Review, Upcoming Learning & Development programmes and other activities at the Secretariat were not left out.

Have a pleasant reading.

Timothy Olawale

Editor

In this Issue:

- The Nigerian Economy Review: Q1 2018 and Implication for Business

- IOE Paper on “State Policy Responses on Human Rights Due Diligence”

- Federal Executive Council Approves Two Executive Orders and Five Amendment Bills

- PICTORIAL: Nigeria Employers’ Delegation at the 107th Session of the International Labour Conference, 2018 held from 28 May – 8 June, 2018 at Geneva, Switzerland

- Law Report Review / Legal Opinion: Collective Agreement (Ganiu Lawal & 3 others vs. Federated Steel Mills Limited) (2014) 42 N.L.L.R. Pt 130, P. 306 NIC

- Upcoming Meetings of various Technical Committees

The Nigerian Economy Review: Q1 2018 and Implication for Business

Business Implication:

- Nigeria’s recovery stalled in the first quarter, with growth edging down after hitting a two-year high in the final quarter of 2017. According to data released by the National Bureau of Statistics (NBS), GDP expanded 2.0% in Q1, slightly below Q4’s revised 2.1% increase (previously reported: +1.9% year-on-year). The result undershot expectations of a pick-up in growth and broke a sequence of five consecutive quarters of improving activity. Along with the national accounts data, the NBS also released revised oil production estimates for Q3 and Q4 of 2017.

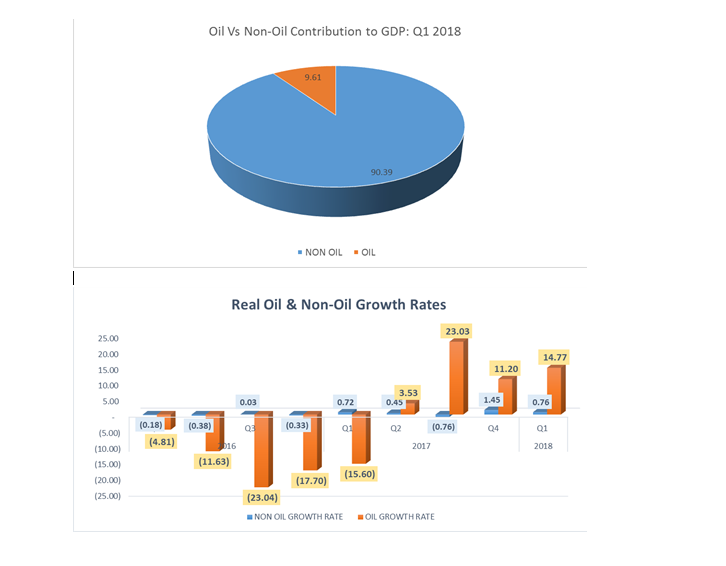

- The first quarter’s slight deceleration was due to a weaker performance by the non-oil sector. Non-oil activity expanded 0.8% annually in Q1, below Q4’s 1.5% expansion. Slower growth in the agricultural and services sectors drove the result and illustrates that the economic recovery is weak. Notably, trade and construction contracted, dragging on growth.

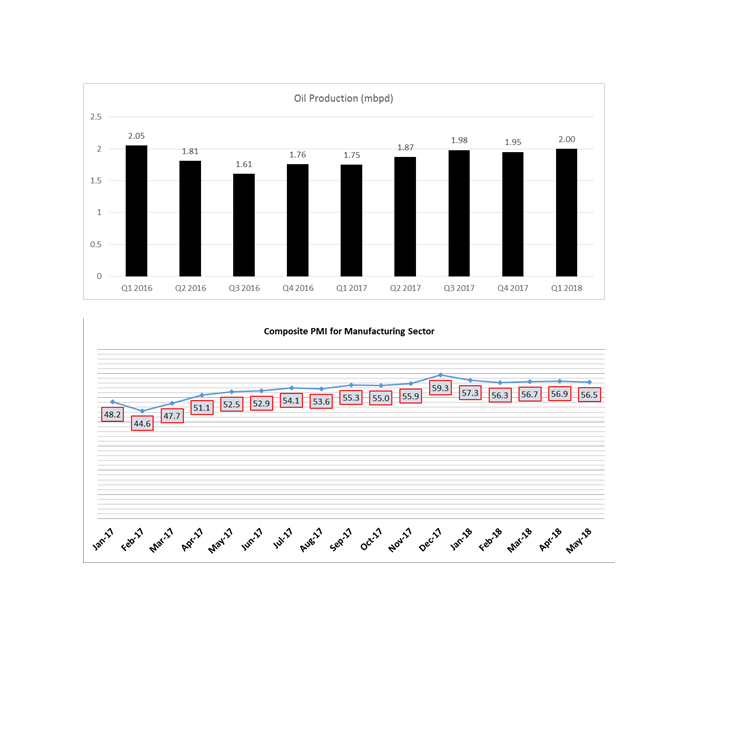

- Meanwhile, the energy sector improved in the first quarter, helping to buffer the slowdown elsewhere in the economy. Oil output averaged 2.00 million barrels per day (mbpd) in the first quarter, which was above the revised 1.95 mbpd recorded in the previous period (previously reported: 1.91 mbpd). Buoyed by higher oil prices, the oil sector expanded 14.8% annually in Q1, above Q4’s revised 11.2% increase (previously reported: +8.4% yoy).

- While the Purchasing Managers Index (PMI) published by the Central Bank of Nigeria (CBN) for the month of May 2018 shows an expansion, the PMI grew at a slower rate when compared with the expansion in April. The Manufacturing PMI of May stood at 56.5 points from 56.9 points recorded in April. Similarly, the Non-Manufacturing PMI stood at 57.3 points, from 57.5 points in April.

The slowdown in the PMI is an indication of the weak economic growth recovery.

CONCLUSIONS

- We believe that the recently passed Federal Government 2018 Budget by the National Assembly, would lead to a pick-up in public spending. In addition, at the end of April, Nigeria and China agreed to a three-year currency swap worth NGN 720 billion. The agreement should help boost liquidity and encourage trade between the two countries; China is one of Nigeria’s largest trading partners.

- Higher oil prices and improved foreign exchange rate liquidity should drive a pick-up in growth this year. However, political uncertainty ahead of February 2019 elections, a lack of diversification away from the oil sector and a poor business environment remain key concerns.

- Looking ahead, the recovery is expected to pick up steam in the coming quarters, albeit remain moderate and fragile overall. Firmer oil prices and improved foreign exchange rate liquidity should fuel activity; however, tight monetary policy, a weak business climate and a lack of structural reforms continue to cast a shadow over the country’s prospects.

IOE Paper on State Policy Responses on Human Rights Due Diligence

What is Human Rights Due Diligence?

Under the UNGPs, the corporate responsibility to respect human rights applies to all business enterprises, regardless of their size, sector, location, ownership and structure.

Human rights due diligence is one of three operational parts of the corporate responsibility to respect human rights. UNGP 15 spells out what those three parts are: “In order to meet their responsibility to respect human rights, business enterprises should have in place policies and processes appropriate to their size and circumstances, including:

- A policy commitment to meet their responsibility to respect human rights;

- A human rights due diligence process to identify, prevent, mitigate and account for how they address their impacts on human rights; and

- Processes to enable the remediation of any adverse human rights impacts they cause or to which they contribute.”

UNGPs 17 to 21 then provide more information about the four-step human rights due diligence approach that is expected of companies: For example, the process should include:

- Assessing actual and potential human rights impacts;

- Integrating and acting upon the findings;

- Tracking the effectiveness of the company’s responses; and

- Being prepared to communicate how impacts are addressed.

The UNGPs also set out some parameters for human rights due diligence:

- Human rights due diligence should cover adverse human rights impacts that the business enterprise may cause or contribute to through its own activities, or which may be directly linked to its operations, products or services by its business relationships;

- Will vary in complexity with the size of the business enterprise, the risk of severe human rights impacts, and the nature and context of its operations;

- Should be ongoing, recognizing that the human rights risks may change over time as the business enterprise’s operations and operating context evolve.

The human rights due diligence process under the UNGPs differs from other forms of business management due diligence. It is about identifying and responding to the human rights risks faced by the rights-holders. It is not about direct risks to the business, although human rights risks can translate into business risks such as legal, financial, reputational and operational risk. It is also not a one-off exercise.

Human rights due diligence also includes two important activities that companies should take, namely engagement with affected groups and relevant stakeholders and exercising leverage where possible:

- Meaningful stakeholder engagement, appropriate to the size of the company and the nature and context of the operation, is an important process to help a business to identify and respond to human rights risks.

- The UNGPs explain that companies should exercise their “leverage” to prevent and mitigate, to the greatest extent possible, harms in those situations when either a company contributes to an adverse impact or when a harm is directly linked to its operations, products or services by its business relationships.

In addition, measures that are not strictly part of human rights due diligence process can, in turn, help inform and strengthen a company’s process to identify and respond to risks. For example, establishing or participating in grievance mechanisms for individuals and communities who are adversely impacted, can help a company to better identify its human rights impacts. Similarly, grievance mechanisms can be a means for a company to track and monitor its human rights due diligence process.

What the UNGPs recommend about State policy and regulatory measures

UNGP 1 explains that States have the duty to protect against human rights abuse within their territory and/or jurisdiction by third parties, including business enterprises. UNGP 2 clarifies that “States are not generally required under international human rights law to regulate the extraterritorial activities of businesses domiciled in their territory and/or jurisdiction.” UNGP 3 then gives recommendations to States on their general regulatory and policy functions. These include:

- Enforcing laws that require business enterprises to respect human rights, and periodically assessing the adequacy of such laws and addressing gaps;

- Ensuring that existing laws and policies that govern the creation and operations of business, such as corporate law, enable business respect for human rights;

- Providing effective guidance to business on how to respect human rights throughout their operations; and

- Encouraging, and where appropriate requiring, companies to communicate how they address their human rights impacts.

Examples of policy responses

Since the UN Human Rights Council endorsed the UNGPs in 2011, the topic of human rights due diligence has received much attention by policy makers in some countries:

- There has been a drive for international policy coherence to embed the UNGPs and their human rights due diligence blueprint into other applicable standards, initiatives and guidance tools. The expectation that companies should exercise human rights due diligence is reflected in standards such as the OECD Guidelines and the ILO MNE Declaration. It is also relevant to many other initiatives and tools such as the International Finance Corporation Performance Standards, the UN Global Compact’s 10 Principles, the Global Reporting Initiative, ISO 26000 Guidance on Social Responsibility, the Voluntary Principles on Security and Human Rights, the work of the Thun Group of Banks, etc.

- To date, some 19 Governments have produced a national action plan (NAP) on business and human rights with a further 20 or more States reportedly in the process of developing a NAP. These plans, among other things, articulate Government’s expectations of companies operating in their jurisdiction to act responsibly with respect for human rights by encouraging them to carry out due diligence vis-à-vis their operations at home and, in some case, abroad.

- At the international level, some States are increasingly urging companies to carry out human rights due diligence especially in relation to their supply chains. For example, the 2015 G7 Leaders’ Declaration issued strong support for the UNGPs and said: “To enhance supply chain transparency and accountability, we encourage enterprises active or headquartered in our countries to implement due diligence procedures regarding their supply chains, e.g. voluntary due diligence plans or guides.” This was followed by a similar commitment of the wider G20 in 2017 when its leaders pledged to “work towards establishing adequate policy frameworks in our countries such as national action plans on business and human rights and underline the responsibility of businesses to exercise due diligence.”

- Furthermore, some Governments have either introduced or are considering laws and other punitive measures that concern the human rights due diligence process (in part or in full). In many instances, these measures expand and extend supply chain responsibility. As such, human rights due diligence requirements are beginning to surface in legal claims.

Concerns About Some Policy Responses

Human rights due diligence – with its focus on risk to people instead of risk to the business – is an important process for companies to avoid involvement in human rights harm throughout their supply chain. Carrying out human rights due diligence allows a company to show that it recognizes and acts upon its human rights risks, and that it is serious about not causing abuses, or contributing and being directly linked to harms caused by others. While there are no guarantees that acting with due diligence will protect a business from legal liability, complicity or public allegations, the process can help protect a company’s values and value. It helps a business to gain and retain a social licence to operate; to demonstrate that it complies with regulations; and to respond to benchmarks, codes of conducts, international framework agreements, and other requests for information. It also allows for learning by doing, identifying blind sports and improving over time including avoiding past failures and partnering and collaborating with others to address systemic issues.

Despite its importance, human rights due diligence – especially in relation to global supply chains – is neither a simple exercise, nor a silver bullet to the world’s business-related human rights problems. The push for policy-makers to create hard laws concerning this process raises many questions and concerns. However well-intentioned these laws may be, taking a top-down, prescriptive and punitive approach risks unintended consequences for rights-holders; it risks driving unhelpful action (or inaction) by some States and businesses; and it risks overlooking and undermining the positive effects of many voluntary and soft-law standards.

It is crucial not to blur State duties and business responsibility

Firstly, while business is committed to respecting human rights in line with Government-backed standards such as the UNGPs and OECD Guidelines, it is vital that States implement their duty to protect human rights first and foremost. The laws focusing on the corporate human rights due diligence process reflect a general absence of concerted and widespread State engagement and action to meet their obligations in critical areas such as strengthening national institutions and mechanisms to promote and protect rights, ensuring national laws are enforced, addressing endemic issues such as informality, taking measures to root out corruption, and intensifying diplomatic and capacity-building efforts to improve local governance. They also mirror the general trend to put the onus on companies, especially a select number of highly-visible brands and retailers that operate across borders and are already implementing the responsibility to respect, with little consideration for the wider business community.

One UN initiative – the IGWG for a UN binding instrument on transnational companies (TNCs) and other business enterprises (OBEs) – illustrates this particular concern. The proposal in the Chairperson’s draft “elements” paper to impose on companies, directly under international law, the same range of human rights duties that States have accepted for themselves is deeply misguided. International human rights law binds States, not private entities. Only sovereign States can achieve the protection of human rights while balancing the range of societal and political interests. Companies neither have the mandate nor the capabilities to assume traditional Government functions. They cannot be co-equal duty bearers for the broad spectrum of human rights. As a practical matter, any instrument imposing direct obligations on companies under international human rights law is also bound to fail due to the sheer number of actors involved and it would be an undesirable outcome for rights-holders, who rely on Governments to develop and enforce national policies and regulations.

Furthermore, establishing international human rights obligations directly on business when these duties often do not exist at the national level suggests that States are seeking to pass the buck onto private entities for their own failure or unwillingness to protect their people’s rights. It is also disingenuous when some States use multilateral settings to call for hard laws targeting business, including on human rights due diligence, as it deflects attention away from their poor treaty implementation records onto visible companies that are easy to scapegoat even if their involvement in a harm may be minimal.

Foreign-imposed legal “solutions” are unlikely to address deep-rooted and complex human rights challenges in many States

Second, the push for Government regulation that mandates some companies to carry out human rights due diligence in their supply chains is unlikely to result in improvements to underlying human rights challenges in countries with weak public institutions. In the absence of robust national laws/policies, enforcement, and judicial and non-judicial remedy mechanisms at the local level, foreign-imposed legal “solutions” are unlikely to have long-term, sustainable and replicable impact for rights-holders. In fact, the patchwork of laws – often enacted by States in developed countries – risks creating a two-tiered compliance system, whereby individuals, communities or workers that suffer business-related harm that may involve foreign-based companies or exporters have higher standards, but the rest get lesser or diluted protections and remediation.

A narrow approach that targets a select number of companies with global operations fails to recognise that human rights abuses and decent work challenges that occur in global supply chains in the vast majority of cases are not caused by cross-border trade. Instead, they mirror harms that occur in national economies generally. The only way to ensure that affected individuals, communities and workers are equally protected is to develop strong national institutions that can implement and enforce domestic laws covering all companies within its borders, regardless of whether they participate in global supply chains or not. In addition, the problem is not the absence of a binding international instrument on business and human rights, but States’ failure or lack of capacity to implement and enforce their own domestic laws and existing international human rights treaties that they have ratified. In many cases, domestic law has not kept pace with changes in the world economy. Therefore, what is needed is for more States to meet their existing obligations required under the UNGPs, and more effective and comprehensive law enforcement in general.

… to be continued in the next edition

Federal Executive Council Approves Two Executive Orders and Five Amendment Bills

On 6 June 2018, the Federal Executive Council (FEC) approved two Executive Orders and five Amendment Bills. Amongst other provisions, the Executive Orders and Bills aim to amend certain controversial tax provisions, reduce some applicable tax rates and reduce tax burden on taxpayers by exempting certain goods and services from Value Added Tax (VAT).

Details

The Executive Orders include the Value Added Tax Act (Modification) Order and the Review of Goods Liable to Excise Duties and Applicable Rate Order. In addition, the following Bills will be presented before the National Assembly for review and enactment:

- Companies Income Tax (CIT) Act Amendment Bill;

- Personal Income Tax Act Amendment Bill;

- Value Added Tax Act Amendment Bill;

- Customs, Excise, Tariff etc. (Consolidation) Act Amendment Bill; and

- Industrial Development (Income Tax Relief) Act Amendment Bill.

Amongst other things, the Executive Orders and Bills seek to introduce the following changes:

- Exemption from VAT for residential property leases or rentals, life insurance, and shared passenger transport service etc.;

- Restriction of VAT exemption on exports to only oil exports;

- Reduction of CIT rate to 25% for companies;

- Reduction of CIT rate to 15% for small and medium scale enterprises; and

- Exemption of dividends paid out of retained earnings and franked investment income from excess dividend tax under Section 19 of CITA.

Implication

The approval of the Executive Orders and Bills by the FEC is a welcomed development as the changes should encourage better tax compliance and improve Nigeria’s business climate. Also, the exemption of dividends paid out of retained earnings and franked investment income from tax will address the incidence of double taxation arising from distributions made from retained earnings (in excess of taxable profits) and by holding companies.

It is expected that the Bills will be promptly submitted to the National Assembly for deliberation and enactment to enable the amended provisions to have the effect of law. We will issue detailed analyses in our subsequent publications.

OPINION

- It is our belief that the Executive Order and the proposed amendments shows commitment by the government towards reducing the tax burden on taxpayers and also improve the ease of doing business in the country.

- We are of the opinion that these initiatives would help the micro and small businesses to thrive, and these would help in reducing the unemployment rate, perhaps the biggest challenge of the country presently. With micro and small business accounting for about 30million, if they can experience a marginal growth, employing at least one (1) additional employee, unemployment rate would reduce to some bearable level.

- We believe that there is need to move very fast into the implementation stage of the Executive Order.

Culled from Andersen Tax (Tax Alert, 7th June, 2018)

……………………………………………………………………………………………………………………

PICTORIAL: Nigeria Employers’ Delegation at the 107th Session of the International Labour Conference, 2018 held from 28 May – 8 June, 2018 at Geneva, Switzerland.

- (L-R) Mr. Steve Olayinka, Mr Jude Eguabor, Mr. Tope-Phillips Aikhuemelo, Mrs Olubunmi Adekoje and Mr. Timothy Olawale

- Mr. Timothy Olawale exchanging gifts with Taiwan Labour Leader to foster friendship

- Nigeria Employers’ Group Dinner at the old Geneve City, Switzerland.

Law Report Review / Legal Opinion: Collective Agreement (Ganiu Lawal & 3 others vs. Federated Steel Mills Limited) (2014) 42 N.L.L.R. Pt 130, P. 306 NIC

Facts:

- The Claimants’ complaint was against the right of the Defendant to terminate their employment in furtherance to a Collective Agreement, which was reached between the Association of Metal Products, Iron and Steel Employers of Nigeria (AMPISEN) and Steel and Engineering Workers’ Union of Nigeria (SEWUN).

- The position of the Defendant was that because the Claimants were accredited members of SEWUN and they paid their dues regularly to the Union; they are bound by the terms and conditions in the Collective Agreement.

Issues:

- Whether or not the Collective Agreement between Association of Metal Products, Iron and Steel Employers of Nigeria (AMPISEN) and Steel and Engineering Workers’ Union of Nigeria (SEWUN) was enforceable on the claimants; thereby making the termination of the Claimants’ employment by the Defendant proper.

The Judgement

On jurisdiction of the National Industrial Court over interpretation and application of Collective Agreement:-

By the provisions of section 254C of the Constitution of the Federal Republic of Nigeria 1999 as amended by third Alteration Act 2010, the National Industrial Court has exclusive jurisdiction in civil causes and matters relating to the determination of any question as to the interpretation and application of any Collective Agreement.

On definition of Collective Agreement:-

Section 54 of the National Industrial Court Act 2006 defines Collective Agreement as: any agreement in writing regarding working conditions and terms of employment concluded between:

- An organisation of employers or an organisation and representing employers (or an association of such organisations) on the one part, and

- An organisation of employees or an organisation and representing employees (or an association of such organisations) on the other part.

From the above provisions, therefore, the Court has unfettered jurisdiction to interpret the Collective Agreement between AMPISEN and SEWUN.

In the instant case, the Claimants being members of SEWUN were covered by the Collective Agreement entered into by SEWUN with AMPISEN. Thus, the Collective Agreement is applicable to the Claimants. See: ASCSN vs. Ho. Minister of Works & Ors (2011) 22 NLLR pt. 63, p 493

Final Judgment:-

The Judge held the Collective Agreement between AMPISEN and SEWUN was binding on the Claimants; consequently their compulsory retirement was proper. The Claimants’ suit was, accordingly, dismissed.

OPINION:

Parties are bound by their agreement and what has been done by agreement can only be undone by another agreement.

Learning and Development Programmes and Upcoming Meetings of various Expert Committees

Business Communication, Presentation and Writing Skills for Impact in the Workplace

Date: 19 – 20 July, 2018

Venue: NECA House, Alausa, Ikeja, Lagos

Time: 9:00am

Fee: Member: N95,000 Non-Member: N110,000

NECA 61ST ANNUAL GENERAL MEETING (AGM)

Date: Tuesday, 17th July, 2018

Venue: NECA Auditorium, NECA House, Alausa, Ikeja.

Time: 10:00am

Thank you for this excellent work.

Please, I could not find the technical expert meeting dates.

Kunle Ogunde Rci

Sorry for the late response, an upgrade was ongoing on the site. We will send it via email